|

市場調查報告書

商品編碼

1851111

行動電源:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Power Bank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

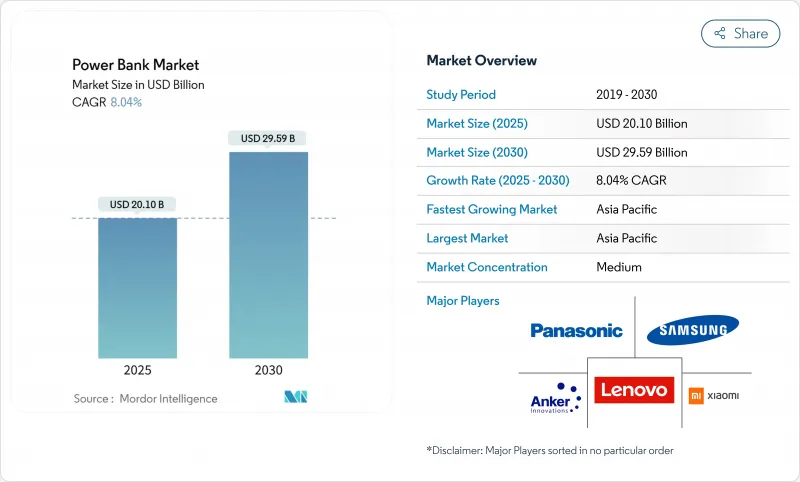

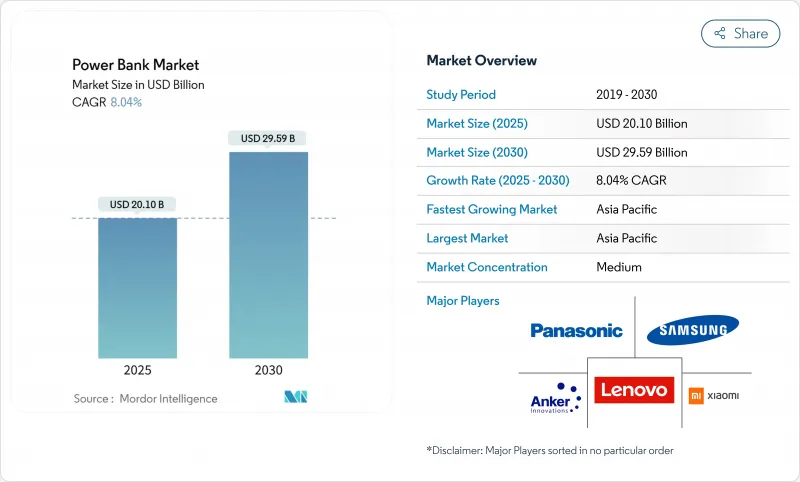

預計到 2025 年,行動電源市場規模將達到 201 億美元,到 2030 年將達到 295.9 億美元,2025 年至 2030 年的複合年成長率為 8.04%。

這種穩定成長反映了可攜式充電在當今環境中的重要作用,因為5G行動電話、更大的螢幕和多裝置使用等因素導致電池消耗速度遠超以往技術。製造商正在大力推廣氮化鎵(GaN)晶片組,該晶片組可透過多個連接埠提供高達165W的功率,同時還能減輕產品重量,從而將用戶群從行動電話擴展到筆記型電腦和主機。遊戲玩家和需要長時間離網供電的遠端辦公人員正在轉向20000mAh及以上的大容量行動電源。亞太地區憑藉其高智慧型手機銷售、薄弱的電網以及成本效益高的製造群,保持著領先地位。該地區的共用行動電源亭網路也使充電成為一種類似公共的服務。基於UN38.3標準的空運法規推高了運輸成本,而世界各地的監管機構正在召回不安全的仿冒品,這進一步鞏固了擁有認證供應鏈的知名品牌的優勢。

