|

市場調查報告書

商品編碼

1641959

晶圓清洗設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Wafer Cleaning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

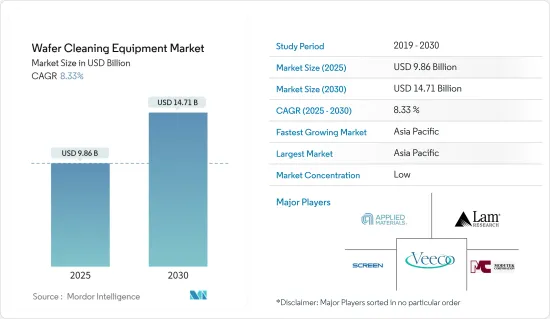

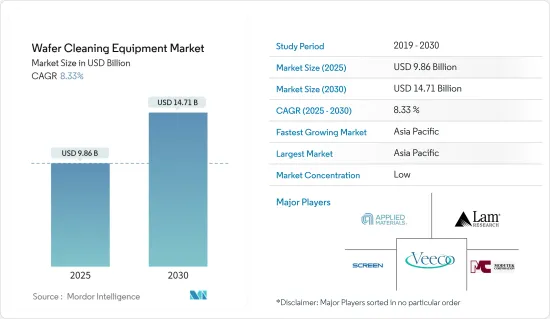

晶圓清洗設備市場規模預計在 2025 年為 98.6 億美元,預計到 2030 年將達到 147.1 億美元,預測期內(2025-2030 年)的複合年成長率為 8.33%。

隨著電子元件需求的增加以及使電子封裝更加資源高效的措施,晶圓清洗設備被廣泛應用於各種領域。

關鍵亮點

- 智慧、相容設備和支援網路的日益普及是全球晶圓清洗設備市場發展的主要驅動力。例如,2022 年 6 月,DISH 宣布將在 Project Genesis 首次推出僅 42 天後將其擴展至美國20% 以上的人口(全美 120 個城市)。這意味著聯邦通訊委員會的臨時期限已經滿足。此網路高度發展、完全雲端原生,並依賴開放式 RAN 架構。

- 此外,印刷電子的日益普及、半導體裝置產業對升級和提高半導體產品品質和生產標準的日益重視也是支持晶圓清洗設備市場發展的突出因素。

- 2022年6月,NEO Battery Materials Ltd.與韓國印刷電路基板生產公司Automobile & PCB Inc.簽署了戰略合作備忘錄(MoU)。透過此次合作,兩家公司將利用 NEO 的技術專長以及 A&P 的附屬公司 YSP 和 Yongsan 已建立的網路來加強 NEO 的全球業務網路。此類產品開發活動可能會進一步推動印刷電子產品的成長並產生市場發展的需求。

- 預計對矽基感測器的需求不斷增加將為市場擴張提供有利的潛力。此外,一些供應商已經在致力於增加SiC晶圓的產量。例如,2023年8月,英飛凌科技股份公司宣布計劃擴建其在馬來西亞的製造工廠並建立一座200毫米SiC晶圓廠。這些發展顯示對晶圓轉型的需求不斷成長。

- 此外,Cree(Wolfspeed)還在增加 Wolfspeed 品牌功率和射頻半導體的生產能力,隨著該公司出售其照明業務以專注於 SiC 和 GaN 產品,該產能還在繼續成長。為了滿足電動車、工業市場和行動通訊領域的高需求,Cree 正在紐約建造一座價值 12 億美元的 200 毫米晶圓廠,並計劃於 2022 年開始生產。

- 生產這些材料的一個主要挑戰是環境管理。晶圓清洗過程會產生灰塵和生物危害廢棄物,如果不妥善處理,將對氣候產生直接影響。因此,政府制定了各種法規來研究如何處理和避免此類問題。此外,對熟練勞動力的需求以及嚴格且不斷變化的品質標準阻礙了市場的成長。

晶圓清洗設備的市場趨勢

智慧型手機和平板電腦推動市場成長

- 智慧型手機和平板電腦等家用電子電器的使用日益增多,刺激了晶圓清洗設備市場的成長。新技術的出現以及消費者對更先進的智慧型手機和平板設備日益成長的需求,極大地推動了該行業的成長速度。例如,根據愛立信預測,到2027年全球智慧型手機用戶數量將達到78.4億。

- 平板電腦和智慧型手機市場的快速成長增加了對半導體晶圓的需求,進而導致對晶圓清洗設備的需求增加。據印度手機與電子協會 (ICEA) 稱,預計到 2025 年,印度的筆記型電腦和平板電腦製造業產值將達到 1,000 億美元。此外,預計到 2026 會計年度,印度行動電話市場的銷售額將達到 2.4 兆印度盧比(293.8 億美元)。

