|

市場調查報告書

商品編碼

1683538

亞太地區工業電腦斷層掃描 (CT):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Industrial Computed Tomography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

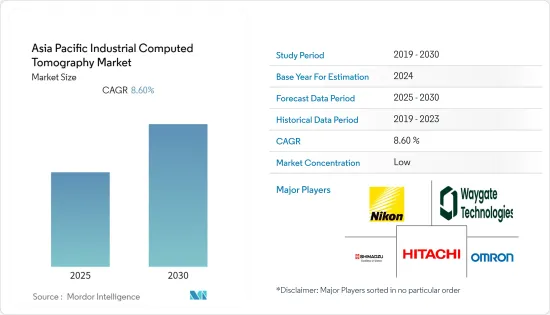

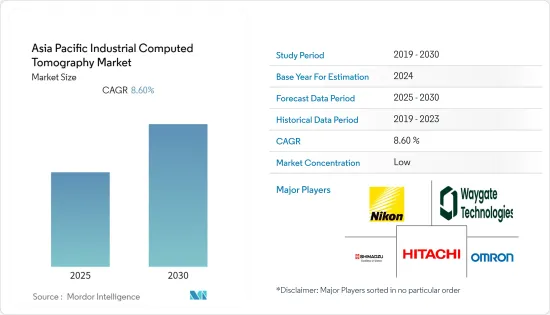

預計預測期內亞太地區工業電腦斷層掃描 (CT) 市場複合年成長率將達到 8.6%。

主要亮點

- 新技術的引入,推動了基於3D列印的積層製造技術的飛躍。隨著最終用戶將 3D 列印融入其製造流程,3D 列印流程已從原型階段發展到生產階段。隨著積層製造的增加,X光偵測的需求也隨之增加,CT正成為最終用戶首選的X光偵測技術。

- X光電腦斷層掃描已被證明是包括汽車工業在內的許多行業必不可少的工具,可確保機器零件、鑄造金屬、複合材料和塑膠材料等工業零件製造的最高品質。此外,工業CT 掃描儀也用於該地區各種製造和組裝作業。

- 該地區的政府也致力於工業 CT 掃描儀的新技術創新。例如,2022年4月,日本政府宣布,計劃在國際教育研究中心建設工業產品大型電腦斷層掃描(CT)系統進行研發,該中心定於2024年在福島縣全面啟用。提案的方法可以拍攝汽車或飛機截面的大尺寸X光影像,無需拆卸即可重建3D模型。

- 近年來工業CT面臨的技術挑戰大多與軟體有關。目前,CT 走向主流的最大障礙是供應鏈和大型OEM缺乏確保技術和結果可靠性的要求和標準。

- 該地區受到新冠肺炎疫情、工廠關閉、供應鏈中斷和經濟放緩的嚴重打擊。這些方面已經阻礙了當地市場一段時間的成長。然而,在 COVID-19 之後,區域市場的成長可能會受到航太、國防、電子和汽車等各行業中工業 CT 系統在檢查和檢測目的的使用增加的推動。

亞太地區工業電腦斷層掃描 (CT) 市場趨勢

該地區汽車產業成長強勁

- 汽車產業整合了一些對品質最為關鍵的產品,從微型電子感測器到汽車中的全複合零件。大多數公司在設計X光偵測和CT系統時都會考慮效率和重複性,以確保設備每次都能安全、準確地運作。為了節省時間和成本,汽車製造商選擇 CT 機一次性檢查渦輪機和活塞引擎等關鍵零件。

- 隨著人口和都市化的發展,該地區每年生產和銷售數百萬輛汽車。為了保持這種高生產率,整個供應鏈必須高效,每個合作夥伴都必須按時交付品質和數量的產品。如今,自動化已在全球汽車產業中廣泛應用,並採用電腦斷層掃描技術來適應機器人生產線,以滿足快速、精確和穩健的要求。

- 根據調查,隨著我國高鐵、大飛機、汽車、火箭、核能等高階裝備產業的快速發展,對密鑰的高品質保證需求日益增加。這些高階電腦斷層掃描的主要特點是尺寸大、品質高、結構複雜、製造技術特殊。

- 如今,許多知名的測試技術被用於汽車領域,以檢驗製造流程、改善組裝、確保可靠性和測量偏差。它們都有其局限性、優點和缺點,而彌補這些缺點的一種新穎的方法是使用X光CT。它是一種無損檢測 (NDT) 技術,可以由工業計量專家、品管或學術研究人員直接或間接執行。在汽車產業,他們可以提升自己的能力。

