|

市場調查報告書

商品編碼

1643163

群眾募資:市場佔有率分析、產業趨勢與群眾集資、成長預測(2025-2030 年)Crowdfunding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

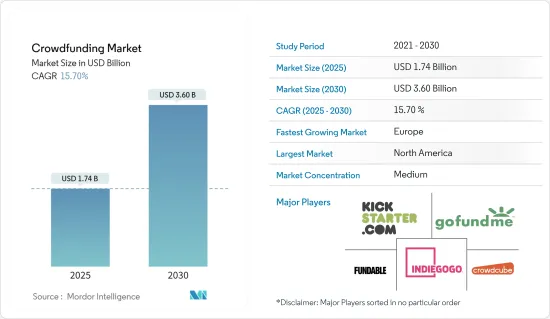

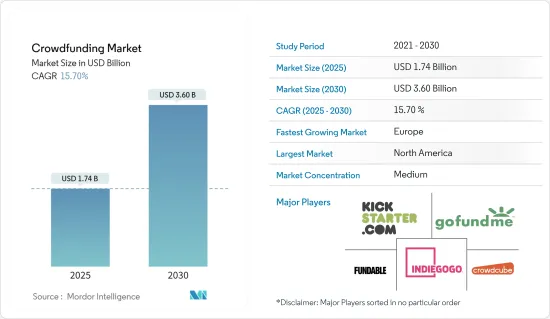

2025 年群眾集資市場規模估計為 17.4 億美元,預計到 2030 年將達到 36 億美元,預測期內(2025-2030 年)的複合年成長率為 15.7%。

主要亮點

- 群眾集資涉及從大量人群(即人群)籌集小額資金。群眾集資平台可以充當捐贈者和受益人之間的中介。該中介機構可以使用多種行銷技巧來影響潛在捐贈者的行為。因此,尋找群眾集資平台(如社群媒體平台)上用於資金籌措的影響者至關重要。

- 近年來,對於那些透過傳統方式資金籌措面臨挑戰的企業家和新興企業來說,群眾集資被譽為一個巨大的、尚未開發的新機會。有眾群眾集資平台致力於資金籌措來支持Start-Ups生態系統。例如今年8月,荷蘭投資群眾集資公司Symbid被位於布加勒斯特的軟體公司共同投資平台SeedBlink收購。擴大 Venture Partners 在西歐的業務將擴大 SeedBlink 的影響力,因為它準備鞏固和發展對各個階段的歐洲數位Start-Ups的股權投資基礎設施。

- 據共和國旗下負責策劃群眾集資舉措和追蹤統計數據的入口網站 Alora 計劃稱,截至今年 5 月底,股權群眾集資平台上對新興企業的金額超過 2.15 億美元,高於去年同期的 2 億美元左右。去年,群眾集資項目共籌集資金 5.02 億美元。

- 今年晚些時候,來自世界各地的企業家、發行人和投資者將齊聚一堂,參加由 2020 年推出的按需商業教育平台 StartupStarter 主辦的第二屆股權眾籌週會議。股權群眾集資週是一場為期三天的身臨其境型活動,展示在美國、加拿大及其他地區籌集私人融資的最具創新的公司。在 Black on the Block(BOTB)的加入下,這種完全身臨其境型的體驗將專注於為想要在創業和股權群眾集資領域取得成功的 BOTB 參與者提供管道和機會。

- 利用宣傳活動作為群眾集資平台對於增加市場佔有率至關重要。推動群眾集資成長的主要因素之一是一般人群慢性病的增加。此外,來自世界各地的各種參與者已開始投資新興企業和成長型公司。

- 去年 12 月,總部位於倫敦的教育科技公司 Mind Stone 透過一場令人興奮的群眾集資宣傳活動籌集了 170 萬美元,超額完成了資金籌措目標,成為 Seedrs 平台上最大的教育科技資金籌措宣傳活動之一。去年 5 月,電動摩托車開發技術先驅 Zeiser Motors 發起了官方 Wefunder宣傳活動,以支持其電動機車的開發和製造。

