|

市場調查報告書

商品編碼

1642060

歐洲 PLC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe PLC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

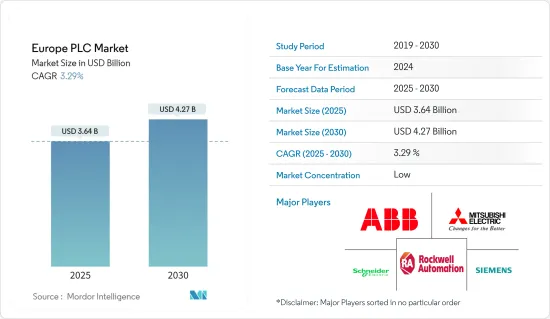

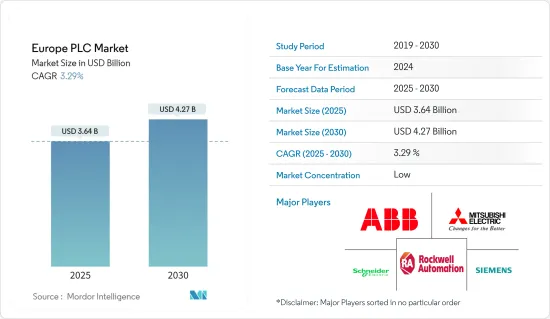

預計 2025 年歐洲 PLC 市場規模為 36.4 億美元,預計到 2030 年將達到 42.7 億美元,預測期內(2025-2030 年)的複合年成長率為 3.29%。

主要亮點

- PLC 系統的實施允許快速識別和糾正錯誤,無需人工干預。因此,據估計,這種自動化 PLC 系統可以將機器停機時間從 20% 減少到近 4%。

- PLC 市場發展的促進因素之一是自動化領域缺乏替代品。另一個重要因素是整合了 PLC 和 PC 的可程式自動化控制器 (PAC) 的發展。此外,模組化 PLC 可以在修正其他模組的錯誤時繼續運作。

- 成員國也贊助國家舉措,例如德國的工業 4.0、義大利和法國的未來工廠以及英國的彈射中心。所研究的市場受到工業生產和電腦及軟體投資的強烈影響。這些 PLC 系統傳統上一直是製程和離散工廠自動化的基礎。工業 4.0 在各個工業領域的日益廣泛應用正在擴大所研究的市場。離散製造業中 PLC 的一個關鍵成長指標是汽車製造業以及電氣和電子產業中機器人的部署日益增多。

- 由於智慧工廠系統的廣泛應用,工業機器人市場在過去十年中出現了巨大的需求。這些機器人發揮著重要作用。例如,2022 年 6 月,使用 PLC 的工業機器人自主運動規劃領域的領導者之一 Realtime Robotics 宣布與自動化領域的領導者三菱電機自動化合作,透過創新的運動控制和防撞軟體加速使用 PLC 的工業機器人的編程和控制。

- 在英國,降低製造成本的需求不斷成長以及機器對機器 (M2M) 技術的普及正在推動自動化的引入,預計這將促進 PLC 的使用並刺激市場成長。

- 德國是世界領先的化學品生產國和出口國之一。製造過程自動化在該國非常普及。 PLC 正在推動市場發展,因為它們有助於推理複雜演算法並提高該領域的效能。

- PLC受到記憶體、CPU和通訊頻寬等資源的限制,可能會影響程式效能和質量,阻礙市場成長。

歐洲 PLC 市場趨勢

石油和天然氣產業佔很大市場佔有率

- 石油和天然氣行業使用各種系統,例如 SCADA,並且需要 PLC 來實現更好的控制。由於歐洲的計劃發展,預計未來幾年石油和天然氣終端用戶行業將經歷顯著成長。過去兩到三年來,該行業的油價一直在波動,我們正在研究該領域的各種成本節約方法。這些節省成本的努力正在推動產業在多個流程中採用自動化。

- 該行業還面臨對更多熟練勞動力和專業知識的需求。這種限制也是自動化背後的主要原因之一。石油和天然氣行業的安全系統也採用 PLC 設備來確保品質和性能。據預算責任辦公室稱,預計2023年英國的油價將達到每桶81.9英鎊。