- 此外, 電腦斷層掃描掃描可以讓製造商確保在正確的時間輸送正確數量的燃料。此外,由於工業電腦斷層掃描簡化了汽車製造技術,它可能繼續成為市場發展的驅動力。然而,掃描儀的前景光明,它必將帶來該地區製造業的模式轉移。

可攜式X 光設備需求不斷成長

- 工業射線照相的要求和優勢、基本設備的可用性、廣泛的工作條件和常用技術包括強伽馬輻射源以及該地區用於工業用途的X光設備的日常操作和曝光。

- 如今,高品質的X光影像對於可攜式工業X光設備來說已不再是問題。尖端射頻技術僅需標準電源連接即可在小尺寸內提供高性能。此外,其輕巧、方便用戶使用的操作以及將X光設備與數位系統結合使用的整合介面使得無損檢測行業能夠實現廣泛的檢測方法。

- 此外,許多公司正致力於開發用於各種應用的創新X光設備。例如,Vision Medicad Equipments Pvt。有限公司提供可攜式X光X光設備可攜式X光設備。

- 這些可攜式設備使用方便,價格市場領先,有多種型號可供選擇,方便移動。該公司的Vision VIXI可攜式X光安全檢查設備廣泛應用於政府機關、火車站、法院、大使館等。

- 同樣,新加坡的Pacific-Tec公司也提供各種可攜式輻射偵測設備,如輻射門式偵測器、輻射檢測器、測量儀或蓋氏計數器、電子劑量計、筆式劑量計、搜尋儀器、同位素識別器、輻射屏蔽和防護、核子醫學校準器和配件、QC測試工具、可攜式X光設備、邊境管制裝置、飯店安全設備和行李掃描設備。在該地區提供此類設備的公司將進入各種應用市場,包括航太、汽車、石油和天然氣。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 可攜式X 光設備需求不斷成長

- 解析度和影像處理的技術進步

- 市場挑戰

- 工業CT系統維護成本高

第6章 市場細分

- 按應用

- 缺陷檢測與檢驗

- 故障分析

- 組裝分析

- 其他用途

- 按最終用戶產業

- 航太

- 車

- 電子產品

- 石油和天然氣

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Waygate Technologies (Baker Hughes Digital Solutions GmbH)

- Nikon Corporation

- Omron Corporation

- Zeiss International

- Hitachi Ltd.

- Bruker Corporation

- Thermo Fischer Scientific Inc.

- Shimadzu Corporation

- Comet Group Limited

- Shimadzu Corporation

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 92079

The Asia Pacific Industrial Computed Tomography Market is expected to register a CAGR of 8.6% during the forecast period.

Key Highlights

- With the introduction of new technologies, laminated modeling based on 3D printing has dramatically developed. As end-users integrated 3D printing into the manufacturing process, the 3D printing process evolved from the prototype stage to the manufacturing stage. As additive manufacturing increases, the need for radiography increases, and CT is the end user's favorite x-ray inspection technology.

- An increasing number of industries, including automotive, have discovered that X-ray CT scanning is an essential tool for ensuring the highest quality in the production of industrial parts, such as mechanical parts, cast metals and composites, and plastic materials. In addition, industrial CT scanners are used in various region manufacturing processes and assembly operations in the region.

- Governments in the region are also focused on innovating new technologies for industrial computed tomography. For instance, in April 2022, the government of Japan plans to conduct research and development to build a large-scale computer tomography (CT) system for industrial products at the International Education and Research Center, scheduled to be fully opened in Fukushima Prefecture in 2024. The proposed method can take large X-ray images of cross-sections of cars and planes to reproduce 3D models without disassembly.

- Most of the technical challenges of industrial CT over the last few years have been software-related. At this point, the most significant setbacks where CT will become mainstream are supply chains and major OEMs that do not have the requirements and standards that enable confidence in technology and results.

- The region has been hit hard by the COVID-19 pandemic, factory closures, supply chain disruptions, and economic slowdowns. These aspects have hindered the growth of regional markets for some time. However, regional market growth post-COVID-19 is likely due to the increased use of industrial CT systems for testing and inspection purposes in various industries such as aerospace, defense, electronics, and automotive.

APAC Industrial Computed Tomography Market Trends

Automotive to Gain Significant Growth in the Region

- The automotive industry integrates some of the most quality-critical products, from small electronic sensors to fully-compound parts of a vehicle. Most companies have X-ray and CT systems designed with efficiency and reproducibility to ensure that the equipment operates safely and correctly every time. To save time and money, automotive manufacturers choose CT equipment to inspect significant components such as turbines and piston engines in a single pass.

- Every year, millions of cars are manufactured and sold in the region with rising population and urbanization. To maintain this high production rate, the entire supply chain must be efficient, and each subcontractor must provide both quality and quantity on time. Automation is now well implemented worldwide in the automotive industry and is adapting to robotized production lines by using computed tomography as it needs to be fast, accurate, and robust.

