|

市場調查報告書

商品編碼

1690725

北美工業電池:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Industrial Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

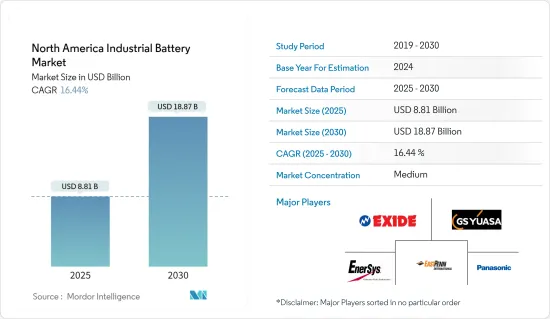

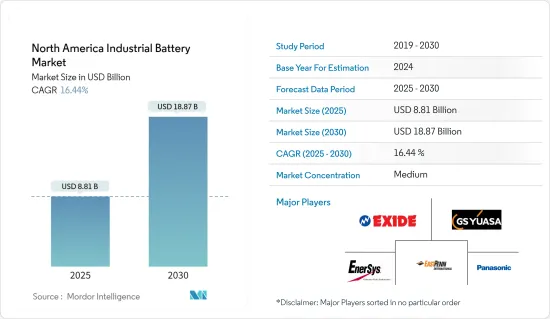

北美工業電池市場規模預計在 2025 年為 88.1 億美元,預計到 2030 年將達到 188.7 億美元,預測期內(2025-2030 年)的複合年成長率為 16.44%。

主要亮點

- 從長遠來看,鋰離子電池價格下降、資料中心和本地通訊產業需求增加以及可再生能源整合的提高是推動市場發展的關鍵因素。

- 然而,預測期內,當地生產所需原料蘊藏量不足等因素抑制了市場成長率。

- 然而,人們對技術先進的電池的日益關注以及在電池製造研發階段擴大使用人工智慧,可能會為電池公司創造重大機會,使其能夠投資並引導資源創造突破性的電池技術。

- 由於不斷擴大的再生能源基礎設施和工業生產,預計美國將在預測期內主導北美工業電池市場。

北美工業電池市場趨勢

鋰離子電池 (LIB) 技術預計將成為成長最快的細分市場

- 在各種類型的工業電池技術中,鋰離子電池(LIB)類型預計將在預測期內在北美工業電池市場見證顯著成長,這主要歸功於其有利的容量重量比。推動 LIB 應用的其他因素包括其性能提升、能量密度提高和成本降低等特性。

- 全球鋰離子電池製造商都致力於降低鋰離子電池的成本。過去十年來,鋰離子電池價格大幅下跌。 2023年,鋰離子電池的平均價格將約為每千瓦時139美元,比2013年下降82%以上。鋰離子電池價格下跌可能會鼓勵工業電池製造商以更低的成本增加電子設備、小型和大型家電、UPS和電能能源儲存系統的產量。

- 2023年11月,美國政府宣佈在《基礎建設法案》中撥款35億美元,用於促進鋰離子等先進電池的國內生產。作為投資美國議程的一部分,政府資金預計將在未來幾年內幫助提高鋰離子電池和電池組的製造能力。

- 此外,過去幾年美國一直在開發鋰離子超級工廠。 2024 年 2 月,EnerSys 提到在格林維爾的奧古斯塔格羅夫商業園區開發一個 2,000 平方英尺的鋰離子電池製造工廠。 EnerSys 計劃於 2027 年開始生產鋰離子電池,以滿足美國工業和國防需求。

- 隨著鋰離子電池在各行業的使用激增,其安全性至關重要,以消除不受控制的自熱和爆炸的可能性。不過,對於高品質的鋰離子電池來說,此類事件很少見,但進行安全檢查至關重要。

- 2024年2月,加拿大國家研究委員會(NRC)宣布開發出用於評估鋰離子電池模組或組中單電池熱失控故障的測試技術。此專利機制稱為熱失控啟動機制(或TRIM)裝置,可用於測試鋰離子電池設計和組件。這對於有關監管機構制定電池使用者的安全指南將有很大幫助。

- 因此,基於上述因素,預計鋰離子電池技術在預測期內將表現出巨大的需求,並成為北美工業電池市場成長最快的部分。

預計美國將主導市場

- 美國是全球工業電池的主要熱點地區之一,得益於基於電池的能源儲存計劃激增、再生能源基礎設施不斷擴大以及工業基礎設施強大。此外,支援美國部署能源儲存系統(ESS)的優惠政策可能會在未來幾年推動工業電池市場的發展。

- 近年來,由於國家對可再生能源基礎設施的投資增加,美國電池能源儲存系統(BESS) 產業經歷了顯著成長。過去幾年,全球可再生能源裝置容量和發電量穩步成長,美國是全球可再生能源熱點地區之一。

- 根據美國能源資訊署 (EIA) 的數據,到 2023 年,美國將增加 6.4 千兆瓦的電池儲存量和增加的電力容量。此次擴張凸顯了該國致力於加強可再生能源基礎設施和減少對石化燃料依賴的決心。

