|

市場調查報告書

商品編碼

1643095

射頻前端模組:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)RF Front End Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

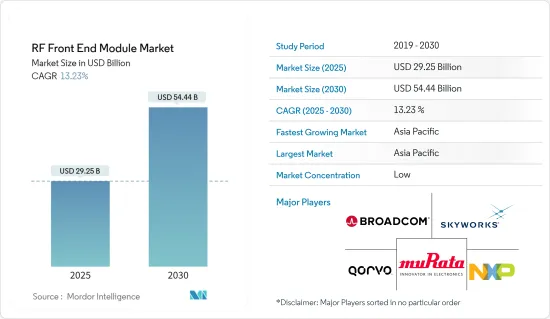

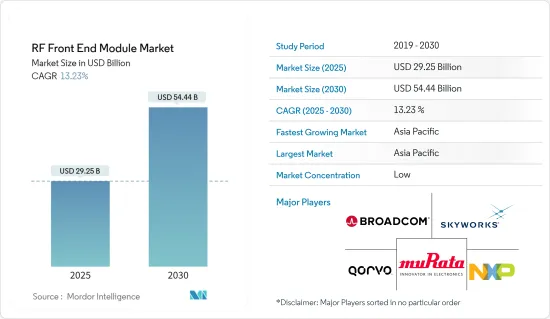

射頻前端模組市場規模預計在 2025 年為 292.5 億美元,預計到 2030 年將達到 544.4 億美元,預測期內(2025-2030 年)的複合年成長率為 13.23%。

最近的趨勢是低成本微型衛星的發展顯著增加。這是透過低成本發射載體和「商用現貨」(COTS)組件來實現的。大多數 COTS 元件通常不符合太空要求,需要額外的電路重新設計和實施工作才能承受並在惡劣的太空環境中運作。 RF前端設計由完全使用COTS元件實現的S波段收發器組成,被認為是專家調查中更好、更可行的選擇之一。隨著微型衛星的應用不斷增加,預計該領域的市場在預測期內將大幅成長。

關鍵亮點

- 射頻前端模組是指無線電接收器電路中位於無線電接收器的天線輸入和發送器的攪拌機級或功率放大器之間的電路。

- 行動通訊設備的快速成長以及資料密集型應用帶來的資料流量的不斷增加,推動 RF FEM 供應商引領技術創新,例如為行動裝置提供高頻率。此外,根據思科視覺化網路指數顯示,2017 年至 2022 年間,全球行動資料流量預計將成長 7 倍,2022 年達到每月 77.5 Exabyte ,複合年成長率為 46%。

- Qorvo 宣布推出首款用於 Wi-Fi 6 的雙頻前端模組 (FEM),分別為 SKY85334-11 和 SKY85750-11。 SKY85334-11 和 SKY85750-11 專為客戶端設備 (CPE) 設計,結合了 HD/4K 視訊傳輸所需的效能和物聯網所需的效率。應用還包括整合開關、帶旁路的低雜訊放大器 (LNA) 和功率放大器 (PA),其中模組具有線性度、功率損耗和效率,適用於網路基地台、路由器和閘道器,其中監管、熱量和乙太網路供電 (PoE) 限制要求低電流消耗。

- 此外,新興國家和已開發國家國防預算的不斷增加以及國內外軍事武器庫對技術先進產品的需求預計將進一步推動全球市場的成長。隨著自動駕駛汽車和無人機技術的進步,軍事射頻和電子戰應用預計將會成長。

- 射頻功率放大器 (PA) 是無線行動基礎架構中每個基地台的重要組成部分。這些是任何現代基礎設施設備子組件中最昂貴的部件之一。這些功率放大器中使用的 GaN RF 半導體必須隨著 RF PA 設計人員和用戶面臨的經濟和技術現實而發展。

- 政府實施的停工以及旅行和貿易限制迫使電子、汽車、航太和國防以及通訊等許多行業停止營運,從而減緩了 2020 年對射頻功率半導體的需求。截至 2022 年,一些射頻元件製造商正在透過與區域原料供應商合作來重組其供應鏈。未來預計生產者因新冠疫情所承受的負擔將會減輕。

射頻 (RF) 前端模組市場趨勢

射頻濾波器經歷顯著成長

- 射頻(RF)濾波器廣泛應用於通訊產業,用於消除各個頻道上接收和傳輸資料時的白噪音干擾。這些濾波器通常用於電視廣播、無線通訊和中高頻無線電等領域。這樣做是為了提供可靠、無錯誤且正確的端對端通訊。 RF 濾波器有四種:頻寬阻濾波器、高通濾波器、帶通濾波器和低通濾波器。

