|

市場調查報告書

商品編碼

1644459

亞非罐頭食品 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Asia and Africa Food Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

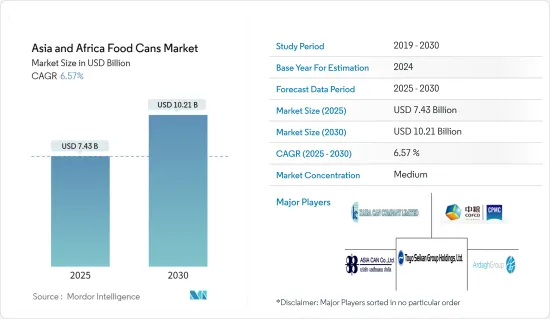

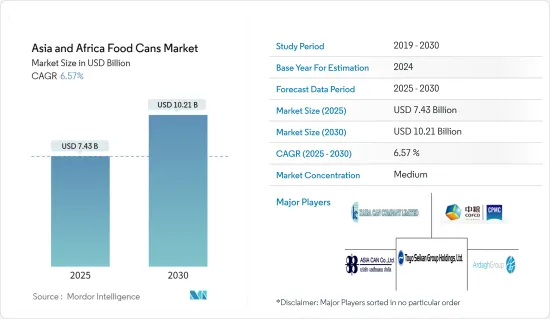

預計 2025 年亞洲和非洲罐頭食品市場規模將達到 74.3 億美元,到 2030 年預計將達到 102.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.57%。

新冠疫情為食品消費帶來了許多變化。食品和雜貨的購買模式凸顯了消費者偏好的變化,其中保存期限長的食品和罐頭食品成為食品購物清單的首選。此外,還有一些含有增強免疫系統成分和高營養價值的新產品。在新冠肺炎疫情導致的挨家挨戶購物和經濟緊縮的背景下,冷凍食品在亞洲消費者中獲得了成長。

關鍵亮點

- 金屬罐的優異的防腐性能和結構完整性可提供更長的保存期限,因此在亞洲和非洲的食品包裝行業中得到廣泛應用。忙碌的生活方式和工作日程使得包裝食品和簡便食品食品成為許多消費者的主食。例如,根據人口問題實驗室的數據,2019年世界都市化程度(城市人口占總人口的百分比)約為54%。

- 根據IIED預測,到2020年,亞洲國家的城市人口將佔全球的53.9%。非洲也擁有世界上成長最快的城市地區,預計到 2050 年將有 9.5 億人居住在非洲城市。

- 各地區金屬產業均呈現淨成長趨勢。在非洲,從鍍錫鋼罐轉向鋁罐預計將為廢金屬和回收業增加每年 1 億至 2 億蘭特的收入。而根據知名飲料罐製造商 Nampak Bevcan 介紹,透過收集和銷售舊罐頭,該行業有可能為另外 2,000-3,000 人提供收入來源。

- 亞洲的趨勢與東南亞的成長混合在一起。來自中國和日本的多家製造商已在該地區建立了業務。例如,昭和鋁罐公司正致力於透過「2020+計劃」加速其在東南亞的中期業務成長。

- 截至2020年10月,位置東南亞的多個大型鋼鐵計劃正得到中國投資的支持。與此同時,據報道,越來越多的食品公司正在從塑膠包裝轉向更可回收的罐頭,東南亞地區正受到關注。總部位於東京的UACJ株式會社計劃在2021年提高其東南亞工廠的鋁板產能。

亞洲和非洲罐頭食品市場的趨勢

水果和蔬菜推動市場成長

- 罐裝蔬菜和水果比冷凍或新鮮替代品便宜,營養價值不折扣。罐裝蔬菜的唯一缺點是其鈉含量,但消費者可以選擇鈉含量較低的蔬菜或清潔蔬菜。

- 聯合國機構2021年1月發布的報告稱,13億南亞人無法負擔健康飲食。此外,疫情導致水果、蔬菜和乳製品的價格上漲,罐裝蔬菜和水果成為更好的選擇。

- 從產量來看,印度和中國是蔬菜和水果的主要生產國。根據聯合國糧食及農業組織的數據,2019年中國生產了5.8826億噸新鮮蔬菜,其次是印度,產量為1.3203億噸。蔬菜的大規模生產為罐裝蔬菜延長保存期限創造了機會。

- 出口也帶動了蔬菜和水果罐頭出口品質的提升。例如,根據中國和加拿大簽署的合作備忘錄,中國蔬菜罐頭有特定的出口要求。

韓國經濟成長速度驚人

- 在韓國,加工肉類、蔬菜、加工蔬菜製品等商品日益增加。根據韓國國家統計資料庫(KOSIS)的數據顯示,2020年每個家庭每月在加工肉品上的平均支出從12,190韓元增加到14,470韓元。

