|

市場調查報告書

商品編碼

1642185

壓力標籤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pressure Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

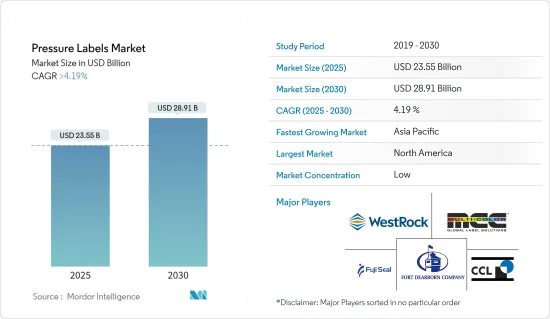

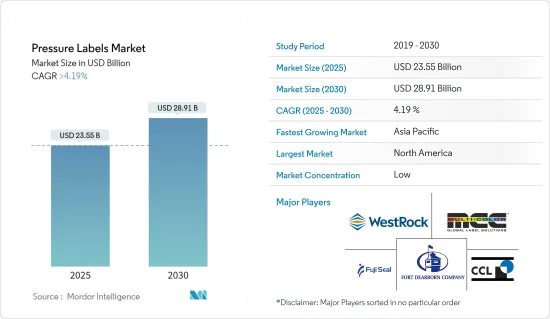

壓力標籤市場規模預計在 2025 年為 235.5 億美元,預計到 2030 年將達到 289.1 億美元,預測期內(2025-2030 年)的複合年成長率將超過 4.19%。

製藥業的成長加上其在不同領域的廣泛應用是壓力標籤市場的主要促進因素。最新的創新和對壓力標籤產品日益成長的需求預計將推動市場成長。

主要亮點

- 感壓標籤仍然是世界上最受歡迎的標籤技術。感壓標籤廣泛應用於食品業。其應用不僅限於食品和飲料行業,還擴展到製藥、消費品、個人護理和建設業等其他領域。

- 根據應用情況,各種黏合劑可以使感壓標籤永久或可移除。此外,用於重型應用的壓敏密封劑可以承受極端的溫度變化。適用於各種最終用戶應用,包括汽車用品、清潔產品、酒精、葡萄酒、烈酒、食品和飲料。

- 此外,隨著消費者永續性意識的不斷增強,PS 標籤的表面材料由可回收材料組成。此外,透過技術突破,許多公司開發了不妨礙回收的專有黏合劑。在這些永續技術的幫助下,感壓標籤有望鞏固其行業領先地位。

- 此外,一些感壓標籤製造商使用PE,PP,PET,PVC聚合物薄膜材料來賦予其產品更多功能。這些包括強度、防潮性、顏色、表面光滑度、透明度、高光澤度、耐久性、機械抗性等。感壓標籤的一些主要趨勢是永續性、堅固性、RFID、增強的防偽標籤、可剝離和可重新定位的薄膜作為布料。

- 儘管存在新冠疫情,食品飲料和醫療保健產業仍表現出更為可觀的成長動能。這些領域的供應商積極致力於繼續生產和交付消費者和醫療保健必需的標籤材料。但隨著銷售和生產的停止,大多數貿易商的損失進一步加劇。隨著競爭的加劇和印刷、裝飾技術的發展,原料的價格也在上漲。此外,俄羅斯和烏克蘭之間的戰爭也影響了整個包裝生態系統。

壓力標籤市場趨勢

飲料終端用戶市場可望推動壓力標籤成長

- 由於對包裝和品牌產品的需求不斷成長,以及消費者對產品真實性和其他方面的了解不斷增加,預計飲料最終用戶類別將在預測期內見證最快的成長。

- 感壓標籤至關重要,因為飲料標籤需要在各種情況下黏附在容器上。無論應用環境是室溫還是更具挑戰性的溫度(如 20F 至 40F),飲料標籤的黏合劑設計都需要快速應用並根據需要保持在原位。儘管寒冷、潮濕且經常需要處理產品,標籤和黏合劑仍必須保持足夠的耐久性。

