|

市場調查報告書

商品編碼

1690951

北美託管服務:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

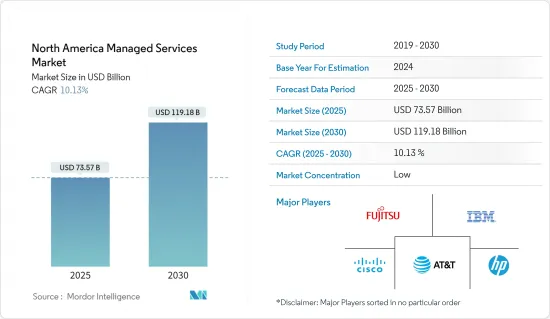

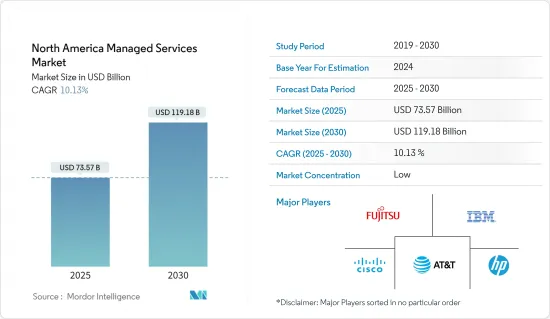

北美託管服務市場規模預計在 2025 年為 735.7 億美元,預計到 2030 年將達到 1191.8 億美元,預測期內(2025-2030 年)的複合年成長率為 10.13%。

主要亮點

- 由於中小型企業(SME)格局的變化,北美市場正在成長,這些企業不斷專注於外包IT基礎設施,尤其是網路安全解決方案。例如,美國新興IT供應製造商和分銷商之一KPaul Properties LLC實施了富士通,以虛擬環境取代其實體伺服器。這使公司的成本降低了約 15%,並將運轉率提高了 95%。

- 據SolarWinds稱,在北美,尤其是美國,MSP專注於為伺服器、儲存硬體、端點設備和網路設備提供解決方案。儘管可能缺乏託管安全產品,但大多數解決方案提供者都在網路和端點硬體和軟體中提供安全點產品。

- 該地區透過對您的 IT 環境進行全面評估並提供解決業務生命週期每個階段的複雜業務挑戰所需的解決方案,整合符合業務需求的 IT 解決方案。例如,總部位於美國的託管解決方案匯集了技術技能和必要資源,以發現挑戰、診斷問題區域、客自訂設計、交付和執行全面的、基於需求的技術藍圖,從而使客戶更安全、更合規、更有效率。

- 儘管託管服務提供了各種好處,但它們也伴隨著可靠性問題等固有挑戰,這可能會阻礙預測期內的市場成長。僱用 MSP 來託管您的關鍵業務基礎設施的過程需要與提供者建立信任。如果供應商無法在競爭激烈的市場中生存,依賴該供應商的企業可能會被迫完全更換其網站寄存、電子郵件、日曆和其他關鍵基礎設施。

- COVID-19 疫情導致美國遠距辦公的組織數量增加。根據 ALM Media Properties LLC 統計,估計有 58% 的美國知識工作者正在遠距工作。這比新冠疫情之前的平均水準高出了 30% 以上,也超過了先前的數據顯示的 1.4 億美國平民勞動力中約有 7%在家工作。大量員工從傳統職場撤離,為許多企業的雇主期望和遠程辦公政策帶來了可喜的變化。

北美託管服務市場趨勢

IT和通訊產業預計將佔據較大的市場佔有率

- 由於各種技術的採用率高、BYOD 政策的採用率不斷提高(使業務操作更加舒適和易於管理)以及由於組織中資料量呈指數成長而對高階安全性的需求不斷成長,IT 和通訊行業已成為託管服務的關鍵市場。

- 過去幾年來,通訊業持續成長。為了在競爭激烈的市場中留住客戶,電信業者面臨以低成本提供創新服務的壓力。為了因應複雜的競爭環境,託管服務已成為通訊業者的普遍需求。

- 此外,由於經濟案例的吸引力較大,預計大多數通訊將用軟體(SDN 和 NFV)取代其網路硬體。推動 SDN 和 NFV 需求的關鍵因素包括縮短產品上市時間、降低資本支出 (CAPEX) 和營運支出 (OPEX),以及從業務角度開闢新的收入來源。所有這些都有望推動所研究市場的成長。此類措施正在推動託管網路服務的需求。

- 北美的許多 SD-WAN 託管服務供應商透過提供廣泛的安全性來脫穎而出。例如,Cato Networks 提供一個雲端原生平台,其中包括 NGFW、安全 Web 閘道、進階威脅防禦、雲端和行動存取保護以及託管威脅偵測和回應服務。 Colt 提供具有 DDoS 保護功能的第 7 層防火牆和第 3/4 層狀態防火牆,而 CenturyLink 則提供一套名為自我調整網路安全的安全服務。

加拿大市場可望快速成長

- 加拿大託管服務市場主要透過新產品發布、收購、合併和合作實現成長,進而影響整個北美市場。加拿大的技術發展正在加速,並持續改變商業運作方式——提高業務效率、利用大量資料、進行內部協作以及與公司及其客戶互動。

