|

市場調查報告書

商品編碼

1642184

歐洲託管服務:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

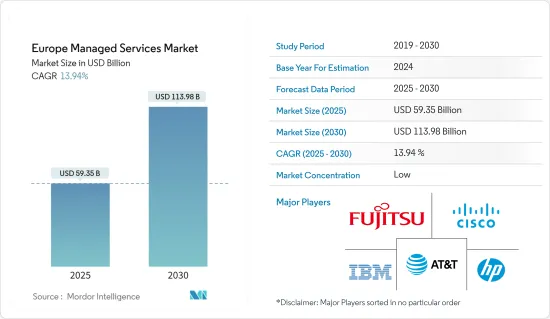

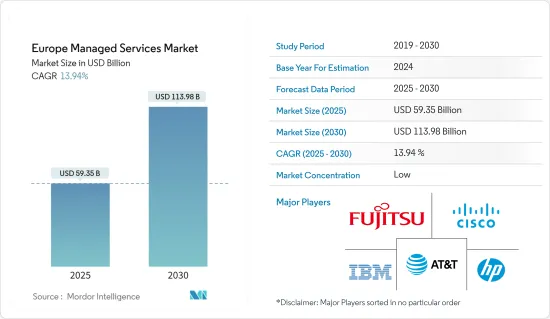

歐洲託管服務市場規模預計在 2025 年為 593.5 億美元,預計到 2030 年將達到 1139.8 億美元,預測期內(2025-2030 年)的複合年成長率為 13.94%。

主要亮點

- 雲端服務的日益普及、雲端的多樣化以及 IT 組織對最小化資本支出和最大化 IT 預算的追求等因素繼續推動著所調查市場的成長。

- 人工智慧和雲端管理滿足各種功能業務需求和託管服務,幫助組織以較低的成本高效運行,而不會犧牲工作品質。主要市場參與企業正在投資創造新產品並實現產品多樣化。我們也進行研究和開發,以提供可靠且實惠的服務。例如,2022年8月,野村綜合研究所(NRI)公佈了「NRI對產品開發的投資」。 NRI 在其丹麥分店開設了一個專用的託管服務室,以加強其在歐洲的託管服務。

- 歐洲是主要的汽車製造市場之一。近年來,汽車產業經歷了劇烈變革,生產的汽車有望實現網聯化、自動駕駛、按需化、共用和電動化。自動駕駛的出現帶來了挑戰,包括訓練人工智慧和即時決策系統所需的大量資料。富士通等服務提供者提供的解決方案可以減少資料量並以分散的方式進行管理,僅收集相關資料。

- 此外,領先的公司正在歐洲建立公有雲來支援他們的業務。例如,微軟最近宣布計劃在德國開設兩個新的雲端區域,使歐洲乃至世界各地的更多組織和公司能夠利用公共雲端解決方案實現數位轉型。這些新區域提供 Microsoft Azure、Office 365 和 Dynamics 365 的全部功能、企業級安全性和其他功能,以協助客戶滿足其合規性和監管要求。

- 此外,物聯網迫使企業重新評估客戶獲取資訊的方式並制定最能為他們服務的策略。每年都有數以百萬計的新設備連接到網際網路,這使得人們幾乎不可能了解本已複雜的情況以及眾多管道帶來的整合挑戰和網路威脅。因此,託管服務供應商可以在此時提高物聯網生態系統每一層的安全性,使企業能夠利用物聯網進行創新,並透過提供合格的資源和全天候支援服務來保持技術領先地位。

- 然而,儘管託管服務提供了顯著的好處,但它們也伴隨著固有的挑戰,例如可靠性問題可能會阻礙預測期內的市場成長。聘請 MSP 來託管關鍵業務基礎設施的過程需要有信心,即提供者的業務能夠維持這種關係。如果供應商無法在市場上保持競爭力,依賴他們的企業可能會被迫更換整個網站寄存、電子郵件、日曆和其他關鍵基礎設施。

