|

市場調查報告書

商品編碼

1643171

罐頭食品市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Food Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

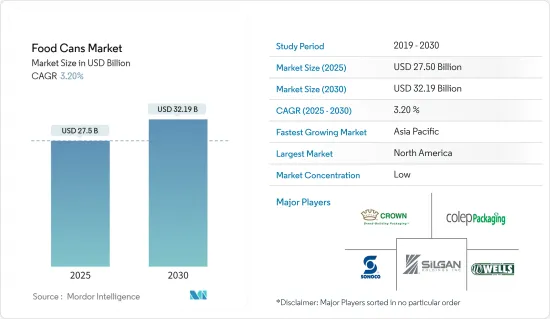

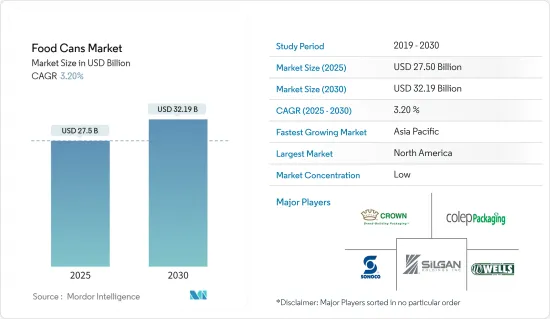

2025 年罐頭食品市場規模預計為 275 億美元,預計到 2030 年將達到 321.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.2%。

罐頭越來越受歡迎,可用於保存各種食品,包括水果、蔬菜、豆類、湯、肉類和魚貝類,這為包裝公司提供了巨大的市場機會。新興國家對即食罐頭食品的需求激增預計將擴大市場規模。

關鍵亮點

- 罐頭食品已成為保存食品新鮮度和營養成分的熱門選擇。罐頭製造流程的增加可望延長包裝食品的保存期限,從而增強罐頭食品市場。鋼鐵作為飲料和冷凍乳製品包裝罐的材料的使用越來越多,為在這個市場營運的公司創造了巨大的機會。

- 另一方面,金屬罐可無限回收,預計將推動食品包裝公司對金屬罐的需求成長。根據美國鋼鐵協會統計,煉鋼過程中生產的90%以上的產品被重新利用或回收。

- 快速的都市化、不斷變化的飲食習慣、不斷提高的收入水平和不斷增加的已調理食品消費正在推動全球對罐頭食品的需求。此外,人們對食品品質的日益關注和對衛生食品的需求不斷增加預計將促進市場成長。新興國家對食品包裝解決方案的高需求為市場參與企業提供了有利可圖的機會。

- 該行業還需要對替代包裝選擇的支持,例如塑膠包裝。塑膠是食品工業中廣泛使用的包裝材料。塑膠以其柔韌性、耐用性和重量輕而聞名。由於人們對塑膠造成的環境污染的擔憂日益增加,可回收塑膠材料的使用日益增加。此類替代材料的成長可能會影響罐頭食品市場的成長。

- 金屬罐包裝面臨來自塑膠、紙和玻璃等其他包裝解決方案的競爭。塑膠包裝仍然是金屬包裝的主要競爭對手。食品業是金屬罐的主要用戶,現在開始採用可回收塑膠包裝解決方案。塑膠罐是透明的,這有助於品牌表明食品的品質。塑膠的透明度和成本效益特性可能會限制金屬食品罐的市場。

罐頭食品市場的趨勢

鋁罐市場成長最快

- 鋁罐有利於長期維持食品品質。這些罐子聲稱可以幾乎 100% 抵抗光、氧氣、濕氣和其他污染物。它還具有防銹、防腐蝕功能,可延長保存期限。鋁具有光滑、輕巧等重要特性,可協助製造商節省物流成本。

- 鋁罐因其可堆疊性、重量輕、強度高、耐運輸、不規則物料輸送和易於回收等多種因素而變得越來越重要,使得品牌能夠使用更少的材料來包裝和運輸更多產品。根據美國地質調查局預測,2021年鋁消費量進口量為483萬噸,2023年將達480萬噸。

- 鋁罐的一大優點是可回收。罐頭中使用的鋁幾乎100%都可以熔化並重新利用。鋁罐在其生命週期結束時可以回收利用,這使其成為整個食品行業品牌的首選包裝形式。

- 紐約大學全球公共衛生學院研究人員的一項新研究表明,幾十年來,幾乎美國每個階層的超加工食品消費量都有所增加。美國的平均飲食結構正在轉向加工飲食。這是一個令人擔憂的問題,因為吃大量超加工食品會導致飲食品質不佳並增加患多種慢性疾病的風險。超加工食品是工業生產的即食或加熱食品,含添加劑,一般不含全食物。

- 產品包裝的可回收性正引發消費者尋求更多永續產品的興趣。因此,被譽為可無限回收的鋁越來越受到產品製造商及其消費者的歡迎。轉向使用鋁的行業包括食品包裝產品。向鋁的轉變也反映在綠色包裝的預期成長。

