|

市場調查報告書

商品編碼

1628722

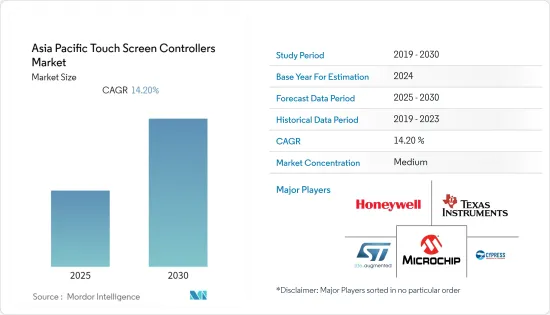

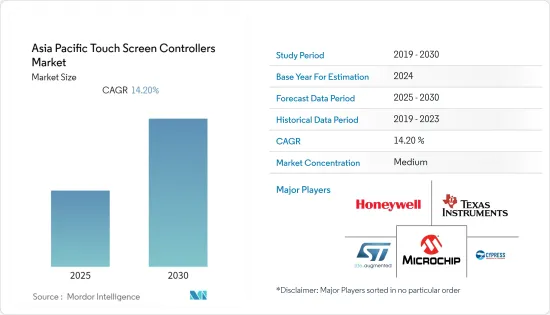

亞太地區觸控螢幕控制器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia Pacific Touch Screen Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區觸控螢幕控制器市場預計在預測期內複合年成長率為14.2%

主要亮點

- >亞太市場正在蓬勃發展,已成為任何製造智慧型手機的公司的巨大市場。該產業在印度和中國等國家的成長巨大,蘋果、三星和 HTC 等公司以及小米、Oppo、Micromax 和 Karbonn 等兩國國內企業之間的競爭正在進行中。

- 智慧型手機的一個重要組成部分是觸控螢幕控制器,它讓消費者感覺他們是透過觸控螢幕來控制行動電話的,而不是觸控按鈕。

- 例如,2022 年 7 月,Panasonic推出了一款與標準觸控感應器相容的電容式旋鈕。例如,

- Panasonic將於 2022 年 7 月支援標準觸控感應器。

- 推出電容式旋鈕

- 。魔旋鈕是一種電容式旋轉編碼器,具有機械旋轉和推動功能,可放置在觸控區域的任何位置。

- 觸碰

- 彌合操縱和機械觸覺之間的差距。

- 觸控螢幕顯示器在全世界的需求量很大。 iPhone和iPad首先推動了對觸控螢幕的需求,幾乎每個供應商都推出了自己版本的智慧型裝置。

- 此外,2022年7月,戴爾在印度推出了搭載英特爾第12代酷睿處理器的筆記型電腦XPS 13 Plus 932。

- 由於智慧型手機和平板電腦等家用電器價格下降、簡單用戶介面 (UI) 的普及、政府對電子學習教育的努力以及透過自助服務降低人事費用,觸控螢幕終端在日本變得越來越受歡迎。使用

亞太地區觸控螢幕控制器市場趨勢

家用電子產品預計將佔據較大佔有率

- 消費性電子產品是市場上最重要、最重要的細分市場之一。隨著對創新新產品的需求迅速成長,觸控螢幕正被融入到各種各樣的產品中。

- 行動電話、穿戴式裝置、平板電腦、筆記型電腦和個人電腦是廣泛採用觸控功能的家用電器。如今,洗衣機、冰箱、影印機等產品都配備了觸控介面,為消費者提供更好的體驗,創造差異化需求。

- 此外,三星於 2021 年 10 月推出了新的「智慧型觸控通話」服務。該服務減少了客戶致電三星顧客關懷解決疑問時的等待時間,使客戶能夠節省時間,同時在家中管理工作和個人責任,預計將進一步推動市場成長。

- 此外,印度政府也推出了《2019年國家電子政策》,目標是到2025年實現銷售收入400美元。它還計劃在2025年生產10億支行動電話,創造總價值1900億美元。此外,印度對高階家電的需求也快速成長。

- 隨著穿戴式裝置變得更加便宜,穿戴式領域的競爭預計將加劇。預計到預測期結束時,設備銷售將突破 10 億台大關。例如,2022年4月,一加在印度推出了最強大的智慧型手機一加10 Pro 5G。這款智慧型手機是去年 3 月推出的 OnePlus 9 Pro 的後繼機。該裝置搭載 Snapdragon 8 Gen 1 晶片組,並擁有高達 12GB 的 RAM。

- 市場上先進且更靈活的設備的激增正在增加消費者對這些設備的採用,從而有助於市場的擴張。折疊式行動電話預計將加劇支援這些系統的控制器的市場競爭。 5G設備預計將維持行動裝置的成長並刺激該細分市場的需求。