- Starport 是一家加拿大託管 IT 服務供應商,為加拿大各地的中型企業提供一流的 IT 設計、實施和持續網路監控。我們的大多數客戶都位於大多倫多地區。該公司為各行各業的客戶提供服務,包括投資銀行、製造業和商業房地產。

- 此外,加拿大在採用多重雲端環境和引入自動化方面也取得了進展。由於雲端、行動和社交技術要求該地區的企業採取主動的IT安全方式,因此對於部署提供全方位安全控制層的強大託管服務的需求日益成長。

- 整合通訊即服務 (UCaaS) 和相關的客服中心即服務 (CCaaS) 市場為託管服務提供者提供了機會。新興供應商提供創新的雲端基礎的解決方案,只需最少的投資即可部署。客戶也傾向於基於消費的計量收費模式。

- 加拿大雲端服務的興起預計將推動託管 MPLS 市場的需求。例如,加拿大政府制定了「雲端優先」策略,在啟動資訊技術投資、舉措、策略和計劃時,將雲端服務確定並評估為主要交付選項。雲端運算還有望使加拿大政府能夠利用私人供應商的創新並提高資訊技術的靈活性。

北美託管服務業概況

託管服務市場競爭激烈,有多家大型參與者。市場的主要企業包括Cisco、IBM、微軟、富士通和 Wipro。隨著市場競爭不斷加劇,企業正在形成策略聯盟和夥伴關係。

- 2021 年 5 月-富士通有限公司與樂天移動公司宣布,雙方已簽署合作備忘錄,以深化合作,共同開發面向全球市場的 Open RAN 解決方案。兩家公司將合作開發4G和5G Open RAN解決方案。

- 2021 年 11 月-AT&T 在其安全存取服務邊緣 (SASE) 產品組合中新增了新產品。 AT&T SASE 與思科合作是一個整合的網路和安全管理系統,它利用軟體定義廣域網路 (SD-WAN) 技術和安全功能來連接和保護您的業務。

- 2021 年 10 月 - Citrix 宣布推出 Citrix Secure Private Access,這是一種新的雲端基礎的零信任網路存取 (ZTNA) 解決方案,可保護從託管、非託管和自帶 (BYO) 裝置存取應用程式和資料的安全性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 向混合 IT 的轉變日益加劇

- 降低成本並提高業務效率

- 市場挑戰

- 對整合、監管問題和可靠性的擔憂

第6章 市場細分

- 按部署

- 本地

- 雲

- 按類型

- 託管資料中心

- 託管安全

- 管理通訊

- 主機網路

- 託管基礎設施

- 管理行動性

- 按公司規模

- 小型企業

- 中型企業

- 大型企業

- 按行業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 娛樂與媒體

- 零售

- 製造業

- 政府

- 其他行業

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Fujitsu Ltd

- Cisco Systems Inc.

- IBM Corporation

- AT&T Inc.

- HP Development Company LP

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Citrix Systems Inc.

- Rackspace Inc.

第8章投資分析

第9章:市場的未來

The North America Managed Services Market size is estimated at USD 73.57 billion in 2025, and is expected to reach USD 119.18 billion by 2030, at a CAGR of 10.13% during the forecast period (2025-2030).

Key Highlights

- The North American market is growing due to the changing landscape of IT infrastructure, especially in small and medium enterprises (SMEs), which continually focus on outsourcing cybersecurity solutions. For instance, KPaul Properties LLC, one of the emerging manufacturers and distributors of IT supplies in the United States, onboarded Fujitsu to replace a physical server with a virtualized environment. This reduced the company's cost by around 15% and delivered 95% uptime.

- According to SolarWinds, in North America, server and storage hardware, endpoint devices, and networking gear solution offerings dominate among MSPs, especially in the United States. Though managed security offerings may be lacking, most solution providers offer security point products in network and endpoint hardware and software.

- In the region, companies are integrating IT solutions tailored to business needs by providing a full assessment of the IT environment and delivering the solutions needed to solve complex business challenges at every stage of the business lifecycle. For instance, Managed Solution, a US company, integrated technical skillsets and the required resources to discover challenges, diagnose problem areas, and custom design, deliver, and execute a comprehensive technology roadmap based on needs, making customers more secure, compliant, and efficient.

- Although managed services offer various benefits, specific challenges, like reliability concerns, may obstruct the market's growth over the forecast period. The process of hiring an MSP to host critical business infrastructure involves a belief in the providers' business relationship. In case of any failure by providers to sustain in the competitive market, enterprises relying upon them may have to entirely replace web hosting, emails, calendars, and other critical pieces of infrastructure, without which it is not possible to conduct business.

- The COVID-19 pandemic increased the number of organizations working remotely in the United States. According to ALM Media Properties LLC, an estimated 58% of American knowledge workers work remotely. This number is increasing by more than 30% from pre-COVID-19 averages and dwarfs previous figures that reported roughly 7% of the US' 140 million civilian employees worked from home. This mass exodus from the conventional workplace has been a welcome shift in many organizations' employer expectations and telework policies.