- 據波蘭中央統計局稱,2023年波蘭啤酒產量將達到約3,520萬百公升。由於飲料包裝行業的擴張,未來幾年對感壓標籤的需求可能會增加。

- 防偽標籤的興起預計將推動對感壓標籤的需求。這對於食品企業來說尤其重要,因為它可以防止假冒並確保食品的真實性。防偽措施還可以幫助企業減少因假冒造成的收益和客戶忠誠度的損失。壓力標籤主要用於食品和藥品標籤,並透過RFID和條碼追蹤減少仿冒。

- 標籤供應商正在透過創造和提供標籤產品來響應永續性趨勢,幫助飲料製造商實現其與永續性相關的包裝目標。在回收系統中,可回收、易於從PET容器上剝離的感壓標籤是PET容器上使用的標籤的新進展。例如,Hammer Packaging Inc. 與基材製造商密切合作,以推動永續性舉措。在我們的感壓標籤業務中,我們也開發了創意的解決方案。

- 根據美國蒸餾酒委員會 (DISCUS) 的數據,優質烈酒在蒸餾酒類別中佔供應商總收入的比例最高,為 33%。 Value Spirits 今年的毛利成長最快。廉價烈酒較去年與前一年同期比較成長 8%,高檔烈酒較去年同期成長 3.8%。

- 頂級烈酒佔供應商總收入的最大比例,顯示消費者對高檔和奢侈品的需求不斷成長。這種模式顯示消費者願意為奢侈品和服務支付更多費用。因此,壓力標籤市場能夠透過提供優質標籤選項來滿足這一需求,從而提高高價烈酒的感知價值和美感吸引力。例子包括特殊的飾面、壓花、燙印和散發優雅和奢華的獨特標籤材料。

北美市場可望創下成長紀錄

- 在美國,RFID 的使用已經越來越廣泛,它利用無線電波來收集和傳輸感壓標籤上的資訊。食品、飲料和藥品是最終用戶領域,在這些領域中,技術被整合用於監控、認證和防偽。

- 作為這條新產品線的一部分,莫霍克宣布與芬歐藍泰美國公司建立戰略合作關係。 Mohawk Renewal Hemp 和 Straw 飾面可以提供捲筒紙壓敏標籤解決方案。

- 夥伴關係也推動了該地區的市場需求。例如,麥安迪與芬歐藍泰標籤最近在北美感壓標籤產業建立了策略合作關係。這項合作將使兩家公司能夠開發出適用於柔版印刷和數位印刷的環保印刷解決方案。

- 由於 PSL 的適應性,其需求正在不斷成長。這迫使行業內的公司提高產能,以滿足不斷成長的市場需求。例如,芬歐藍泰標籤已宣布計劃於 2022 年 12 月在美國華盛頓州溫哥華開設一個新碼頭。新工廠將擴大芬歐藍泰標籤的分切和配送能力並支援該公司的北美終端網路。為了支持客戶成功並滿足對感壓標籤日益成長的需求,芬歐藍泰標籤繼續投資加強其業務。

壓力標籤行業概況

壓力標籤市場高度分散,Multi-color Corporation、CCL Industries Inc、Westrock Company 和 Fuji Seal International Inc 等中小型企業佔據主導市場佔有率。這也使得市場競爭變得異常激烈。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 4 月 - 全球最大的標籤公司之一 Multicolor Corporation (MCC) 宣布收購土耳其的 Corsini,後者套模貼標 (IML) 解決方案領域的主要企業之一。 IML 是一種高成長的標籤技術,其中預先列印的標籤在容器製造過程中插入包裝模具中,從而創造出完全可回收、經濟高效、耐用且一致的產品。

- 2023 年 6 月 - CCL Industries 宣布已簽署協議,從瑞士 Capri-Sun 集團旗下的 Pouch Partners AG(瑞士)收購 Pouch Partners srl(義大利)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 市場促進因素

- 數位印刷技術的演變

- 市場限制

- 缺乏能夠承受惡劣天氣條件的產品

第5章 COVID-19 對市場的影響

第6章 市場細分

- 按印刷過程

- 凹版印刷

- 柔版印刷

- 螢幕

- 凸版印刷

- 噴墨

- 其他工藝(膠版印刷、靜電複印)

- 按最終用戶產業

- 食物

- 飲料

- 衛生保健

- 化妝品

- 適合家庭使用

- 工業(汽車、工業化學品、耐用性和非耐用消費品)

- 後勤

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Fort Dearborn Company

- Multicolor Corporation

- CCL Industries Inc

- Westrock Company

- Fuji Seal International Inc.