- 據 GP Systems GmbH 稱,石油和天然氣行業的自動化對可程式邏輯控制器 (PLC) 的可靠性和技術規格提出了很高的要求。該公司的Regul RX00 PLC滿足所有行業要求,提供穩定、連續的運行控制,承受多種系統故障,並實現靈活的系統設計和現場互連子系統之間的通訊。

- 英國政府宣布,作為其新能源策略的一部分,很快就會在北海(英國)啟動石油和天然氣計劃。例如,2022年5月,BP宣布計劃在2030年終前向英國能源系統投資高達180億歐元(191.8億美元),彰顯BP對英國的堅定承諾,助力加強能源安全、實現英國實現淨零排放的雄心勃勃的目標。英國石油公司是英國最大的石油和天然氣生產商之一,該公司打算繼續投資北海石油和天然氣計劃,同時減少其營運產生的排放。預計此類案例將推動該地區的市場成長。

德國經濟快速成長

- 德國是歐洲自動化設備的重要消費國,也是領先的製造國。德國擁有西門子、施耐德電氣、庫卡等主要企業,鼓勵對研發活動進行大力投資。由於對自動化解決方案的需求不斷增加,國內自動化公司也是市場成長的主要動力之一。根據德國聯邦統計局的預測,2023年德國汽車產業的收益預計將達到5,943億歐元(6,333.9億美元)。

- 由於許多大型電力計劃被擱置,該國電網需要幫助來適應可再生能源和分散式能源的崛起。同樣,政府也在嘗試使電網適應新的需求。國家電網營運商為提高輸電能力所採取的措施可能會加大使用 PLC 來累積資料並採取進一步的漸進式行動,從而刺激市場研究。

- 該國的汽車工業也享譽全球。據德國聯邦教育與研究部稱,2022年德國汽車產業的創新支出將達到495.4億歐元(528億美元)。由於人事費用上升和安全措施加強,各汽車製造商都在引入自動化技術。隨著這樣的發展,預計該國對 PLC 市場的需求將會巨大。

- 較大的公司也正致力於擴大在該國的業務。例如,位於杜塞爾多夫的日立傳動與自動化有限公司是日立工業設備系統公司的德國子公司。該公司的核心業務是推進零件和自動化技術的銷售。例如,我們提供變頻器、可程式邏輯控制器 (PLC)、交流伺服驅動器、電動/齒輪馬達、操作員控制單元 (HMI)、工業噴墨印表機 (CIJ)/雷射編碼器等。

歐洲 PLC 產業概況

歐洲可程式邏輯控制器(PLC)市場競爭激烈。高昂的研發成本、夥伴關係、聯盟和收購是該地區企業為在激烈的競爭中保持領先地位而採取的關鍵成長策略。市場的主要企業包括 ABB 有限公司、三菱電機株式會社、施耐德電氣 SE、羅克韋爾自動化、西門子股份公司、霍尼韋爾國際公司、Omron Corporation、Panasonic Corporation、羅伯特·博世有限公司、艾默生電氣公司等。

- 2022 年 11 月 - 羅克韋爾自動化與 Comau 合作,利用機器人解決方案的強大功能,幫助企業最大程度提高製造效率並加快創新速度。將羅克韋爾自動化組件與柯馬機器人整合,並透過一個 PLC 控制兩者,無需其他機器人製造商所需的額外機器人程式設計技能。

- 2022 年 8 月-Honeywell國際與布加勒斯特理工大學合作,透過建立工業自動化實驗室幫助學生進入全球勞動市場。該實驗室包括Honeywell的 ControlEdge 可程式邏輯控制器 (PLC),它與霍尼韋爾 Experion 製程知識系統配合使用,有助於降低工廠整合成本、最大限度地減少計劃外中斷、透過內建網路安全降低風險並降低整體擁有成本。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對歐洲可程式邏輯控制器 (PLC) 市場的影響

第5章 市場動態

- 市場促進因素

- 越來越多採用自動化系統

- 易於使用且熟悉的 PLC 程式設計有利於發展

- 市場挑戰

- 離散製造業產品客製化需求及由批量向連續加工的逐步轉變

- 擴大採用具有增強的安全性和先進控制能力的分散式控制系統 (DCS)

第6章 市場細分

- 按類型

- 硬體和軟體

- 大型 PLC

- 奈米PLC

- 小型 PLC

- 中型PLC

- 其他硬體

- 按服務

- 硬體和軟體

- 按最終用戶產業

- 食品、菸草、食物及飲料

- 車

- 化工和石化

- 能源與公共產業

- 藥品

- 石油和天然氣

- 其他最終用戶產業

- 按國家

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Rockwell Automation

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.

