|

市場調查報告書

商品編碼

1643204

印度的付款閘道:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)India Payment Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

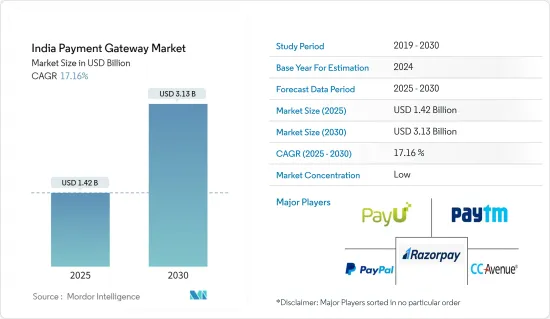

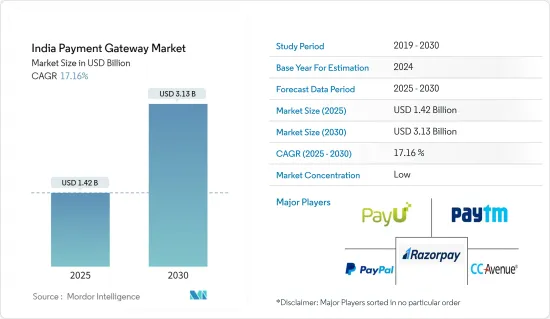

印度付款閘道市場規模預計在 2025 年為 14.2 億美元,預計到 2030 年將達到 31.3 億美元,預測期內(2025-2030 年)的複合年成長率為 17.16%。

付款閘道整合已成為任何行業任何業務的最重要方面之一。這樣就可以透過客戶首選的銀行收取資金,而不會洩漏敏感資料。

關鍵亮點

- 隨著網路越來越普及,消費者越來越意識到網路交易的便利性,偏好對網路付款的偏好也在改變。無障礙交易增強了用戶轉向網路交易的信心。線上付款的快速普及正在推動印度付款閘道市場的成長。

- 數位付款是政府「數位印度」計畫的核心之一,線上付款管道和服務在全國範圍內越來越受歡迎。死亡後,數位付款呈指數級成長,導致付款閘道供應商數量激增。

- 印度付款閘道市場受到該國日益成長的數位付款趨勢的推動。政府舉措有助於加強數位付款領域,凸顯向無現金經濟的轉變。例如,「數位印度計劃」是印度政府的旗艦計劃,其願景是將印度轉變為數位化社會。

- Worldline表示,輕資產技術將在不久的將來出現,以建立商家收單業務。輕資產是指透過商家的行動電話而不是傳統的銷售點設備接受包括卡片在內的所有形式的數位付款。該技術平台允許商家使用行動電話應用程式接受2D碼和信用卡付款。這可能會推動印度進一步採用數位化支付。

- 雖然人們對數位付款的認知和採用正在不斷成長,但需要進一步加強數位基礎設施,以確保在層級、三層級城市和農村地區的持續覆蓋和滲透。小型商家需要經濟高效且易於使用的受理工具。小商家通常很難追蹤各種可用的方法,包括錢包、UPI 和銀行應用程式。

- 疫情期間,小城市和城鎮一直處於數位付款和交易復甦的前沿。印度國家支付公司統一付款介面(UPI)表示,預計新冠疫情將促進交易活性化。據管理印度零售付款系統的統籌組織稱,在後疫情時代,UPI 在「物理」世界中的重要性將增強,將實體空間和數位空間結合起來。

印度付款閘道市場趨勢

電子商務交易量增加推動市場成長

- 電子商務交易的成長導致印度採用各種付款閘道。據印度品牌資產基金會稱,印度電商產業正在崛起,預計到2034年將超過美國成為全球第二大電商市場。預計2020年電子商務市場規模將達640億美元,2026年將達2,000億美元。

- 各種政府法規正在推動印度電子商務產業的發展。印度允許B2B電子商務領域進行100%的外商直接投資。根據電子商務領域外商直接投資的新指南,在市場/模式電子商務中,可以透過自動途徑進行 100% 的外商直接投資。

