|

市場調查報告書

商品編碼

1642004

多點觸控技術:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Multi-touch Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

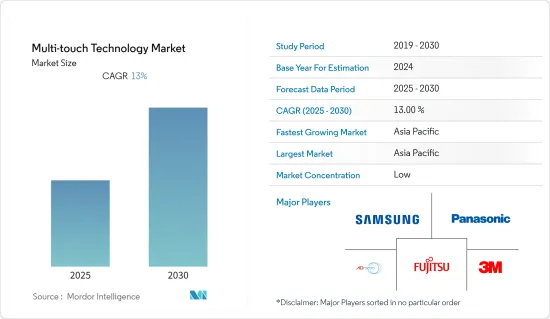

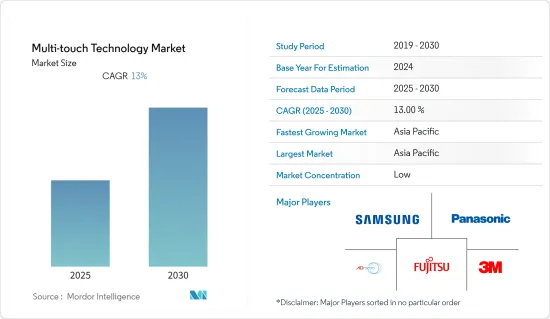

預計預測期內多點觸控技術市場複合年成長率將達到 13%。

智慧型手機、平板電腦和筆記型電腦等智慧電子顯示器的使用日益增多,使得這些產品在多點觸控技術市場佔據主導地位。人們對多用戶顯示器(如縱向螢幕和多點觸控平板電腦)的日益關注推動了市場的成長。

主要亮點

- 多點觸控螢幕設備的使用和採用不斷增加也是研究期間推動市場成長的因素之一。新的觸控螢幕應用的創建預計將推動市場需求。蘋果iPad的日益普及以及基於Android的平板電腦的巨大成長潛力促使幾家主要的PC和行動裝置製造商進入平板電腦市場。推動整體市場需求的主要因素是觸控螢幕顯示器的廣泛使用和電子設備的興起。

- 此外,具有增強感測功能的低成本多點觸控螢幕顯示器的推出也推動了市場的成長。此外,出於客戶參與和品牌推廣目的,該產品在零售和媒體應用中的使用不斷增加,從而推動了市場成長。

- 此外,在北美和歐洲等已開發地區,零售業正在使用互動式多點觸控顯示器來實現品牌推廣和客戶參與策略。互動式服務站和桌面顯示器是這些市場中多點觸控技術的例子。

- 面板高成本、原物料短缺、價格波動等挑戰是阻礙市場成長的主要因素。然而,為了應對這些挑戰,大型目標商標產品製造商(OEM)正在提供廉價勞動力和原料的新興國家設立工廠。

- COVID-19 疫情擾亂了觸控螢幕顯示器和自助服務終端製造商的供應鏈,尤其是在早期階段。此外,為遏制病毒傳播而採取的嚴格措施導致全球商業活動大幅下滑,影響了零售、運輸、酒店、體育和休閒行業的需求以及全球經濟成長,阻礙了多點觸控。然而,隨著全球經濟重回正軌以及各行業需求恢復勢頭,受調查市場預計將逐步成長。

多點觸控技術市場趨勢

消費性電子產品的使用增加推動了需求

- 近年來,全球消費性電子產業經歷了顯著成長。連接技術的進步和價格實惠的顯示面板的普及,使得許多消費性電子設備都採用了觸控螢幕顯示器單元。

- 數位化的快速進步以及智慧型手機和個人電腦銷量的增加,為多點觸控技術在全球市場創造了潛在的空間。高階電子產品價格的上漲以及對採用最新技術的偏好日益增加是推動全球消費性電子產品市場發展的主要因素。

- 根據美國消費科技協會(CTA)預測,美國消費科技產業的零售額將首次超過 5,050 億美元。該預測意味著 2021 年的收入將比 2020 年增加 2.8%,高於令人印象深刻的 9.6% 的增幅。預計對智慧型手機、個人健康設備、汽車技術和串流媒體服務的強勁需求將成為這一成長的主要驅動力。

- 在消費性電子領域,智慧型手機預計將佔據多點觸控技術應用的很大佔有率。這些設備的日益普及預計將創造巨大的成長機會。例如,愛立信預計未來五年智慧型手機用戶數量將從去年的 62.59 億部成長至 76.9 億部。

亞太地區預計將成為成長最快的市場

- 亞太地區是多點觸控技術市場成長最快的地區,預計在預測期內仍將維持成長。快速的都市化正在增加亞太地區的可支配收入,使消費者有能力購買新技術。

- 人們對數位科技的認知不斷提高,推動了智慧型手機和穿戴式裝置等智慧消費設備的普及,為多點觸控科技產業創造了有利的市場環境。例如,根據愛立信預測,東南亞和大洋洲的智慧型手機用戶數量預計將從 2020 年的 8.5 億增加到未來五年的 11.4 億。

