|

市場調查報告書

商品編碼

1642196

肉類包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Meat Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

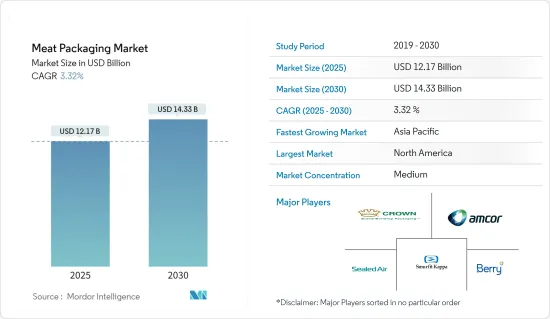

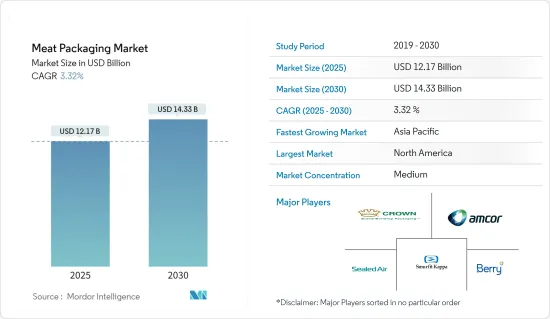

2025 年肉類包裝市場規模預計為 121.7 億美元,預計到 2030 年將達到 143.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.32%。

隨著對肉類產品的需求增加,對高品質、有吸引力的肉類包裝的需求也隨之增加。包裝有助於維持肉類的質量,並透過控制導致腐敗的因素來延緩腐敗的發生。

主要亮點

- 與許多其他行業一樣,肉類包裝的創新面臨巨大的壓力,需要實現衛生和品管,同時減少排放和材料使用。過去三年來,原物料價格不斷上漲、成本上漲以及供應鏈挑戰加劇了這些需求。

- 肉類包裝的一個重要因素是被包裝的肉類的類型。大型豬肉和牛肉包裝廠使用真空包裝來保存肉類。真空包裝可以去除包裝內的氧氣並有助於將肉保留在包裝內。雜貨店主要使用帶有發泡底托盤的彈性塑膠肉類包裝。

- 根據經合組織和糧農組織的數據,到 2024 年全球人均肉品消費量預計將增加到 34.9 公斤。包裝肉類等產品的需求強勁,主要是因為世界各地的大多數消費者更喜歡即食食品的便利性。例如,根據美國農業部/經濟研究局的數據,美國消費最多的肉類是肉雞,每人約 91 磅。預計到 2028 年,這一數字將上升至每人 94.3 英鎊。

- 在 COVID-19 期間,主動包裝製造商面臨的挑戰包括供應鏈中斷、製造過程中使用的原料無法使用、勞動力短缺和價格波動。此外,國際貿易爭端、經濟通膨、原物料短缺以及俄羅斯-烏克蘭戰爭也在不斷提高包裝製造商實現雄心勃勃的循環經濟目標的門檻。俄烏戰爭也導致多國遭受經濟制裁、大宗商品價格上漲、供應鏈中斷,影響全球多個市場。

肉類包裝市場趨勢

軟塑膠有望佔據主要市場佔有率

- 由於牲畜產品消費量的增加,預計預測期內軟包裝解決方案領域將呈指數級成長。世界人口成長、收入增加和都市化等因素與畜產品消費呈現強烈的正相關關係。世界衛生組織(WHO)估計,肉品消費量將從1997-1999年的2.18億噸增加到2030年的3.76億噸。

- 該國廣泛而強大的零售連鎖店提供肉類和豬肉產品,這增強了市場競爭力。隨著對更長、更穩定的保存期限的需求不斷成長,對蒸餾包裝和熱成型高阻隔薄膜的需求也日益成長。在人口成長、收入提高和都市化因素的共同推動下,全球畜牧業正經歷前所未有的成長。