- 由於冠狀病毒大流行,為避免商家和用戶湧向商店和附近的網點,商家將開始以數位方式接受和管理訂單,同時要求線上付款。 Flipkart 旗下的 PhonePe 和 Google Pay 允許用戶以數位方式識別附近營業的商店,並在透過各自的應用程式付款的同時進行送貨。據印度儲備銀行稱,2020 年 4 月 UPI 零售付款交易超過 15,110 億印度盧比。

- 新的供應商正在進入電子商務領域,促進了該國各種付款閘道的使用。 2020 年 5 月,信實產業以 JioMart 品牌在 200 個城市啟動了其雜貨業務的線上擴張。 JioMart 提供的產品包括水果和蔬菜、乳製品和烘焙點心、主食、零食和品牌食品、食品和飲料、個人護理和居家醫療。

- 信用卡交易量和 UPI 等其他產品的激增也令人鼓舞。據印度儲備銀行稱,2019 年簽帳金融卡交易額為 6.8 兆印度盧比,信用卡交易額為 7.1 兆印度盧比,2019 年和 2020 年與前一年同期比較增 21% 和 33%。

有利的政府措施和監管標準推動市場成長

- 印度儲備銀行 2020 年 3 月發布的關於付款聚合商 (PA) 和付款閘道(PG) 的指南對於促進印度付款閘道的發展至關重要。除了保障客戶資金安全(根據印度儲備銀行 2009 年關於涉及仲介業者的電子付款交易的指示)之外,新指南還承認 PA 為授權營業單位,賦予它們對資金業務和管理的靈活性和控制力。

- 根據印度儲備銀行的新規範,不允許向託管帳戶發放貸款和支付利息。 PA的業務構成了指定的付款系統。根據日均餘額計算的「核心部分」可以累積利息,然後轉入單獨帳戶,為 PA 提供新的收入來源。

- 此外,為了透過本土即時付款系統促進付款,政府宣布免除透過 UPI 和 RuPay付款方式進行的交易的商家折扣率 (MDR) 費用。

- NPCI 也將與印度所得稅部門合作,實現透過 UPI 繳稅。所有這些舉措都有望推動印度付款閘道的採用。

- Worldline表示,輕資產技術正在興起,商家收購也將很快確立。輕資產是指透過商家的行動電話而不是傳統的銷售點設備接受包括卡片在內的所有形式的數位付款。該技術平台允許商家使用行動電話應用程式接受2D碼和信用卡付款。預計這將進一步推動印度數位付款的普及。

印度付款閘道產業概況

印度的付款閘道市場競爭激烈。市場參與企業,有大有小,市場集中度較高。主要參與企業包括 PayU、Paytm、Razorpay Software Private Limited、PayPal India Private Limited、CCAvenue、BillDesk、Instamojo Technologies Private Limited 等。這些公司透過建立多種夥伴關係關係、投資計劃和向市場推出新產品來擴大市場佔有率。

- 2022 年 3 月-Razorpay 收購銀行創新付款解決方案供應商 IZealiant Technologies。此次收購使我們能夠為銀行提供卓越的技術基礎設施,從而增強最終用戶的付款體驗。銀行是付款生態系統的關鍵相關人員。收購 IZealiant Technologies 將使兩家公司能夠為銀行打造業界首創的解決方案,為企業及其客戶提供世界一流的付款體驗。

- 2021 年 9 月-PayU 收購付款閘道公司 Billdesk。透過此次收購,該公司的付款和金融科技業務 PayU(業務範圍涵蓋超過 20 個市場)已成為以總付款量(TPV)計算的全球領先線上付款提供者。合併後的公司每年將處理40億筆交易。由 Prosus 支持的金融科技公司 PayU 收購 Billdesk 正值印度付款產業在 2021 年取得重大進展之際。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對印度付款閘道市場的影響