- 射頻濾波器用於無線電接收器,以確保只廣播適當的頻率,並濾除不需要的頻帶。它是無線技術的一個基本要素。這些濾波器適用於中頻至超高頻,如兆赫和吉赫。由於其功能特性,它最常用於廣播電台、無線通訊和電視等設備。

- 行動運算設備在需要不斷移動和保持連網的行動用戶和商務旅行者中越來越受歡迎。消費者使用這些設備可以完成多種任務,包括造訪社群媒體、瀏覽網頁、閱讀新聞和查看電子郵件。網路普及率的提高和價格實惠的資料通訊速度正在推動對行動運算設備的需求。

- 行動運算設備的使用日益增多導致網路流量呈指數級成長。功能日益強大的行動運算設備(例如智慧型手機、平板電腦和筆記型電腦)的普及正在推動網路頻寬的增加。智慧型手機和平板設備正在採用 LTE 和 Wi-Fi 等先進的無線技術,對新的 RF 功能的需求日益成長。

- 此外,射頻濾波器在行動電話環境中發揮著至關重要的作用。例如,行動電話需要一定數量的頻段才能有效運作。如果沒有適當的射頻濾波,各個頻寬就無法同時共存。這導致某些頻寬被拒絕,包括 Wi-Fi、公共和全球導航衛星系統 (GNSS)。 RF 濾波器非常重要,因為它們允許所有頻寬同時共存。

- 5G智慧型手機需求的不斷成長預計將進一步推動對射頻濾波器的需求。根據 GSMA 預測,到 2025 年,加拿大 5G 普及率將達到行動連線的 49%,高於 2021 年的 8%。

亞太地區將經歷大幅成長

- 預計亞太地區將實現強勁成長。中國、印度和韓國等主要新興國家的顯著成長,以及家用電子電器的進步和國防設備需求的不斷成長,預計將進一步推動射頻元件市場的需求。

- 蓬勃發展的積體電路 (IC) 產業、亞太地區不斷擴大的 SOI 生態系統以及 SOI 在物聯網應用中的日益廣泛使用,為射頻前端模組 (RFFE) 帶來了成長機會。根據《富比士》報道,到2023年物聯網設備數量將超過35億,其中亞洲將佔據最高市場佔有率。到2023年,東北亞將成為一個超過22億台設備的市場。

- 對於 2G、3G 和 4G/LTE(長期演進)中的資料傳輸,行動裝置需要專用的前端模組 (FEM)。 FEM 使用 RF-SOI 晶片將開關、功率放大器、天線調諧組件、電源管理單元、濾波器等整合到單一平台上,用於物聯網應用。這有助於該地區的市場成長。

- 此外,亞太地區汽車產量的成長預計將推動對在 L1 頻段(1,574.42 至 1,576.42 MHz)運行的全球定位系統 (GPS) 和在 S 頻段(2,320 至 2,345 MHz)運行的衛星數位音訊和無線電系統 (SDARS) 的前端緊湊型需求。這可能會促進該地區的市場發展。中國是最大的電動車製造國,預測期內也將在電動車普及率方面領先世界。到 2030 年,電動車在所有道路運輸方式(二輪車、汽車、巴士和卡車)新車銷量中的佔有率預計將達到 57%。

- 此外,由於前端模組對於基地台和5G智慧型手機等許多無線應用至關重要,中國旨在發展國內半導體產業的大型資本投資計劃已開始為第二階段資金籌措。該計劃預計運行五年,預算為 2,041.5 億元人民幣(289 億美元)。華為在射頻前端模組方面的工作為該公司提供了一個機會,使其能夠仔細考慮需要關注的領域,以開發必要的技術、設計和IP,甚至可能在中國開始設計完整的整合模組系統。這將進一步促進市場未來的成長。

射頻(RF)前端模組產業概況

由於市場競爭激烈,射頻前端模組市場高度分散。隨著技術創新、合作夥伴關係和合併的不斷增加,預計預測期內市場競爭將非常激烈。市場的主要企業包括 Broadcom Inc.、Skyworks Solutions, Inc. 等。

2022年6月,高通技術公司宣布推出Wi-Fi 7前端模組,該模組將增強車內和網路連線設備的無線效能。採用 RFFE 模組符合該公司的目標,即透過針對汽車和物聯網的數據機到天線解決方案來擴展行動電話範圍。

2022 年 2 月,村田製造公司宣布擴展其用於 5G 無線基礎設施的毫米波 RF 前端產品組合。三個波束成形 IC 和兩個上/下變頻器允許靈活更換 IC,從而提供 n257、n258 和 n260頻寬從 IF 到 RF 的全面覆蓋。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- RF-SOI的普及與智慧型設備的擴展

- 藍牙物聯網應用

- 市場問題

- 疫情導致需求下滑

- 製造成本高且晶圓尺寸小

第6章 市場細分

- 按零件

- 射頻濾波器

- 射頻開關

- 射頻功率放大器

- 其他

- 按應用

- 家用電子電器

- 車

- 軍隊

- 無線通訊

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 其他 其他 (拉丁美洲、中東和非洲)

- 北美洲

第7章 競爭格局

- 公司簡介

- Broadcom Inc.