- 根據國際可再生能源機構(IRENA)的數據,2013年至2023年間,美國可再生能源裝置容量將增加一倍以上,到2023年,美國可再生能源總合裝置容量將達到約387.54 GW。

- 據美國能源資訊署稱,美國公共產業規模的電池儲存容量預計將增加近一倍,開發商計劃在 2023 年增加 14.3 GW 至 15.5 GW。 2023 年,美國電網將增加 6.4 GW 的新電池儲存容量,年增率為 70%。德克薩斯預計新增裝置容量6.4吉瓦,加州新增裝置容量5.2吉瓦,佔新增裝置容量的82%。

- 此外,開發商計劃在 2022 年至 2025 年期間安裝 20.8 GW 公用事業規模電池容量,其中 75% 將位於德克薩斯州(7.9 GW)和加利福尼亞州(7.6 GW)。

- 在美國,加州獨立系統營運商(CAISO)和德克薩斯州電力可靠性委員會(ERCOT)正在增加最多的電池容量。在過去的 12 個月中,加州獨立系統營運商 (CAISO) 的電池儲存容量佔太陽能容量的百分比大幅增加,從 2023 年 1 月的 29% 增加到 2023 年 12 月的 41%。

- 此外,政府正積極尋求國際合作,以加強美國的BESS產業。例如,2023年12月,歐盟委員會與澳洲、美國和加拿大政府共同支持了一項新計劃,以在全球向低排放電力轉型過程中推動電池儲存的發展。

- 該計劃是在聯合國氣候大會COP28期間宣布的,名為“超級充電電池儲存舉措”,源自清潔能源部長級會議,其成員包括許多國家的能源部。此類雙邊清潔能源活動可望幫助美國開發強勁的電池能源儲存系統系統市場。

- 因此,由於上述因素,預計美國將在預測期內主導北美工業電池市場。

北美工業電池產業概況

北美工業電池市場規模減少了一半。主要參與者(不分先後順序)包括 Exide Industries Ltd、GS Yuasa Corporation、East Penn Manufacturing Company Inc.、Panasonic Holding Corporation 和 EnerSys。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 2029 年各主要技術類型的電池價格趨勢及預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 鋰離子電池成本下降

- 限制因素

- 當地生產所需原料短缺

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 技術領域

- 鋰離子電池

- 鉛酸電池

- 其他技術(鎳鎘電池、鎳氫電池、鋅碳電池等)

- 應用

- 堆高機

- 電信

- UPS

- 其他用途

- 地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- C&D Technologies Pvt. Ltd

- East Penn Manufacturing Company Inc.

- EnerSys

- Exide Industries Ltd

- GS Yuasa Corporation

- Leoch International Technology Limited Inc.

- Panasonic Holding Corporation

- Saft Groupe SA

- List of Other Prominent Companies(Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 市場排名分析

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 71172

The North America Industrial Battery Market size is estimated at USD 8.81 billion in 2025, and is expected to reach USD 18.87 billion by 2030, at a CAGR of 16.44% during the forecast period (2025-2030).

Key Highlights

- Over the long term, declining lithium-ion battery prices, increasing demand from data centers, regional telecom industries, and rising renewable energy integration are some major factors driving the market.

- On the other hand, factors such as the lack of prominent raw material reserves required for local production are likely to curtail the market's growth rate during the forecast period.

- Nevertheless, the rising focus on technologically advanced batteries and the growing use of artificial intelligence in the R&D phase of battery manufacturing are likely to create massive opportunities for battery companies to invest and redirect their resources to make breakthrough battery technologies.

- The United States is expected to dominate the North American industrial batteries market during the forecast period, owing to the country's expansion in renewable power infrastructure and industrial production.

North America Industrial Battery Market Trends

Lithium-ion Battery (LIB) Technology Projected to be the Fastest-growing Market Segment

- Among the different types of industrial battery technologies, the lithium-ion battery (LIB) type is expected to witness significant growth in the North American industrial batteries market over the forecast period, majorly due to its favorable capacity-to-weight ratio. Other factors boosting LIB adoption include properties like better performance, higher energy density, and decreasing price.

- Global lithium-ion battery manufacturers are focusing on reducing the cost of lithium-ion batteries. The price of lithium-ion batteries declined steeply over the past ten years. In 2023, the price of an average lithium-ion battery was valued at around USD 139 per kWh, having witnessed a decrease of more than 82% in the price compared to 2013. The decline in lithium-ion battery prices will encourage industrial battery manufacturers to mobilize the production of electronics, small and large appliances, UPS, and electrical energy storage systems at cheaper rates.

- In November 2023, the US government announced a funding of USD 3.5 billion under the ambit of its Infrastructure Law to expedite indigenous production of advanced batteries such as lithium-ion in the country. As a part of the Invest in America Agenda, government funding is expected to help lithium-ion cell and pack manufacturing capabilities over the coming years.

