|

市場調查報告書

商品編碼

1644340

亞太工業電池:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Asia-Pacific Industrial Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

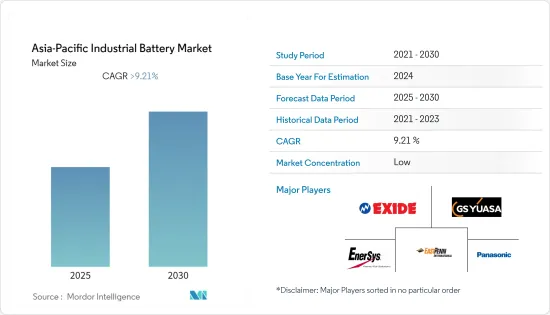

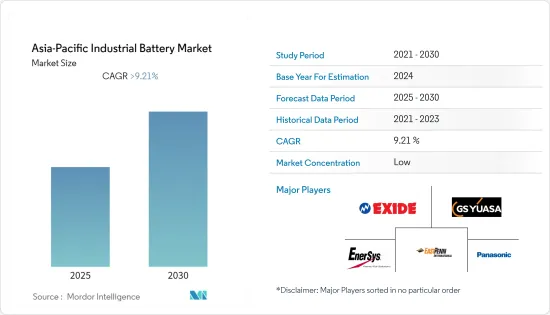

預計預測期內亞太工業電池市場複合年成長率將超過 9.21%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長遠來看,鋰離子電池價格下降、資料中心和通訊領域需求增加以及可再生能源整合的增加是推動市場發展的一些關鍵因素。

- 另一方面,價格不確定性以及鈷、鉛和鋰等原料的可用性等因素可能會在預測期內抑制市場成長率。

- 人們對技術先進的電池的日益關注以及在電池製造研發階段使用人工智慧可能會為電池公司創造重大機遇,使其能夠投資和重新分配資源以創造突破性的電池技術。

- 受電網側能源儲存產業、資料中心和通訊產業需求的推動,亞太工業電池市場可能會見證來自中國的巨大需求。

亞太工業電池市場趨勢

鋰離子電池 (LIB) 技術需求旺盛

- 預計預測期內鋰離子電池(LIB)將在工業電池市場中見證顯著成長,這主要歸功於其良好的容量重量比。推動 LIB 應用的其他因素包括其性能提升、能量密度提高和成本降低等特性。

- 通常情況下,LIB 的價格高於其他電池。然而,市場領導者正在投資研發活動,以提高 LIB 的性能和價格,從而獲得規模經濟。商業和住宅能源儲存系統(ESS) 等新興市場的出現正在推動對 LIB 的需求。

- 由於價格下跌,鋰離子電池在電池能源儲存市場的需求龐大。鋰離子電池預計很快將佔據電池能源儲存市場的最大佔有率,因為它們維護成本低、重量輕、循環壽命可靠、單位體積能量密度高、充放電效率高。

- 最近的發展包括亞太地區的電動汽車產業正在經歷巨大的發展。光是在該地區,2021 年電動車銷量就將接近 296 萬輛。預計電動車的廣泛使用最終將推動市場成長。

- 鋰離子堆高機電池透過降低人事費用和提高生產力在物料輸送應用中提供了額外的優勢。與鉛酸電池相比,鋰離子堆高機電池可以在低溫下(甚至在冷凍庫中)快速充電,並且在較低溫度下保持其容量。對更快交付產品的需求不斷成長也推動了北美、歐洲和亞太等新興地區的物流和配送改善。因此,預計未來幾年物料輸送產業對工業鋰離子電池的需求將會增加。

- 2021年12月,寧德時代宣布其位於福建省寧德市的最大工廠於週三投產。該生產工廠的年產能將達到120GWh。隨著中國電動車市場的快速成長,該公司已將電池規劃產能提升至300GWh以上,包括已投產及待建產能。

- 因此,基於上述因素,預計預測期內鋰離子電池技術將在工業電池市場中看到巨大的需求。

中國:預計需求旺盛

- 中國擁有多個正在成長的經濟體,擁有豐富的自然資源和人力資源。基於政府鼓勵製造業的政策層面支持,印度預計在未來幾年成為電池企業的主要投資熱點。

- 截至 2021 年,純電動車 (BEV) 佔中國汽車市場的 10.9%。中國被譽為全球最大的電動車市場。電動車的興起反過來將支持該國工業電池的成長。

- 可再生能源發電量大幅增加、公用事業公司宣布的2021年能源儲存目標,加上電池成本下降等因素,正在推動該國大規模能源儲存容量的增加。因此,預計 2021 年能源儲存採用的成長將在未來幾年持續,成為預測期內該國工業電池市場的最大驅動力之一。

- 中國是應用人工智慧(AI)和機器學習技術的領先國家之一。然而,隨著AI細分領域的成長,資料收集和處理的需求正在快速成長。國內資料中心的容量並未以同樣的速度成長。因此,為了滿足需求,資料中心產業預計將出現投資激增,這將推動該國對 UPS 的需求,從而推動市場發展。

- 2022年9月,四川省政府發布全省製造業發展新計畫。該計畫的重點是電池,目標是到2027年將四川打造成為世界一流的新能源汽車(NEV)研發和製造基地。

- 因此,基於上述因素,預計預測期內中國將對工業電池市場產生正面影響。

亞太工業電池產業概況

亞太地區工業電池市場適度細分。主要參與企業(不分先後順序)包括 Exide Industries Ltd、GS Yuasa Corporation、East Penn Manufacturing Company Inc.、Panasonic Corporation 和 EnerSys。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 按主要技術類型分類的電池價格趨勢和預測(美元/千瓦時)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 技術板塊

- 鋰離子電池

- 鉛酸電池

- 其他技術(鎳鎘電池、鎳氫電池、鋅碳電池等)

- 應用

- 堆高機

- 電信

- UPS

- 其他

- 地區

- 中國

- 印度

- 日本

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- C&D Technologies Pvt. Ltd

- East Penn Manufacturing Company Inc.