- Skyworks Solutions Inc.

- Murata Manufacturing Co. Ltd

- Qorvo Inc.

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Infineon Technologies AG

- Qualcomm Technologies Inc.

- Teradyne, Inc.(LitePoint Corporation)

- RDA Microelectronics Inc.

第8章投資分析

第9章:市場的未來

The RF Front End Module Market size is estimated at USD 29.25 billion in 2025, and is expected to reach USD 54.44 billion by 2030, at a CAGR of 13.23% during the forecast period (2025-2030).

In recent years, the development of low-cost nanosatellites has grown considerably. It has been made viable due to the availability of low-cost launch vectors and "commercial off-the-shelf components" (COTS). Most COTS components are usually not space-qualified, and to make them work and withstand the harsh space environment, they need extra effort in in-circuit redesign and implementation. The RF front-end design is considered one of the better and more feasible choices in expert research, which consists of an S-band transceiver that is fully implemented using COTS components. If further implemented in nanosatellites, the market in this sector shall grow significantly during the forecast period.

Key Highlights

- An RF front-end module refers to the circuitry in a radio receiver circuit between a radio receiver's antenna input and the mixer stage or the transmitter's power amplifier.

- The exponential increase in mobile communication devices on a unit basis and rising data traffic due to data-intensive applications have led RF FEM providers to lead innovation, such as high-frequency bands in handsets. Additionally, per the Cisco Visual Networking Index, the global mobile data traffic is expected to increase sevenfold between 2017 and 2022, with a CAGR of 46%, reaching 77.5 exabytes per month by 2022.

- Qorvo introduced the first dual-band front-end module (FEM) for Wi-Fi 6, the SKY85334-11 and SKY85750-11. It is designed ideally for customer premise equipment (CPE), combining the performance required to deliver HD/4K video with the efficiency needed for IoT. Also, by featuring linearity, power dissipation, and efficiency for access points, routers, and gateways, where regulatory, thermals, or Power-over-Ethernet (PoE) limitations demand low current consumption, the modules overlook integration at switching, low-noise amplifier (LNA) with bypass and power amplifier (PA) as applications.

- Moreover, the constant increase in defense budgets in developing and developed nations and the demand for technologically-advanced products in the arsenal of national and international armed forces are expected to further fuel the global market's growth. Military radio frequency and electronic warfare applications are expected to grow in addition to the technological advancements in autonomous vehicles and drones.

- RF power amplifiers (PA), thus, form an integral part of all the base stations for wireless mobile infrastructure. They represent one of the most expensive components of sub-assemblies in modern infrastructure equipment. The GaN RF semiconductors used in these power amplifiers must evolve with the economic and technical realities facing the designers and users of these RF PAs.

- Due to government-imposed lockdowns and travel and trade restrictions, many industries, such as electronics, automotive, aerospace & defense, and telecommunications, were forced to shut down their operations, lowering the demand for RF power semiconductors in 2020. As of 2022, several RF component makers have reorganized their supply chains by working with regional raw material suppliers. In the future, this is projected to reduce the burden of the COVID-19 pandemic on producers.

Radio Frequency (RF) Front End Module Market Trends

RF Filters to Witness Significant Growth

- Radiofrequency (RF) filters are widely used in the communication industry to eliminate white noise interference when receiving and transferring data across various channels. These filters are often employed in operating fields, such as television broadcasting, wireless communication, and radios operating from medium to high frequencies. This is done to provide reliable, error-free, and appropriate communication from one end to the other. Band-reject, high-pass, band-pass, and low-pass filters are the four types of RF filters.

- RF filters are used with radio receivers to ensure that only the appropriate frequencies are broadcasted, filtering out undesirable bands of frequencies. They are a crucial component of wireless technology. These filters are built to function at frequencies ranging from medium to extremely high, such as megahertz and gigahertz. Due to their working feature, they are most commonly employed in equipment like broadcast radio, wireless communications, and television.

- Mobile computing devices are becoming more popular among mobile users and business travelers who need constant mobility and connection. Consumers use these gadgets for various tasks, including accessing social media applications, surfing the web, reading news, and checking emails. The growing internet penetration rate and the availability of high data rates at affordable speeds are driving the demand for mobile computing devices.