- 這是企業首次能夠與所有歐洲成員國的潛在投資者建立聯繫。為了吸引投資者,它將採用類似於可轉讓證券、貸款和有限責任公司股份的金融工具,並可透過群眾外包每年籌集高達 500 萬美元的資金。

- 全球金融和經濟問題正在影響許多國家,使得各國政府很難滿足當地民眾的緊急需求。在這種危機情況下,傳統的融資來源很難調動,因為流動性的缺乏影響到包括政府、企業、家庭和金融機構在內的所有參與者。

- 因此,他的創業經歷意味著他很難資金籌措來實現他的目標。由於透過傳統資金籌措管道獲取資金面臨這些挑戰,因此群眾集資已成為商業資金籌措的主要驅動力。新冠疫情大大加速了群眾集資的成長,這種轉變即使在疫情後仍在持續。

群眾集資市場趨勢

獎勵型群眾集資籌將加速市場成長

- 獎勵群眾集資是指一家公司(通常是新興企業)透過線上平台籌集種子前資金或種子資金,為支持者提供禮物或「額外津貼」以換取他們的資金。預售是個人、舉措或公司從銀行家籌集資金以換取非貨幣獎勵的交易。這使得組織能夠參與現有網路並徵求他們可以利用的資訊。這種群眾外包類型通常適合早期企業或專業計劃。

- 疫情導致旨在幫助受全球疫情影響的人們的捐贈和獎勵型群眾集資案例增加。在整個歐洲大陸,由廣泛人群(包括公民、商業組織、基金會、慈善機構和信託)發起的基於 COVID-19 獎勵的群眾集資宣傳活動數量顯著增加。

- 據Indiegogo稱,硬體和技術群眾集資預計在日本也將流行起來。在過去的一年裡,Indiego 與大大小小的活動家合作,幫助創業品牌接觸新的受眾並測試小批量的新產品。

- 根據《富比士日本》報道,日本創業家去年籌集了近 70 億美元,預計未來幾年這一數字將增加至每年 100 億美元。

- 基於獎勵的群眾集資不涉及對公司的投資或貸款,具有固有的風險。群眾集資很快就從一種向支持者提供的支持某項事業或訴求的感謝禮物演變成了現實。禮品通常是與捐贈一起購買的產品,將其轉變為回饋禮物的銷售管道。

預計歐洲將佔很大佔有率

- 隨著越來越多的政府針對群眾集資模式製定規則,歐洲群眾集資的佔有率和成長率可能會增加。據稱,歐盟國家也將頒布法律,允許本國的眾群眾集資網站在其他歐盟地區運作。

- 德國的各種眾群眾集資平台為新手和有經驗的投資者提供私人投資機會。德國群眾外包網站是受到最嚴格監管的網站之一,並且遵循最佳實踐。德國群眾集資網站透過提供投資小型企業和房地產的選擇來幫助人們累積財富。

- 根據thecrowdspace.com報道,德國有112個平台專門從事P2P借貸、股權、債務、捐贈、獎勵和迷你債券。私人和合格投資者可投資多個商業領域,包括物流、房地產、綠色能源、新興企業、個人貸款、藝術、中小型企業 (SME)、健康和科學、社區服務、教育、農業、體育和航運。此外,德國還有25個股權群眾外包網站。這些網站為散戶和合格投資者提供了各種投資機會,重點關注房地產、綠色能源、新興企業、藝術、小型企業、健康和科學、社區服務、教育和農業。各平台的最低投資金額有所不同,取決於特定平台的產業和目標。

- 歐洲群眾集資市場近年來取得了長足的發展。歐洲技術的進步和保護科技企業的崛起正在為房地產、銀行業和其他行業創造新的群眾集資機會。

- 例如今年 4 月,Heura 的第二次 Equity for Good Rebels群眾集資宣傳活動僅在 12 小時內就籌集了約 422 萬美元,鞏固了其作為歐洲成長最快的植物來源公司的聲譽。 Crowdcube宣傳活動吸引了來自歐洲各地的 4,500 名投資者加入 Good Rebel 社區,其使命是加速蛋白質轉變。

