|

市場調查報告書

商品編碼

1643014

資料轉換器 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Data Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

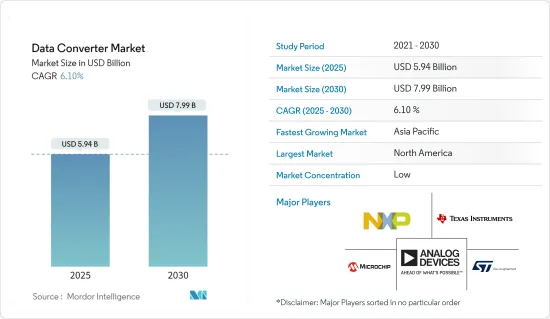

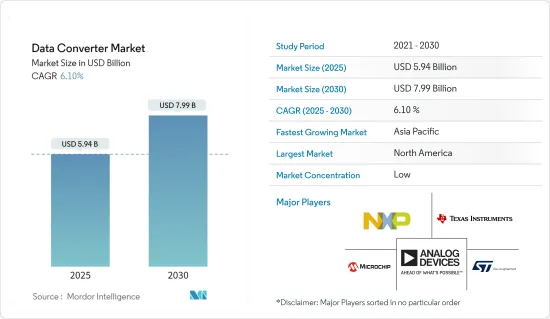

資料轉換器市場規模預計在 2025 年為 59.4 億美元,預計到 2030 年將達到 79.9 億美元,預測期內(2025-2030 年)的複合年成長率為 6.1%。

高效能電子系統正在使用越來越多的高效能資料轉換器來改進和塑造其架構並開拓新的應用領域。最先進調變前沿的新電路和系統技術正在推動效能的進步,創造出新一代資料轉換器。此外,當前和未來的趨勢受到全球經濟、技術進步和行銷等新舊因素的驅動。

關鍵亮點

- 技術先進的資料收集系統的採用正在推動市場的發展。多種訊號中編碼的高資訊率迫使資料擷取 (DAQ) 系統從實驗室任務發展成為現代工程流程。產業正朝著模組化硬體與靈活軟體結合的趨勢發展,這些新的模組化系統具有適當的訊號調節和類比數位轉換(ADC),可以與各種感測器介面,支援多種資料收集要求。

- 考慮到當今的要求,執行某些 DAQ 任務的傳統方法根本不可行。因此,市場趨向於採用軟體定義的 DAQ 方法,並出現支援高速 USB 的 DAQ。

- 此外,科學和醫學應用對高解析度影像的需求不斷成長,推動了市場研究。資料轉換器代表了醫學影像在所需的動態範圍、解析度、準確性、線性度和雜訊方面提出的最具挑戰性的電子設計挑戰。 ADC(類比數位轉換)需要具有至少 24 位元的高解析度才能獲得更好的影像清晰度,並且需要快速的取樣率才能將檢測器讀數位化,在 CT(電腦斷層掃描)解決方案中,該取樣率可以短至 100 μs。 ADC 取樣率還必須允許連接複用,這樣就可以使用更少的轉換器並減少整體系統尺寸和功率。

- 像 ADI 公司這樣的公司提供關鍵訊號鏈功能塊的高度整合的解決方案來滿足這些要求並實現一流的臨床成像設備。該公司的ADAS1256(用於X光應用)、ADAS1135和ADAS1134(用於CT應用)等產品引領醫療應用市場。

- 此外,低功耗資料轉換器的開發對於市場成長來說是一個挑戰。功耗是當今積體電路的主要設計限制之一。低頻生物電訊號的轉換不需要很高的速度,但需要超低功耗操作。這一點,加上所需的轉換精度,使得這種 ADC 的設計成為一項巨大的挑戰。

- 此外,新冠疫情對半導體產業的國際供需產生了重大影響。開發資料轉換器需要 IC、電阻器、電容器等。分銷管道的中斷正在減緩資料感測器市場的成長。然而,許多中央和地方政府認知到半導體產業的戰略重要性,並在強制關閉企業的情況下優先考慮國內公司和供應商的不間斷營運。

資料轉換器市場趨勢

通訊佔很大市場佔有率

- 隨著4G和通訊的出現,通訊基礎設施正在刺激市場成長。無線基礎設施製造商,尤其是 4G 和 5G 製造商,正在不斷縮小新無線基礎設施安裝的規模和成本,同時保持高標準的性能、功能和服務品質。資料轉換模組是無線基礎架構設計中的關鍵功能。類比數位轉換器 (ADC) 是將輸入的中頻 (IF) 訊號數位化並將數位資料傳遞到數位下變頻器的基本模組。