- 同樣,在蔬菜和蔬菜加工製品上的支出也從 2019 年的 33,580 韓元增加到 2020 年的 41,370 韓元。因此,國內加工肉類和蔬菜產品的成長帶來了對罐頭食品等適當包裝的需求。

- 政府致力於2030年將塑膠廢棄物排放減少一半,並將回收率從34%提高一倍至70%。

- 此外,政府於2020年5月修訂了食品接觸材料的規範和標準。最新修訂涵蓋了通用的製造標準和規範,包括對食品用具、容器和包裝的製造方法和佈局的改進。

- 該標準還包括有關再生塑膠樹脂使用的澄清。因此,政府採取措施推動該國的食品罐頭工業,鼓勵人們擺脫塑膠和鋼鐵、鋁等其他材料。

- COVID-19 疫情在向罐頭食品的轉變中發揮了重要作用,從而推動了罐頭食品市場的發展。例如,根據新世界百貨的調查,截至2020年2月,罐頭食品的線上銷量大幅增加了268%,其次是米(187%)、泡麵(175%)和家常小菜(168%)。

亞洲和非洲罐頭食品產業概況

亞非罐頭食品市場的特徵是主要市場參與企業之間的競爭適中,新進入者不斷增加。市場先驅者正在投入更多精力進行研究和開發,為媒體參與企業整合先進的特性和能力。公司不斷創新並建立戰略夥伴關係以保持市場佔有率。

- 2021 年 2 月-Ardagh Group 同意將其金屬包裝業務部門與 Gores Holdings V 合併,組成一家上市公司。根據該協議,特殊目的收購公司 Gores Holdings V 將與 Ardagh 的金屬包裝 (AMP) 部門合併,組成一家名為 Ardagh Metal 的新公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 可回收性高,可替代金屬罐

- 成本和便利優勢推動罐頭食品需求

- 產品創新延長保存期限

- 市場問題

- 塑膠在每個地區仍然是可靠的替代品

- 市場機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭強度

- 替代品的威脅

- 工業供應鏈分析

- COVID-19 市場影響

第5章 市場區隔

- 材料

- 鋁罐

- 鋼罐/錫罐

- 罐裝型

- 2 件

- 3 件

- 應用

- 魚貝類

- 水果和蔬菜

- 加工食品

- 寵物食品

- 其他

- 地區

- 亞洲

- 中國

- 印度

- 韓國

- 東南亞

- 非洲

- 南非

- 亞洲

第6章 競爭格局

- 公司簡介

- Crown Holdings Inc.

- ORG Packaging Co. Limited

- Kian Joo Can Factory(Can One)

- Silgan Holdings Inc.

- CPMC Holdings Limited

- Kaira Can Private Limited

- Toyo Seikan Group Holdings Ltd

- Ardagh Group

- Asia Can Co. Ltd

- Royal Cans Industries Company

- CanSmart Group

- MC Packaging(Pte)Ltd

- Dongwon Systems

- Can It

- Nampak Ltd

第7章投資分析

第 8 章:市場的未來

The Asia and Africa Food Cans Market size is estimated at USD 7.43 billion in 2025, and is expected to reach USD 10.21 billion by 2030, at a CAGR of 6.57% during the forecast period (2025-2030).

COVID-19 has brought a slew of changes to food consumption. Food and grocery purchase patterns highlighted the changing consumer preferences; shelf-stable foods and canned goods were positioned on top of the grocery shopping list. Moreover, newer products were aligned to have immune system boosting ingredients and nutritional aspects. Frozen foods, among Asian consumers amid the COVID-19 pandemic, garnered growth during lockdowns and tightening economics.

Key Highlights

- The excellent preservative properties and structural integrity of the metal cans, offering higher shelf life, have resulted in the high usage of metal cans in the food packaging industry across Asia and Africa. Packaged and convenience foods have become a staple diet for many consumers, owing to their hectic lifestyles and work schedules. For instance, according to the Population Reference Bureau, in 2019, the degree of urbanization (percentage of the urban population in total population) across the world was around 54%.

- According to IIED, across the Asian counterparts, the percentage of the world's urban population living in the region was estimated at 53.9% in 2020. Also, Africa is projected to have the fastest urban growth rate in the world, i.e., by 2050, African cities may be home to an additional 950 million people.

- Metal industries in the respective regions demonstrate a net flourishing trend. In Africa, between ZAR 100 million and ZAR 200 million per year is expected to flow into the scrap metals and recycling industry due to the conversion from tin-plated steel cans to aluminum cans. Also, the industry may provide an additional 2,000-3,000 people a source of income from collecting and selling used cans, as per a reputed beverage can manufacturer, Nampak Bevcan.

- Asian trends are mixed with Southeast Asia's growth. Multiple manufacturers from China and Japan have expanded their footprint in the region. For instance, via its Project 2020+, Showa Aluminum Can Corporation has focused on the growth acceleration of its business in the medium-term by targeting Southeast Asia.