- 德國是群眾集資的重要市場,有多個外國平台積極接觸德國投資者或尋求在德國擴大業務。然而,直到最近,德國私人群眾集資公司的法規環境才有所改善。因此,當歐盟《群眾集資服務提供者條例》(ECSPR)首次頒布時,德國似乎需要幫助才能像其他歐盟國家一樣輕鬆地實施該條例。結果,2021年6月,德國議會通過了一項法案,將歐盟對群眾集資服務提供者的規定實施到國家法律中。

- 儘管德國群眾集資監管在地方層級存在一些缺陷,但總體而言蓬勃發展的德國金融科技產業(尤其是群眾集資)預計不會受到新規的不利影響,預計德國群眾集資平台在研究期間將呈現穩定成長態勢。

群眾集資產業概況

全球群眾集資市場處於適度整合的狀態,少數公司佔據市場主導地位,其他多家公司則相互競爭。此外,這些公司正在進行大量投資,為客戶提供適用於特定產業最終用戶應用的廣泛技術。市場的最新趨勢包括:

2022 年 10 月,韓國圖板遊戲製造商 Bad Comet 宣布透過 Kickstarter宣傳活動發布其最新圖板遊戲。

2022 年 4 月,Crowdcube 推出了其法國網站。 Crowdcube 是一個覆蓋英國和歐洲的群眾外包證券平台。最近的監管變化將使已在歐洲活躍一段時間的 Crowdcube 更容易幫助資金籌措。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 使用社群媒體作為免費推廣的來源

- 增加投資者的積極策略行為和投資者之間的社交互動

- 市場限制

- 耗時的流程和嚴格的監管合規性

第6章 市場細分

- 依產品類型

- 獎勵型群眾集資

- 股權群眾集資

- 捐贈和其他產品類型

- 按最終用戶應用

- 文化類別

- 科技

- 產品

- 衛生保健

- 其他最終用戶應用程式

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Kickstarter PBC

- Indiegogo Inc.

- GoFundMe Inc.

- Fundable LLC

- Crowdcube Limited

- GoGetFunding

- Crowdfunder Inc.

- Alibaba Group Holding Limited

- Wefunder Inc.

- Fundly

- Jingdong Inc.

- Suning.com Co. Ltd

- Owners Circle

- Realcrowd Inc.

第8章投資分析

第9章:市場的未來

The Crowdfunding Market size is estimated at USD 1.74 billion in 2025, and is expected to reach USD 3.60 billion by 2030, at a CAGR of 15.7% during the forecast period (2025-2030).

Key Highlights

- Crowdfunding entails soliciting many small amounts of money from an undefined group known as the crowd. Crowdfunding platforms could be intermediaries between donors and beneficiaries. This intermediary could exploit a plethora of marketing techniques to influence the behavior of the potential donor. Therefore it is essential to look for the influencing factors that are being used on crowdfunding platforms such as social media platforms for raising funds.

- In recent years, crowdfunding has been acclaimed as an untapped and vast new opportunity for entrepreneurs and startups that face challenges in obtaining funding from traditional methods. There is a dedicated crowdfunding platform for raising funds to support the startup ecosystem. For instance, in August this year, Dutch investment crowdfunding company, Symbid, was bought by SeedBlink, a co-investment platform for software firms situated in Bucharest. By expanding the venture partners' operations in Western Europe, the acquisition will expand SeedBlink's reach as it prepares to consolidate and develop the infrastructure for equity investment in European digital startups at all stages.

- According to the Arora Project, a Republic-owned portal that curates crowdfunding initiatives and tracks statistics, more than USD 215 million was invested in startups on equity crowdfunding platforms in the current year until the end of May, up from about USD 200 million in the same period last year. Last year, crowdfunding programs raised a total of USD 502 million.