亞太地區可望創下最快成長

- 金屬罐的環境效益及其簡單且快速的回收利用,以及對罐頭產品日益成長的需求,預計將對該地區市場的成長產生積極影響。政府對蔬菜、麵條、肉類等塑膠包裝產品的監管日益嚴格,為市場成長創造了機會。

- 亞太地區對自然資源利用的需求不斷成長,刺激了回收活動並增加了金屬的再利用。該地區各國的鋁罐回收率差異很大。

- 日本等國家進口鋁罐,根據日本鋁罐回收協會(JACRA)的數據,2023 年進口量將達到 4.3 億個滿罐和 6,000 萬個空罐,高於 2021 年的 4.1 億個滿罐和 9,000 萬個空罐。

- 都市化進程加快、可支配收入增加、核心家庭增加以及對方便產品的偏好正在推動加工食品的需求。透過加工和銷售食品,他們可以賣出更高的價格並獲得更大的經濟價值。例如,根據印度儲備銀行的估計,製造預製家常小菜可為產品增加 30% 的價值,而加工肉類可為產品增加 12.7% 的價值。

- 據IBEF稱,印度有巨大的潛力成為世界主要加工食品出口國。這些包括豐富的農業資源基礎、戰略地理位置和接近性糧食進口國,以及廣泛的食品加工培訓、學術和研究設施網路。預計食品業對經濟成長至關重要,2022 年的市場規模將達到 8,660 億美元。 2023年,食品市場預計將創造9,630億美元的收益。

罐頭食品產業概況

罐頭食品市場本質上是細分的,許多主要企業不斷試圖搶佔最大的市場佔有率。主要參與企業包括 Crown Holdings Inc.、Silgan Holdings Inc.、CANPACK SA、Wells Can Company 和 Sonoco Products Company。

- 2024年1月,供應食品罐的澳洲包裝回收公司Visy Industries宣布收購塑膠回收再利用Advanced Circular Polymers (ACP)。這項策略性舉措將加強 Visy 的回收業務,並防止大量難以回收的塑膠最終進入垃圾掩埋場。

- 2023 年 11 月,Sonoco Products Company 收購了 Amcor Packaging(澳洲)的複合槽業務。 Amcor 的業務由兩家工廠組成,一家位於墨爾本郊外,一家位於悉尼,主要服務於香辛料、食品和清潔劑市場。收購Amcor的罐頭廠將進一步加強該公司在亞太地區的地位。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 收入水準的提高和零售體系的發展導致包裝食品和食品飲料的消費量增加

- 市場限制

- 食品業對軟質塑膠替代品的需求不斷增加

第6章 市場細分

- 依材料類型

- 鋁罐

- 鋼罐

- 按應用

- 調理食品

- 粉末產品

- 魚貝類

- 水果和蔬菜

- 加工食品

- 寵物食品

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Crown Holdings, Inc.

- Wells Can Company

- Kian Joo Group

- Silgan Holdings Inc.

- CANPACK SA(CANPACK Group)

- Aaron Packaging Inc.

- Toyo Seikan Group Holdings Ltd.

- Visy Industries

- Jamestrong Packaging

- Colep Packaging

- Trivium Packaging

- Sonoco Products Company

第8章投資分析

第9章:市場的未來

The Food Cans Market size is estimated at USD 27.50 billion in 2025, and is expected to reach USD 32.19 billion by 2030, at a CAGR of 3.2% during the forecast period (2025-2030).

The increase in the popularity of canned food to preserve a wide variety of food, such as fruits, vegetables, beans, soups, meats, and seafood, offers significant market opportunities for packaging companies. The surge in demand for ready-to-eat canned food products in developing countries is expected to boost the market value.

Key Highlights

- Food cans are a widespread option for maintaining the freshness and nutritional content of food products. An increase in the canning process to enhance the shelf life of packaged food is expected to strengthen the food cans market. The rise in the utilization of steel as the material for cans for packaging beverages and frozen dairy products presents significant opportunities for companies operating in the market.

- On the other hand, metal cans are infinitely recyclable, which is anticipated to fuel the growth of these cans among food packaging companies. According to the American and Iron Steel Institute, over 90% of the co-products from the steel-making process are reused or recycled.

- Rapid urbanization, changing food habits, increased income levels, and increased consumption of ready-to-eat food are fueling the demand for canned food cans across the world. Moreover, the rise in concern over food quality and increased demand for hygienic food are expected to contribute to the market growth. Significant demand for food packaging solutions in developing countries offers lucrative opportunities for market players.

- The industry also needs help with alternative packaging options, such as plastic packaging. Plastic is a widely used packaging material in the food industry. It is known for its flexibility, durability, and lightweight. The usage of recyclable plastic materials is gaining traction due to the growing concerns about environmental pollution caused by plastic. Such growth of alternative materials can affect the market growth of food cans.

- Metal can packaging faces much competition from other packaging solutions such as plastic, paper, or glass. Plastic packaging continues to be the main competitor of metal packaging. The food industry, the primary user of metal cans, has started adopting recyclable plastic packaging solutions. Plastic cans are transparent, which helps brands to show their food's quality. Plastic's transparent and cost-effective properties might limit the metal food cans market.

