|

市場調查報告書

商品編碼

1642957

壁紙:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wallpaper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

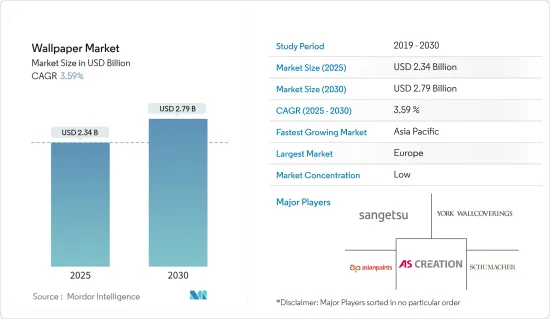

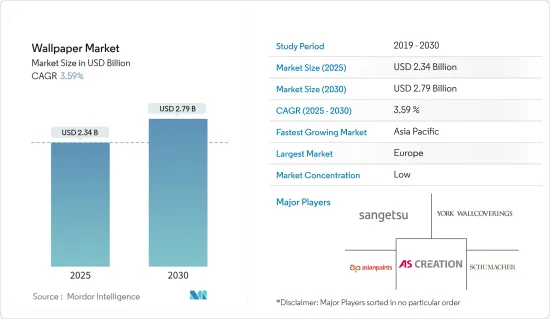

壁紙市場規模預計在 2025 年為 23.4 億美元,預計到 2030 年將達到 27.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.59%。

壁紙由不織布紙或特殊織物製成,並以模印、印刷或繪製的圖案裝飾。壁紙是美化任何房間最方便、最經濟的方式。

主要亮點

- 可支配收入的增加和都市化正在改變世界各地的生活方式,刺激住宅和商業空間對壁紙的需求。壁紙有多種設計、顏色和圖案可供選擇,增強了美感。

- 住宅裝修正在蓬勃發展,尤其是在北美、歐洲和亞洲。這一趨勢受到遠距辦公的興起的推動,鼓勵人們自訂自己的家以適應專用的工作空間。根據家居裝修研究機構的資料,過去兩年美國住宅裝修支出一直穩定成長。 2023 年,35% 的住宅將增加支出,預計這一趨勢將持續到 2024 年。

- 此外,以印度為首的亞洲國家房地產產業的蓬勃發展也是壁紙市場的重要推動力。 IBEF資料支持這一點,顯示印度住宅房地產市場在 23 會計年度經歷了顯著的成長。住宅銷售額飆升至創紀錄的 34.7 億印度盧比(420 億美元),年增 48%。同時,房屋銷售數量增加了36%,達到379,095套。

- 此外,人們對環保壁紙的日益偏好也推動了對乙烯基壁紙的需求。特別是生產乙烯基壁紙的消費量僅為紙質壁紙的一半。這種環保意識的轉變促使製造商擴大其產品線,以滿足對美觀、環保壁紙日益成長的需求。

- 在壁紙市場,許多客戶面臨的一大挑戰就是價格。壁紙和油漆的價格分佈範圍很廣,從經濟實惠到豪華不等。整體而言,壁紙往往比油漆更貴,因為涉及捲材、消耗品和安裝的成本,這可能會阻礙市場擴張。

壁紙市場趨勢

不織布市場預計將佔據主要佔有率

- 眾所周知,不織布壁紙非常耐用且不易損壞。其基礎材料由不織布製成,具有柔韌性和抗撕裂性,非常適合客廳和走廊等人流量大的區域。

- 這些壁紙具有不同的設計、圖案和紋理,可滿足不同的室內設計品味。它可以令人信服地模仿織物、紋理表面甚至壁畫,為住宅和設計師提供一種多功能且具有視覺吸引力的選擇。

- 領先的不織布壁紙製造商注重創新設計,並經常提供帶有紙質內襯的壁紙,以確保易於安裝和拆除。這些壁紙可清洗、耐磨、吸音。其 100% 溶液染色特性和靈活性進一步增加了它的受歡迎程度,尤其是在交通繁忙的地區。

- 壁紙和壁材出口。根據國際貿易中心(ITC)的數據,德國壁紙出口額從 2022 年的 1.7899 億美元增加到 2023 年的 1.8347 億美元。

預計歐洲將佔很大市場佔有率

- 歐洲壁紙市場在全球壁紙產業中發揮著至關重要的作用。歐洲悠久的歷史、輝煌的建築和設計精神正在推動該地區對壁紙的需求。此外,在創新產品和消費者偏好變化的推動下,市場正在快速成長。

