|

市場調查報告書

商品編碼

1642130

工業電腦斷層掃描:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Industrial Computed Tomography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

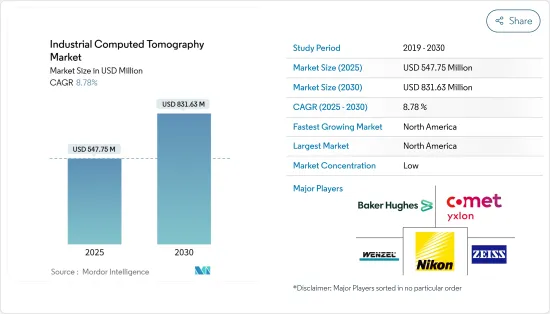

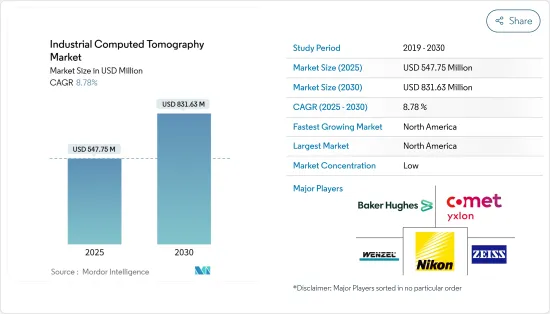

工業電腦斷層掃描市場規模在 2025 年估計為 5.3917 億美元,預計到 2030 年將達到 8.2087 億美元,預測期內(2025-2030 年)的複合年成長率為 8.77%。

關鍵亮點

- CT(電腦斷層掃描)是一種無損檢測方法,在品質保證和品管中發揮重要作用。工業電腦斷層掃描提供了一種快速、有效且無損的資料收集方法,能夠表徵內部形態並全面重建 3D 模型。工業電腦斷層掃描可執行各種材料分析,從傳統的工業評估(例如檢測製程缺陷(空隙、裂縫、孔隙率))到計量任務(包括測量複雜形式的外部和內部形態)。

- 汽車、航太、電子和醫療設備等行業越來越重視產品品質和安全標準,從而增加對 CT 系統的投資以實現精確的品質保證。

- 例如,2024年8月,美國太空總署的內部監控機構指出波音公司在下一代太空發射系統的工作中存在嚴重的品管失誤。在 8 月 8 日發布的一份報告中,NASA 監察長辦公室 (OIG) 指出波音公司對 SLS Block 1B 型號的回應存在重大缺陷。這項工作在新奧爾良的米肖組裝廠進行,被發現因品管體係不佳和工人缺乏適當培訓而受到影響。航太工業日益嚴重的品管問題推動了對 CT 技術進行缺陷檢測、材料表徵和品質維護的需求。

- 用於識別缺陷、裂縫、損壞和設計偏差的產品檢測需求不斷成長,極大地推動了用於缺陷檢測和檢查的工業 CT 掃描儀的需求。使用工業CT系統進行產品檢測的製造商可以顯著降低生產成本。此外,這些掃描器可以快速識別和分析使用傳統檢測技術難以檢測到的細微缺陷。

- 購買工業 CT 系統的成本過高,成為市場成長的一大障礙。購買該系統所需的初始投資可能很高,特別是對於中小型企業和新興企業而言,他們可能沒有財力購買如此昂貴的設備。如此高的進入成本限制了潛在的買家基礎並限制了市場擴張。

- 隨著工業 4.0 的到來,工業領域正在迅速採用新技術和擴展網路架構,這有望為市場擴張提供巨大的前景。石油和天然氣、汽車、製藥和航太等主要行業使用工業 CT 掃描儀進行故障檢測、材料分析以及缺陷檢測和分析。然而,預計美國戰爭、以色列與哈馬斯戰爭以及俄羅斯與烏克蘭戰爭等若干地緣政治因素將威脅這些地區的市場成長。

工業 CT 市場趨勢

最大的終端用戶是汽車產業

- 工業 CT 系統廣泛用於汽車製造的品質保證。透過提供零件的詳細 3D 影像,可以檢測到使用傳統檢測方法無法發現的內部缺陷,例如裂縫、空隙和夾雜物。這項特性對於確保汽車零件的可靠性和安全性至關重要。