- 透過將頻率轉換和濾波從類比域轉移到數位域,可以滿足 5G 解決方案的高頻寬要求。兩款 RF 轉換器,即 AD9081/AD9082 混合訊號 RF 轉換器,就是 ADI 公司推出的這數位化浪潮的一部分。這些射頻轉換器旨在允許多頻段無線電安裝在與單頻段無線電相同的空間內,有助於將通話容量提高到目前 4G LTE基地台的三倍。

- 此外,為了使 5G 解決方案支援小型天線的部署,無線電架構核心必須緊密整合。一種解決方案是採用傳統方法,將多千兆取樣 ADC 和 DAC 與系統晶片(SoC) 結合。這種方法證明了嵌入式系統設計能夠滿足日益成長的操作頻寬需求。有些資料轉換器使用 JESD204B 實作介面。

- 此外,在過去十年中,Xilinx 等 FPGA 製造商透過縮小矽製造結構的尺寸改進了其技術,從而降低了其設備的尺寸、重量和功率 (SWaP) 值。 Xilinx 最新的系統晶片單晶片(SoC) 裝置 RFSoC 在同一晶片上整合了 FPGA 結構、ARM 處理器、類比數位轉換器 (ADC) 和數位類比轉換器 (DAC)。

- 16nm 技術的特點是每個設備有 4.2K DSP 切片、四個 1.5GHz A53 Arm 處理器、兩個 600MHz R5 ARM 處理器、八個 4GHz、12 位元 ADC 和八個 6.4GHz、14 位元 DAC。商用現貨 (COTS) 製造商可以使用這項突破性技術,為開發 5G 無線產品的工程師提供多通道 SDR 收發器。

北美佔有最大市場佔有率

- 由於通訊領域的成長和 FPGA(現場可程式閘陣列)的使用,北美貢獻了最高的佔有率。在家用電子電器中,對於獲取高解析度影像的 A2D 轉換器的需求不斷增加是推動市場發展的關鍵因素。

- 此外,需要資料轉換器的汽車感測器應用範圍包括識別不同引擎狀況的溫度感測器以及支援汽車駕駛輔助系統 (ADAS) 的雷達/雷射雷達。其他資料轉換器應用包括用於與其他車輛或固定網路通訊的無線收發器。每輛車 7,500 美元的稅額扣抵(該政策推動了美國電動車的銷售)即將取消,但獎勵上限不會提高。

- 關稅風險也迫使外國公司到北美購物。福斯汽車宣布將投資 8 億美元在田納西州查塔努加建造一座製造工廠。此外,豐田和馬自達將在阿拉巴馬州亨茨維爾聯合建造一家組裝廠。該工廠投資約16億美元,年產能30萬輛。預計此類案例將推動該地區汽車領域資料轉換器市場的成長。

- 此外,預計 IT 和通訊應用佔據美國資料轉換器市場的最大佔有率。這一成長是由 4G 網路的發展所推動的,4G 網路採用更好的調變和天線格式來改善語音和資訊服務,從而增加了對 AMS 模組的需求。

- 此外,根據 GSMA 的數據,未來三年美國行動連線的 5G 普及率預計將分別成長 33%、40% 和 46%。這將進一步推動5G資料轉換器應用的成長。

資料轉換器行業概況

由於全球參與企業將訊號整合到家用電子電器和汽車等各種應用中,資料轉換器市場呈現細分化,導致競爭對手之間的競爭異常激烈。主要企業包括 Analog Devices Inc. 和 Microchip Technology Inc.。

- 2022 年 5 月:Analog Devices Inc. 推出了新一代 16 至 24 位元超精度 SAR ADC 產品組合,簡化了儀器、工業和醫療領域複雜的 ADC 設計流程。 ADI 的取得專利的Easy Drive 技術和自適應 Flexi-SPI 序列周邊介面 (SPI) 是新型高效能 SAR ADC 系列的兩個方面,可解決系統設計難題並擴大直接相容伴同性產品的範圍。

- 2022 年 9 月:MaxLinear Inc. 和 RFHIC 宣布合作開發用於 5G大型基地台無線電的可投入生產的 400 MHz 功率放大器 (PA) 解決方案。此解決方案採用MaxLinear MaxLIN數位預失真(DPD)和波峰因子降低(CFR)技術來增強RFHIC最新ID-400W系列GaN RF電晶體的效能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 市場定義和範圍

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 擴大採用技術先進的資料收集系統

- 科學和醫學應用對高解析度影像的需求日益增加

- 市場問題

- 開發低功耗資料轉換器的挑戰

- 新冠疫情對全球半導體供應鏈分佈的影響

第6章 重大技術投入

- 雲端技術

- 人工智慧

- 網路安全

- 數位服務

第7章 市場區隔

- 按類型

- 類比數位轉換器

- 數位類比轉換器

- 按最終用戶

- 車

- 通訊

- 家用電子電器

- 工業的

- 醫療

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 其他

- 北美洲

第8章 競爭格局

- 公司簡介

- Analog Devices Inc.

