|

市場調查報告書

商品編碼

1643160

消毒機器人:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Disinfectant Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

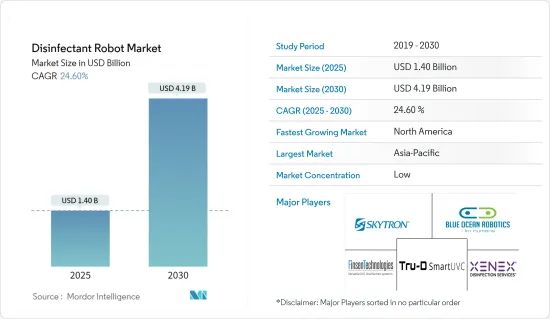

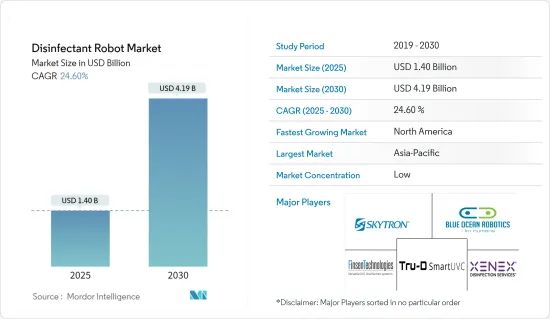

消毒機器人市場規模預計在 2025 年為 14 億美元,預計到 2030 年將達到 41.9 億美元,預測期內(2025-2030 年)的複合年成長率為 24.6%。

由於 COVID-19 疫情導致的醫療保健和衛生支出激增以及對消毒機器人領域的大量投資,推動了市場成長的需求。

關鍵亮點

- 近年來,對消毒機器人的需求日益增加,以在不增加人事費用的情況下減少醫院感染。過氧化氫和紫外線消毒等過程都是手動完成的。這是因為消毒機器人在許多國家的醫療市場上仍然是一個相對較新的發明。製藥業已在無塵室中使用 UV-C 超過 10 年。

- 該行業的主要趨勢是能夠進行紫外線消毒的移動機器人。由於對服務機器人的需求不斷增加,市場預計將會擴大,特別是在醫療領域。

- 在醫院、餐廳、飯店、機場和學校等人口密集的地區,衛生和消毒尤其令人擔憂。這就是為什麼越來越多的公司和機構轉向自動化消毒應用並投資機器人技術的原因。

- 消毒機器人的高成本與有效且強大的硬體和高效的軟體有關。自動化設備涉及投資自動化技術所需的更高資本支出(自動化系統的設計、製造和安裝成本可能高達數百萬美元)。隨著技術的進步和功能的增加,成本也隨之增加。

- COVID-19 疫情增強並凸顯了機器人和自動化技術的價值。這些技術除了幫助克服人類勞動力在疫情期間面臨的挑戰之外,還將大大減少病毒的影響。

消毒機器人市場趨勢

技術進步使機器人能夠在消毒過程中充當增值營業單位(合作者)

- 大多數第一代自動消毒系統都是複雜的機器,靈活性差,範圍有限。因此,其大多數客戶都是希望提高績效的高階醫院。然而,隨著第二代機器人的引入,機器人技術的進步為消毒過程增加了新的價值。

- 此外,大多數機器人都是協作機器人,具有許多安全和衛生功能。例如,必須避免暴露在 UV-C 光線下,因此許多機器人都內建了多種安全功能。例如,許多機器人配備一台平板電腦,可作為病房門上的運動感應器,如果有人試圖進入房間,就會自動關閉 UV-C 燈。

- 例如,2021 年 4 月,總部位於上海的 TMI Robotics 製造了一款可預先可程式設計的自主消毒機器人。這些機器人使用紫外線、超乾汽化過氧化氫和空氣過濾方法對錶面進行消毒。透過結合紫外線消毒和空氣過濾,這些機器人能夠對錶面和周圍的空氣進行消毒。

- 現在,一些機器人配備了各種安全功能,例如,如果有人在機器人開啟時進入房間,機器人就會自動關閉,或者門和運動感測器可以偵測到何時有人試圖進入。自動駕駛是另一個功能和軟體整合,為整個消毒過程增加了更多價值。

- 第三代消毒機器人主要利用機器學習和物聯網支援的智慧無線連接和安全功能。標準功能包括觸控螢幕、整合感測器、監控、自動報告和物聯網。近日,UVD機器人展示了其第三代自主移動UV-C消毒機器人。該機器人配備了最先進的安全系統,該系統採用四層安全層,使其能夠在各種環境中導航。該機器人具有清晰的功能,可以檢測、記錄並向用戶顯示某個區域的消毒效果,從而使用戶可以根據需要輕鬆快速地調整流程以最佳化品質。