- 此外,此次疫情也暴露了各組織的災害復原計畫(DRP)和業務永續營運計畫(BCP)中的缺陷。大多數計劃都未能預見疫情,迫使各組織爭相轉移IT基礎設施,以適應分散式遠端勞動力。此次疫情凸顯了監控技術和服務的重要性,以便在安全事件造成營運風險之前發現它們。因此,預計後疫情時期將為歐洲託管服務市場帶來成長機會。

歐洲託管服務市場的趨勢

雲端領域預計將高速成長

- 隨著該地區數位轉型的進展,企業越來越依賴 IT 提供的創造性應用和增強功能來取得成功。這已成為大多數組織的關鍵競爭優勢。此外,IT外包已不僅是一種削減成本的策略,還包括雲端遷移和雲端服務選項。因此,這種新形式是由業務成長、客戶體驗和競爭顛覆等組織動機所驅動的。

- 雲端外包需求的不斷成長表明歐洲公司更傾向於使用開源雲端平台來儲存資料。此外,在雲端上營運的公司可能會擔心安全威脅,並透過外包IT安全服務來消除任何威脅。這樣,就需要供應商的專業知識,並且可以更容易委派責任。

- 據歐盟統計局稱,近年來歐盟企業對雲端處理的使用大幅增加。業內消息進一步表示,該地區對 IaaS 和 SaaS 的採用正在成長,從而推動了對混合雲的需求。此外,歐盟的「數位十年」等多項區域措施也在推動市場的成長。 「數位十年」旨在到 2030 年將歐洲企業對雲端運算技術的採用率提高到 75%。

- 自帶設備 (BYOD) 和物聯網 (IoT) 正在推動雲端運算採用的成長。雲端基礎的解決方案主要被用來從物聯網產生的資料中獲取價值。這是由公有、私有和混合雲模型支撐的。此外,公司的傳統IT基礎設施可能必須依靠雲端來連接物聯網設備。此外,企業也意識到公有和私有雲端服務的一些缺點。公司正在尋找混合方法,以提供兩種架構的優勢,同時最大限度地減少每種模型的缺點。因此,出現了一種新趨勢,即將在私有和公有系統上運行的兩個或多個應用程式整合在一起 - 混合雲託管服務。

- 此外,歐洲各國僱用 ICT 專業人員的公司比例不斷成長,證明了歐洲對雲端和混合IT基礎設施的採用日益廣泛。例如,根據丹麥統計局的數據,在丹麥,僱用 ICT 專業人員的公司比例將從 2016 年的 25% 成長到 2022 年的 34%。

託管安全佔據主要市場佔有率

- 為了保持競爭力,歐洲各地各種規模的企業擴大轉向託管服務提供者。託管安全服務提供者透過提供正確的專業知識、解決方案和定價模式來增加其產品組合的價值。託管安全服務是該地區充滿活力的商業領域中的新興產業。服務提供者正在建立託管安全營運中心 (SOC) 來提供安全和支援服務。大多數服務提供者為其客戶部署自己的整合安全管理平台,提供安全資訊和事件管理 (SIEM) 和其他監控解決方案。

- 由於技術發展導致網路安全威脅日益增加,各國政府正在對網路安全和 MSSP 進行投資。例如,根據 AAG IT Services & CyberSecurity 的數據,約有 39% 的歐洲公司將報告在 2022 年遭受網路攻擊。

- 完全託管的託管服務包括伺服器安裝和設定、根據客戶要求安裝已通過核准的軟體、安全監控、軟體更新和管理、資料備份和保護以及許多其他服務。德國許多公司,尤其是新興企業和中小型企業,正在尋找這樣的解決方案。這些服務為需要大量資金來維護和管理現場伺服器、需要合適的 IT 團隊或因業務需求而時間緊迫的中小型企業提供了商業機會。

- 該地區資料外洩的增加預計將推動託管安全服務,並允許託管安全供應商開發新產品以獲得市場佔有率。例如,根據 TourShark 的數據,今年第三季度,俄羅斯在資料外洩方面居中歐和東歐 (CEE) 國家之首,洩漏記錄超過 2,230 萬條。烏克蘭位居第二,黑山位居第三。