- 汽車工業中的CT也用於檢查引擎和變速箱外殼中所使用的鑄件等應用。可以測量內部結構並識別裂縫、孔隙和夾雜物等缺陷。 X光成像解決方案的超大型CT系統可以掃描成品車輛以識別組裝缺陷或揭示碰撞測試後內部結構的變形。

- 在汽車產業,複雜的幾何形狀和精巧的設計正在興起,尤其是隨著電動車和先進材料的興起。工業 CT 可以檢查這些複雜的零件,包括引擎零件、傳動系統和結構元素,以確保它們符合設計規範和性能標準。

- 透過將工業 CT 融入製造業,汽車公司可以最佳化生產工作流程。 CT 掃描的即時回饋可以立即進行調整,減少浪費並提高整體效率。這意味著降低成本並加快生產時間。

- 據Volume Graphics稱,一家奧地利汽車零件製造商在採用工業CT(電腦斷層掃描)作為測量工具後,成本降低了約50%。使用傳統的光學和觸覺檢查方法,僅初次檢查就需要花費 450 個小時,並且在此過程中會損壞零件。工業CT 可以以非破壞性且低成本的方式捕捉零件的幾乎所有特徵。利用CT資料、巨集功能和批次功能,同樣的流程僅需100個工時,而最終檢查僅需80個工時。

- 如今,電動車測試不僅僅是對車輛及其零件進行認證測試。現在它還包括對充電介面和相關系統的評估,以實現車輛、充電站和後勤部門系統之間的通訊。

- 根據國際能源總署《2024年全球電動車展望》,預計2024年美國電動車銷量將比2023年成長20%,相當於比2023年增加近50萬輛。儘管歐洲最近取得了進展,並計劃在 2025 年制定更嚴格的二氧化碳排放目標,但預計歐洲的電動車銷量成長將是三大重要市場中最慢的。預計2024年銷售量將達到約350萬台,與前一年同期比較成長不到10%。預計這些發展將在整個預測期內推動工業 CT 市場的成長。

亞太地區:預計大幅成長

- 亞太地區是汽車、航太、電子、石油和天然氣等幾個主要行業的活躍地區。過去幾十年來,在消費需求不斷成長、都市化和中階不斷壯大的推動下,亞太地區汽車產業經歷了顯著成長。預計中國、日本和韓國等國家將在汽車生產和技術創新方面處於領先地位。中國是全球最大的汽車市場,汽車銷售量超過美國。

- 亞太地區處於汽車技術的前沿,製造商對電動和自動駕駛汽車的研發投入巨大。豐田汽車公司、工業和現代汽車公司等主要企業正透過減少排放氣體和提高汽車效率的創新技術引領潮流。

- 由於電動車 (EV) 產量和銷量的不斷增加以及政府大力推動電動車銷售,該地區的工業 CT 市場正在獲得發展動力。隨著中國汽車銷售的成長,政府正在推行更嚴格的排放氣體法規,以防止嚴重的環境影響。中國將於2023年7月起在全國針對輕型車、柴油車和重型車實施國VI-b排放法規。

- 此外,到 2025 年,印度的電動車 (EV) 市場規模預計將達到 70.9 億美元(5,000 億印度盧比)。根據 CEEW 能源融資中心的報告,到 2030 年,印度的電動車市場價值預計將達到 2,060 億美元,需要在汽車製造和充電基礎設施方面投入 1,800 億美元。此外,根據中國工業協會的數據,2019年中國新能源汽車銷量為59.7萬輛,其中搭乘用55.9萬輛,商用車3.8萬輛。預計電動車需求的增加將大幅推動所調查市場的需求。

- 國內幾大汽車廠商紛紛推出新車型擴大市場佔有率,進一步刺激超音波流量計市場的需求。例如,2024 年4 月,現代汽車集團(現代汽車和起亞汽車的母公司)宣布,計劃到2025 年在印度生產1,000 輛電動車,以鞏固其在日益成長的電動車領域的地位,目前塔塔汽車有限公司在該領域處於領先地位。起亞預計還將在同一時間推出在印度生產的電動車。該集團的目標是到2030年總合擁有五款電動車車型。