- Taylor Corporation

- Huhtamaki Group

- Taghleef Industries Inc(Al Ghurair Group)

- Coveris

- Avery Dennison Corp

- UPM Raflatac, Inc

- Inland Printing Co. Ltd

- Constantia Flexibles Group GmbH

- Folienprint RAKO GmbH

- Herma GmbH

- Skanem AS

第8章投資分析

第9章:市場的未來

The Pressure Labels Market size is estimated at USD 23.55 billion in 2025, and is expected to reach USD 28.91 billion by 2030, at a CAGR of greater than 4.19% during the forecast period (2025-2030).

Growth in the pharmaceutical industry, coupled with its vast application scope in diverse sectors, is the major driver for the pressure labels market. The latest innovations in pressure label products and rising demand is expected to fuel the market growth.

Key Highlights

- The most popular label technology worldwide will continue to be pressure-sensitive labels. They are used extensively in the food business. Their uses extend beyond the food and beverage industry, including the pharmaceutical, consumer goods, personal care, and other sectors, including construction.

- Depending on the application, different adhesives can make pressure-sensitive labels permanent or releasable. Furthermore, temperature extremes would not harm pressure-sensitive sealants for heavy-duty applications. They are appropriate for applications across a range of end-users, including automotive items, cleaning products, alcohol, wine, spirits, food, and beverage, because they can handle the weights of thick labels, such as expanded content labels.

- Additionally, in keeping with consumers' increased awareness of sustainability, the face stock of PS Labels is comprised of recyclable materials. Furthermore, through technical breakthroughs, numerous businesses created unique adhesives that do not obstruct recycling. Pressure Sensitive labels are anticipated to strengthen their position as industry leaders with the aid of sustainable technologies like these.

- Additionally, a growing portion of pressure-sensitive label makers uses PE, PP, PET, and PVC polymer film materials to provide their products with additional functionality. It includes strength, moisture resistance, color, smoothness on the surface, transparency, high gloss, durability, and mechanical resistance. Important trends offered by pressure-sensitive labels include sustainability, robustness, RFID, a rise in anti-counterfeit labels, and detachable and repositionable films as face stock.

- The food, beverage, and healthcare sectors showed more encouraging growth despite the COVID-19 scenario. The suppliers to these sectors are actively engaged in the ongoing production and provision of label materials for essential consumer and healthcare products. However, with sales and production on hold, most merchants' losses are worsening. Along with increased competition and developing printing and decorating technologies, the price of raw materials is also rising. Further, the Russia-Ukraine war also impacts the overall packaging ecosystem.

Pressure Labels Market Trends

Beverage End-User Segment is Expected to Drive Growth of Pressure Labels

- With the rising demand for packaged and branded products and rising consumer knowledge of the authenticity and other aspects of the product, the beverage end-user category is anticipated to see the fastest growth over the projection period.

- Because beverage labels must stick to the container in various situations, pressure-sensitive labeling is essential. Whether the application environment is room temperature or something more difficult, like 20F to 40F, an adhesive design for beverage labeling should stick rapidly and stay in place as needed. Despite cold, dampness, and continuous product handling, the label and adhesive must maintain the appropriate durability.

- According to the Central Statistical Office of Poland, the volume of beer produced in Poland amounted to approximately 35.2 million hectolitres in 2023. The need for pressure-sensitive labels will rise in the upcoming years due to the expanding beverage packaging sector.

- One driving demand for Pressure Labels is anticipated to be the expansion of Anti-Counterfeit Labels. As it discourages copying and verifies the meal's authenticity, this is particularly crucial for the food business. Anti-counterfeiting measures also assist businesses in reducing revenue and customer loyalty losses brought on by counterfeiting. Pressure labels are mostly used to label food and pharmaceutical products to decrease counterfeiting using RFID or barcode tracking.

- Label suppliers are responding to sustainability trends by creating and providing label goods to assist beverage manufacturers in achieving their sustainability-related packaging goals. In recycling systems, pressure-sensitive labels that are recyclable and effortlessly removed from PET containers are new advances for labels used on PET containers. For instance, Hammer Packaging Inc. collaborates closely with substrate producers to promote sustainability initiatives. For its pressure-sensitive label business, it includes developing creative solutions.