- 由於現在大多數任務都可以透過智慧型手機完成,包括電子郵件、社群媒體、遊戲和聊天,因此對智慧型手機的需求正在增加,而個人電腦的銷售正在下降。根據GSMA預測,到2025年,智慧型手機連線數將達到約75億,佔行動連線的五分之四以上。

- 智慧型手機技術正在發展,影響消費者的日常行銷策略、商業活動和生活方式。智慧型手機技術的接受度是當今科技成功的關鍵因素。因此,確定影響消費者對智慧型手機技術行為的關鍵因素具有重要價值。

- 根據IBEF報道,三星宣布計畫未來5年在印度投資3.7兆盧比(500億美元)用於生產行動電話。該公司還計劃根據 PLI 計劃生產價值 2.2 兆印度盧比(300 億美元)的行動電話,每部價格超過 15,000 印度盧比(200 美元)。智慧型手機和平板電腦等家用電子電器產品的擴張可能會進一步推動對晶圓清洗設備的需求。

亞太地區市場顯著成長

- 亞太地區已成為最大的半導體市場。數位技術的滲透、快速的都市化和工業化正在促進這一成長。此外,大型半導體製造、封裝和組裝產業的存在也為該地區晶圓設備市場的發展創造了有利的條件。

- 此外,中國不僅是亞太地區,也是世界上最大的半導體中心。據半導體產業協會稱,中國近期以 1,925 億美元的晶片總銷售額領先半導體市場,與前一年同期比較成長 27.1%。中國也吸引了領先晶片製造商的巨額投資,透過建立新工廠來擴大晶片產量。此外,WSTS 預測 2022 年全球銷售額將達到 5,730 億美元。

- 此外,受電動車產業需求不斷成長的推動,日本企業正在大力投資提高碳化矽功率半導體的產量。例如,總部位於東京的昭和電工株式會社於2022年3月開始量產直徑6吋(150毫米)的結晶單晶晶片(SiC晶片)。

- 由於消費性電子和半導體產業的不斷發展,亞太地區是主要的半導體晶圓清洗市場之一。對小型、智慧和攜帶式設備日益成長的需求正在支撐該地區市場的成長。根據 IBEF 預測,印度家用電子電器(ACE) 市場將以 9% 的複合年成長率成長,到 2022 年達到 3.15 兆印度盧比(483.7 億美元)。此外,2022年9月,印度月度行動電話出口額首次突破10億美元大關。

- 受冠狀病毒大流行推動的居家隔離趨勢繼續推動對半導體晶片的需求。例如,根據WSTS的數據,預計2023年亞太半導體產業的銷售額將超過4,000億美元。這些趨勢正在鼓勵主要設備製造商進入亞太市場。

- 例如,市場上最知名的供應商之一 ASML 最近在台灣台南開設了一個最先進的培訓設施。該地區上述的擴張可能會在預測期內進一步增加對晶圓清洗設備的需求。

晶圓清洗設備產業概況

晶圓清洗設備市場高度分散,主要企業包括 Lam Research Corporation、Applied Materials Inc.、Veeco Instruments、Tokyo Electron Ltd.、Entegris、Modutek 和 Semes。這些參與企業的市佔率較大,且信譽度較高,因而帶動了市場整合。

- 2024年3月:利用「精密流體模擬」等技術,開發出滿足日益小型化的半導體製造最清洗節點需求的晶圓,並以優異的清洗乾燥性能實現卓越的生產率和高產量。設備榮獲大河內財團法人第70屆大河內紀念生產獎。

- 2023 年 10 月 - SCREEN SPE 將引入 FTD Solutions Inc. 的 WMA(水管理應用程式),以實現水資源管理的可視化,從而加速永續發展。作為世界頂級的半導體清洗設備製造商,該系統使用水,我們正在加快開創性的努力,以減少對環境的影響。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 採用市場促進因素與限制因素

- 市場促進因素

- 平板電腦和智慧型手機的需求不斷成長

- 半導體產業的成長

- 市場限制

- 晶圓清洗過程中產生的有害化學物質和氣體相關的環境問題

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 技術簡介

- 單波噴霧系統

- 單晶圓低溫系統

- 大量浸泡清洗系統

- 批量噴淋清洗系統

- 洗滌器

第6章 市場細分

- 依運作方式類型

- 自動裝置

- 半自動設備

- 手動操作

- 按應用

- 智慧型手機和平板電腦

- 儲存裝置

- 射頻設備

- LED

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 亞洲

- 中國

- 日本

- 台灣

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Applied Materials, Inc.