- Microchip Technology Inc.

- STMicroelectronics NV

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Mouser Electronics Inc.

- DATEL Inc.

- Synopsys Inc.

- Cirrus Logic Inc.

- Maxim Integrated Products Inc.

第9章投資分析

第10章 市場機會與未來趨勢

The Data Converter Market size is estimated at USD 5.94 billion in 2025, and is expected to reach USD 7.99 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

High-performance electronic systems use more and more high-performance data converters to improve and shape the architecture and open new application perspectives. The emerging circuits and systems techniques at the forefront of state-of-the-art modulators are pushing their performance forward and giving rise to new generations of data converters. Further, the current and future trend depends on old and new factors, including the global economy, technological evolution, and marketing.

Key Highlights

- Increasing adoption of technologically advanced data acquisition systems drives the market. The high rates of encoded information in multiple signals forced data acquisition (DAQ) systems to evolve from research work to modern engineering processes. The industry is evolving toward a trend of having a combination of modular hardware and flexible software, where these newer modular systems have appropriate signal conditioning and analog-to-digital conversion (ADC), with various interfacing sensors that support multiple data acquisition requirements.

- The traditional approach for performing specific DAQ tasks is not feasible, considering today's requirements. Thus, a market tends toward a more software-defined approach to DAQ and the emergence of high-speed USB-enabled DAQs.

- Furthermore, the growing demand for high-resolution images in scientific and medical applications is driving the market studied. Data converters constitute the most demanding challenge medical imaging imposes on the electronics design in terms of required dynamic range, resolution, accuracy, linearity, and noise. The ADC (analog to digital) must have a high resolution of at least 24 bits to achieve better and sharper images and a fast sampling rate to digitize detector readings that can be as short as 100 µs in a CT (computed tomography) solution. The ADC sampling rate must also enable multiplexing, which would allow the use of fewer converters as well as the reduction of the size and power of the entire system.

- A company such as Analog Devices addresses these requirements and offer highly integrated solutions for the key signal chain functional blocks to enable best-in-class clinical imaging equipment. Its products, such as ADAS1256 (X-ray applications), ADAS1135, ADAS1134 (CT applications), and many more, drive the market in medical applications.

- Further, the development of low-power consumption data converters challenges the market's growth. Power consumption is one of the leading design constraints in today's integrated circuits. Conversion of the low-frequency bioelectric signals does not require high speed but requires an ultra-low-power operation. This, combined with the required conversion accuracy, makes designing such ADCs a major challenge.

- Further, due to the impact of the COVID-19 pandemic, there is a high effect internationally on supply-demand in the semiconductor industry. For the development of data converters, there is a need for ICs, resistors, capacitors, etc. The breakage in the distribution channel holds slow growth for the data converter market. However, many central and local governments have recognized the strategic importance of the semiconductor industry and prioritized uninterrupted operations for their domestic companies and suppliers in the midst of mandated business closures.

Data Converter Market Trends

Telecommunication to Account for Significant Market Share

- Telecommunication infrastructure is stimulating market growth owing to the advent of 4G communication and the emerging 5G communication. Manufacturers of wireless infrastructure, especially 4G and 5G, are constantly reducing the size and cost of newly installed wireless infrastructure while holding to high standards of performance, functionality, and quality of service. The data conversion block is a critical function in wireless infrastructure designs. The analog-to-digital converter (ADC) is the fundamental block that digitizes the incoming intermediate frequency (IF) signal and then passes the digital data to the digital downconverter.

- The wide bandwidth demands of the 5G solution can be met by moving frequency translation and filtering from the analog to the digital domain. Two RF converters are part of this digitization wave: the AD9081/AD9082 mixed-signal RF converters, which analog devices introduce. They have been engineered to install multi-band radios in the same footprint as single-band ones, which helps to increase call capacity three-fold, compared to the call capacity available in today's 4G LTE base stations.

- Further, the radio architecture core must be tightly integrated for a 5G solution to support small antenna deployments. One solution is the traditional approach combining multi-Giga sample ADCs and DACs with a System-on-Chip (SoC). This approach provides the ability to perform the embedded system design and to address the increased required operating bandwidths. Several data converters implement interfaces using JESD204B.