- 在日本到 2050 年實現淨零排放、到 2030 年減少排放量 46% 的雄心勃勃的目標的推動下,電動車 (EV) 越來越受歡迎。政府已經設定了具體的目標來支持這一轉變,目標是到 2030 年電動車和插電式混合動力汽車(PHEV) 將佔乘用車銷量的20-30%,燃料電池汽車(FCV) 將佔3%。因此,預計該國汽車行業的成長將推動市場成長。

工業CT行業概覽

工業CT市場包括貝克休斯、卡爾蔡司股份公司、YXLON國際、溫澤集團、尼康計量、Diondo GmbH、Werth集團、North Star Imaging和RX Solution等主要製造商,競爭十分激烈。這些供應商對工業 CT 系統市場有著深入的滲透。

開發工業CT掃描儀所需的資金較高,導致退出門檻較高,並增加了產品的整體成本。因此,退出障礙會對競爭企業之間的敵意產生正面影響。

此外,大量投資的參與也提高了現有參與企業的退出門檻。在先進檢測和品管解決方案的需求推動下,工業 CT 掃描儀市場穩步成長,並且保持了競爭力,沒有陷入極端的價格戰。因此,市場參與者之間的競爭非常激烈,預計在預測期內將繼續加劇。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情和其他宏觀經濟因素的後續影響將影響市場

- 技術演進

- CT系統產業價格趨勢及年銷售分析

- 工業 CT 軟體市場趨勢與動態

- 分銷鏈分析

- 按 X 光管電壓進行的市場分析(高壓與低壓/中壓)

第5章 市場動態

- 市場促進因素

- 改進的解析度和影像處理技術

- 可攜式X 光設備需求不斷成長

- 市場限制

- 工業CT系統的購置與維修成本高

第6章 市場細分

- 按應用

- 缺陷檢測與檢驗

- 故障分析

- 組裝分析

- 其他

- 按最終用戶產業

- 航太和國防

- 車

- 電子產品

- 石油和天然氣

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 工業CT供應商市場佔有率

- 公司簡介

- Baker Hughes Company(waygate Technologies)

- Carl Zeiss AG

- Yxlon International Gmbh(comet Group)

- Wenzel Group

- Nikon Metrology NV(Nikon Corporation)

- Diondo Gmbh

- Werth Messtechnik Gmbh

- North Star Imaging

- RX Solutions

- VJ Technologies Inc.

- Visiconsult Gmbh

- Rayscan Technologies Gmbh

- Rigaku Corporation(Carlyle Group)

第8章投資分析

第9章 未來市場機會

The Industrial Computed Tomography Market size is estimated at USD 539.17 million in 2025, and is expected to reach USD 820.87 million by 2030, at a CAGR of 8.77% during the forecast period (2025-2030).

Key Highlights

- Computed tomography is a pivotal non-destructive testing method playing a crucial role in quality assurance and control. Industrial CT scanning offers a swift and effective non-destructive means to gather data, enabling the characterization of internal features and the comprehensive reconstruction of 3D models. Industrial computed tomography conducts a range of material analyses, spanning from traditional industrial evaluations like detecting process defects (voids, cracks, and porosities) to metrology tasks, which include measuring both external and internal features of intricate geometries.

- As industries such as automotive, aerospace, electronics, and medical devices place greater emphasis on product quality and safety standards, they are increasingly investing in CT systems for precise quality assurance.

- For instance, in August 2024, NASA's internal watchdog took Boeing to task over its work on the upcoming version of the Space Launch System, highlighting major quality control oversights. In a report published on August 8, NASA's Office of Inspector General (OIG) pointed out critical shortcomings in Boeing's handling of the Block 1B variant of the SLS. This work, conducted at the Michoud Assembly Facility in New Orleans, was found to be compromised due to an inadequate quality management system and a workforce lacking proper training. The rising quality control issues in the aerospace industry drive demand for CT technology to detect defects, characterize materials, and maintain quality.

- The rising demand for product inspections aimed at identifying flaws, cracks, damages, or deviations from design has significantly boosted the demand for industrial CT scanners for flaw detection and inspection. Manufacturers leveraging industrial CT systems for product inspections can achieve notable reductions in production costs. Moreover, these scanners swiftly identify and analyze minor defects, a task often challenging for traditional inspection methods.