- 全國各地的消費者都開始轉向含有魚、肉和蔬菜的產品,這些產品主要蒸餾包裝來延長保存期限。此外,預製家常小菜也越來越受歡迎。網上購物的趨勢也有幫助。

- 軟乙烯基薄膜對油脂具有優異的阻隔性,但滲透性透過氧氣。其透明度極佳,且不易被刺穿。這些特性使得軟性 PVC 薄膜非常適合食品包裝,以保持肉類和生鮮食品的新鮮度。 PVC薄膜具有滲透性,滲透性足夠的氧氣通過,有助於保持肉類的新鮮度並維持其鮮豔的紅色,是包裝新鮮紅肉的理想選擇。在對透明度有嚴格要求的場合,通常使用 PVC 薄膜。

- 為了滿足日益成長的需求,一些市場相關人員正在建立聯盟和夥伴關係關係,以獲得更好的收益。例如,2020年1月,Amcor宣布與北美和拉丁美洲的Moda真空包裝系統建立合作關係。此次合作將安姆科的肉類阻隔膜收縮袋和捲筒膜與聚氯乙烯(PVC) 薄膜結合在一起,其中包括各種各樣的 PVC肉類膜,主要用於包裝新鮮肉類,特別是家禽。

亞太地區預計將顯著成長

- 亞太地區不斷成長的城市人口對市場的成長貢獻巨大。生活方式的改變,例如花在食物準備上的時間減少,導致人們轉向食用經過加工、易於包裝和已烹調的肉類,這預計將推動所研究市場的成長。

- 來自印度、中國和巴西等新興經濟體的激烈工業競爭正鼓勵英國製造商繼續透過創新和技術來提高生產能力,以保持市場競爭力。

- 近幾個月來,印度、中國和其他國家的肉類出口和進口都有所增加,推動了強力包裝的成長。根據2021年全球主要出口商品統計,澳洲牛肉出口額約70億美元,為亞太國家最高。其次是印度,約有 28 億美元。

- 自 1960 年代以來,肉類消費量一直在增加,尤其是由於過去幾十年人口的增加。

- 在新冠肺炎疫情期間,世界各國都實施了封鎖規定,引發了恐慌性購買。這給企業採用軟包裝解決方案帶來了極大的壓力。加工和已烹調肉類肉類已經發現,小包裝預包裝食品的趨勢日益明顯。

- 常溫食品、冷凍和舒適食品的需求不斷成長,預計將增加該國對軟包裝解決方案的需求,因為它們能夠延長此類產品的保存期限。

- 高蛋白食品的需求不斷增加和食品技術的發展是市場發展的主要驅動力。已開發國家和開發中國家忙碌的生活方式和飲食模式的快速變化也在推動該行業的發展。然而,原物料價格波動、供應不確定性和政府法規正在限制市場的發展。

肉類包裝產業概況

肉類包裝市場競爭激烈,有幾家大型企業在市場上競爭。市場上的公司正在透過推出新產品、擴大營運和進行策略併購來不斷努力提高其市場佔有率。

- 2022 年 6 月:Lidl GB 已停止在其生鮮肉包裝中使用海洋基塑膠。該零售商已決定推出含有至少 30% POP 的托盤,用於包裝 400 克和 XXL 667 克的豪華香腸。這項舉措將使 Lidl GB 每年能夠防止 170 萬個水瓶流入海洋。

- 2022 年 1 月:Novolex 旗下部門 Waddington Europe 推出了一種用於盛放肉類、魚類和家禽產品的新托盤,該托盤可回收,不需要聚乙烯 (PE) 層或黏合劑塗層。根據該公司介紹,新款 Piranha 容器採用圍繞密封法蘭周邊的一系列凸起齒進行密封,而不是像通常用於密封調氣包裝(MAP) 蓋子那樣使用 PE 層或黏合劑。 Waddington Europe 聲稱,即使法蘭被動物脂肪污染,凸起的齒也能保持密封的完整性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對全球肉類包裝產業的影響評估

第5章 市場動態

- 市場促進因素(例如對簡便食品的需求不斷增加)

- 市場挑戰(環境議題,如可回收性、健康問題等)

- 技術簡介

- 真空包裝

- 主動智慧包裝

- 調氣包裝

第6章 市場細分

- 依材料類型

- 塑膠

- 靈活(依產品類型)

- 小袋

- 包包

- 薄膜包裝

- 其他靈活產品

- 剛性(依產品類型)

- 托盤和容器

- 其他硬質產品

- 金屬

- 鋁

- 鋼

- 其他材料

- 新鮮/冷凍

- 加工肉品

- 已烹調

- 塑膠

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Sealed Air Corporation

- Berry Global Inc.