- Further, the United States has been witnessing the development of lithium-ion gigafactories in recent years. In February 2024, EnerSys noted the development of a square-foot lithium-ion battery manufacturing unit at the Augusta Grove Business Park in Greenville. By 2027, EnerSys plans to start manufacturing lithium-ion battery cells to cater to the demand for industrial and defense applications in the United States.

- Owing to the surge in the utilization of lithium-ion batteries across various industries, their safety is of immense importance in eliminating the possibility of uncontrolled self-heating instances and explosions. Such events are, however, rare for high-quality lithium-ion batteries, but it becomes critically important to hold safety checks.

- In February 2024, the National Research Council of Canada (NRC) announced the development of a testing technique to assess the single-cell thermal runaway failure of lithium-ion battery modules or packs. The patented mechanism known as the Thermal Runaway Initiation Mechanism (or TRIM) device can be used to test the design and components of lithium-ion batteries. This can significantly help the concerned regulators devise safety guidelines for battery users.

- Therefore, based on the abovementioned factors, lithium-ion battery technology is expected to witness significant demand and be the fastest-growing segment of the North American industrial batteries market during the forecast period.

United States Projected to Dominate the Market

- The United States is one of the major hotspots for industrial batteries worldwide on account of the surging deployment of battery-based energy storage projects, expansion in renewable power infrastructure, and a robust industrial infrastructure. Moreover, favorable policies backing the deployment of energy storage systems (ESS) in the United States are likely to drive the industrial batteries market over the coming years.

- The US battery energy storage systems (BESS) industry has been experiencing notable growth over the past few years, supported by rising investments in renewable energy infrastructure in the country. Over the past few years, the installed renewable energy capacity and generation have been rising steadily globally, and the United States is one of the global renewable energy hotspots.

- In 2023, according to the Energy Information Administration (EIA), the United States augmented its electric capacity with a significant addition of 6.4 gigawatts in battery storage, marking a notable 2.2 gigawatt increase over the previous year. This expansion underscored the country's commitment to enhancing its renewable energy infrastructure and reducing reliance on fossil fuels.

- According to the International Renewable Energy Agency (IRENA), during 2013-23, installed renewable energy capacity grew by more than two times, and as of 2023, the total installed renewable capacity stood at around 387.54 GW in the United States.

- According to the US Energy Information Administration, the US utility-scale battery storage capacity was expected to nearly double, with developers planning to add 14.3 GW to the 15.5 GW in 2023. In 2023, 6.4 GW of new battery storage capacity was added to the US grid, marking a 70% annual increase. Texas and California were expected to contribute 82% of the new capacity, with 6.4 GW and 5.2 GW, respectively.

- Moreover, 75% of the 20.8 GW of utility-scale battery capacity planned by developers to be installed from 2022 to 2025 is in Texas (7.9 GW) and California (7.6 GW).

- In the United States, the California Independent System Operator (CAISO) and Electric Reliability Council of Texas (ERCOT) have the most large-scale battery storage capacity additions. Over the past twelve months, battery capacity as a percentage of solar generation capacity in CAISO has significantly increased, climbing from 29% in January 2023 to 41% by December 2023.

- In addition, the government is also proactively assuring international ties to make a robust BESS industry in the United States. For instance, in December 2023, the European Commission, together with the national governments of Australia, the United States, and Canada, supported a new initiative to promote battery storage in the global transition to low-emission electricity.

- This initiative, announced during the COP28 UN Climate Conference, called the 'Supercharging Battery Storage Initiative,' originates from the Clean Energy Ministerial, which includes energy departments from numerous countries as members and participants. Such bilateral clean energy activities are expected to help the United States develop a robust market for battery energy storage systems.

- Therefore, based on the abovementioned factors, the United States is expected to dominate the North American industrial batteries market during the forecast period.

North America Industrial Battery Industry Overview

The North American industrial batteries market is semi-fragmented. Some of the major players (not in any particular order) include Exide Industries Ltd, GS Yuasa Corporation, East Penn Manufacturing Company Inc., Panasonic Holding Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, Till 2029

- 4.3 Battery Price Trends and Forecasts, By Major Technology Type, Till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Declining Costs of Lithium-ion Batteries

- 4.6.2 Restraints

- 4.6.2.1 Lack of Prominent Raw Material Reserves Required for Local Production

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Other Technologies (Nickel Cadmium Battery, Nickel Metal Hydride, Zinc Carbon, etc.)

- 5.2 Application

- 5.2.1 Forklift

- 5.2.2 Telecom

- 5.2.3 UPS

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 C&D Technologies Pvt. Ltd

- 6.3.2 East Penn Manufacturing Company Inc.

- 6.3.3 EnerSys

- 6.3.4 Exide Industries Ltd

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Leoch International Technology Limited Inc.

- 6.3.7 Panasonic Holding Corporation

- 6.3.8 Saft Groupe SA

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219