全球行動電源市場趨勢與洞察

5G智慧型手機的快速普及

5G行動電話的能耗將比4G手機高出20-30%,毫米波處理和頻繁的基地台切換會迅速消耗電池電量。平均螢幕續航時間將從12-14小時縮短至8-10小時,迫使用戶在日常通勤中攜帶備用電源。隨著行動通訊業者在人口密集的城市完成中頻段部署,活躍的5G連線數將超過智慧型手機流量的一半,這將在未來十年內對可攜式充電解決方案形成結構性需求。

家用電器電子商務的擴張

2024年,網路商店在出貨量中佔據了很大佔有率,其成長速度超過了實體店。注重規格的買家會參考產品頁面上的詳細運力圖表、港口通訊協定和安全標籤。用戶評論凸顯了仿冒品的風險,並為發布獨立測試摘要的品牌帶來了流量。數位化履約也突破了地理限制,使中型供應商能夠觸及沒有經銷商網路的偏遠地區的買家。

假冒偽劣產品的氾濫破壞了人們的信任

監管機構召回了42.9萬個小型充電器,先前有51起故障報告和6起燒燙傷事故發生。 UL的調查發現,大多數假冒產品繞過了過熱保護電路,增加了熱失控的風險。海關加強檢查、提高罰款額度以及強制摘要報告等措施增加了持證企業的合規成本,但並未徹底消除市場上的假冒產品。

細分市場分析

容量在 8001-20000mAh 之間的行動電源,兼顧了兩到三次智慧型手機充電的需求以及航空公司隨身攜帶物品的限制,在 2024 年佔據了行動電源市場 32.5% 的佔有率。這一細分市場將受益於重量低於 400 克、卻能為筆記型電腦提供 65W 功率的價格分佈(GaN) 產品。隨著內建 4500-5000mAh 電芯的 5G中階設備的推出,該細分市場的營收也將同步成長。

容量在 20,001-30,000mAh 區間的行動電源成長最快,複合年成長率 (CAGR) 為 8.6%。專業遊戲玩家、無人機飛行員和遠端辦公人員傾向於選擇能為 85W 筆記型電腦提供 4-6 小時續航的行動電源。產品通訊重點在於支援直通充電、智慧溫控和符合美國運輸安全管理局 (TSA) 規定的尺寸,從而將高容量行動電源的容量控制在航空公司規定的 100Wh 限制之內。預計隨著高階遊戲筆記型電腦出貨量的成長,該細分市場的行動電源規模也將擴大,而隨著入門級行動電話容量超過 5,000mAh,容量低於 3,000mAh 的行動電源市場規模將會下降。

由於有線解決方案具有高轉換效率和與 USB-C 電源傳輸協定的廣泛相容性,預計到 2024 年,其市場佔有率將保持在 58.3%。企業和內容創作者更傾向於使用有線設備,因為目前的感應線圈無法滿足 90W 以上的負載需求。儘管如此,無線產品的複合年成長率仍將達到 9.7%,這主要得益於無連接行動電話的普及以及 Qi2 認證的推出,後者將線圈對準效率提升至 80%。

如今,街角小攤就能租到線圈式行動電源,供遊客租賃,這標誌著行動電源逐漸被主流市場接受。能夠同時為15W行動電話和5W耳機充電的二合一行動電源也越來越受歡迎。因此,隨著每瓦成本的下降,無線設備行動電源的市場佔有率可能會在2030年之前持續擴大。

行動電源市場按容量範圍(最高 3,000 mAh、3,001-8,000 mAh、8,001-20,000 mAh 及其他)、充電技術(有線、無線)、應用領域(智慧型手機和平板電腦、筆記型電腦和遊戲機及其他)、分銷(有線、無線)、應用領域(智慧型手機和平板電腦、筆記型電腦和遊戲機及其他)、分銷(有線、無線和離線)以及線上進行區域通路。市場預測以美元計價。

區域分析

亞太地區行動電源市佔率將在2024年達到高峰51.2%,並在2030年之前以9.1%的複合年成長率成長。中國、印度和印尼每年智慧型手機出貨量合計超過10億部,城市附近電網經常出現2-6小時的輪流停電。當地製造商正利用勞動力和零件的接近性,將前置作業時間縮短至30天以內,而叫車公司則在地鐵站安裝租賃充電亭,並將充電服務轉化為微服務。