- The highest percentage of supplier gross income in the spirits category, 33%, belongs to high-end spirits, according to the Distilled Spirits Council of the United States (DISCUS). Value spirits saw the fastest increase in gross income during that same year. Value spirits had an increase of 8% over the prior year, while premium spirits saw an increase of 3.8%.

- The fact that premium spirits comprised the greatest portion of supplier gross income suggests increased consumer demand for high-end and upscale goods. This pattern implies consumers are prepared to shell out more money for premium goods and services. Consequently, the Pressure Labels Market can satisfy this need by offering premium labeling options that raise expensive spirits' perceived value and aesthetic appeal. Some examples might include specialized finishing, embossing, foil stamping, or distinctive label materials that exude elegance and exclusivity.

North America is Expected to Register Market Growth

- The incorporation of radio-frequency identification, which employs radio waves to gather and communicate information in pressure-sensitive labels, became more important in the United States. Food, drinks, and medicines are only end-user verticals with technological integration for monitoring, authentication, and anti-counterfeiting items.

- Mohawk declares a strategic relationship with UPM Raflatac Americas as a part of this new product line. Mohawk Renewal Hemp and Straw paper face stocks can provide roll-fed, pressure-sensitive labeling solutions.

- Partnerships are also driving the market demand in the region. For instance, Mark Andy and UPM Raflatac recently formed a strategic relationship in the North American pressure-sensitive label industry. This collaboration should enable these players to create printing solutions that are both flexographic and digital converters friendly to the environment.

- The demand for PSLs is rising as a result of their adaptability. The industry's operators are compelled by this to increase their capabilities, allowing them to meet the escalating demand of the market. As an illustration, UPM Raflatac declared intentions to open a brand-new terminal in Vancouver, Washington, in the United States, in December 2022. The new location will expand UPM Raflatac's slitting and distribution capabilities while supporting the company's North American terminal network. To support the success of its clients and meet the increasing demand for pressure-sensitive labels, UPM Raflatac consistently invests in operational enhancements.

Pressure Labels Industry Overview

The Pressure Labels Market is highly fragmented as several small and medium-sized players, such as Multi-color Corporation, CCL Industries Inc, Westrock Company, and Fuji Seal International Inc, contain a share in the market. Also, this makes the market extremely competitive too. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2023 - Multi-Color Corporation (MCC), one of the largest label companies in the world, has announced the acquisition of Turkiye-based Korsini, one of the leading providers of in-mold label (IML) solutions. IML is a high-growth labeling technology in which pre-printed labels are inserted into a packaging mold during a container's manufacturing process, creating a fully recyclable, cost-effective, durable, and consistent product.

- June 2023 - CCL Industries has announced it has signed an agreement to acquire Pouch Partners s.r.l., Italy, from Pouch Partners AG, Switzerland, a company owned by Swiss-headquartered Capri-Sun Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Evolution of Digital Print Technology

- 4.5 Market Restraints

- 4.5.1 Lack of Products with Ability to Withstand Harsh Climatic Conditions

5 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Print Process

- 6.1.1 Gravure

- 6.1.2 Flexography

- 6.1.3 Screen

- 6.1.4 Letterpress

- 6.1.5 Inkjet

- 6.1.6 Other Processes (Offset Lithography, Electrophotography)

- 6.2 By End-User Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Cosmetics

- 6.2.5 Household

- 6.2.6 Industrial (Automotive, Industrial Chemicals, and Consumer and Non-consumer Durables)

- 6.2.7 Logistics

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fort Dearborn Company

- 7.1.2 Multicolor Corporation

- 7.1.3 CCL Industries Inc

- 7.1.4 Westrock Company

- 7.1.5 Fuji Seal International Inc.

- 7.1.6 Taylor Corporation

- 7.1.7 Huhtamaki Group

- 7.1.8 Taghleef Industries Inc (Al Ghurair Group)

- 7.1.9 Coveris

- 7.1.10 Avery Dennison Corp

- 7.1.11 UPM Raflatac, Inc

- 7.1.12 Inland Printing Co. Ltd

- 7.1.13 Constantia Flexibles Group GmbH

- 7.1.14 Folienprint RAKO GmbH

- 7.1.15 Herma GmbH

- 7.1.16 Skanem AS