- EnerSys

- Exide Industries Ltd

- GS Yuasa Corporation

- Amara Raja Batteries Ltd

- Panasonic Corporation

- Saft Groupe SA

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 71173

The Asia-Pacific Industrial Battery Market is expected to register a CAGR of greater than 9.21% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, declining lithium-ion battery prices, increasing demand from data centers and telecom sectors, and rising renewable energy integration are some of the major factors driving the market.

- On the other note, factors such as uncertainty in raw material prices and availability of raw materials, such as cobalt, lead, and lithium, are likely to curtail the market growth rate during the forecast period.

- The rising focus on technologically advanced batteries and the use of artificial intelligence in the R&D phase of battery manufacturing is likely to create a massive opportunity for the battery companies to invest and redirect their resources to make a breakthrough battery technology.

- China is likely to witness significant demand in the Asia-Pacific industrial battery market, supported by the grid-side energy storage sector and the demand for data center and the telecom industry.

APAC Industrial Battery Market Trends

Lithium-ion Battery (LIB) Technology to Witness Significant Demand

- Lithium-ion battery (LIB) is expected to witness significant growth in the industrial battery market over the forecast period, majorly due to its favourable capacity-to-weight ratio. Other factors boosting the LIB adoption include its properties, like better performance, higher energy density, and decreasing price.

- The price of LIB is usually higher compared to other batteries. However, leading players in the market have been investing in R&D activities to improve LIB's performance and price to gain economies of scale. The emergence of new and exciting markets, such as Energy Storage Systems (ESS), for both commercial and residential applications is driving the demand for LIB.

- Due to declining prices, lithium-ion batteries are witnessing massive demand in the battery energy storage market. Also, lithium-ion batteries are expected to hold the most significant share in the battery energy storage market soon, as they require little maintenance, are lightweight, have a reliable cycle life, have high energy density regarding volume, and have high charge/discharge efficiency.

- Throughout recent years the electric vehicle industry across the Asia-Pacific region has experienced huge developments. The region alone sold close to 2.96 million battery electric vehicles in 2021. The adoption of electric vehicles will, in turn, culminate in the market's growth.

- Lithium-ion forklift batteries provide an extra edge to material handling applications by reducing labor costs and improving productivity. Lithium-ion forklift batteries can be fast-charged in cold temperatures (even inside freezers) and can maintain their capacity in cold temperatures better than their lead-acid counterparts. The increasing demand for the fast delivery of products also has pushed for improvements in logistics and distribution in emerging regions like North America, Europe, and Asia-Pacific. This, in turn, is likely to boost the demand for industrial li-ion batteries in the material handling industry in the coming years.

- In December 2021, CATL announced that its largest factory in Ningde city, Fujian Province, started production on Wednesday. The manufacturing facility has an annual production capacity of 120 GWh. Along with the rapid growth of China's EV market, the company has boosted its planned battery capacity, including capacity under production and to be built, to over 300 GWh.

- Therefore, based on the above-mentioned factors, Lithium-ion battery technology is expected to witness significant demand in Industrial Battery Market during the forecast period.

China to Witness Significant Demand

- China has multiple growing economies with substantial natural and human resources. India is expected to become a major investment hotspot for battery companies in the coming years, based on the policy-level support from the government encouraging the manufacturing sector.

- As of 2021, Battery Electric Vehicles (BEVs) accounted for 10.9 per cent of the Chinese vehicle market. China is known as the biggest market for electric vehicles in the world. The growing number of Battery Electric Vehicles will, in turn, support the growth of industrial batteries within the country.

- Factors such as significant growth in renewable power generation capacity, and energy storage targets released by electric utilities in 2021, coupled with the declining battery costs, have driven the large-scale energy storage capacity additions in the country. Hence, the growth witnessed in the energy storage deployment in 2021 is expected to continue in the coming years, which, in turn, is expected to be one of the biggest drivers for the industrial battery market in the country, during the forecast period.

- China is among the forerunners using artificial intelligence (AI) and machine learning technologies. But, with the growth of the AI sector, demand for data collection and processing is rising rapidly. The data centers capacity in the country has not increased at the same pace. Hence, to meet the demand, the data center industry is expected to witness a surge in investments, which is expected to drive the demand for UPS in the country, in turn driving the market.

- In September 2022, the Sichuan provincial government issued a new plan for developing the province's manufacturing industry. A key focus of the plan is electric batteries and the transformation of Sichuan into a world-class New Energy Vehicle (NEV) research and manufacturing base by 2027.

- Therefore, based on the above-mentioned factors, China is expected to positively impact the industrial battery market during the forecast period.

APAC Industrial Battery Industry Overview

The Asia-Pacific Industrial Battery Market is moderately fragmented. Some of the major players (not in a particular order) include Exide Industries Ltd, GS Yuasa Corporation, East Penn Manufacturing Company Inc., Panasonic Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Battery Price Trends and Forecast in USD per kWh, by Major Technology Type

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Other Technologies (Nickel Cadmium Battery, Nickel Metal Hydride, Zinc Carbon, etc.)

- 5.2 Application

- 5.2.1 Forklift

- 5.2.2 Telecom

- 5.2.3 UPS

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 C&D Technologies Pvt. Ltd

- 6.3.2 East Penn Manufacturing Company Inc.

- 6.3.3 EnerSys

- 6.3.4 Exide Industries Ltd

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Amara Raja Batteries Ltd

- 6.3.7 Panasonic Corporation

- 6.3.8 Saft Groupe SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219