北美地區銷量位居第二。消費者平均每兩年更換行動電話,並且偏好支援 65W PPS 快充的 USB-C 介面等功能,這種介面可以在 50 分鐘內為筆記型電腦充滿電。對中國製造的電子產品徵收關稅預計到 2025 年將使平均售價上漲 18%,但消費者對 Anker、Belkin 和蘋果認證供應商的品牌忠誠度穩定了出貨量。獲得認證的電商平台透過提供免費送貨服務來承擔危險品運輸費用,從而維持了需求動能。

在永續性政策的推動下,歐洲市場呈現溫和成長。歐盟電池法規將加強可回收性資訊揭露,強制要求從2027年起使用QR碼材料護照,並激勵品牌宣傳更長的循環壽命和消費後回收計畫。德國、法國和北歐國家在無線充電的普及方面處於領先地位,公共交通工具的座椅上已安裝了感應式墊片。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 5G智慧型手機的快速普及

- 家用電器電子商務的擴張

- 在電力系統不穩定的開發中國家擴大應用

- 大容量筆記型電腦和遊戲機的快速普及

- 交通樞紐行動租賃亭的激增

- 將氮化鎵快速充電晶片組整合到高階機型中

- 市場限制

- 假冒偽劣產品的氾濫正在侵蝕信任。

- 延長智慧型手機原生電池續航力

- 收緊對鋰離子運輸的聯合國38.3號航空貨運規定

- 早期採用固體微型電池將減少外部電池組的需求。

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場宏觀經濟趨勢

第5章 市場規模與成長預測

- 按容量範圍

- 最高可達 3000mAh

- 3,001-8,000 mAh

- 8,001-20,000 mAh

- 20,001-30,000 mAh

- 30,000mAh 或以上

- 透過充電技術

- 有線

- 無線的

- 透過使用

- 智慧型手機和平板電腦

- 筆記型電腦和遊戲機

- 穿戴式裝置和物聯網設備

- 相機和無人機

- 其他設備(電子煙、路由器、醫療設備)

- 透過分銷管道

- 線上

- 離線

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Anker Innovations Ltd.

- Xiaomi Corporation

- Samsung Electronics Co., Ltd.

- Shenzhen Haopai Electronics(RAVPower)

- Lenovo Group Ltd.

- Sony Group Corporation

- Koninklijke Philips NV

- ADATA Technology Co., Ltd.

- Panasonic Energy Co., Ltd.

- Huawei Technologies Co., Ltd.

- ZAGG Inc.(mophie)

- Belkin International

- UGREEN Group Ltd.

- Baseus Technology Co., Ltd.

- Syska Mobile Accessories

- Ambrane India Pvt. Ltd.

- Intex Technologies(India)Ltd.

- Aukey Technology Co., Ltd.

- Zendure USA Inc.

- EcoFlow Inc.

第7章 市場機會與未來展望

The power bank market generated USD 20.10 billion in 2025 and is forecast to reach USD 29.59 billion in 2030, translating to an 8.04% CAGR over 2025-2030.

This steady rise reflects the indispensable role of portable charging in an environment where 5G phones, larger displays and multi-device lifestyles drain batteries faster than earlier technology generations. Manufacturers are pushing gallium nitride (GaN) chipsets that supply up to 165 W through several ports while cutting product weight, which expands the addressable user base beyond phones to laptops and consoles. Capacity migration to 20,000 mAh and above is visible among gamers and remote workers who need prolonged off-grid power. Asia Pacific holds the lead thanks to its smartphone volume, patchy grids and cost-efficient manufacturing clusters, and the region's shared-power-bank kiosk networks are making charging a utility-like service. Regulatory oversight is tightening in parallel; air-cargo rules under UN 38.3 standards raise shipping costs, while authorities worldwide are recalling unsafe counterfeit units, reinforcing the advantage of established brands with certified supply chains.