- Hitachi Ltd

- General Electric Co.

- Beckhoff Automation

第8章投資分析

第9章:市場的未來

The Europe PLC Market size is estimated at USD 3.64 billion in 2025, and is expected to reach USD 4.27 billion by 2030, at a CAGR of 3.29% during the forecast period (2025-2030).

Key Highlights

- The deployment of PLC systems enables the identification and rectification of errors and can initiate rapid responses even without human intervention. Hence, these automated PLC systems are estimated to reduce machine downtime from 20% to almost 4%.

- One of the driving factors of the PLC market is that it has yet to replace in the automation field. Another significant factor is the development of programmable automation controllers (PACs), which integrate PLCs with PCs. Furthermore, a modular PLC can continue working while errors in other modules are being fixed.

- Member States also sponsor national initiatives such as Industry 4.0 in Germany, the Factory of the Future in Italy and France and Catapult centers in the UK. The market studied is strongly impacted by the industrial output and the investment funneled into computers and software. These PLC systems have traditionally been the foundation of process and discrete factory automation. The growing adoption of Industry 4.0 across the industrial verticals has augmented the market studied. A significant growth indicator for PLCs in the discrete-manufacturing sectors is the amplified deployment of robots across the automotive manufacturing, electrical, and electronics industries.

- The industrial robot market has witnessed a massive demand during the past decade owing to the rising adoption of smart factory systems. These robots play a vital part. For Instance, In June 2022, Realtime Robotics, one of the leaders in autonomous motion planning for industrial robots using PLC, announced a collaboration with Mitsubishi Electric Automation, Inc., a leader in automation, to accelerate industrial robot programming and control with PLC and with innovative motion control and collision avoidance software.

- The rising need for mitigating the manufacturing cost and penetration of machine-to-machine (M2M) technologies are encouraging the adoption of automation in the United Kingdom, which is likely to boost the usage of PLC, thereby fueling market growth.

- Germany is one of the largest producers and exporters of chemicals in the world. Automating manufacturing processes is gaining high traction in the country. PLC helps in deducing complex algorithms and enhancing performance in the sector, thus, driving the market.

- PLCs are limited by the resources, such as memory, CPU and communication bandwidth, which may affect program performance and quality which might hamper the market growth.

Europe PLC Market Trends

Oil and Gas Industry to Hold Significant Market Share

- The oil and gas industry has been using various systems, such as SCADA, which needs PLCs for better control. The oil and gas end-user sector is expected to witness significant growth in the following years, owing to plans for its development in Europe. The industry has been fluctuating, in terms of oil prices, in the past two to three years, and it has been looking forward to saving various costs in the domain. The industry is adopting automation in multiple processes due to these cost-cutting activities.

- The sector has also been suffering from needing a more skilled workforce and expertise in the domain. This limitation has also been one of the primary causes behind automation. The safety systems in the oil and gas industry have also been adopting the use of PLC devices to ensure quality and performance. According to Office for Budget Responsibility, in 2023, In the United Kingdom, oil prices are expected to reach 81.9 British pounds per barrel.

- According to GP Systems GmbH, Automation in the oil and gas industry imposes stringent demands on programmable logic controllers' reliability and technical specifications (PLCs). The company's Regul RX00 PLC meets all industry requirements, provides stable and continuous operation control, resists multiple system failures, and provides flexible system design and communication between field interconnected subsystems.

- The United Kingdom government, as part of its new energy strategy, announced licensing several oil and gas projects in the North Sea (United Kingdom) to begin soon. For instance, in May 2022, BP intended to invest up to EUR18 billion (USD 19.18 billion) in the United Kingdom's energy system by the end of 2030, demonstrating BP's firm commitment to the United Kingdom and helping the United Kingdom to deliver on its strong ambitions to boost energy security and reach net zero. The United Kingdom as one of the largest oil and gas producers in the United Kingdom, BP intended to continue investing in North Sea oil and gas projects while driving down operational emissions. Such instances are expected to drive the market's growth in the region.