- Lam Research Corporation

- Veeco Instruments Inc.

- Screen Holdings Co., Ltd

- Modutek Corporation

- Entegris, Inc

- PVA Tepla AG

第8章投資分析

第9章:市場的未來

The Wafer Cleaning Equipment Market size is estimated at USD 9.86 billion in 2025, and is expected to reach USD 14.71 billion by 2030, at a CAGR of 8.33% during the forecast period (2025-2030).

Due to the massive demand for electronic components owing to amplified usage, the increasing measures to make electronic packaging highly resourceful have made wafer-cleaning equipment used in myriad applications.

Key Highlights

- The growth in adopting smart and compatible devices and feasible networks is significantly aiding the development of the global wafer-cleaning equipment market. For instance, in June 2022, DISH informed that Project Genesis would be expanded to over 20% of the US population (in 120 cities across the USA) only 42 days after the initial launch. As such, it just met the FCC's interim deadline. The network is very developed, completely cloud-native, and reliant on Open RAN architecture.

- Furthermore, the increasing penetration of printed electronics and rising concern for upgrading and improving the semiconductor product quality and production standards in the semiconductor devices industry are some prominent factors behind the development of the Wafer Cleaning Equipment Market.

- In June 2022, NEO Battery Materials Ltd. signed a strategic Memorandum of Understanding (MoU) with Automobile & PCB Inc., a Korean company manufacturing printed circuit boards. Through this collaboration, both players will leverage NEO's technical expertise and the reputable and recognized network of A&P's related companies, YSP and Yongsan, to strengthen NEO's business network globally. Such activities for product development may further drive the growth of printed electronics, creating demand for studied market growth.

- An increase in demand for silicon-based sensors is anticipated to deliver lucrative possibilities for market expansion. Further, some vendors are already working toward increasing the production of SiC wafers. For instance, in August 2023, Infineon Technologies AG announced its plans to expand its manufacturing facility in Malaysia to establish 200 mm SiC fab. Such developments indicate the growing demand for wafer transition.

- Furthermore, Cree (Wolfspeed) is also elevating its production capacity for its Wolfspeed brand of power and radio frequency semiconductors, an ongoing strategy that grew when the company sold its lighting business to focus on SiC and GaN products. To meet the high demand in EVs, industrial markets, and mobile telecommunications, Cree is building a USD 1.2 billion 200mm SiC wafer fab in New York, where production began in 2022.

- The major challenge for the production of these materials is to control the environment, especially in the process of wafer cleaning, especially dust and biohazard waste are generated, which have a direct impact on the climate if they are not appropriately treated. Therefore different government regulations are made to consider how they must be handled to avoid such problems. Moreover, the need for a skilled workforce and strict and changing quality standards hinder the market growth.

Wafer Cleaning Equipment Market Trends

Smartphones & Tablets to Drive the Market Growth

- The increase in the usage of consumer electronic devices such as smartphones and tablets has stimulated the growth of the wafer-cleaning equipment market. Emerging new technologies and growth in consumer demand for more advanced smartphones and tablets have boosted the growth pace of the industry to a great extent. For instance, according to Ericsson, the global number of smartphone subscribers is anticipated to reach 7,840 million by 2027.

- The enormous growth in the tablets and smartphones market has raised the need for semiconductor wafers, thus raising the demand for wafer-cleaning equipment. According to India Cellular & Electronics Association (ICEA), India is anticipated to acquire a value of USD 100 billion in manufacturing laptops and tablets by 2025. In addition, the Indian mobile phone market is expected to generate INR 2.4 trillion (USD 29.38 billion) in revenue by FY2026.

- The demand for smartphones has increased, and PC sales have declined because most tasks, such as emailing, social media, gaming, and chatting, can now be done via smartphones. According to GSMA, there will be about 7.5 billion smartphone connections by 2025, accounting for above four in five mobile connections.

- Smartphone technology is developing to influence the consumer's daily marketing strategies, business activities, and lifestyle. The acceptance of smartphone technology is a crucial factor in the success of today's technology. Due to this, identifying the main factors that influence the consumer's behavior toward smartphone technology is extremely valuable.

- According to IBEF, Samsung announced plans to invest INR 3.7 lakh crore (USD 50 billion) in India over the next five years to manufacture phones. It plans to produce phones worth INR 2.2 lakh crore (USD 30 billion), priced above INR 15,000 (USD 200), under the PLI scheme. Such expansion in consumer electronics such as smartphones and tablets may further drive the demand for Wafer Cleaning equipment.