Global Power Bank Market Trends and Insights

Surging Penetration of 5G-Enabled Smartphones

5G handsets draw 20-30% more energy than 4G equivalents because millimeter-wave processing and constant cell-handover drain batteries quickly. Average screen-on endurance drops from 12-14 hours to 8-10 hours, pushing users to carry supplementary power on daily commutes. As mobile operators finish mid-band roll-outs in dense cities, active 5G connections pass the halfway mark of smartphone traffic, embedding a structural demand for portable charging solutions through this decade.

Expanding E-Commerce for Consumer Electronics

Online stores held a significant share of 2024 unit shipments and grew faster than physical retail. Spec-driven buyers rely on detailed capacity charts, port protocols, and safety labels posted on product pages. User-generated reviews expose counterfeit risks, nudging traffic toward brands that publish independent test summaries. Digital fulfillment also short-circuits geographic barriers, allowing mid-tier vendors to reach rural buyers without dealer networks.

Inflated Counterfeit and Sub-Standard Products Eroding Trust

Regulators recalled 429,000 compact chargers after 51 failure reports and 6 burn injuries, underscoring the safety threat posed by untested cells. UL Research shows most fakes skip temperature cut-off circuitry, raising thermal-runaway risk.Heightened customs inspections, fines, and mandatory test summaries raise compliance costs for licensed firms while still failing to fully shut counterfeiters out of marketplace listings.

Other drivers and restraints analyzed in the detailed report include:

- Higher Penetration in Developing Economies with Unreliable Power Grids

- Integration of GaN Fast-Charging Chipsets in Premium Models

- Incremental Gains in Native Smartphone Battery Life

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 8,001-20,000 mAh tier led the power bank market with 32.5% revenue in 2024, due to its compromise between two to three smartphone recharges and airline cabin limits. This segment benefits from mid-priced GaN variants that stay under 400 g yet deliver 65 W for notebooks. Revenue here will rise in tandem with 5G mid-range handsets that still launch with 4,500-5,000 mAh internal cells.

The 20,001-30,000 mAh tier is the fastest climber at 8.6% CAGR. Professional gamers, drone pilots, and remote-first employees gravitate to packs that sustain 4-6 hours of 85 W laptop draw. Product messaging highlights pass-through charging, smart-temperature control, and TSA-compliant footprints, keeping the high-capacity segment within the accepted 100 Wh airline ceiling. The power bank market size for this tier is projected to expand alongside premium gaming notebook shipments, while sub-3,000 mAh units fade as entry-level phones cross 5,000 mAh internal capacity.

Wired solutions retained a 58.3% share in 2024 due to higher conversion efficiency and broader compatibility with USB-C Power Delivery. Enterprises and content creators prefer cabled units because 90 W-plus loads remain impractical on current inductive coils. Nevertheless, wireless SKUs will log a 9.7% CAGR, reflecting more port-less phones and Qi2 certification that lifts coil alignment efficiency to 80%.

High-street kiosks now rent coil-based bricks for tourists, signaling mainstream acceptance. Two-in-one surfaces that power both a handset at 15 W and an earbud case at 5 W drive up-selling value. Consequently, the power bank market share of wireless devices will keep widening through 2030 as the cost per watt falls.

Power Bank Market is Segmented by Capacity Range (Up To 3, 000 MAh, 3, 001 - 8, 000 MAh, 8, 0001 - 20, 000 MAh, and More), Charging Technology (Wired, Wireless), Application (Smartphones and Tablets, Laptops and Gaming Consoles, and More), Distribution Channel (Online and Offline), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintained the highest regional power bank market share at 51.2% in 2024 and is headed for a 9.1% CAGR to 2030. China, India, and Indonesia together ship more than 1 billion smartphones annually, and rolling blackouts of 2-6 hours are common in peri-urban grids. Local manufacturers leverage labor and component proximity, compressing lead times to under 30 days, while ride-hail firms install rental kiosks in metro stations, framing charging as a micro-service.