- 由於其視覺吸引力和環保效益,越來越多的企業採用數位印刷來製作壁紙。數位印刷減少了廢棄物,因為它不需要印版,並且僅使用傳統方法所需油墨的一小部分。 AS Creation Tapetan AG 優先考慮永續原料,壁紙廢棄物的回收率高達 60%,加強了當地的循環經濟。

- 歐洲房地產行業正在從近期的利率波動和俄羅斯-烏克蘭衝突等地緣政治緊張局勢中復甦,並經歷溫和擴張。歐洲各國商業和住宅空間建設計劃激增,進一步推動了壁紙的需求,從而推動了這一成長。

- 歐洲製造商 Industrie Emiliana Parati SpA 提供具有特殊壓花效果的頂級產品,包括珠光色、金屬色、金色和銀色。該公司生產各種帶有不織布背襯的創新乙烯基壁紙,從而推動了該地區的市場成長。

- 此外,根據歐盟委員會預測,到2050年歐洲都市化將達到約83.7%。這項變化伴隨著城市人口的穩定成長和農村人口的相對減少。預計到 2050 年,歐洲功能性城市區 (FUA) 的平均人口成長率將達到 4%。預計都市化趨勢將進一步推動該地區的壁紙市場。

壁紙產業概況

壁紙市場高度分散,主要參與者包括: York Wall Coverings Inc.、Asian Paints、F. Schumacher & Co、AS Creation Tapeten AG 和 Sangetsu Corporation。

- 2024 年 7 月印度塗料公司 Asian Paints 在古瓦哈提開設了一家實體店,展示其多樣化的產品。其中包括模組化廚房、裝飾照明、壁紙、壁材、牆面覆蓋物、地毯和大量其他產品。憑藉其廣泛的產品系列,亞洲塗料將自己定位為印度首屈一指的豪華家居裝飾中心。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 住宅裝修日益流行

- 對環保和永續壁紙的需求很高

- 市場挑戰

- 法規嚴格且高成本

第6章 行業法規、政策與標準

第7章 市場區隔

- 壁紙類型

- 乙烯基塑膠

- 不織布

- 紙

- 布藝壁紙

- 其他壁紙

- 按應用

- 商業的

- 非商業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- York Wall Coverings Inc.

- Brewster Home Fashion LLC

- F. Schumacher & Co

- AS Creation Tapeten AG

- Sangetsu Corporation

- Erismann & Cie. GmbH

- Laura Ashley Holdings PLC

- Grandeco Wallfashion Group

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- LEN-TEX Corporation

- Asian Paints Ltd

- Gratex Industries Ltd

第9章投資分析

第10章:市場的未來

The Wallpaper Market size is estimated at USD 2.34 billion in 2025, and is expected to reach USD 2.79 billion by 2030, at a CAGR of 3.59% during the forecast period (2025-2030).

Wallpapers, crafted from non-woven paper or specialized fabrics, are adorned with stenciled, printed, or painted designs. They are the most convenient and cost-effective means to enhance any room.

Key Highlights

- Rising disposable incomes and urbanization are reshaping global lifestyles, fueling the demand for wallpapers in residential and commercial spaces. With many designs, colors, and patterns, wallpapers enhance aesthetics.

- Notably, a surge in home renovations, particularly in North America, Europe, and Asia, is evident. This trend is bolstered by the rise of remote work, prompting individuals to tailor their homes to accommodate dedicated workspaces. Home Improvement Research Institute data highlights a consistent uptick in home improvement spending over the past two years in the United States. In 2023, 35% of homeowners upped their expenditures, a trend anticipated to persist through 2024.

- Furthermore, the burgeoning real estate sector in Asian countries, notably India, is a pivotal driver of the wallpaper market. IBEF data underscores this, revealing that in FY23, India's residential property market witnessed a remarkable surge. Home sales values soared to a record INR 3.47 lakh crore (USD 42 billion), marking a 48% annual increase. Concurrently, sales volume rose by 36%, reaching 379,095 units.

- Additionally, the rising preference for eco-friendly options is propelling the demand for vinyl-based wallpapers. Notably, the energy consumption for manufacturing vinyl wallpapers is merely half that of paper variants. This eco-conscious shift is prompting manufacturers to expand their offerings, catering to a growing appetite for aesthetically pleasing and environmentally friendly wall coverings.

- In the wallpaper market, a significant challenge for many customers is pricing. Wallpaper and paint are available at a spectrum of price points, from budget-friendly to premium. Typically, wallpaper, with its costs for rolls, supplies, and installation, tends to be pricier than paint, potentially impeding the market's expansion.