- 達梭系統等多家法國大型公司正在透過提供易於部署的打包解決方案(SaaS、PaaS、IaaS)並為新興企業提供客製化服務,加強該國的新興企業生態系統。法國政府決定利用 Orange Business Services 將非關鍵資料外包給外部雲端。這是因為他們已經意識到使用雲端運算的好處,雲端運算非常適合容量波動(為政府提供了更快推出新服務所需的靈活性)。

歐洲管理服務業概況

歐洲託管服務市場較為分散,主要由擁有強大基本客群的國際公司主導。此外,隨著公司採取強力的競爭策略來維持市場地位並留住客戶,競爭對手之間的競爭正在加劇。主要參與者包括富士通、IBM 和Cisco。

- 2024 年 1 月 - 商業 ISP 和託管服務提供商 Evolve 成為加入 MS3 位於英格蘭北部的全新 10Gbps 光纖到戶寬頻網路的最新供應商,目標是到 2025年終連接英國各地的 535,000 戶居民。 Asterion 的一項未指定的投資正在支持 MS3,它現在涵蓋 158,779 個站點(119,139 RFS)並且正在迅速成長。透過與 MS3 的新合作,Evolve 將利用 MS3 的 XGS-PON 網路,率先酵母約克郡和剪切機地區的企業提供新解決方案。

- 2023 年 12 月 BT 和安全存取服務邊緣 (SASE) 參與者 Netskope 宣佈建立合作夥伴關係,向 BT 的全球客戶提供 Netskope 市場領先的安全服務邊緣 (SSE) 功能。此次夥伴關係是在幾家大型客戶部署之後達成的,兩家公司曾共同努力滿足大型企業的安全和存取需求。根據英國電信的資料,目前全球 76% 的勞動力青睞混合工作方式,需要更靈活、更安全的連接。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 向混合 IT 的轉變日益加劇

- 降低成本,提高業務效率

- 市場限制

- 整合和監管問題以及可靠性問題

第6章 市場細分

- 按部署

- 本地

- 雲

- 按類型

- 託管資料中心

- 託管安全

- 管理通訊

- 主機網路

- 託管基礎設施

- 管理行動性

- 按公司規模

- 中小型企業

- 大型企業

- 按行業

- BFSI

- 製造業

- 衛生保健

- 零售

- 其他行業

- 按國家

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Fujitsu Ltd

- Cisco Systems Inc.

- IBM Corporation

- AT&T Inc.

- HP Development Company LP

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Nokia Solutions and Networks

- Deutsche Telekom AG

- Tata Consultancy Services Limited

- Citrix Systems Inc.

- Wipro Ltd

- NSC Global Ltd

- Telefonica Europe PLC

第8章投資分析

第9章 市場機會與未來趨勢

The Europe Managed Services Market size is estimated at USD 59.35 billion in 2025, and is expected to reach USD 113.98 billion by 2030, at a CAGR of 13.94% during the forecast period (2025-2030).

Key Highlights

- Factors such as the growing adoption of cloud services, growth in cloud diversification, and the willingness of IT companies to minimize capital expenditure and make the most of their IT budgets continue to drive the growth of the studied market.

- Artificial technology and cloud management address various functional business requirements and managed services and assist with the efficient operation of the organization at a low cost without sacrificing the caliber of the work produced. The key market participants are making investments in the creation of new items and the diversification of their product offerings. They are also conducting research and development efforts to provide dependable and affordable services. For instance, in August 2022, Nomura Research Institute, Ltd. (NRI), a leading provider of system solutions and consulting services and system solutions, launched a dedicated managed services room at the NRI Europe Denmark Branch in order to enhance its system for providing managed services in Europe.

- The European region is among the leading automotive manufacturing markets. In recent years, the automotive industry has entered into a period of radical change, with the vehicles being produced expected to be connected, autonomous, shared on-demand, and electric. The emergence of autonomous driving will have challenges, including huge data volumes required for training AI and real-time decision-making systems. Service providers, like Fujitsu, offer solutions that will decrease data volumes and manage them in a distributed fashion, where only the relevant data is collected.