預計亞太地區將佔據最大市場佔有率

- 亞太地區正迅速成為推動消毒機器人生產和使用的關鍵地區之一。隨著該地區在全球機器人行業的市場佔有率不斷成長,利用所調查的市場也將成為可能。

- 澳洲、韓國、日本、印度、中國和新加坡等國家正在對整個價值鏈中所研究的市場進行投資。韓國、日本、印度和中國是全球機器人製造地。香港、印度和新加坡也正在成為全球機器人Start-Ups中心。東南亞憑藉升級的醫療設施和經濟支持已成為重要的投資目的地。

- 例如,2021 年 2 月,信實工業的子公司 Reliance Strategic Business Ventures Limited (RSBVL) 以 2,676 萬美元收購了投資組合公司 skyTran Inc. 的額外股份,以全面攤薄計算,其持股比例增至 54.46%。 skyTran Inc.是一家美國科技公司。我們開發了用於個人交通的突破性被動磁浮和推進技術,以緩解全球交通堵塞。

- 例如,中國農業技術公司Xenex Disinfectant Systems最近投入500萬元人民幣(約70萬美元),在疫情期間進行無人機消毒行動。該公司已使用農業無人機對全國各地的公共場所進行消毒。無人機是一種有效的機器人消毒解決方案,因為它們可以非接觸式操作並在更短的時間內覆蓋更大的區域。

消毒機器人產業概況

在消毒機器人市場,主要企業企業之間的競爭十分激烈。隨著新產品的推出、提供專有技術的產品以及與最終用戶達成協議,工業供應商正在增加其整體市場佔有率。

- 2022 年 1 月 - Blue Ocean Robotics 宣布投資 3.35 億丹麥克朗(4355 萬美元),擴大其在全球範圍內的移動機器人解決方案推廣,以滿足對支援企業和機構的服務機器人日益成長的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 相關人員分析

- 市場機會

- 重要夥伴關係和聯盟

- 消毒機器人部署的關鍵技術和社會考慮

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 全球主要市場醫院內感染發生率高

- 技術進步將使機器人在消毒過程中實現增值(協作)操作

- 新冠肺炎疫情導致醫療衛生支出激增

- 消毒機器人領域投入龐大

- 市場限制

第6章 市場細分

- 產品類型

- UV-C

- HPV 和其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Blue Ocean Robotics

- Xenex Disinfectant Systems

- Finsen Technologies(Thor UV-C)

- Skytron(Infection Prevention Technologies)

- Tru-d Smartuvc

- Akara Robotics Ltd

- Mediland Enterprise Corporation

- Tmirob Technology

- OTSAW Digital Pte Ltd

- Bioquell PLC(Ecolab Inc.)

- Bridgeport Magnetics

- Decon-X International

- MTR Corporation(Joint venture)

- Fetch Robotics Inc.

- Solustar

- Ateago Technology

- Time Medical Holding Robotics

- AUDITE Robotics

第8章 投資分析及市場展望

The Disinfectant Robot Market size is estimated at USD 1.40 billion in 2025, and is expected to reach USD 4.19 billion by 2030, at a CAGR of 24.6% during the forecast period (2025-2030).

The rapid rise in healthcare and sanitation spending due to the COVID-19 Outbreak and high investments in the field of disinfectant robots has increased the demand for growth in the market.

Key Highlights

- Recently, the need for disinfection robots increased in order to decrease HAIs without adding to personnel expenditures. Processes like hydrogen peroxide and ultraviolet disinfection are carried out by manual labor because disinfection robots are still relatively recent inventions in the healthcare market in many nations. The pharmaceutical sector has been utilizing UV-C in cleanroom settings for more than ten years.

- The industry is primarily observing a trend of mobile robots that can UV-sanitize spaces. The market under study will advance due to the rising need for service robots, particularly in the healthcare sector.

- Sanitizing and disinfectant have become an area of concern, especially in highly populated areas, including hospitals, restaurants, hotels, airports, and schools. Due to this, the market is witnessing more companies and institutions that shifted to automation for disinfecting applications, hence, investing in robots.

- The higher costs of disinfectant robots are associated with effective and robust hardware and efficient software. Automation equipment includes higher capital expenditure required to invest in automation technologies (an automated system can cost millions of dollars to design, fabricate, and install). And with increasing advancement and functionality, the cost also increases.

- The COVID -19 pandemic increased and highlighted the value of robotic and automated technology. In addition to assisting in overcoming the difficulties faced by the human workforce during the pandemic, these technologies substantially reduce the virus's impact.

Disinfectant Robot Market Trends

Technological Advancements to Enable Robots to Operate as a Value-added Entity (Collaborative) in the Disinfection Process

- Most of the first generation of automated disinfectant systems were complex machines that were neither too flexible nor limited in scope. Therefore, most of its customers were high-end hospitals that wanted performance enhancement. However, the robots' advancement with the advent of second-generation robots has added extra value to the disinfectant process.