- 大多數主要的智慧型手機製造商都來自該地區,包括三星、小米、一加、Panasonic和華為。該地區龐大的消費群和不斷擴大的智慧型手機製造地預計將推動對多點觸控技術顯示器的需求。

- 過去幾十年來,中國已成為智慧型手機和其他電子產品的主要製造國。由於顯示設備日益普及,且「中國製造2025」等政府措施推動產業成長,中國可望成為多點觸控技術市場的主要參與者。

- 考慮到成長前景,一些在多點觸控技術產業價值鏈各個階段運作的全球領先公司正在擴大其在該地區的業務。例如,2022 年 1 月,智慧型手機和平板電腦設備手寫筆和多點觸控感應器組件的領先供應商Wacom開設了第九家體驗中心,擴大了在印度的業務。

多點觸控技術產業概況

多點觸控技術市場由各種全球和區域參與者組成,例如 3M、AD Metro Inc.、富士通有限公司、Panasonic Corporation和三星電子。大多數參與者都參與了合併、收購、新產品發布和市場擴張等多項策略發展,以在研究市場中獲得競爭優勢。

- 2023年4月-三星電子在倫敦舉辦的全球最大的教育科技展覽會Bett(英國教育訓練與科技)2023上推出了具有升級功能和強大軟體解決方案的新型互動式顯示器。與會的 30,000 名相關人員將能夠利用尖端的三星互動顯示器和三星白板應用程式探索教育的未來。

- 2023 年 1 月 - Panasonic Connect Europe 推出一流的 EQ2-PCAP 系列,擴大了其 4K 觸控顯示器範圍。這些優質的互動式多點觸控專業顯示器有六種螢幕選項,尺寸從 43 吋到 86 吋不等,並配備電容式觸控技術,讓會議、腦力激盪會議和課堂協作變得輕鬆而高效。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

- 技術簡介

- 反抗

- 電容式

- 光學

- 其他技術

第5章 市場動態

- 市場促進因素

- 擴大消費性電子產品的使用

- 互動式螢幕在商業應用中的使用迅速增加

- 顯示技術的進步

- 市場限制

- 觸控面板高成本

第6章 市場細分

- 按產品

- 智慧型手機

- 藥片

- 個人電腦和筆記型電腦

- 自助服務終端

- 其他產品

- 按應用

- 個人使用

- 企業用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- 3M Company

- AD Metro Inc.

- DMC Co. Ltd

- Dongguan Cloudtop Electronic Technology Co. Ltd

- Fujitsu Limited

- GestureTek

- Ideum

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- TouchNetix Limited

第8章投資分析

第9章:未來市場展望

The Multi-touch Technology Market is expected to register a CAGR of 13% during the forecast period.

The increasing utilization of intelligent electronic displays, such as smartphones, tablets, and laptops, has formed a predominant share of these products in the multi-touch technology market. The growing focus on multi-user displays, such as vertical screens and multi-touch tablets, enables market growth.

Key Highlights

- Another factor driving the market growth during the study is the increasing use and adoption of multi-touch screen devices. The creation of new touchscreen applications will be a driving factor in market demand growth. The rising popularity of Apple's iPad and the enormous growth potential of Android-based tablets have prompted several major PC and mobile original equipment manufacturers to enter the tablet market. The main factors driving the overall market demand are the growing acceptance of touch panel displays and an increase in the number of electronic devices.

- Furthermore, the introduction of low-cost multi-touch screen displays with enhanced sense capabilities is boosting the market growth. Furthermore, rising product utilization in retail and media applications for customer engagement and branding is boosting the market growth.

- Additionally, the retail industry uses interactive multi-touch displays for branding and customer engagement strategies in developed regions, such as North America and Europe. Interactive kiosks and table displays are examples of multi-touch technologies in these markets.

- Factors such as the higher cost of panels, lack of availability of raw materials, and fluctuation in their prices are among the major factors challenging the market's growth. However, to counter such challenges, major original equipment manufacturers (OEMs) are establishing their units in developing countries, as they provide cheap labor and raw materials at a lower cost.

- The outbreak of COVID-19 disrupted supply chains for manufacturers of touchscreen displays or kiosks, especially during the initial phase. Additionally, stringent measures taken to contain the spread of the virus caused a significant drop in global commercial activities, affecting the demand from the retail, transportation, hospitality, sports, and entertainment sectors, as well as global economic growth, stifling the development of the multi-touch technology market. However, with the economy worldwide back on track and demand across all sectors gaining momentum again, the studied market is also expected to grow gradually.