印度預計將出現顯著成長

- 印度電子產業的顯著成長是創造積極市場前景的關鍵因素之一。此外,汽車、消費性電子產品、零售和銀行自助終端等資訊娛樂系統中觸控螢幕面板的廣泛採用進一步推動了市場成長。

- 近日,電子和資訊技術部發布了印度電子製造業願景文件第二卷,指出電子製造業將從2020-21年的750億美元成長到2025-26年的3000億美元。

- 此外,由於豐富的產業環境和投資者友善的政策,三星決定將其顯示器製造部門從中國轉移到諾伊達。該公司已在諾伊達投資約6.5億美元。為了吸引三星的行動和IT顯示器製造部門落腳諾伊達,政府提供了6,100萬美元的特別獎勵。這項重大投資創造了500個直接就業機會和1,300多個間接就業機會。因此,印度顯示器製造相關投資的增加預計將增加該國觸控螢幕控制器的需求,從而推動整體市場成長。

- 此外,據 IBEF 稱,作為受歡迎的製造地,印度國內電子產品產量已從 2014-15 年的 290 億美元成長到 2020-21 年的 670 億美元。印度電子業對國內生產總值(GDP)的貢獻約為3.4%。政府承諾在未來六年內投入約 170 億美元,透過四個 PLI 計畫促進國內電子製造業:半導體與設計、智慧型手機、IT 硬體和組件。

亞太地區觸控螢幕控制器產業概況

亞太地區觸控螢幕控制器市場適度分散。公司不斷創新並結成策略夥伴關係以維持市場佔有率。

- 2022 年 6 月 - Microchip Technology Inc. 推出了顯示控制器上的 maXTouch 旋鈕,推出了一系列汽車級觸控螢幕控制器,該控制器本身支援觸控面板上的電容式旋轉編碼器和機械開關的檢測和彙報。

- 2021 年 4 月 - Microchip 推出 maXTouch MXT2912TD-UW 觸控螢幕控制器。 MXT2912TD-UW 減少了在車輛人機介面 (HMI) 顯示器中使用多個觸控控制器的需要。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 智慧型設備增加

- 各行業的使用量增加

- 市場挑戰

- 與技術相關的複雜性

第6章 市場細分

- 按類型

- 電阻膜式

- 電容式

- 按最終用戶

- 工業的

- 衛生保健

- 家電

- 零售

- BFSI

- 其他最終用戶

- 按國家/地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- STMicroelectronics, NV

- Texas Instruments, Inc.

- Cypress Semiconductor Corporation

- Microchip Technology, Inc.

- Honeywell International, Inc.

- Atmel Corporation

- Freescale Semiconductor, Inc.

- Future Electronics, Inc.

- Silicon Laboratories, Inc.

- Infineon Technologies AG

- Analog Devices, Inc.

- Maxim Integrated Products, Inc.

- Semtech Corporation

- Rohm Company Limited

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 52126

The Asia Pacific Touch Screen Controllers Market is expected to register a CAGR of 14.2% during the forecast period.

Key Highlights

- >

- The boom in Asia Pacific markets has been enormous and is a huge market for every company that makes smartphones. The growth of this industry in countries like India and China is huge, with intense competition from companies like Apple, Samsung, and HTC and between home-grown companies in the two countries like Xiaomi, Oppo, Micromax, Karbonn, etc. There is a huge demand in both the low-cost and high-end smartphone segments.

- An essential part of the smartphone is the touch screen controller, which helps the consumer get the real feel of handling the phone by touching the screen, unlike touching buttons. As the smartphone industry grows in this region, the touch screen controller market is also anticipated to propel.

- For instance, in July 2022, Panasonic launched Capacitive Knob ready for Standard Touch Sensors. The Magic Knob is a capacitive rotary encoder containing mechanical rotation & push functionality that can be placed everywhere in the touch area to bridge the gap between touch and mechanical haptics.

- Touch screen displays are in huge demand across the world. First given a boost by iPhones and iPads, demand for touchscreen has been rising exponentially with almost every vendor launching its own version of smart devices. This growth is driving the touch screen controller market, with the increasing application of touch screens across the industries.

- Moreover, in July 2022, Dell launched its XPS 13 Plus 932 laptop powered by Intel's 12 Gen core processor in India.

- Furthermore, the declining cost of consumer electronics, such as smartphones and tablet PCs, the growing adoption of simple user interface (UI), government initiatives toward E-learning education, and reduction in labor cost through self-service, have encouraged the usage of these devices in Japan.

APAC Touch Screen Controllers Market Trends

Consumer Electronics is Expected to Hold the Major Share

- Consumer electronics is one of the market's most important and significant segments. The fast-paced demand from the segment for new and innovative products has seen touch screens being embraced by multiple products.