- Then, as of October 2020, multiple large steel projects located in Southeast Asia were underpinned by Chinese investment. At the same time, Southeast Asia reportedly gained attention as more food companies shifted away from plastic containers for more recyclable cans. UACJ Corporation, a Tokyo-based company, is expected to boost the output capacity of aluminum sheets at its Southeast Asian plants by 2021.

Asia & Africa Food Cans Market Trends

Fruits and Vegetables to Drive the Market Growth

- Canned fruits and vegetables cost less when compared to frozen alternatives or fresh alternatives without compromising nutrition. The only drawback for canned vegetables is the sodium content, but consumers can choose lower sodium versions or rinse the vegetables.

- According to the United Nations agency report published in January 2021, 1.3 billion South Asians could not afford a healthy diet. Further, the pandemic has increased the prices of fruits, vegetables, and dairy products, making canned fruits and vegetables a better option.

- From the production point of view, India and China are the primary producers of vegetables and fruits. According to the Food and Agriculture Organization, in 2019, China produced 588.26 million metric ton of fresh vegetables, followed by India at 132.03 million metric ton. The massive production of vegetables creates opportunities for canning to increase the shelf life.

- The exports are also triggering the quality improvement of the canned vegetable and fruit exports. For instance, according to a memorandum signed by China and Canada, the Chinese canned vegetables have specific export requirements.

South Korea to Witness Significant Growth Rate

- South Korea has seen growth in items such as processed meat, vegetables, and processed vegetables. According to the National Statistics database of Korea (KOSIS), the average monthly expenditure on processed meat per household increased from KRW 12,190 to KRW 14,470 in 2020.

- Similarly, the expenditure on vegetables and processed vegetables increased from KRW 33,580 in 2019 to KRW 41,370 in 2020. Thus, the growth in the processed meat and vegetables in the country creates the need for appropriate packaging, such as cans.

- The government is making efforts to reduce its plastic waste production by half and more than double recycling rates from 34% to 70% by 2030.

- Also, in May 2020, the government revised the standards and specifications for food contact materials. The revision is for common manufacturing standards and specifications, including improved methods and layouts for food utensils, containers, and packaging.

- The standards also include clarification on the use of recycled plastic resins. Hence, government initiatives encourage the push away from plastics and other materials such as steel and aluminum, thus driving the country's food cans.

- The COVID-19 pandemic has played a significant role in the shift toward canned food, thus driving the market for food cans. For instance, according to a survey by Shinsegae, as of February 2020, the online sales of canned food increased by a significant 268%, followed by rice (187%), instant noodles (175%), and prepared meals (168%).

Asia & Africa Food Cans Industry Overview

The Asian and African food cans market is characterized by moderate competitiveness among key market players and an increase in the number of new entrants. Market players are further focusing on research and development to integrate advanced functions and capabilities into media players. The companies keep on innovating and entering strategic partnerships to retain their market share.

- February 2021 - Ardagh Group entered an agreement to merge its Metal Packaging business segment with Gores Holdings V, thereby creating a public listed company. The agreement would see Gores Holdings V, a special purpose acquisition company, merge with Ardagh's Metal Packaging (AMP) division to form the newly created Ardagh Metal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Recyclable Score of Metal Cans over Alternatives

- 4.2.2 Demand for Canned Foods Driven by Cost and Convenience-related Advantages

- 4.2.3 Product Innovations Leading to Increased Shelf Life

- 4.3 Market Challenges

- 4.3.1 Plastic Remains a Highly Credible Alternative in the Regions

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Intensity of Competitive Rivalry

- 4.5.5 Threat of Substitutes

- 4.6 Industry Supply Chain Analysis

- 4.7 Impact of COVID-19 on the Market

5 Market Segmentation

- 5.1 Material

- 5.1.1 Aluminum Cans

- 5.1.2 Steel/Tin Cans

- 5.2 Can Type

- 5.2.1 2-piece

- 5.2.2 3-piece

- 5.3 Application

- 5.3.1 Fish and Seafood

- 5.3.2 Fruits and Vegetables

- 5.3.3 Processed Food

- 5.3.4 Pet Food

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 Asia

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 South Korea

- 5.4.1.4 Southeast Asia

- 5.4.2 Africa

- 5.4.2.1 South Africa

- 5.4.1 Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Crown Holdings Inc.

- 6.1.2 ORG Packaging Co. Limited

- 6.1.3 Kian Joo Can Factory (Can One)

- 6.1.4 Silgan Holdings Inc.

- 6.1.5 CPMC Holdings Limited

- 6.1.6 Kaira Can Private Limited

- 6.1.7 Toyo Seikan Group Holdings Ltd

- 6.1.8 Ardagh Group

- 6.1.9 Asia Can Co. Ltd

- 6.1.10 Royal Cans Industries Company

- 6.1.11 CanSmart Group

- 6.1.12 MC Packaging (Pte) Ltd

- 6.1.13 Dongwon Systems

- 6.1.14 Can It

- 6.1.15 Nampak Ltd