- Later this year, entrepreneurs, issuers, and investors from around the world will gather in person for the second annual Equity Crowdfunding Week Conference, organized by StartupStarter, an on-demand business education platform that began in 2020. Equity Crowdfunding Week is a three-day immersive event that showcases the most creative firms raising private financing in the United States, Canada, and beyond. With the inclusion of black on the block (BOTB), this fully immersive experience will now focus on offering access and opportunities to the BOTB audience wanting to make a mark in the world of entrepreneurs and equity crowdfunding.

- Using campaigns as crowdfunding platforms is crucial in expanding the market share. The increased prevalence of chronic illnesses among the general population is one of the primary causes encouraging the expansion of crowdfunding. Furthermore, various players across the globe started investing in startups and growth companies.

- In December last year, Mind Stone, a London-based edtech firm, received USD 1.7 million in an exciting crowdfunding campaign, exceeding its funding goal and becoming one of the most extensive edtech financing campaigns on the Seedrs platform. Further, in May last year, Zaiser Motors, a technological pioneer in developing the Electrocycle, launched an official Wefunder campaign to support developing and manufacturing of its electric motorbike.

- Companies can now connect with potential investors across all Europe member states for the first time. To entice investors, they can employ transferrable securities, loans, or financial products that resemble shares of limited liability corporations to generate up to USD 5 million each year through crowdsourcing.

- The global financial and economic problems have hurt many nations, making it extremely difficult for governments to address the urgent needs of local populations. Traditional sources of finance are challenging to mobilize in this crisis scenario as lack of liquidity impacts all agents, including the government, businesses, families, and financial institutions.

- As a result, the entrepreneurial experience found itself challenging to raise money to fulfill its goal. Due to these challenges in obtaining finance through conventional fundraising channels, crowdfunding has become a significant factor in business financing. The COVID-19 situation dramatically accelerated the growth of crowdfunding, and the change is continuing in the post-pandemic scenario.

Crowdfunding Market Trends

Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market

- Reward-based crowdfunding occurs when a firm (often a start-up) seeks pre-seed and seed money via an online platform and provides investors with a gift or "perk" in exchange for their financial contribution. Pre-sales are transactions in which people, initiatives, or businesses raise funds from bankers in exchange for a non-monetary incentive. It allows organizations to interact and build on an existing network and solicit that can be used. This type of crowdsourcing is typically appropriate for early-stage businesses or specialized projects.

- The pandemic resulted in increased contributions and reward-based crowdfunding incidents targeted at assisting those impacted by the worldwide pandemic. The number of COVID-19 reward-based crowdfunding campaigns created by various persons (including citizens, commercial organizations, foundations, charities, and trusts) throughout the European continent increased significantly.

- According to Indiegogo, Inc., hardware and technology crowdfunding is expected to gain popularity in Japan. Last year, Indieogo collaborated with small and large campaigners to assist entrepreneurial brands in reaching new audiences and testing small batches of new goods.

- According to Forbes Japan, Japanese entrepreneurs raised almost USD 7,000 million last year, expected to rise to USD 10,000 million annually in a few years.

- Reward-based crowdfunding, which does not include making an investment in or a loan to a company, carries inherent risks. It soon advanced from giving supporters a token of thanks for their support of a cause or an appeal. In many instances, it has transformed into a sales channel where the gift is the product bought with the contribution, thereby giving the gift's price in return.

Europe is Expected to Hold Significant Share

- The European crowdfunding share of the market and growth is likely to increase as more governments in the area organize rules for the crowdfunding model. The European Union nations are also allegedly going to establish laws to allow crowdfunding sites in the region to operate across other EU regions.

- Different crowdfunding platforms in Germany give novice and experienced investors access to private investment opportunities. German crowdsourcing sites are among the most well-regulated and adhere to best practices. German crowdfunding websites provide choices for investment in SME and real estate and let users accumulate wealth.