Food Cans Market Trends

Aluminum Cans to Witness Highest Market Growth

- Aluminum cans deliver long-term food quality preservation advantages. These cans offer nearly 100% protection against light, oxygen, moisture, and other contaminants. They are rust and corrosion-resistant, providing extended shelf life. Aluminum has significant properties, such as being smoother and lighter, aiding manufacturers in saving logistics expenses.

- Aluminum cans are gaining significance due to various factors, such as stackability, light weight, strength, resistance to transportation, irregular handling, and easy recyclability, allowing brands to package and transport more using less material. According to the US Geological Survey, the imports of aluminum consumption in 2021 were 4,830 thousand metric tons, and they reached 4,800 thousand metric tons in 2023.

- One of the significant benefits of aluminum cans is that they are recyclable. Almost 100% of the aluminum used in the cans can be melted down and utilized too. These can be recycled at the end of their lifecycle, making them the preferred packaging type for brands across the food industry.

- According to a new study by the NYU School of Global Public Health researchers, the consumption of ultra-processed foods has risen over a couple of decades across nearly all segments of the US population. The composition of the average US diet has moved toward a more processed diet. This is concerning, as eating more ultra-processed foods is associated with inadequate diet quality and a higher risk of several chronic diseases. Ultra-processed foods are industrially manufactured, ready to eat or heat, include additives, and are mainly devoid of whole foods.

- The recyclability of product packaging is of increasing interest to consumers seeking more sustainable products. As a result, aluminum, which is touted as infinitely recyclable, is gaining traction among product manufacturers and the consumers they serve. Industries transitioning to aluminum include food packaging products. The move to aluminum is reflected in the expected growth of green packaging.

Asia-Pacific Expected to Register Fastest Growth

- The environmental advantages of metal cans and their easy and quick recycling, along with the growing demand for canned products, are anticipated to positively affect the market growth in the region. Increasing government restrictions on plastic packaging products for packing vegetables, noodles, meat, etc., are creating opportunities for market growth.

- Growing demand for the utilization of natural resources in the region has revved recycling activities and increased the reuse of metals in the Asia-Pacific. There are substantial variations in the recycling rate of aluminum cans across the countries in the region.

- Countries such as Japan import aluminum cans to the country, and according to the Japan Aluminum Cans Recycling Association (JACRA), in 2023, the actual cans imported were 430 million units, and empty cans were 60 million units, and imports increased from 410 actual cans and 90 empty cans in 2021.

- Increased urbanization, higher disposable incomes, the growth of nuclear families, and a preference for convenience goods are driving the demand for processed food products. Selling food in processed form allows one to charge a more significant price and capture a more considerable economic value. For instance, according to an estimation by the RBI, manufacturing prepared meals adds 30% value to the product, whereas processing meat adds 12.7%.

- According to the IBEF, India has significant potential to become a global processed food export powerhouse. It includes an affluent agricultural resource base, strategic geographic location and proximity to food-importing countries, and an expansive network of food processing training, academic, and research facilities. With a market size of USD 866 billion in 2022, the food industry was projected to be critical to the economy's growth. In 2023, the food market was expected to generate USD 963 billion in revenue.

Food Cans Industry Overview

The food cans market is fragmented in nature, as many key players continually try to gain maximum market share. Some of the major players include Crown Holdings Inc., Silgan Holdings Inc., CANPACK SA, Wells Can Company, and Sonoco Products Company.

- In January 2024, Australian packaging and recycling company Visy Industries, a provider of food cans, announced the acquisition of Advanced Circular Polymers (ACP), a plastic recycling company. This strategic move will bolster Visy's recycling operations and prevent a significant volume of hard-to-recycle plastics from ending in landfills.

- In November 2023, Sonoco Products Company purchased the composite can operations of Amcor Packaging (Australia). The Amcor operations consist of two plants, one in suburban Melbourne and the other in Sydney, and they mainly serve the spice, food, and cleanser sectors. Acquiring the Amcor can plants will further strengthen its position in the Asia-Pacific.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Improving Income Levels and Development of Retail Systems are Increasing the Consumption of Packaged Food and Beverages.

- 5.2 Market Restraints

- 5.2.1 Increasing Demand for Alternatives, such as Flexible Plastics, in the Food Industry.

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminium Cans

- 6.1.2 Steel Cans

- 6.2 By Application

- 6.2.1 Ready Meals

- 6.2.2 Powder Products

- 6.2.3 Fish and Seafood

- 6.2.4 Fruits and Vegetables

- 6.2.5 Processed Food

- 6.2.6 Pet Food

- 6.2.7 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings, Inc.

- 7.1.2 Wells Can Company

- 7.1.3 Kian Joo Group

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 CANPACK S.A. (CANPACK Group)

- 7.1.6 Aaron Packaging Inc.

- 7.1.7 Toyo Seikan Group Holdings Ltd.

- 7.1.8 Visy Industries

- 7.1.9 Jamestrong Packaging

- 7.1.10 Colep Packaging

- 7.1.11 Trivium Packaging

- 7.1.12 Sonoco Products Company