第5章 市場動態

- 市場促進因素

- 國內電子商務交易量增加

- 不斷變化的市場條件為新供應商進入市場鋪平了道路,持續的技術進步(特別是在安全方面)將進一步支持數位交易的採用

- 市場問題

- 印度付款閘道的演變

- 政府主要措施和監管標準(廢除 MDR 和增加現金交易課稅)

第6章 市場細分

- 按組織規模

- 小型至中型

- 大規模

第7章 競爭格局

- 公司簡介

- PayU

- Paytm

- Razorpay Software Private Limited

- PayPal India Private Limited

- CCAvenue

- BillDesk

- Instamojo Technologies Private Limited

- One MobiKwik Systems Private Limited

- IMSL-Fiserv

- Ingenico

第8章投資分析

第9章:市場的未來

The India Payment Gateway Market size is estimated at USD 1.42 billion in 2025, and is expected to reach USD 3.13 billion by 2030, at a CAGR of 17.16% during the forecast period (2025-2030).

Integrating a payment gateway has become one of the most critical aspects of any business in every industry. It allows collecting money through the customer's preferred bank without compromising sensitive data.

Key Highlights

- With the increasing internet penetration and awareness about the ease of online transactions, consumers are changing their preferences for making payments online. The hurdle-free transactions generate confidence among the users for switching to online transactions. This rapid adoption of the online payment method is fueling India's payment gateway market growth.

- Digital payment has been one of the highlights of the government's 'Digital India' initiative, and online payment platforms and services have spread themselves in the country. Post demonetization, digital transactions witnessed a tremendous increase, which led to the sudden emergence of payment gateway vendors.

- The payment gateway market in India is boosted by an increase in digital payment trends in India. Government initiatives are helping enhance the digital payment space and emphasize moving toward a cashless economy. For instance, the Digital India program is a flagship program of the Government of India with a vision to transform India into a digitally empowered society.

- As per Worldline, asset-lite technologies will emerge and establish merchant acquiring in the near future. Asset-lite refers to the acceptance of all forms of digital payments, including cards, not on traditional POS machines but merchants' mobile phones. On this technology platform, merchants using an app on their phones will be able to accept payments through QR and cards. This will further increase the adoption of digital costs all over India.

- Although the awareness and adoption of digital payments are increasing, the digital infrastructure needs to be strengthened further to ensure consistent reach and penetration across the Tier 2 and Tier 3 cities and rural areas. Small merchants need acceptance tools that are cost-effective and easy to enable. In many cases, it is difficult for a micro-merchant to keep tabs on different means such as wallets, UPI, and bank apps.

- Smaller cities and towns have been at the forefront of digital payments and transactions recovery amid the pandemic. According to the National Payments Corporation of India, Unified Payments Interface (UPI), transactions will see a boost due to the outbreak of Covid-19. The umbrella organization for operating retail payments and settlement systems in India said that the relevance of UPI would grow in the 'physical' world, combining the physical and digital space, in a post-COVID world.

India Payment Gateway Market Trends

Growing E-Commerce Transactions to Drive Market Growth

- The rise in e-commerce transactions is increasing the adoption of various payment gateways in India. According to the Indian Brand Equity Foundation, the Indian e-commerce industry has been on an upward growth trajectory and is expected to surpass the United States to become the second-largest e-commerce market in the world by 2034. The e-commerce market is expected to reach USD 64 billion by 2020 and USD 200 billion by 2026.

- Various government regulations are boosting the e-commerce industry in the country. In India, 100% FDI is permitted in B2B e-commerce. As per new guidelines on FDI in e-commerce, 100% FDI under automatic route is allowed in the marketplace model of e-commerce.

- As merchants and users avoid crowding in shops and neighborhood stores due to the coronavirus pandemic, merchants will start taking and managing orders digitally while requesting online payments. Flipkart-owned PhonePe and Google Pay allowed users to digitally identify neighborhood stores in a customer's locality, which were open and delivering while allowing users to pay them through their respective apps. According to the RBI, UPI transactions for April 2020 exceeded INR 1511 billion for retail payments.