North America Managed Services Market Trends

IT and Telecom Sector Expected to Hold a Significant Market Share

- The IT and telecom sector is a significant market for managed services due to the high rate of various technological adoptions, increased rate of adoption of the BYOD policy (in order to make business operations much more comfortable and controllable), and increased need for high-end security due to rapidly increasing data volumes in organizations.

- The telecom industry has observed increased growth during the past few years as telecommunication companies are encountering constant pressure to deliver innovative services at lower costs to retain their customers in the competitive market. In order to address a complex and competitive environment, managed services have become a widespread demand for operators.

- Moreover, because of their compelling economic case, most telecom carriers are expected to replace their network hardware with software (SDN & NFV). Major factors driving the demand for SDN and NFV include improved time-to-market, reduction in CAPEX and OPEX, and opening up new revenue streams from a business standpoint. All these are expected to drive the growth of the market studied. Such initiatives are driving demand for managed network services.

- Many SD-WAN managed service providers in North America differentiate themselves with a broad range of security offerings. For instance, Cato Networks offers a cloud-native platform that includes NGFW, Secure Web Gateway, Advanced Threat Prevention, Cloud and Mobile Access Protection, and a Managed Threat Detection and Response service. Colt offers Layer 7 firewall or a Layer 3/4 stateful firewall with DDoS protection, and CenturyLink provides a suite of security services referred to as Adaptive Network Security.

Canada Expected to be the Fastest-growing Market

- The market for managed services in Canada is growing mainly due to new product roll-outs, acquisitions, mergers, and partnerships, shaping the overall North American market. The accelerated growth of technology in Canada continues to reshape how businesses improve operational efficiencies, leverage massive amounts of data, collaborate internally, and interaction between businesses and customers.

- Starport is a Canada-based managed IT services provider that delivers top-class IT design, implementation, and continuous network monitoring to mid-sized organizations, throughout Canada. Most of its clients are concentrated in the Greater Toronto Area. It offers its services to clients from various industries, including investment banking, manufacturing, and commercial real estate.

- Besides, Canada is witnessing high growth in the application of multi-cloud environments and increased adoption of automation. In the region, cloud, mobile, and social technologies demand that businesses take a proactive approach toward IT security, thus, boosting the demand for the deployment of robust managed services that would deliver in all security management layers.

- Unified Communications as a Service (UCaaS) and related Contact Center as a Service (CCaaS) markets represent a business opportunity for managed service providers. This is because emerging players are offering innovative cloud-based solutions that require a minimum investment and are easy to deploy. Customers are also leaning toward consumption-based, pay-as-you-go models.

- Rising cloud services in the country are expected to augment the demand for the managed MPLS market. For instance, the Government of Canada has a 'cloud-first' strategy, whereby cloud services are identified and evaluated as the principal delivery option while initiating information technology investments, initiatives, strategies, and projects. The cloud is also expected to allow the Government of Canada to harness the innovation of private sector providers to make its information technology more agile.

North America Managed Services Industry Overview

The managed services market is very competitive because of the presence of several major players. Some major players in the market are Cisco Systems Inc., IBM Corporation, Microsoft Corporation, Fujitsu Ltd, and Wipro Ltd. The market players are forming strategic collaborations and partnerships to sustain the intense competition in the market.

- May 2021 - Fujitsu Ltd and Rakuten Mobile Inc. announced a Memorandum of Understanding (MoU) to deepen their collaboration on joint efforts to develop Open RAN solutions for the global market. Both companies will jointly collaborate to develop 4G and 5G Open RAN solutions.

- November 2021 - AT&T added a new offering to its Secure Access Service Edge (SASE) portfolio. AT&T SASE with Cisco is a converged network and security management system that uses software-defined wide-area networking (SD-WAN) technology and security capabilities to connect and protect businesses.

- October 2021 - Citrix launched Citrix Secure Private Access, a new cloud-based Zero-Trust Network Access (ZTNA) solution that safeguards app and data access from managed, unmanaged, and Bring-Your-Own (BYO) devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Shift to Hybrid IT

- 5.1.2 Improved Cost and Operational Efficiency

- 5.2 Market Challenges

- 5.2.1 Integration, Regulatory Issues, and Reliability Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Managed Data Center

- 6.2.2 Managed Security

- 6.2.3 Managed Communications

- 6.2.4 Managed Network

- 6.2.5 Managed Infrastructure

- 6.2.6 Managed Mobility

- 6.3 By Enterprise Size

- 6.3.1 Small Enterprises

- 6.3.2 Medium Enterprises

- 6.3.3 Large Enterprises

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT and Telecom

- 6.4.3 Healthcare

- 6.4.4 Entertainment and Media

- 6.4.5 Retail

- 6.4.6 Manufacturing

- 6.4.7 Government

- 6.4.8 Other End-user Verticals

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 AT&T Inc.

- 7.1.5 HP Development Company LP

- 7.1.6 Microsoft Corporation

- 7.1.7 Verizon Communications Inc.

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Citrix Systems Inc.

- 7.1.10 Rackspace Inc.