- Crown Holdings Inc.

- Amcor PLC

- Mondi Group

- Coveris Holdings SA

- Winpak Ltd

- Smurfit Kappa Group

- Viscofan Group

- Sonoco Products Company

第8章投資分析

第9章:未來市場展望

The Meat Packaging Market size is estimated at USD 12.17 billion in 2025, and is expected to reach USD 14.33 billion by 2030, at a CAGR of 3.32% during the forecast period (2025-2030).

With the growing demand for meat products, the need for quality and attractive meat packaging is rising. Packaging can help maintain the quality of meat and delay the onset of spoilage by controlling the factors contributing to it.

Key Highlights

- Like many other industry areas, meat packaging innovation has been under high pressure to achieve hygiene and quality control while reducing emissions and material use. These demands are further compounded by rising raw material prices, cost inflation, and supply chain issues that have cascaded over the past three years.

- One of the crucial factors in meat packaging is the type of meat being packaged. Large pork and beef packing plants use vacuum packaging to preserve meat. Vacuum packaging removes oxygen within the package, which helps to maintain the meat within the packaging. Grocery stores mostly use stretchable plastic meat film and a bottom foam tray.

- According to the OECD and FAO, the per capita meat consumption worldwide is projected to increase to 34.9 kilograms by 2024. There is a strong demand for products like packaged meat, mainly because most consumers worldwide prefer the convenience of ready-to-serve foods. For instance, according to the US Department of Agriculture and Economic Research Service, the most consumed type of meat in the United States was broiler chicken, at about 91 pounds per capita. This is expected to increase to 94.3 pounds per capita by 2028.

- During COVID-19, active packaging manufacturers were flooded with challenges like supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices, etc. In addition, international trade disputes, economic inflation, raw material shortages, and the Russo-Ukraine war have steadily raised higher and higher hurdles for packaging producers as they strive to achieve ambitious circular economy targets. The Russo-Ukraine war further resulted in economic sanctions against several countries, a jump in commodity prices, and supply chain disruptions that have impacted many markets worldwide.

Meat Packaging Market Trends

Flexible Plastic Expected to Hold Significant Market Share

- The flexible packaging solutions segment is expected to witness exponential growth during the forecast period owing to increased animal product consumption. Factors such as the increasing world population, rising incomes, and urbanization are strongly and positively related to the consumption of animal products. The World Health Organization (WHO) estimates that meat consumption may increase to 376 million metric tons by 2030, from 218 million tons from 1997-1999.

- The increasing availability of meat and pork products across widespread and robust retail chains in different countries strengthens the market. With the demand for a longer stable shelf time, the need for retort packaging and thermoformed high-barrier films is on the rise. The livestock sector is growing at an unprecedented rate globally, driven by a combination of population growth, rising incomes, and urbanization.

- Consumers in different countries are inclined toward products containing fish, meat, and vegetables, which are mainly retort-packed to keep them shelf-stable. Moreover, readymade meals have gained increased popularity. The increasing trend of online purchasing has further buoyed them.

- Flexible vinyl films have excellent barrier properties to oil and grease but are oxygen permeable. They have excellent clarity and are puncture-resistant. These properties make flexible PVC films suitable for food packaging to keep meat and other perishable produce fresh. PVC films are an ideal choice to package fresh red meat as they are semi-permeable, meaning they are just enough oxygen permeable to keep meat products fresh and to maintain their bright red color. PVC films are often used when transparency is essential.

- Due to the increasing demand, several market players are establishing collaborations and partnerships to drive better revenues. For instance, in January 2020, Amcor announced its cooperation with Moda vacuum packaging systems in North America and Latin America. This partnership combines Amcor's shrink bag and roll stock film for meat barrier films and its polyvinyl chloride (PVC) films, which include a broad array of PVC meat films used primarily to wrap fresh meats, especially poultry.

