|

市場調查報告書

商品編碼

1641972

付款閘道:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Payment Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

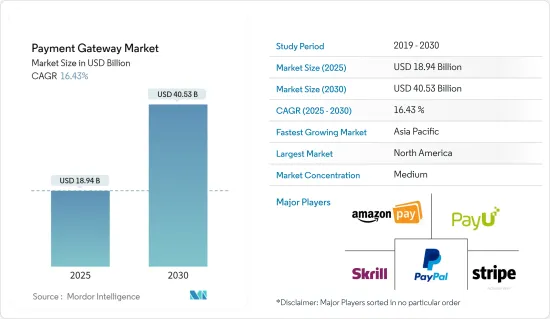

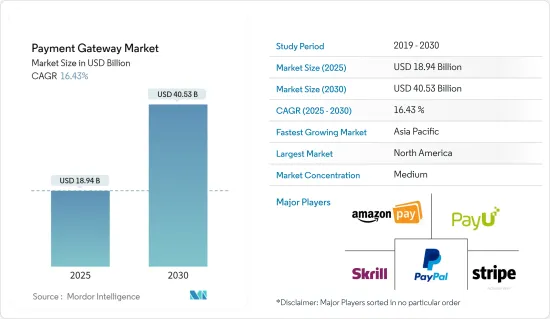

預計 2025 年付款閘道市場規模為 189.4 億美元,到 2030 年將達到 405.3 億美元,預測期間(2025-2030 年)的複合年成長率為 16.43%。

此外,由於全球數百萬人被隔離,COVID-19 疫情導致全球商品、服務和娛樂的線上銷售激增。 ACI Worldwide對來自全球各地線上零售商的數百筆交易進行的研究發現,今年大多數零售業的交易量比往年同期成長了74%,推動了市場成長。

主要亮點

- 近年來,付款方式迅速發展,從代幣系統發展到現金池和無現金付款。付款閘道使任何企業(無論是實體商店還是網路零售業)能夠透過客戶首選的銀行收取付款,而不會洩露敏感資料。在所有行業中,整合付款閘道已成為任何組織的基本組成部分之一。此外,預計線上交易的成長將在整個預測期內推動市場擴張。

- 全球電子商務銷售額的成長和網際網路普及率的提高使得金融服務公司能夠為客戶提供獨特的數位服務,從而推動了付款閘道市場的成長。高速網路的日益普及和普及可能會繼續刺激付款閘道市場的擴張。

- 全球對行動付款日益成長的需求也推動了付款閘道市場的發展。預計在預測期內,購買外送外帶、電影票、升級智慧型手機遊戲等各種交易採用行動付款將推動市場擴張。此外,無論在已開發國家還是開發中國家,這些付款都是使用簽帳金融卡卡和信用卡進行的。預計此方面將推動被調查市場的進一步成長。這是因為您可以輕鬆使用智慧型手機付款,並且可以儲存您的卡片詳細資訊。

- 由於大多數客戶都會保存自己的卡片訊息,因此網路攻擊竊取資料的案例可能會增加,這是一個限制。此外,偏遠地區缺乏網路存取、缺乏跨境付款的國際標準以及各國政府法規不同等其他因素也可能在研究期間抑制市場發展。

- 由於封鎖、COVID-19 大流行以及隨之而來的封鎖導致全球向電子商務的轉變,對付款閘道推出產生了不利影響,導致許多付款閘道為電子商務網站的線上購買提供線上付款便利。 。儘管面臨疫情危機,市場仍不斷擴大。由於 UPI 的重要性日益增加,再加上後疫情時代的環境,預測期內市場可能會見證數位領域的成長。

付款閘道市場趨勢

零售業越來越多採用付款閘道

- PayPal、Samsung Pay、Apple Pay、支付寶和微信支付等行動付款應用程式正在迅速被世界各地的零售商和服務機構採用和接受。此外,由於生活方式的改變、日常商業的發展以及網路零售的快速成長,預計這一趨勢將在預測期內持續下去。全球對線上零售的需求不斷成長預計將推動線上付款的發展,從而在預測期內促進付款閘道市場的發展。

- 零售商正在製定新策略,以便從宅配和網路購物的便利經濟中獲益。付款閘道作為付款基礎設施發揮重要作用。它是現代經濟中必不可少的連接點,因為網路購物車、POS 系統和虛擬終端都與付款流程相連。預計這一因素將推動付款閘道市場的成長。