- Furthermore, major players are setting up public cloud setups in Europe to empower businesses. For instance, Microsoft recently announced its plans to deliver two new cloud regions in Germany to equip more organizations and companies in Europe and worldwide to transform them digitally with public cloud solutions. These new regions will offer Microsoft Azure, Office 365, and Dynamics 365 full functionality features, enterprise-grade security, and other features to help customers meet compliance and regulatory requirements.

- Additionally, IoT has forced companies to re-evaluate how customers access information and develop a strategy to best reach them. Millions of new gadgets connect to the Internet every year, making it practically impossible to understand the already complex landscape and the integration challenges and cyber threats provided by many channels. Hence, managed service providers can improve security for each tier of the IoT ecosystem at this point, enabling firms to harness IoT for innovation and stay on the cutting edge of technology by providing qualified resources and round-the-clock support services.

- However, despite the managed services providing excellent benefits, the specific challenges, like reliability concerns, may obstruct the market's growth over the forecast period. The process of hiring an MSP to host critical business infrastructure involves the belief that the providers' business may endure the relationship with them. In case of any failure by the providers to sustain the competition in the market, the enterprises relying upon them may have to entirely replace web hosting, emails, calendars, and other critical pieces of infrastructure, without which it is not possible to conduct business.

- Moreover, the pandemic has also revealed gaps in organizations' disaster recovery plans (DRP) and business continuity plans (BCP). Most of these plans could not address the pandemic, forcing organizations to scramble to transition their IT infrastructure to accommodate a distributed and remote workforce. The pandemic highlighted the importance of monitoring technology and services in detecting security incidents before they cause operational risk. Hence, the post-COVID period is anticipated to drive growth opportunities in the European managed services market.

Europe Managed Services Market Trends

Cloud segment is expected to grow at a higher pace

- With digital transformation in the region, organizations have become dependent on the success of creative applications and extensions that IT could provide. It has become a critical competitive edge for most organizations. Moreover, IT outsourcing has become more than a simple cost-reduction technique with cloud migrations and cloud service options. Therefore, this new form is driven by organizational motivations regarding business growth, customer experience, and competitive disruption.

- The increasing demand for cloud outsourcing indicates that European companies prefer cloud platforms from public sources for data storage purposes. Also, businesses operating over the cloud will likely be concerned about security threats and will eliminate all possible threats by outsourcing IT security services. This way, the demand for expert knowledge of the vendor will be required, along with an easy delegation of responsibilities.

- According to Eurostat, the use of cloud computing among EU enterprises increased significantly in recent years. Industry sources further suggest the increasing adoption of IaaS and SaaS in the European region, which in turn would increase the demand for hybrid cloud in the market. Furthermore, several regional initiatives such as EU's Digital Decade which to expand the use fo cloud-edge technologies among European businesses to 75% by 2030 also favors the studied market's growth.

- Bring-your-own-device (BYOD) and the Internet of things (IoT) have pushed the growth of cloud adoption, as cloud-based solutions are being leveraged primarily to derive value from the data generated by IoT. This is supported by the public, private, and hybrid cloud models. In addition, the legacy IT infrastructure of enterprises may have to rely on the cloud to connect with IoT devices. Besides, organizations realize several drawbacks of public and private cloud services. They are looking for a hybrid approach that provides advantages of both architectures, minimizing the drawbacks in each model. As a result, there is an emerging trend of integrating two or more applications running on private and public systems, i.e., hybrid cloud hosting services.

- Furthermore, the growing adoption of cloud and hybrid IT infrastructure in the European is also evident from the fact that the share of enterprises employing ICT specialists has been growing across various European countries. For instance, according to Statistics Denmark, in Denmark, the share of enterprises employing ICT specialists increased to 34% in 2022, compared to 25% in 2016.

Managed Security Account for Significant Market Share

- To maintain a competitive edge, organizations across Europe, irrespective of their sizes, increasingly rely on managed service providers to ensure technology usage to transform and scale businesses. Managed security service providers are adding value to their portfolio of offerings by providing the right expertise, solutions, and pricing models. Managed security service is an emerging field in the dynamic business space of the region. Service providers are setting up managed security operations centers (SOC) to deliver security and support services. Most service providers deploy their own unified security management platform for customers to provide security information and event management) and other monitoring solutions (SIEM).