- The acquisition cost of industrial computed tomography systems is notably high, which poses a significant barrier to market growth. The initial investment required for purchasing these systems can be prohibitive, especially for small and medium-sized enterprises and startups that may not have the financial resources to afford such expensive equipment. This high cost of entry limits the number of potential buyers and restricts the expansion of the market.

- The industrial sector has witnessed the swift adoption of novel techniques and augmented networking architectures with the emergence of Industry 4.0, which is anticipated to offer substantial prospects for market expansion. Major industries such as oil and gas, automotive, pharmaceutical, aerospace, and others are adopting industrial CT scanners for fault detection, material analysis, and flaw detection and analysis. However, several geopolitical factors, such as the US-China war, the Israel-Hamas war, and the Russia-Ukraine War, are expected to threaten the growth of the market in these regions.

Industrial Computed Tomography Market Trends

Automotive Industry to be the Largest End User

- Industrial CT systems are extensively used for quality assurance in automotive manufacturing. They provide detailed 3D images of components, allowing manufacturers to detect internal defects such as cracks, voids, and inclusions that may not be visible through traditional inspection methods. This capability is crucial for ensuring the reliability and safety of automotive parts.

- CT in the automotive industry is also used for applications, including inspecting castings used in engines and gearbox casings. Internal structures may be measured, and defects, including fractures, porosities, and inclusions, may be identified. Very large CT systems based on X-ray imaging solutions are able to scan complete vehicles to identify assembly defects or reveal how internal structures have deformed after crash testing.

- The automotive industry often involves complex geometries and intricate designs, especially with the rise of electric vehicles and advanced materials. Industrial CT can inspect these complex components, including engine parts, transmission systems, and structural elements, ensuring they meet design specifications and performance standards.

- Automotive companies can optimize production workflows by integrating industrial CT into manufacturing. Real-time feedback from CT inspections enables immediate adjustments, reducing waste and improving overall efficiency. This leads to cost savings and faster production times.

- According to Volume Graphics, one of the Austrian automotive suppliers reduced costs by around 50% after introducing industrial computed tomography (CT) as a measurement tool. Measurements using conventional optical and tactile inspection methods took 450 man-hours for the initial acceptance alone and destroyed the part in the process. Industrial CT provides insight into virtually all features of the part without destroying it and at lower costs. With the help of CT data and the macro and batch functionality, the same process only took 100 man-hours with only 80 more man-hours needed for final acceptance.

- At present, the testing for EVs has expanded to encompass more than just homologation testing for the vehicles and their components. It now involves evaluating charging interfaces and the associated systems that enable communication between the cars, charging stations, and back-office systems.

- Based on the Global EV Outlook 2024 by IEA, electric car sales in the United States are forecasted to increase by 20% in 2024 compared to 2023, resulting in nearly half a million more sales than in 2023. Despite recent trends and the upcoming tightening of CO2 targets in 2025, the growth in electric car sales in Europe is anticipated to be the slowest among the three most significant markets. Sales are expected to reach approximately 3.5 million units in 2024, showing a modest growth of less than 10% from the previous year. These developments are expected to drive the growth of the industrial CT market throughout the forecast period.

Asia Pacific Expected to Witness Significant Growth

- The Asia-Pacific region is a dynamic hub for several key industries, including automotive, aerospace, electronics, and oil and gas. The automotive industry in the Asia-Pacific region has witnessed significant growth over the past few decades, driven by rising consumer demand, urbanization, and the expansion of the middle class. Countries like China, Japan, and South Korea are anticipated to lead automotive production and innovation. China is the largest automotive market in the world, surpassing the United States in vehicle sales.

- The APAC region is at the forefront of automotive technology, with manufacturers investing heavily in research and development (R&D) for electric and autonomous vehicles. Major players like Toyota Motor Corporation, Honda Motor Co. Ltd, and Hyundai Motor Company are leading the charge with innovative technologies to reduce emissions and improve vehicle efficiency.

- The industrial CT market is gaining traction in the region, driven by the rising production and sales of electric vehicles (EVs) and the government's strong push for EV sales. Due to the increasing automotive sales in China, the government is prompted to enforce stringent emissions regulations to prevent significant environmental repercussions. China has introduced the China VI-b emission standards for light-duty, diesel-fueled, and heavy-duty vehicles nationwide, starting from July 2023.