- 所調查的市場正隨著消費者行為而改變。無現金經濟、行動銀行、即時付款、數位商務和日益增強的監管影響是影響零售業的某些趨勢。線上付款使消費者的付款過程更加輕鬆和便捷,從而縮短了排隊時間,消除了現金問題,並加快了排隊速度。

- 推動與本地銀行整合的付款閘道需求的關鍵因素是銀行擴大採用數位技術。當進行金融交易時,該付款閘道會引導用戶到銀行,在那裡輸入他們的財務詳細資料。這種付款解決方案設定起來快速又簡單,因此在中小型企業中越來越受歡迎。因此,與本地銀行整合的付款閘道的需求不斷成長,預計將推動零售業付款閘道市場的成長。

- 例如,總部位於印度的PayU被認為是最容易取得的電子商務付款解決方案之一,旨在填補複雜服務供應商留下的空缺。 PayU 受歡迎的原因是其最高的轉換率。 Netflix、Airbnb、Bookmyshow 等大公司都使用 PayU 的付款閘道。 2022 年 11 月:10 分鐘雜貨配送服務 Zepto 已將 CashFreePayments 的付款閘道API 整合到其行動應用程式中,使其能夠提供更快、更直覺的付款UPI 體驗。此閘道器配有附加價值服務功能,可讓更多的商家上網。預計這些舉措將推動市場成長。

- 儘管許多零售商面臨物流困難,但自停工以來,電子商務銷售額仍有所成長,尤其是雜貨和保健食品。例如,在英國,自新冠疫情爆發以來,一些產品的線上零售訂單量增加了200%以上。

中國正在經歷快速成長

- 阿里巴巴和騰訊等中國巨頭率先推出數位商家付款,協助中國經濟擺脫現金支付。兩家公司的行動付款產品支付寶和微信支付迅速改變了中國的付款格局。它也是世界上最大的之一。

- 中國銀聯簽帳金融卡和信用卡是最受歡迎的卡片品牌。支付寶和微信支付等行動電子錢包和數位錢包目前主導著中國的線上市場,並正在擴展到實體店。以支付寶和微信支付為主導的行動電子錢包和數位錢包佔該國電子商務交易的71%。

- 快錢集團、易支付和支付寶等其他公司也在中國提供付款閘道。快錢集團是一家專注於提供線上付款管道服務以促進中國線上商務發展的網路公司。本公司重視產業鏈發展,擁有80多家金融機構及300多個網路基地台。其擁有超過110萬商家合作夥伴,涵蓋20個產業,包括網路購物、物流、服飾、旅遊、保險和教育。

- 易寶支付也是中國領先的付款服務提供商,致力於透過技術和創新提供更好的電子付款解決方案和增值金融服務。它與中國100多家商業銀行有業務往來,是首批獲得中國人民銀行通用付款許可證的公司之一。

付款閘道產業概覽

付款閘道市場高度整合,主要企業包括: PayPal、PayU、Amazon Payments 和 Stripe。

2022 年 11 月 BlueSnap 是一家面向領先 B2B 和 B2C 企業的付款編配平台,它擴大了與頂級電子商務機構objectsource 的合作夥伴關係,以加強與Magento 的整合,以適應不斷發展的歐盟市場,為整個歐洲的線上商家提供支援。

2022 年 9 月,英國付款公司 Paysafe 與付款編配平台 Spreedly 合作,為英國和歐洲各地的商家提供國際付款支持,重點關注電子商務、零售、旅遊、加密貨幣和金融服務領域。交易成為可能付款閘道。

2022 年 8 月,金融服務平台 Mswipe Technologies 獲得了印度儲備銀行 (RBI) 頒發的付款聚合商 (PA) 許可證。此項批准將允許 Mswipe 開發自己的線上付款閘道。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

- 市場概況

- 產業吸引力模型-五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響

第4章 市場動態

- 市場促進因素

- 電子商務銷售額不斷成長,網路普及率不斷提高

- 行動付款需求不斷成長

- 零售業越來越多採用付款閘道

- 市場挑戰

- 隱私和安全威脅仍然令人擔憂

第5章 市場區隔

- 按類型

- 託管

- 非寄主型

- 按公司

- 中小企業

- 大型企業

- 按最終用戶

- 旅行

- 零售

- BFSI

- 媒體與娛樂

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 拉丁美洲

- 亞太地區

- 中東和非洲

第6章 競爭格局

- 公司簡介

- PayPal Holdings Inc.