- The growing cyber security threats due to the increase in the development of technologies have led the government to invest in cyber security and MSSP. For instance, according to AAG IT Services & Cyber Security, in 2022, about 39% of enterprises in Europe reported suffering a cyberattack.

- Fully managed to host services, including server installations and setup, approved software installations according to customer requirements, security monitoring, software updates and management, data backup and protection, and a slew of other services. Many enterprises in Germany, especially startups and SMEs, are looking for such solutions. These services offer the opportunity for SMEs that need more capital to keep and maintain their servers on-site, need an appropriate IT team, or are time-constrained due to the demands of their business operations.

- The rise in data breaches in the region is expected to drive the managed security services and enable managed security vendors to develop new products to capture the market share. For instance, according to tour shark, with over 22.3 million data breaches in the third quarter of the current year, Russia led all of Central and Eastern Europe (CEE) countries. Ukraine and Montenegro came in second and third, respectively.

- To empower the thriving startup ecosystem in the country, many French majors, like Dassault Systems, are offering packaged solutions (software-as-a-service (SaaS), platform-as-a-service, PaaS, and infrastructure-as-a-service (Iaas)) that can be easily deployed with tailored offerings for startups to augment growth. The French government decided to use the services of outsourcing non-critical data to an external cloud provided by Orange Business Services after realizing the benefits of using the cloud, which is perfectly suited to capacity fluctuations (thereby empowering the government with the flexibility required to implement new services more quickly).

Europe Managed Services Industry Overview

The Europe managed services market is fragmented as the market studied is dominated by international players with a strong client base. Additionally, companies are employing powerful competitive strategies to sustain themselves in the market and retain their clients, intensifying competitive rivalry. Key players are Fujitsu Ltd, IBM Corporation, Cisco Systems, etc.

- January 2024: Business ISP and managed service provider Evolve has become the latest provider to hop onto MS3's new 10Gbps capable Fibre-to-the-Premises broadband network in the North of England, aiming to reach 535,000 UK premises by the end of 2025. An unspecified investment from Asterion is backing MS3 and has covered 158,779 premises passed (119,139 RFS) and is rising fast. Evolve's new partnership with MS3 allows them to leverage MS3's XGS-PON network to bring new solutions to businesses in the East Riding and Lincolnshire regions for the first time.

- December 2023: BT and Netskope, a player in Secure Access Service Edge (SASE), announced a partnership to bring Netskope's market-leading Security Service Edge (SSE) capabilities to BT's global customers. The partnership follows several large customer implementations where the two companies have collaborated to meet the security and access needs of large enterprises successfully. BT's data shows that hybrid working is now a requirement for 76% of global workers, driving a requirement for more agile, secure connectivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Shift to Hybrid IT

- 5.1.2 Improved Cost and Operational Efficiency

- 5.2 Market Restraints

- 5.2.1 Integration and Regulatory Issues and Reliability Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Managed Data Center

- 6.2.2 Managed Security

- 6.2.3 Managed Communications

- 6.2.4 Managed Network

- 6.2.5 Managed Infrastructure

- 6.2.6 Managed Mobility

- 6.3 By Enterprise Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Manufacturing

- 6.4.3 Healthcare

- 6.4.4 Retail

- 6.4.5 Other End-user Verticals

- 6.5 By Country

- 6.5.1 United Kingdom

- 6.5.2 Germany

- 6.5.3 France

- 6.5.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 AT&T Inc.

- 7.1.5 HP Development Company LP

- 7.1.6 Microsoft Corporation

- 7.1.7 Verizon Communications Inc.

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Nokia Solutions and Networks

- 7.1.10 Deutsche Telekom AG

- 7.1.11 Tata Consultancy Services Limited

- 7.1.12 Citrix Systems Inc.

- 7.1.13 Wipro Ltd

- 7.1.14 NSC Global Ltd

- 7.1.15 Telefonica Europe PLC