- Moreover, the Indian electric vehicle (EV) market is projected to achieve a value of USD 7.09 billion (INR 50,000 crore) by 2025. According to a report from the CEEW Centre for Energy Finance, the Indian EV market is expected to be valued at USD 206 billion by 2030, which will require a significant investment of USD 180 billion in vehicle manufacturing and charging infrastructure. Furthermore, according to the China Association of Automobile Manufacturers (CAAM), China's new energy vehicle sales amounted to 597,000 units, of which 559,000 were passenger electric vehicles and 38,000 were commercial electric vehicles. An increase in demand for EVs is anticipated to significantly aid the demand for the studied market.

- Several leading automotive players in the country are expanding their presence by introducing new models, further creating demand for the ultrasonic flow meters market. For instance, in April 2024, Hyundai Motor Group, the umbrella organization of Hyundai and Kia, announced that it intends to launch its inaugural electric vehicles produced in India in an effort to solidify its position in the growing electric vehicle sector, which Tata Motors Limited presently lead, by 2025. Furthermore, Kia is set to introduce its electric vehicle manufactured in India around the same period. The group's objective is to reveal a combined total of five electric models by 2030.

- Fueled by Japan's ambitious goals of achieving net-zero emissions by 2050 and a 46% reduction by 2030, electric vehicles (EVs) are becoming increasingly popular. The government has set specific targets to support this transition, aiming for EVs and plug-in hybrid electric vehicles (PHEVs) to make up 20-30% of passenger car sales by 2030, with fuel cell vehicles (FCVs) targeted at 3%. Thus, the growing automotive industry in the country is expected to propel the growth of the market.

Industrial Computed Tomography Industry Overview

The industrial CT market includes some of the major manufacturers such as Baker Hughes, Carl Zeiss AG, YXLON International, WENZEL Group, Nikon Metrology, Diondo GmbH, Werth Group, North Star Imaging, and RX Solution, which contribute to the intensity of competitive rivalry. Such vendors are established and have deep penetration in the market for industrial CT systems.

The barriers to exit are high as the capital requirements for developing industrial CT scanners are high, leading to the overall cost of the products. Thus, the barriers to exit positively affect the intensity of competitive rivalry.

Moreover, the involvement of large-scale investment increases the barriers to exit for the existing players. The market for industrial CT scanners is growing steadily, driven by the demand for advanced inspection and quality control solutions, which sustains the competition without leading to extreme price wars. Therefore, the competitive rivalry in the market is high, and it is expected to increase over the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.4 Technology Evolution

- 4.5 Analysis of Pricing Trends in the Industry and Volume of CT Systems Sold in A Year

- 4.6 Trends and Dynamics in the Industrial CT Software Market

- 4.7 Distribution Chain Analysis

- 4.8 Analysis of the Market By X-ray Tube Voltage (High Vs Low/Medium)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technology Improvements in Resolution and Image Processing

- 5.1.2 Intensifying Demand for Portable Radiography Equipment

- 5.2 Market Restraints

- 5.2.1 High Acquisition and Maintenace Cost of Industrial CT systems

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Flaw Detection and Inspection

- 6.1.2 Failure Analysis

- 6.1.3 Assembly Analysis

- 6.1.4 Other Applications

- 6.2 By End-user Industry

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive

- 6.2.3 Electronics

- 6.2.4 Oil and Gas

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Industrial Computed Tomography Vendor Market Share

- 7.2 Company Profiles

- 7.2.1 Baker Hughes Company (waygate Technologies)

- 7.2.2 Carl Zeiss AG

- 7.2.3 Yxlon International Gmbh (comet Group)

- 7.2.4 Wenzel Group

- 7.2.5 Nikon Metrology NV (Nikon Corporation)

- 7.2.6 Diondo Gmbh

- 7.2.7 Werth Messtechnik Gmbh

- 7.2.8 North Star Imaging

- 7.2.9 RX Solutions

- 7.2.10 VJ Technologies Inc.

- 7.2.11 Visiconsult Gmbh

- 7.2.12 Rayscan Technologies Gmbh

- 7.2.13 Rigaku Corporation (Carlyle Group)