- Furthermore, most of these robots work as collaborative robots with many safety features and disinfectant features. For instance, as UV-C light exposure should be avoided, many robots contain several safety features. For example, many robots come with a tablet on the patient room door that acts as a motion sensor, which automatically disengages the UV-C light if someone wants to enter the room.

- For instance, in April 2021, TMI Robotics, a Shanghai-based company, produced autonomous disinfection robots that can be pre-programmed. These robots use ultraviolet, ultra-dry vaporized hydrogen peroxide, and air filtration methods to disinfect surfaces. UV disinfection combined with air filtration will enable these robots to disinfect the surfaces and the air around them.

- Several robots now also come with various safety features, including an auto-shutdown function if a person goes in the room while it is on and door motion sensors to detect people trying to enter. Autonomous is another feature and software integration that further adds value to the overall disinfectant process.

- The third-generation disinfectant robots mainly leverage machine learning and IoT-enabled smart wireless connectivity and safety features. Standard features include touch screens, Integrated sensors, surveillance, automated reports, and IoT. Recently, UVD robots showcased their 3rd generation of autonomous mobile UV-C disinfection robot. The robot has the latest safety system that utilizes four safety layers, enabling the robot to move around in different environments. It has a distinct capability to sense, document, and show the users how well-disinfected an area is, enabling the user to easily and quickly adjust the process and optimize the quality if needed.

Asia-Pacific is Expected to Hold the Largest Market Share

- The Asia Pacific is quickly becoming one of the significant regions driving disinfectant robot production and use. Leveraging the market under study is also made possible by the region's expanding market share in the global robot industry.

- Countries like Australia, South Korea, Japan, India, China, and Singapore are investing in the market studied across the value chain. South Korea, Japan, India, and China are global robot manufacturing hubs. Hong Kong, India, and Singapore are also emerging as robotic start-up hubs globally. Southeast Asia is emerging as a significant investment due to the upgrade of its healthcare facility and support of its economy.

- For instance, in February 2021, Reliance Industries' subsidiary Reliance Strategic Business Ventures Limited (RSBVL) purchased a further equity position in its investee firm skyTran Inc. for USD 26.76 million, bringing its shareholding to 54.46% on a fully diluted basis. SkyTran is a technological business based in the United States. It has created ground-breaking passive magnetic levitation and propulsion technology for personal transportation to alleviate traffic congestion globally.

- The china region is witnessing many local vendors and start-ups participating and investing in the global disinfectant robot market, helping the area create dominance in the market studied; for instance, Xenex Disinfectant Systems, a Chinese agritech company, recently released a fund of CNY 5 million (~USD 0.7 million) to initiate drone disinfection operations amidst the pandemic. The company leveraged its agricultural drones to disinfect the public spaces in the nation. Drones are an impactful robotic disinfectant solution since they can be operated in a contactless manner and can cover a broader area in less time.

Disinfectant Robot Industry Overview

The competitive rivalry among major players is high in the disinfectant robot market. By introducing new products, providing items with proprietary technology, and reaching agreements with end-users, the industry's vendors are increasing their overall market share.

- January 2022 - Blue Ocean Robotics announced the roll expansion of mobile robot solutions globally with an investment of DKK 335 million (USD 43.55 million) to meet the growing demand for service robots that can assist companies and institutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Market Opportunities

- 4.5 Major Partnerships and Collaborations

- 4.6 Key Technical and Social Considerations in the Deployment of Disinfectant Robots

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Incidence of Hospital-acquired Infections in Major Markets Worldwide

- 5.1.2 Technological Advancements Enable Robots to Operate as a Value-added Entity (Collaborative) in the Disinfection Process

- 5.1.3 Rapid Rise in Healthcare and Sanitation Spending due to the COVID-19 Outbreak

- 5.1.4 High Investments in the Field of Disinfectant Robots

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 UV-C

- 6.1.2 HPV and Others

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blue Ocean Robotics

- 7.1.2 Xenex Disinfectant Systems

- 7.1.3 Finsen Technologies (Thor UV-C)

- 7.1.4 Skytron (Infection Prevention Technologies)

- 7.1.5 Tru-d Smartuvc

- 7.1.6 Akara Robotics Ltd

- 7.1.7 Mediland Enterprise Corporation

- 7.1.8 Tmirob Technology

- 7.1.9 OTSAW Digital Pte Ltd

- 7.1.10 Bioquell PLC (Ecolab Inc.)

- 7.1.11 Bridgeport Magnetics

- 7.1.12 Decon-X International

- 7.1.13 MTR Corporation (Joint venture)

- 7.1.14 Fetch Robotics Inc.

- 7.1.15 Solustar

- 7.1.16 Ateago Technology

- 7.1.17 Time Medical Holding Robotics

- 7.1.18 AUDITE Robotics