- According to a recent study, the rapid development of the high-end equipment industry in high-speed rail, large aircraft, automotive, rockets, and nuclear power in China has increased the demand for high-quality assurance of keys. The main features of these high-end CT scans are large dimensions, high quality, complex structures, and special manufacturing techniques.

- Today, the automotive sector uses many well-known test technologies to verify manufacturing processes, improve assembly, ensure reliability, and measure deviations. They all have limitations, strengths, and weaknesses, and a new and innovative way to complete them is to use XRay CT. It is a non-destructive inspection (NDT) technique that enables industrial measurement professionals, quality managers, or academic researchers to work directly or indirectly. The automotive industry allows them to improve their capabilities.

- Moreover, manufacturers can ensure that the right amount of fuel is delivered at the right time by inspecting the CT scans. Also, industrial CT scans will still drive the market to streamline automotive manufacturing techniques. However, the future of scanners will be bright and bring a paradigm shift to the manufacturing industry in the region.

Rising Demand for Portable Radiography Equipment

- The requirements and benefits of industrial radiography, the availability of critical equipment, a wide range of working conditions, and commonly used techniques involve powerful gamma-ray sources and routine operation and exposure of x-ray equipment used for industrial purposes in the region.

- Today, high-quality x-ray images are no longer a problem for portable industrial x-ray equipment. State-of-the-art high-frequency technology provides high performance in a miniature format with only standard power connections. The lightweight, user-friendly operation and integrated interface for using X-ray equipment in digital systems enable various inspection methods in the NDT industry.

- Further, many companies are focused on developing innovative radiography equipment for various applications. For instance, Vision Medicad Equipments Pvt. Ltd. offers Portable X-ray equipment, including portable X-ray scanners and portable X-ray appliances for welding.

- These portable devices are easy to use and are offered at market-leading prices, and are available in a variety of models that are easy to move around. The company's VisionVIXI portable X-ray security inspection equipment is widely used in government buildings, train stations, courts, and embassies.

- Similarly, Pacific-Tec, Singapore offers a broad spectrum of Portable Radiation Detection Instruments such as Radiation Portal Monitors, Radiation Detectors, Survey Meters or Geiger Counters, Electronic Dosimeters, Pen Dosimeters, Search Instruments, Isotope Identifiers, Radiation Shielding and Protection, Nuclear Medicine Calibrators and accessories, QC test tools or X-ray equipment for Radiology departments or X-Ray Security equipment for border control, embassies, hotel security, and luggage check. Companies offering such equipment in the region will leverage the market in various applications such as aerospace, automotive, oil and gas, and more.

APAC Industrial Computed Tomography Industry Overview

The Asia Pacific computer monitor market is fragmented by the presence of major companies such as Baker Hughes Digital Solutions GmbH, Nikon Corporation, Omron Corporation, and Hitachi Ltd. Key players focus on new product innovation and business growth by collaborating with other market players.

- September 2021 - Shimadzu Corporation has launched its new Xslicer SMX-1010 and Xslicer SMX-1020 microfocus X-ray inspection systems in Japan and other countries. Both X-ray inspection systems are designed for broad market appeal, with a vertical emission X-ray configuration, a 90 kV microfocus X-ray generator, and a high-resolution flat panel detector.

- March 2021 - Nikon Corporation announced the release of a 225kV, microfocus X-ray CT system that is 'XT H 225 ST 2x'. Advanced improvements have been made by the company in its new 'XT H 225 ST 2x'. The product helps both the exterior and interior of a sample to be inspected and measured non-destructively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Portable Radiography Equipment

- 5.1.2 Technology Advancements in Resolution and Image Processing

- 5.2 Market Challenges

- 5.2.1 High Maintenance Cost of Industrial CT Systems

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Flaw Detection and Inspection

- 6.1.2 Failure Analysis

- 6.1.3 Assembly Analysis

- 6.1.4 Other Applications

- 6.2 By End-User Industry

- 6.2.1 Aerospace

- 6.2.2 Automotive

- 6.2.3 Electronics

- 6.2.4 Oil and Gas

- 6.2.5 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1

Waygate Technologies (Baker Hughes Digital Solutions GmbH)

- 7.1.2 Nikon Corporation

- 7.1.3 Omron Corporation

- 7.1.4 Zeiss International

- 7.1.5 Hitachi Ltd.

- 7.1.6 Bruker Corporation

- 7.1.7 Thermo Fischer Scientific Inc.

- 7.1.8 Shimadzu Corporation

- 7.1.9 Comet Group Limited

- 7.1.10 Shimadzu Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219