Germany to Witness the Significant Growth

- Germany is a significant consumer of automation equipment and a major manufacturer of automation equipment in Europe. Several important automation and control equipment players, such as Siemens, Schneider Electric, and KUKA, are based out of Germany, thus driving a high flow of investments toward R&D activities. Due to the increasing demand for automation solutions, automation companies in the country are also one of the major reasons for the market's growth. According to Statistisches Bundesamt, the predicted revenue development of the automobile industry in Germany is expected to reach EUR 594.3 Billion (633.39 USD Billion) in 2023.

- The electricity grid in the country needs help to cope with the extent of renewable and distributed energy in the country, and many major power projects are on hold. Similarly, the government attempts to adapt the grid to the new demands. The measures by national grid operators to boost power transmission capacity are likely to escalate PLC usage to accumulate data and further take successive steps, thereby fueling the market studied.

- The country is also globally recognized for its automobile industry. According to the BMBF, the German automobile industry expenditure on innovation in the automobile industry is EUR 49.54 Billion (USD 52.80 Billion) in 2022. Various automobile manufacturers are adopting automation, primarily due to the labor costs and increasing safety measures. Owing to such developments, the country is expected to hold significant demand for the PLC market.

- Major companies are also focused on expanding business in the country. For instance, Hitachi Drives & Automation GmbH in Dusseldorf is the German subsidiary of Hitachi Industrial Components & Equipment Ltd. Its core business is the distribution of propulsion components and automation technology. For instance, it offers frequency converters, programmable logic controllers (PLC), AC servo drives, electrical / geared motors, operator control units (HMI), and industrial inkjet printers (CIJ) / laser coders.

Europe PLC Industry Overview

The Europe Programmable Logic Controller (PLC) Market is highly competitive in nature. The high expense on research and development, partnerships, collaborations, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Key players in the market are ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric SE, Rockwell Automation, Siemens AG, Honeywell International Inc., Omron Corporation, Panasonic Corporation, Robert Bosch GmbH, Emerson Electric Co., and many more.

- November 2022 - Rockwell Automation and Comau partnered to leverage the power of robotic solutions to help enterprises maximize their manufacturing efficiencies and increase the speed of innovation. Integrating Rockwell Automation components and Comau's robots, using one PLC for controlling both, eliminates the need for additional robot programming skills required by other robot manufacturers.

- August 2022 - Honeywell International Inc collaborated with the University Politehnica Of Bucharest to support student entry into the global workforce by launching an industrial automation lab. The lab includes Honeywell's ControlEdge Programmable Logic Controller (PLC), which, It is possible to reduce the cost of integrating a plant, minimize unplanned interruptions, mitigate risk through embedded cybersecurity and lower overall ownership costs by working together with Honeywell Experion Process Knowledge System.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Europe Programmable Logic Controller (PLC) Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Automation Systems

- 5.1.2 Ease of Use and Familiarity with PLC Programming to Sustain Growth

- 5.2 Market Challenges

- 5.2.1 Demand for Customization of Products and Gradual Shift from Batch to Continuous Processing in the Discrete Industries

- 5.2.2 Increase in Adoption of Distributed Control Systems (DCS), with Enhanced Safety and Advanced Control Capabilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware and Software

- 6.1.1.1 Large PLC

- 6.1.1.2 Nano PLC

- 6.1.1.3 Small PLC

- 6.1.1.4 Medium PLC

- 6.1.1.5 Other Hardware Types

- 6.1.2 Service

- 6.1.1 Hardware and Software

- 6.2 By End-user Industry

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pharmaceutical

- 6.2.6 Oil and Gas

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Europe

- 6.3.1.1 Germany

- 6.3.1.2 United Kingdom

- 6.3.1.3 France

- 6.3.1.4 Italy

- 6.3.1 Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Schneider Electric SE

- 7.1.4 Rockwell Automation

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co.

- 7.1.11 Hitachi Ltd

- 7.1.12 General Electric Co.

- 7.1.13 Beckhoff Automation