- Also, over the past ten years, FPGA manufacturers like Xilinx have been improving technology by reducing the silicon fabrication structure size and, as a result, the device's size, weight, and power (SWaP) values. The latest system-on-chip (SoC) device from Xilinx, the RFSoC, consists of FPGA fabric with arm processors, analog-to-digital converters (ADCs), and digital-to-analog converters (DACs) all on the same chip.

- This 16-nm technology has over 4.2K DSP slices, four 1.5-GHz A53 Arm processors, two 600-MHz R5 ARM processors, eight 4-GHz, 12-bit ADCs, and eight 6.4-GHz, 14-bit DACs per device. COTS (Commercial-off-the-shelf) manufacturers can use this game-changing technology to provide multichannel, SDR transceivers for engineers developing 5G radio products.

North America to Hold the Largest Market Share

- North America holds the highest share due to the growth in the telecom sectors and the use of FPGA (field-programmable gate array). The rising demand for A2D converters in consumer electronics for high-resolution images has become an essential part of driving the market.

- Further, sensor applications in automotive that require data converters range from temperature sensors identifying different engine statuses to radar/LIDAR enabling automotive driver assistance systems (ADAS). Other data converters applications include wireless transceivers for communicating with other vehicles or fixed networks. The USD 7,500 per vehicle tax credit that has boosted EV sales in the United States is drafted to be repealed without any increment in the upper limit of the incentive.

- Also, tariff risk is compelling foreign companies to shop in North America. Volkswagen announced spending USD 800 million to build a manufacturing facility in Chattanooga, Tennessee. Further, Toyota and Mazda are joining forces to construct an assembly plant in Huntsville, Alabama. The factory, which costs about USD 1.6 billion, would have a production capacity of 300,000 units per year. These instances are expected to increase the data converter market's growth in the region's automotive segments.

- Further, IT and telecommunications applications were estimated to have the largest share of the data converter market in the United States. The growth is driven by the development of the 4G network, with superior modulation and antenna methods for improved voice and data services, which enhances the demand for the AMS blocks.

- Further, according to GSMA, in the United States, the 5G adoption rate as a share of mobile connections is expected to increase by 33%, 40%, and 46% in the coming three years, respectively. This further enhances the growth of applications in 5G for data converters.

Data Converter Industry Overview

The data converter market is fragmented as the global players integrate signals in various applications like consumer electronics and automotive, which gives an intense rivalry among the competitors. Key players are Analog Devices, Inc., Microchip Technology Inc., etc.

- May 2022: Analog Devices Inc. introduced a new portfolio of next-generation 16- to 24-bit, ultrahigh-precision SAR ADCs to simplify the complicated process of designing ADCs for instrumentation, industrial, and healthcare applications. The patented Easy Drive technology and the adaptable Flexi-SPI serial peripheral interface (SPI) of ADI are two aspects of the new high-performance SAR ADC series that address system design issues and increase the range of directly compatible companion products.

- September 2022: MaxLinear Inc. and RFHIC announced a collaboration to develop a 400MHz Power Amplifier (PA) solution for 5G Macrocell Radios that is production-ready. This solution will use MaxLinear MaxLIN Digital Predistortion (DPD) and Crest Factor Reduction (CFR) technologies to enhance the performance of RFHIC's newest ID-400W series GaN RF Transistors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Technologically Advanced Data Acquisition Systems

- 5.1.2 Growing Demand for High-Resolution Images in Scientific and Medical Applications

- 5.2 Market Challenges

- 5.2.1 Challenges in the Development of Low-power Consumption Data Converters

- 5.3 Impact of the COVID-19 Pandemic in Supply Chain Distribution of Semiconductors Globally

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Analog to Digital Converter

- 7.1.2 Digital to Analog Converter

- 7.2 By End User

- 7.2.1 Automotive

- 7.2.2 Telecommunication

- 7.2.3 Consumer Electronics

- 7.2.4 Industrial

- 7.2.5 Medical

- 7.2.6 Other End Users

- 7.3 Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 United Kingdom

- 7.3.2.3 France

- 7.3.2.4 Italy

- 7.3.2.5 Rest of Europe

- 7.3.3 Asia-Pacific

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Japan

- 7.3.3.4 Rest of Asia-Pacific

- 7.3.4 Rest of the World

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Analog Devices Inc.

- 8.1.2 Microchip Technology Inc.

- 8.1.3 STMicroelectronics NV

- 8.1.4 NXP Semiconductors NV

- 8.1.5 Texas Instruments Incorporated

- 8.1.6 Mouser Electronics Inc.

- 8.1.7 DATEL Inc.

- 8.1.8 Synopsys Inc.

- 8.1.9 Cirrus Logic Inc.

- 8.1.10 Maxim Integrated Products Inc.