- Amazon Pay

- Stripe Inc

- Skrill Limited

- PayU Group

- Adyen NV

- Payza

- Ingenico Group

- Alipay.com

- Payoneer Inc

- Paytm Mobile Solutions Pvt. Ltd

- Verifone Holdings Inc

第7章投資分析

第8章 市場機會與未來趨勢

The Payment Gateway Market size is estimated at USD 18.94 billion in 2025, and is expected to reach USD 40.53 billion by 2030, at a CAGR of 16.43% during the forecast period (2025-2030).

Additionally, due to the COVID-19 pandemic, online sales of goods, services, and entertainment grew globally due to millions of people being quarantined worldwide. According to a study by ACI Worldwide of hundreds of transactions from global online retailers, transaction volumes in most retail sectors witnessed a 74% rise in current year compared to the same period last few years, driving the market growth.

Key Highlights

- The payment method has evolved at a dizzying pace in the past few years, from the token system to cash pooling and cashless payments. A payment gateway allows any business, such as brick-and-mortar or online retailing, to collect money through the customer's preferred bank without compromising sensitive data. In every industry, integrating a payment gateway has emerged as one of the essential components of every organization. Additionally, rising online transactions are anticipated throughout the forecast period to fuel market expansion.

- Financial service companies have been able to offer unique digital services to customers due to increased e-commerce sales and the high rate of internet penetration around the world, which helps the growth of the payment gateway market. High-speed internet's rising popularity and availability will continue to fuel the market's expansion for payment gateways.

- The market for payment gateways is also driven by the increasing global demand for mobile-based payments. The use of mobile payments for various transactions, such as purchasing takeout, purchasing cinema tickets, and upgrading smartphone games, is anticipated to fuel the market's expansion over the forecast period. Also, developed and developing nations use debit or credit cards to make these payments. This aspect is anticipated to help the market under study grow even more. This is due to the ease with which payments may be made on smartphones and the ability to save card information on them.

- As most customers save their card details, there is a prone for the rising number of cyber attack cases that steal data which is a restraint. Also, other factors, such as lack of internet access in remote areas, no international standards for cross-border payments, and varying government restrictions in different countries, could restrain the market over the study period.

- Due to a global shift towards e-commerce caused by lockdowns, the COVID-19 pandemic, and the ensuing lockdowns negatively impact the payment gateway market, which has led to the launch of many payment gateways that facilitate online payments for online purchases from e-commerce websites. Due to this, the market has expanded despite the pandemic crisis. Due to UPI's growing importance in the combined post-pandemic environment, the market would experience growth in the digital sector over the projection period.

Payment Gateway Market Trends

Growing adoption of payment gateway in Retail

- Retail stores and services worldwide are rapidly adopting and have integrated mobile payment applications, such as PayPal, Samsung Pay, Apple Pay, AliPay, and WeChat Pay, to accept payments. Further, owing to the changing lifestyles, daily commerce, and rapid growth in online retailing, this trend is expected to continue during the forecast period. The raging demand for online retailing worldwide is expected to drive online payment, propelling the payment gateway market over the forecast period.

- Retailers are developing new strategies to profit from the at-home delivery and online shopping convenience economies. Payment gateways are playing a bigger role in the infrastructure of payments. For online shopping carts, point-of-sale systems, and virtual terminals to link to the payment process, they are a necessary connection point in the modern economy. This factor is expected to drive the growth of the payment gateway market.

- The market studied is changing in line with consumer behavior. The cashless economy, mobile banking, instant payments, digital commerce, and the growing impact of regulatory agencies are a few trends affecting the retail sector. Online payments make the payment process easier and more convenient for consumers, who benefit from shorter lines, cash-on-hand issue elimination, and faster-moving queues.

- The main factor driving the demand for local bank-integrated payment gateway is banks' growing adoption of digital technology. When doing a financial transaction, this payment gateway points users to banks where they can enter their financial information. This payment solution's quick and simple setup has accelerated its uptake in SMEs. Thus the mounting demand for local bank-integrated payment gateway is expected to drive the growth of the payment gateway market for the retail sector.