- Network traffic is increasing exponentially, owing to the growing use of mobile computing devices. The proliferation of mobile computing devices (such as smartphones, tablets, and laptops) with increased capabilities is driving internet bandwidth. The increased need for new RF functionalities in smartphones and tablets has resulted from incorporating advanced wireless technologies, such as LTE and Wi-Fi.

- Furthermore, RF filters play an essential function in the cell phone environment. Mobile phones, for example, require a particular number of bands to function effectively. Without the right RF filter, the various bands cannot coexist simultaneously. This will result in the rejection of certain bands, such as the Wi-Fi, public safety, and global navigation satellite system (GNSS). RF filters are crucial because they allow all bands to coexist simultaneously.

- The increasing demand for 5G smartphones will further boost the demand for RF filters. According to GSMA, the 5G adoption rate as a share of mobile connections in Canada will reach 49% by 2025 from 8% in 2021.

Asia-Pacific to Witness Major Growth

- The Asia-Pacific is expected to witness significant growth. The advancement in consumer electronics and growing defense equipment requirements with the considerable growth of major emerging economies, such as China, India, and South Korea, will further boost the demand for the RF component market.

- The flourishing Integrated Circuit (IC) industry, expanding the SOI ecosystem in the Asia-Pacific, and increasing the use of SOI in IoT applications act as growth opportunities for the RF Front End Module (RFFE). According to Forbes, the number of IoT devices will surpass 3.5 billion by 2023, with Asia leading the highest market share. By 2023, Northeast Asia will be a market for more than 2.2 billion devices.

- For data transmission over 2G, 3G, and 4G/ Long-term Evolution (LTE), mobile devices require dedicated front-end modules (FEMs). FEMs use RF-SOI chips, which integrate switches, power amplifiers, antenna tuning components, power management units, and filters on a single platform for IoT applications. Hence, this caters to the market growth in the region.

- Further, increasing the production of vehicles in the Asia-Pacific is expected to drive the demand for compact dual-band RF front-end modules for global positioning system (GPS) operating in the L1-band (1574.42-1576.42 MHz) and satellite digital audio radio system (SDARS) operating in the S-band (2320-2345 MHz. This, in turn, may boost the market in the region. China is the largest maker of electric vehicles and leads with the highest level of EV uptake over the projection period. By 2030, the share of EVs in new vehicle sales is estimated to reach 57% across all road transport modes (i.e., two-wheelers, cars, buses, and trucks).

- Furthermore, as front-end modules are essential to many wireless applications, such as base stations and 5G smartphones, China's massive capital investment project designed to nurture the domestic semiconductor industry has rolled out its second funding phase. The project is scheduled for the next five years with a budget of YUAN 204.15 billion (USD 28.9 billion). By addressing RF front-end modules, Huawei creates an opportunity to ponder areas that need attention for developing the necessary technologies, designs, and IPs, possibly expected to begin designing a whole integrated module system in China. This further penetrates future growth for the market.

Radio Frequency (RF) Front End Module Industry Overview

The RF front-end module market is fragmented due to high market rivalry. With increasing innovation, partnerships, and mergers, the market is expected to have high competition in the forecasted period. Key players in the market are Broadcom Inc., Skyworks Solutions, Inc., etc.

In June 2022, Qualcomm Technologies Inc. announced the launch of Wi-Fi 7 front-end modules that offered enhanced wireless performance in automotive and internet-connected devices. The introduction of the RFFE modules aligned with the company's objective to extend its handset range with modem-to-antenna solutions for automotive and IoT.

In February 2022, Murata Manufacturing announced the expansion of its millimeter-wave RF front-end portfolio for 5G wireless infrastructure applications. The three beam-forming ICs and two up-down converters offered flexibility to interchange ICs for full IF-to-RF coverage across the n257, n258, and n260 bands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Popularity of RF-SOI and the Increasing Adoption of Smart Devices

- 5.1.2 Adoption of Bluetooth IoT Applications

- 5.2 Market Challenges

- 5.2.1 Low Demand due to the Impact of COVID-19

- 5.2.2 Expensive to Fabricate and Smaller Wafer Sizes

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 RF Filters

- 6.1.2 RF Switches

- 6.1.3 RF Power Amplifiers

- 6.1.4 Other Components

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Military

- 6.2.4 Wireless Communication

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World (Latin America, Middle East and Africa)

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Skyworks Solutions Inc.

- 7.1.3 Murata Manufacturing Co. Ltd

- 7.1.4 Qorvo Inc.

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 Infineon Technologies AG

- 7.1.8 Qualcomm Technologies Inc.

- 7.1.9 Teradyne, Inc. (LitePoint Corporation)

- 7.1.10 RDA Microelectronics Inc.