Multi-touch Technology Market Trends

Increasing Use of Consumer Electronics is Driving the Demand

- The global consumer electronics industry has witnessed significant growth in recent years. The advancement in connectivity technologies and the availability of affordable display panels have significantly enhanced the adoption of touchscreen display units in many consumer electronics devices.

- A surge in digitalization and increased sales of smartphones and personal computers have created a potential space for multitouch technology in the global market. Decreasing cost of high-end electronics products and growing preference toward adopting updated technology are primarily driving the market for consumer electronics in various parts of the world.

- According to the Consumer Technology Association (CTA), the US consumer technology industry is projected to generate over USD 505 billion in retail sales revenue for the first time ever. The estimation represents a 2.8% revenue increase from 2021's impressive 9.6% growth over 2020. Strong demand for smartphones, personal health devices, automotive tech, and streaming services are expected to be among the major driving factors behind this growth.

- In the consumer electronics segment, the smartphone is expected to hold a major share in terms of multitouch technology adoption. The increasing penetration of these devices is expected to create significant growth opportunities. For instance, according to Ericsson, smartphone subscription is expected to grow from 6,259 million last year to 7,690 million in the next five years.

Asia-Pacific Projected to be the Fastest-growing Market

- The Asia-Pacific region has seen rapid growth in the multitouch technology market and is expected to sustain growth over the forecast period. Rapid urbanization has increased disposable income in the Asia-Pacific region, letting consumers spend on new technologies.

- Growing awareness about digital technologies is driving the adoption of smart consumer devices such as smartphones, wearables, etc., creating a favorable market scenario for the multitouch technology industry. For instance, according to Ericsson, smartphone subscriptions in Southeast Asia and Oceania region are expected to increase from 850 million in 2020 to 1,140 million in the next five years.

- Most major smartphone manufacturers, such as Samsung, Xiaomi, OnePlus, Panasonic, Huawei, etc., hail from this region. The region's large consumer base and expanding smartphone manufacturing footprint are expected to drive the demand for multitouch technology displays.

- In the last few decades, China has emerged to be the leading manufacturer of smartphones and other electronic products. The country is expected to hold a prominent position in the multitouch technology market owing to the increasing penetration of display devices and favorable government initiatives such as "Made in China 2025," supporting the industry's growth.

- Considering the growth prospects, some of the leading global players operating across various stages of the multitouch technology industry value chain are expanding their presence in the region. For instance, in January 2022, Wacom, a leading supplier of pen and multitouch sensor components for smartphones and tablet-type devices, expanded its presence in India by opening its ninth experience center.

Multi-touch Technology Industry Overview

The multi-touch technology market is fragmented with various global and regional players, such as 3M, A D Metro Inc., Fujitsu Limited, Panasonic Corporation, Samsung Electronics Co. Ltd, and many others. Most of these players are involved in several strategic developments, including mergers, acquisitions, new product launches, and market expansion, to gain a competitive edge in the market studied.

- April 2023 - Samsung Electronics Co., Ltd. launched a new interactive display with upgraded features and a powerful software solution at Bett (British Educational Training and Technology) 2023, London's world's largest education technology exhibition. The 30,000 educators in attendance can explore the future of education with the cutting-edge Samsung Interactive Display and Samsung Whiteboard App.

- January 2023 - Panasonic Connect Europe has expanded its range of 4K touch displays by introducing the best-in-class EQ2-PCAP Series. With six screen options, ranging from 43-86 inches, these premium interactive multi-touch professional displays with Capacitive Touch Technology make collaboration in meetings, brainstorming sessions, and classrooms effortless and productive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

- 4.5.1 Resistive

- 4.5.2 Capacitive

- 4.5.3 Optical

- 4.5.4 Other Technologies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Consumer Electronics

- 5.1.2 Surge in Usage of Interactive Screens in Commercial Application

- 5.1.3 Advancements in Display Technology

- 5.2 Market Restraints

- 5.2.1 Relative High Cost of Touch Screen Panels

6 MARKET SEGMENTATION

- 6.1 By Products

- 6.1.1 Smartphones

- 6.1.2 Tablets

- 6.1.3 PCs and Laptops

- 6.1.4 Kiosks

- 6.1.5 Other Products

- 6.2 By Application

- 6.2.1 Personal Application

- 6.2.2 Enterprise Application

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3M Company

- 7.1.2 A D Metro Inc.

- 7.1.3 DMC Co. Ltd

- 7.1.4 Dongguan Cloudtop Electronic Technology Co. Ltd

- 7.1.5 Fujitsu Limited

- 7.1.6 GestureTek

- 7.1.7 Ideum

- 7.1.8 Panasonic Corporation

- 7.1.9 Samsung Electronics Co. Ltd

- 7.1.10 TouchNetix Limited