- For instance, the India-based company, PayU, is considered one of the most accessible e-commerce payment solutions designed to fill in the gaps left by complex service providers. PayU is favored due to the best conversion rates it offers. Notable companies like Netflix, Airbnb, and Bookmyshow use the PayU payment gateway. In November 2022, Zepto, the 10-minute grocery delivery service, would now be able to offer a faster and more intuitive payments UPI experience through the integration of Cashfree Payments' Payment Gateway API into its mobile app. The gateway is equipped with added-value service capabilities to bring more merchants online. Such initiatives are expected to fuel the growth of the market.

- Since the lockdown, e-commerce sales have increased, particularly for groceries and health products, even though many retailers are struggling with logistics. For instance, online retail order volumes in the United Kingdom have risen by over 200 % on some products since the COVID -19 outbreak.

China to Witness Significant Growth

- Chinese giants, such as Alibaba and Tencent, have pioneered digital merchant payments and are instrumental in the shift away from cash in the Chinese economy. The companies' mobile payments products, Alipay and WeChat Pay, have rapidly reshaped China's payments landscape. They are also among the largest in the world.

- China UnionPay debit and credit cards are the most used card brand. Mobile and digital wallets, such as Alipay and WeChat Pay, currently dominate the country's online market and increase physical stores. The mobile and digital wallets led by Alipay and WeChat Pay account for 71% of e-commerce transactions in the country.

- Other companies such as 99 Bill Corporation, YEEPAY, and Pay Ease also offer payment gateway in China. 99Bill Corporation is an internet organization focusing on providing online payment platform services to facilitate online transactions in China. The company has emphasized developing its industry chain and has over 80 financial institutions with over 300 access points. It has over 1.1 million merchant partners that span 20 industries, including online shopping, logistics, clothing, travel business, insurance, and education, among others.

- YeePay is another leading payment service provider in China, which focuses on offering better e-payment solutions and value-added financial services through technology and innovation. With access to more than 100 commercial banks in China, the company was among the first businesses to obtain a general payment license from the People's Bank of China.

Payment Gateway Industry Overview

The Payment Gateway Market is highly consolidated by prominent players such as PayPal, PayU, Amazon Payments, and Stripe. However, other companies are trying to attain larger market shares through mergers and acquisitions to gain more consumers.

In November 2022, BlueSnap, the payment orchestration platform for leading B2B and B2C businesses, expanded its partnership with the top eCommerce agency, objectsource, to support online sellers across Europe to enhance Magento integration for evolving EU Market.

In September 2022, British payments company Paysafe allied with Spreedly, a payments orchestration platform, to help merchants with their international payments across the UK and Europe would be able to make transactions through Paysafe's payment gateway with a focus on e-commerce, retail, travel, crypto, and financial services sectors.

In August 2022, Financial services platform Mswipe Technologies received an in-principal Payment Aggregator (PA) license from the Reserve Bank of India (RBI). With this approval, Mswipe can develop an in-house online payment gateway.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

- 3.2 Industry Attractiveness Model - 'Porter's Five Forces Analysis'

- 3.2.1 Threat of New Entrants

- 3.2.2 Bargaining Power of Consumers

- 3.2.3 Bargaining Power of Suppliers

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 Impact of COVID-19 on the Market

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased e-commerce Sales and the High Internet Penetration Rate

- 4.1.2 Increase Demand for Mobile Based Payments

- 4.1.3 Growing adoption of payment gateway in Retail

- 4.2 Market Challenges

- 4.2.1 Privacy and Security-related Threats Continue to Remain a Concern

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hosted

- 5.1.2 Non-Hosted

- 5.2 By Enterprise

- 5.2.1 Small and Medium Enterprise (SME)

- 5.2.2 Large Enterprise

- 5.3 By End User

- 5.3.1 Travel

- 5.3.2 Retail

- 5.3.3 BFSI

- 5.3.4 Media and Entertainment

- 5.3.5 Other End-user Verticals

- 5.4 BY Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Latin America

- 5.4.4 Asia Pacific

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PayPal Holdings Inc.

- 6.1.2 Amazon Pay

- 6.1.3 Stripe Inc

- 6.1.4 Skrill Limited

- 6.1.5 PayU Group

- 6.1.6 Adyen NV

- 6.1.7 Payza

- 6.1.8 Ingenico Group

- 6.1.9 Alipay.com

- 6.1.10 Payoneer Inc

- 6.1.11 Paytm Mobile Solutions Pvt. Ltd

- 6.1.12 Verifone Holdings Inc