Asia-Pacific Expected to Show Significant Growth

- The increasing urban population in Asia-Pacific has been contributing significantly to the growth of the market. The altering patterns in lifestyle, including the reduced amount of time spent on preparing meals, are leading to a shift toward more processed, easily packed, and pre-prepared meat, which is expected to propel the growth of the market studied.

- The high industrial competition from the emerging economies of India, China, and Brazil has urged manufacturers in the United Kingdom to continue to develop their production capabilities with innovation and technology to maintain a competitive edge in the market.

- Countries such as India, China, and others have been observing an increase in meat exports and imports in the last few months, bolstering active packaging growth. According to the World's Top Exports in 2021, by exporting beef worth nearly USD 7 billion, Australia ranked the highest among the Asia-Pacific countries. This was followed by India, with a value of approximately USD 2.8 billion.

- The consumption of meat has been rising since the 1960s due to the increase in the human population, especially over the past few decades.

- During COVID-19, nations worldwide witnessed lockdown restrictions, which led to panic buying. This imposed massive pressure on the companies to adopt flexible packaging solutions. The processed and ready-to-eat meat-producing companies witnessed increased inclination toward pre-packaged food in smaller, consumer-sized packaging.

- The rise in demand for ambient foods, frozen foods, and comfort foods is expected to increase the demand for flexible packaging solutions in the country, owing to its ability to extend the shelf life of such products.

- The rising demand for high-protein food and the development of food technology are significant factors in the growth of the market. The surge in hectic lifestyles and the changing dietary patterns in developed and developing nations is also boosting the industry. However, fluctuating prices of raw materials, the inconsistency of supply, and government regulations are restraining the market.

Meat Packaging Industry Overview

The meat packaging market is marked with intense competition and consists of several major players. Companies in the market are continuously involved in increasing their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions.

- June 2022: Lidl GB stopped using ocean plastic for fresh meat packaging. The retailer decided to introduce trays containing at least 30% POP for its 400 g and XXL 667 g Deluxe sausage. Through this initiative, Lidl GB expects to prevent an additional 1.7 million water bottles from entering the ocean a year, which is equivalent to more than 40 tons of plastic.

- January 2022: Waddington Europe, a division of Novolex, introduced a new tray for meat, fish, and poultry products that is recyclable and does not require a polyethylene (PE) layer or adhesive coating. According to the company, its new Piranha container is sealed using a series of raised teeth that run around the sealing flange instead of applying a layer of PE or adhesive, which are typically used to seal the lid of modified atmosphere packaging (MAP). Waddington Europe claims that the raised teeth maintain the seal's integrity even if the flange becomes contaminated by animal fat.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Meat Packaging Industry at a Global Level

5 MARKET DYNAMICS

- 5.1 Market Drivers (Increasing Demand for Convenience Food, etc.)

- 5.2 Market Challenges (Environmental Issues such as Recyclability and Health Concerns, etc.)

- 5.3 Technology Snapshot

- 5.3.1 Vacuum Packaging

- 5.3.2 Active and Intelligent Packaging

- 5.3.3 Modified Atmosphere Packaging

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 Flexible (By Product Type)

- 6.1.1.1.1 Pouches

- 6.1.1.1.2 Bags

- 6.1.1.1.3 Films and Wraps

- 6.1.1.1.4 Other Flexible Products

- 6.1.2 Rigid (By Product Type)

- 6.1.2.1 Trays and Containers

- 6.1.2.2 Other Rigid Products

- 6.1.3 Metal

- 6.1.3.1 Aluminum

- 6.1.3.2 Steel

- 6.1.3.3 Other Material Types

- 6.1.1 Plastic

- 6.2 By Type of Meat

- 6.2.1 Fresh and Frozen

- 6.2.2 Processed

- 6.2.3 Ready to Eat

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Spain

- 6.3.2.4 Russia

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sealed Air Corporation

- 7.1.2 Berry Global Inc.

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Amcor PLC

- 7.1.5 Mondi Group

- 7.1.6 Coveris Holdings SA

- 7.1.7 Winpak Ltd

- 7.1.8 Smurfit Kappa Group

- 7.1.9 Viscofan Group

- 7.1.10 Sonoco Products Company