Asia Pacific to Experience Significant Market Growth

- Asia Pacific region has appeared as the largest semiconductor market. The growing penetration of digital technologies, rapid urbanization, and industrialization contribute to this growth. Additionally, the presence of large semiconductor manufacturing, packaging, and assembly industries also creates a favorable scenario for developing the wafer equipment market in the region.

- In addition, China is the largest semiconductor hub not only in Asia-Pacific but also in the world. As per Semiconductor Industry Association, China recently led the semiconductor market with total chip sales of USD 192.5 billion, marking an expansion of 27.1 percent year on year. The country also draws huge investments from significant chipmakers to extend chip production by launching new facilities. Further, in 2022, WSTS forecasted global sales totaled USD 573 billion.

- Furthermore, Japanese companies are creating heavy investments to improve the production of SiC power semiconductors driven by the increased demand from the EV industry. For instance, in March 2022, Tokyo-headquartered Showa Denko KK introduced the mass production of silicon carbide single crystal wafers (SiC wafers) with a diameter of 6 inches (150 mm), which are used as materials for SiC epitaxial wafers to be processed and installed into SiC power semiconductors.

- Asia-Pacific is one of the vital semiconductor wafer cleaning markets owing to the presence of the ever-growing consumer electronics and semiconductor industries. The rise in demand for small and smart portable devices supplements the market growth in the region. According to IBEF, India's consumer electronics (ACE) market increased at 9 percent CAGR to reach INR 3.15 trillion (USD 48.37 billion) in 2022. Furthermore, in September 2022, monthly mobile phone exports from India crossed the USD 1 billion mark for the first time.

- The stay-at-home trend spurred by the coronavirus pandemic continues to drive the demand for semiconductor chips. For instance, according to WSTS, the estimated semiconductor industry revenue in the Asia Pacific region is expected to reach over USD 400 billion in 2023. Such trends encourage leading equipment manufacturers to enter the Asia Pacific (APAC) market.

- For instance, ASML, one of the most prominent vendors in the market, recently opened a new state-of-the-art training facility in Tainan, Taiwan. The above expansion in the region may further create demand for the Wafer Cleaning Equipment in the forecasted period.

Wafer Cleaning Equipment Industry Overview

The Wafer Cleaning Equipment Market is quite fragmented, with the major players in the studied market such as Lam Research Corporation, Applied Materials, Inc., Veeco Instruments Inc., Tokyo Electron Limited, Entegris, Inc, Modutek Corporation, Semes Co., Ltd., among others. These players account for a significant share and are reliable, leading to higher market consolidation.

- March 2024 - SCREEN Holdings Co. and SCREEN Semiconductor Solutions Co., Ltd. have received the Okochi Memorial Production Prize during the 70th annual award ceremony sponsored by the Okochi Foundation as their wafer cleaning equipment accommodates the advanced nodes in increasingly miniaturized semiconductor manufacturing by leveraging precise fluid simulation and other technologies, which bring about excellent cleaning and drying performance, as well as outstanding productivity supported by high throughput.

- October 2023 -SCREEN SPE introduced FTD solutions INC's Water Management Application (WMA) to visualize water management to accelerate sustainability development. As the company with the top global market share for semiconductor cleaning systems, which are systems that deal with water, we will accelerate advanced initiatives to reduce the environmental impact.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Demand for Tablets and Smartphones

- 4.3.2 Growth in the Semiconductor Industry

- 4.4 Market Restraints

- 4.4.1 Environmental Concerns Related to Hazardous Chemicals and Gases Generated During Wafer Cleaning Process

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

- 5.1 Single-wafer Spray Systems

- 5.2 Single-wafer Cryogenic Systems

- 5.3 Batch Immersion Cleaning Systems

- 5.4 Batch Spray Cleaning Systems

- 5.5 Scrubbers

6 MARKET SEGMENTATION

- 6.1 By Operating Mode Type

- 6.1.1 Automatic Equipment

- 6.1.2 Semi-automatic Equipment

- 6.1.3 Manual Equipment

- 6.2 By Application

- 6.2.1 Smartphones & Tablets

- 6.2.2 Memory Devices

- 6.2.3 RF Device

- 6.2.4 LED

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 United Kingdom

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Taiwan

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials, Inc.

- 7.1.2 Lam Research Corporation

- 7.1.3 Veeco Instruments Inc.

- 7.1.4 Screen Holdings Co., Ltd

- 7.1.5 Modutek Corporation

- 7.1.6 Entegris, Inc

- 7.1.7 PVA Tepla AG