- In Germany, there are 112 platforms dedicated to P2P lending, equity, debt, donations, rewards, and mini-bonds, according to thecrowdspace.com. Retail and accredited investors can invest through them in several company sectors, including logistics, real estate, green energy, startups, personal loans, art, small and medium-sized enterprises (SMEs), health & science, social causes, education, farming, sport, and maritime. Additionally, Germany has 25 sites for equity crowdsourcing. They provide various investment possibilities for retail and accredited investors, emphasizing real estate, green energy, startups, art, SME, health & science, social causes, education, or farming. The minimum investment amount varies from platform to platform depending on the sector or specific platform objectives.

- The European crowdfunding market has recently made tremendous strides. Technology advancements and increasing proptech businesses in Europe have created new crowdfunding opportunities in real estate, banking, and other industries.

- For instance, In April this year, Heura's second Equity for Good Rebels crowdfunding campaign raised almost USD 4.22 million in just 12 hours, cementing its reputation as Europe's fastest-growing plant-based firm. The Crowdcube campaign saw 4,500 investors from all over Europe join the Good Rebel community, which is on a mission to speed the protein transition.

- Germany is a key market for crowdfunding, as evidenced by the several foreign platforms aggressively courting German investors or trying to extend their operations there. However, until recently, Germany's regulatory climate for private crowdfunding enterprises could have been better. One of the main barriers to cross-border service provision was the absence of unified law, so when the EU regulation on Crowdfunding Service Providers (ECSPR) was created, it initially seemed that Germany would need help to implement it as easily as other EU nations. As a result, on June 2021, the German Parliament passed a bill into national legislation that implements the EU regulation on Crowdfunding Service Providers.

- Even though the local level of the German crowdfunding regulation has some shortcomings, it is anticipated that the robust German FinTech industry, in general, and crowdfunding, in particular, will not be negatively impacted by the new rule, and the German crowdfunding platforms will witness a steady rise in the study period.

Crowdfunding Industry Overview

The global crowdfunding market is moderately consolidated due to the presence of a few companies dominating the market with the presence of many other companies competing between themselves. Also, these companies are investing extensively in offering customers a wide range of technologies for industry-specific end-user applications. Some of the recent developments in the market are:

In October 2022, Bad Comet, a South Korean board game manufacturer, announced the launch of their newest board game as a Kickstarter campaign.

In April 2022, Crowdcube launched a France-facing website. Crowdcube is a platform for crowdsourcing securities in the UK and throughout Europe. Recent regulatory changes will make it easier for Crowdcube, which has been active in Europe for some time, to support issuers in raising up to Euro 5 million (USD 5.27 million) throughout European member states.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment on the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Use of Social Media as a Free of Cost Promotion Source

- 5.1.2 Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors

- 5.2 Market Restraints

- 5.2.1 Time Consuming Process and Stringent Regulatory Compliance

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Reward-based Crowdfunding

- 6.1.2 Equity Crowdfunding

- 6.1.3 Donation and Other Product Types

- 6.2 By End-User Application

- 6.2.1 Cultural Sector

- 6.2.2 Technology

- 6.2.3 Product

- 6.2.4 Healthcare

- 6.2.5 Other End-User Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-pacific

- 6.3.4 Middle East & Africa

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kickstarter PBC

- 7.1.2 Indiegogo Inc.

- 7.1.3 GoFundMe Inc.

- 7.1.4 Fundable LLC

- 7.1.5 Crowdcube Limited

- 7.1.6 GoGetFunding

- 7.1.7 Crowdfunder Inc.

- 7.1.8 Alibaba Group Holding Limited

- 7.1.9 Wefunder Inc.

- 7.1.10 Fundly

- 7.1.11 Jingdong Inc.

- 7.1.12 Suning.com Co. Ltd

- 7.1.13 Owners Circle

- 7.1.14 Realcrowd Inc.