Wallpaper Market Trends

The Non-woven Segment is Expected to Hold a Significant Share in the Market

- Non-woven wallpapers are known for their durability and resistance to damage. Crafted from non-woven fabric, their foundation gives them flexibility and tear resistance, making them ideal for high-traffic areas like living rooms and hallways.

- These wallpapers come in different designs, patterns, and textures, catering to diverse interior design tastes. They can convincingly mimic fabrics, textured surfaces, and even murals, offering homeowners and designers a versatile and visually appealing choice.

- Leading non-woven wallpaper manufacturers emphasize innovative designs and often provide wallpapers with paper backing, ensuring easy installation and removal. These wallpapers are washable, abrasion-resistant, and sound-absorbing. Their 100% solution-dyed nature and flexibility further fuel their popularity, especially in high-traffic settings.

- The market receives a boost from the increasing export of wallpapers and wall coverings, particularly from European nations like Germany. According to the International Trade Centre (ITC), Germany's wallpaper exports increased from USD 178.99 million in 2022 to USD 183.47 million in 2023.

Europe is Expected to Hold a Significant Share in the Market

- The European wallpaper market is a pivotal player in the global wallpaper industry. It is buoyed by Europe's deep-rooted history, architectural splendor, and design ethos, which fuels the demand for wallpapers in the region. Furthermore, the market is witnessing a surge, propelled by innovative offerings and shifting consumer tastes.

- More companies are embracing digital printing for their wallpaper collections, drawn to its visual appeal and eco-friendly advantages. Digital printing slashes waste by eliminating the necessity for plates and consuming just a fraction of the ink traditional methods require. AS Creation Tapetan AG stands out, prioritizing sustainable raw materials and boasting a remarkable 60% recycling rate for wallpaper waste, bolstering the local circular economy.

- Europe's real estate sector, rebounding from recent interest rate fluctuations and geopolitical tensions, like the Russia-Ukraine conflict, is witnessing a gradual expansion. This growth is further fueled by a surge in construction projects, both for commercial and residential spaces, across various European countries, thereby boosting the demand for wallpapers.

- Industrie Emiliana Parati SpA, a European manufacturer, provides top-of-the-range products made with particular embossing techniques, such as pearlescent and metallic colors, gold, and silver. The company manufactures a wide range of innovative vinyl wallpapers on non-woven backing, which drives the market's growth in the region.

- Additionally, as per the European Commission, Europe's urbanization rate is forecasted to hit approximately 83.7% by 2050. This shift is accompanied by a steady rise in urban populations, while rural areas witness a relative decline. The functional urban areas (FUAs) in Europe are poised for an average population growth of 4% by 2050. This increasing urbanization trend is set to further bolster the region's wallpaper market.

Wallpaper Industry Overview

The wallpaper market is highly fragmented, with major players such as York Wall Coverings Inc., Asian Paints, F. Schumacher & Co, AS Creation Tapeten AG, and Sangetsu Corporation. Players are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a sustainable competitive advantage in the global market.

- July 2024: Asian Paints, an Indian paint company, inaugurated a physical studio in Guwahati, showcasing a diverse array of offerings. These include modular kitchens, decorative lighting, furniture, wallpapers, wall coverings, rugs, and an extensive selection. With this broad product portfolio, Asian Paints is positioning itself as India's premier luxury home decor hub.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trends of Home Renovations

- 5.1.2 High Demand for Eco-friendly and Sustainable Wallpapers

- 5.2 Market Challenges

- 5.2.1 Stringent Regulations and High Costs

6 INDUSTRY REGULATIONS, POLICIES, AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Wallpaper Type

- 7.1.1 Vinyl

- 7.1.2 Non-woven

- 7.1.3 Paper-based

- 7.1.4 Fabric Wallpaper

- 7.1.5 Other Wallpaper Types

- 7.2 By Application

- 7.2.1 Commercial

- 7.2.2 Non-commercial

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 York Wall Coverings Inc.

- 8.1.2 Brewster Home Fashion LLC

- 8.1.3 F. Schumacher & Co

- 8.1.4 AS Creation Tapeten AG

- 8.1.5 Sangetsu Corporation

- 8.1.6 Erismann & Cie. GmbH

- 8.1.7 Laura Ashley Holdings PLC

- 8.1.8 Grandeco Wallfashion Group

- 8.1.9 Sanderson Design Group PLC

- 8.1.10 Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- 8.1.11 LEN-TEX Corporation

- 8.1.12 Asian Paints Ltd

- 8.1.13 Gratex Industries Ltd