- New vendors are entering the e-commerce space, which will boost the use of various payment gateways in the country. In May 2020, Reliance Industries launched an online extension of its grocery business under the JioMart brand across 200 cities. Products offered on JioMart include fruits and vegetables, dairy and baked goods, staples, snacks and branded foods, beverages, and personal and home care.

- The surge in card transactions and other products like UPI has also been encouraging. As per RBI, the transaction value of debit cards stood at INR 6.8 trillion while the transaction value of credit cards stood at INR 7.1 trillion, registering YoY growth of 21% and 33%, respectively, in 2019 & 2020.

Favourable Government Initiatives and Regulatory Standards to Boost the Market Growth

- The RBI's March 2020 guidelines on Payment Aggregators (PAs) and Payment Gateways (PGs) are crucial to driving the growth of payment gateways in India. Besides protecting customer funds (as per the RBI's 2009 Directions for Electronic Payment Transactions involving Intermediaries), the new guidelines also express recognition of PAs as authorized entities and grant flexibility and control with operations and funds management.

- Under the new norms of RBI, neither loans nor earning interest is permissible for the escrow account. The PA's operations will constitute designated payment systems. Interest can be accumulated over a 'core portion,' computed based on the average daily outstanding balance, and transferred to a separate account, thus creating a new avenue of income for the PA.

- Also, to boost payments through home-grown real-time payment systems, the government announced the exemption of Merchant Discount Rate (MDR) charges on transactions via UPI and RuPay payment modes.

- Besides, NPCI is planning to collaborate with the income tax department of India to enable tax payments using UPI. All these initiatives are expected to increase the adoption of payment gateways in India.

- As per Worldline, asset-lite technologies will emerge and establish merchant acquisition shortly. Asset-lite refers to the acceptance of all forms of digital payments, including cards, not on traditional POS machines but on merchants' mobile phones. On this technology platform, merchants using an app on their phones will be able to accept payments through QR and cards. This will further increase the adoption of digital payment all over India.

India Payment Gateway Industry Overview

The India Payment Gateway Market is very competitive. The market is highly concentrated due to various small and large players. The major players in the market are PayU, Paytm, Razorpay Software Private Limited, PayPal India Private Limited, CCAvenue, BillDesk, Instamojo Technologies Private Limited, and many more. The companies are increasing the market share by forming multiple partnerships, investing in projects, and launching new products in the market.

- March 2022 - Razorpay acquired IZealiant Technologies, a provider of innovative payment solutions for banks. The acquisition enables support banks with excellent tech infrastructure that enhances the payment experience for end-users. Banks are key stakeholders in the payments ecosystem. With the acquisition of IZealiant technologies, both companies can build industry-first solutions for banks to create a world-class payments experience for businesses and customers.

- September 2021 - PayU acquired Billdesk, a payment gateway company. This acquisition helped PayU, the payments and fintech business of the company, which operates in more than 20 markets, emerge as the leading online payment provider globally by total payment volume (TPV). The combined entity will have a total of 4 billion transactions annually. The Prosus-backed fintech firm PayU acquired Billdesk when the Indian payments segment saw huge traction in 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the India Payment Gateway Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Volume of E-Commerce Transactions in the Country

- 5.1.2 Evolving Market Landscape To Pave Way For Entry of New Vendors and the Ongoing Technological Advancements (Specifically Focused on Security) to Further Aid Penetration of Digital Transactions

- 5.2 Market Challenges

- 5.2.1 Evolution of Payment Gateway Landscape in India

- 5.2.2 Key Government Initiatives and Regulatory Standards (Removal of MDR and Higher Tax on Cash Transactions)

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium

- 6.1.2 Large-Scale

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PayU

- 7.1.2 Paytm

- 7.1.3 Razorpay Software Private Limited

- 7.1.4 PayPal India Private Limited

- 7.1.5 CCAvenue

- 7.1.6 BillDesk

- 7.1.7 Instamojo Technologies Private Limited

- 7.1.8 One MobiKwik Systems Private Limited

- 7.1.9 IMSL-Fiserv

- 7.1.10 Ingenico