- Mobiles, wearables, tablets, laptops, and PCs are a few consumer electronic products that have adopted touch capabilities on a broader scale. Recently, products, such as washing machines, refrigerators, copiers, etc., have all been equipped with touch-enabled interfaces to offer a better consumer experience and create a differentiated demand.

- Moreover, in October 2021, Samsung launched the new 'Smart Touch Call' service, which will reduce customer wait time when they call Samsung's Customer Care to resolve their queries, allowing them to save time while managing their work and personal responsibilities from home, which seems further drive market growth.

- Furthermore, The Government of India launched the National Policy on Electronics, 2019, which aims to achieve a turnover of USD 400 by 2025. It is also aimed at the production of a billion mobile handsets by 2025, valued at USD 190 billion. In addition, India is also witnessing a surge in demand for high-end consumer electronics.

- The competition in the wearables segment is expected to grow as these devices have become more affordable. The device volume is expected to surpass the billion mark by the end of the forecast period. For instance, in April 2022, OnePlus launched its most powerful smartphone OnePlus 10 Pro 5G, in India. The smartphone is the successor to the OnePlus 9 Pro, launched in March last year. The handset is powered by a Snapdragon 8 Gen 1 chipset with up to 12GB of RAM.

- The proliferation of advanced and more flexible devices in the market contributes to market expansion as consumers increasingly adopt these devices. Foldable mobile phones are expected to increase competition in the market for controllers that support these systems. 5G devices are expected to sustain the growth of mobile devices and boost the demand in the market segment.

India is Expected to Register Significant Growth

- Significant growth in the electronics industry across India is one of the key factors creating a positive outlook for the market. Moreover, the widespread adoption of touchscreen panels in infotainment systems in automobiles, home appliances, and retail and banking kiosks will further drive market growth.

- Recently, the Ministry of Electronics & Information Technology released the second volume of the Vision document on Electronics Manufacturing in India, which stated that the electronics manufacturing industry will grow to USD 300 billion by 2025-26, from USD 75 billion in 2020-21.

- Furthermore, due to the enhanced industrial environment and investor-friendly policies, Samsung decided to relocate its display manufacturing unit from China to Noida. The company has invested almost USD 650 million in Noida. To attract Samsung's mobile and IT display production unit to Noida, the government gave special incentives to the tune of USD 61 million. This massive investment also created 500 direct and over 1,300 indirect jobs. Therefore, the growing investments related to display manufacturing in India will augment the demand for touch screen controllers in the country, thereby boosting the overall market growth.

- Moreover, according to IBEF, India, which is considered a popular manufacturing hub, has grown its domestic electronics production from USD 29 billion in 2014-15 to USD 67 billion in 2020-21. The electronics sector of India contributes around 3.4% of the country's Gross Domestic Product (GDP). The government has committed nearly USD 17 billion over the next six years across four PLI Schemes, semiconductors and designs, Smartphones, IT Hardware, and Components to boost electronics manufacturing in the country.

APAC Touch Screen Controllers Industry Overview

The Asia Pacific Touch Screen Controllers Market is moderately fragmented. The companies keep innovating and entering into strategic partnerships to retain their market share.

- June 2022- Microchip Technology Inc. announced the maXTouch Knob on Display controller as the foremost automotive-grade touchscreen controller family to natively support the detection and reporting of capacitive rotary encoders and mechanical switches on top of a touch panel.

- April 2021- Microchip announces maXTouch MXT2912TD-UW touchscreen controller. The MXT2912TD-UW decreases the need for multiple touch controllers within a vehicle's human-machine interface (HMI) display.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Smart Devices

- 5.1.2 Increased Usage across Various Industries

- 5.2 Market Challenges

- 5.2.1 Complexities Associated with the Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Resistive

- 6.1.2 Capacitive

- 6.2 By End User Application

- 6.2.1 Industrial

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Retail

- 6.2.5 BFSI

- 6.2.6 Other End Users Applications

- 6.3 By Country

- 6.3.1 India

- 6.3.2 China

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of the Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics, N.V.

- 7.1.2 Texas Instruments, Inc.

- 7.1.3 Cypress Semiconductor Corporation

- 7.1.4 Microchip Technology, Inc.

- 7.1.5 Honeywell International, Inc.

- 7.1.6 Atmel Corporation

- 7.1.7 Freescale Semiconductor, Inc.

- 7.1.8 Future Electronics, Inc.

- 7.1.9 Silicon Laboratories, Inc.

- 7.1.10 Infineon Technologies AG

- 7.1.11 Analog Devices, Inc.

- 7.1.12 Maxim Integrated Products, Inc.

- 7.1.13 Semtech Corporation

- 7.1.14 Rohm Company Limited

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219