North America ranked second by revenue. Consumers replace handsets every two years and favor specs such as PPS-enabled USB-C at 65 W that refuel laptops in under 50 minutes. Tariffs on Chinese electronics lifted average selling prices 18% in 2025, but brand loyalty toward Anker, Belkin, and Apple-certified suppliers held shipments steady. Certified e-tailers absorb hazmat fees into free-shipping bundles, preserving demand momentum.

Europe shows moderate growth centered on sustainability mandates. The EU Battery Regulation enforces recyclability disclosures and requires QR-coded material passports from 2027, motivating brands to highlight longer cycle life and post-consumer recycling programs. Wireless-charging adoption leads Germany, France, and the Nordics, where public transport integrates inductive pads in seating.

- Anker Innovations Ltd.

- Xiaomi Corporation

- Samsung Electronics Co., Ltd.

- Shenzhen Haopai Electronics (RAVPower)

- Lenovo Group Ltd.

- Sony Group Corporation

- Koninklijke Philips N.V.

- ADATA Technology Co., Ltd.

- Panasonic Energy Co., Ltd.

- Huawei Technologies Co., Ltd.

- ZAGG Inc. (mophie)

- Belkin International

- UGREEN Group Ltd.

- Baseus Technology Co., Ltd.

- Syska Mobile Accessories

- Ambrane India Pvt. Ltd.

- Intex Technologies (India) Ltd.

- Aukey Technology Co., Ltd.

- Zendure USA Inc.

- EcoFlow Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging penetration of 5G-enabled smartphones

- 4.2.2 Expanding e-commerce for consumer electronics

- 4.2.3 Higher Penetration in Developing Economies with Unreliable Power Grids

- 4.2.4 Rapid adoption of high-capacity laptops and gaming consoles

- 4.2.5 Proliferation of power-bank rental kiosks at transit hubs

- 4.2.6 Integration of GaN fast-charging chipsets in premium models

- 4.3 Market Restraints

- 4.3.1 Inflated counterfeit and sub-standard products eroding trust

- 4.3.2 Incremental gains in native smartphone battery life

- 4.3.3 Stricter UN 38.3 air-cargo limits for Li-ion shipments

- 4.3.4 Early traction of solid-state micro-batteries reducing need for external packs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Trends on Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Capacity Range

- 5.1.1 Up to 3,000 mAh

- 5.1.2 3,001 - 8,000 mAh

- 5.1.3 8,001 - 20,000 mAh

- 5.1.4 20,001 - 30,000 mAh

- 5.1.5 Above 30,000 mAh

- 5.2 By Charging Technology

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Application

- 5.3.1 Smartphones and Tablets

- 5.3.2 Laptops and Gaming Consoles

- 5.3.3 Wearables and IoT Devices

- 5.3.4 Cameras and Drones

- 5.3.5 Other Devices (e-cigarettes, routers, medical)

- 5.4 By Distribution Channel

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle-East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle-East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Anker Innovations Ltd.

- 6.4.2 Xiaomi Corporation

- 6.4.3 Samsung Electronics Co., Ltd.

- 6.4.4 Shenzhen Haopai Electronics (RAVPower)

- 6.4.5 Lenovo Group Ltd.

- 6.4.6 Sony Group Corporation

- 6.4.7 Koninklijke Philips N.V.

- 6.4.8 ADATA Technology Co., Ltd.

- 6.4.9 Panasonic Energy Co., Ltd.

- 6.4.10 Huawei Technologies Co., Ltd.

- 6.4.11 ZAGG Inc. (mophie)

- 6.4.12 Belkin International

- 6.4.13 UGREEN Group Ltd.

- 6.4.14 Baseus Technology Co., Ltd.

- 6.4.15 Syska Mobile Accessories

- 6.4.16 Ambrane India Pvt. Ltd.

- 6.4.17 Intex Technologies (India) Ltd.

- 6.4.18 Aukey Technology Co., Ltd.

- 6.4.19 Zendure USA Inc.

- 6.4.20 EcoFlow Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment