|

市場調查報告書

商品編碼

1644343

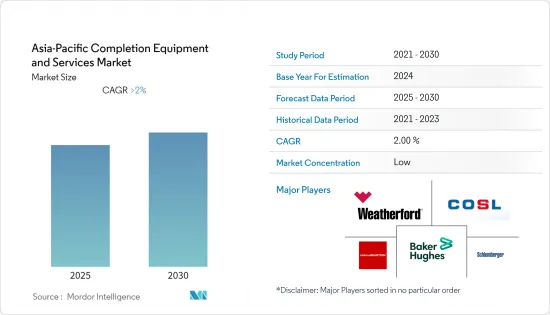

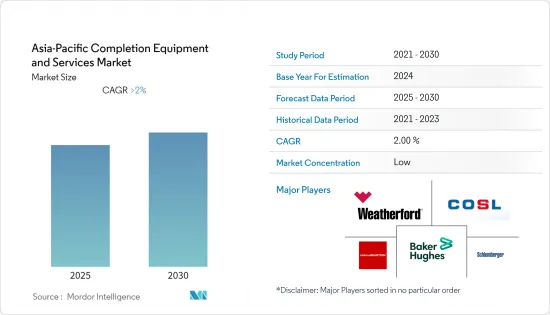

亞太地區成套設備與服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Completion Equipment and Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區完工設備和服務市場預計在預測期內實現超過 2% 的複合年成長率

關鍵亮點

- 從長遠來看,預計傳統型和非傳統資源產量增加以及油井維修成本下降等因素將推動市場發展。

- 另一方面,由於岩層薄弱,中國和印度等國家石油和天然氣開採困難,是阻礙市場成長的主要因素。

- 隨著完井等各項技術的不斷進步,高階自適應流入控制完井技術的出現,可望使油氣生產更加可行、高效,為完井配套服務市場創造巨大機會。

- 由於石油和天然氣產量豐富、技術進步以及對互補設備服務市場的投資不斷增加,預計中國將在預測期內成為最大的市場。預計還會進一步成長。

亞太地區成套設備與服務市場趨勢

海上業務實現顯著成長

- 在海上領域,完井設備和服務已經證明了其在管理多區多邊井和水平井生產方面的價值,因為井下干涉成本高且風險高。預計技術的進一步進步將推動市場成長。

- 完井設備的改進為該領域引入了智慧完井或智慧完井等新模式。智慧完井涉及永久性井下感測器,將資料傳輸到地面,以便在數位井平台上進行本地或遠端監控。

- 提供這些資料是為了增加油井產量,這些數據可能是自動化的,也可能不是。這些系統用於海上油田,以減少油井的產水量。

- 根據貝克休斯公司統計,亞太地區海上鑽機數量估計約84個。南海和孟加拉灣等地區的探勘和生產增加可能有助於市場海上部門的成長。

- 因此,由於投資增加、技術進步和石油產量增加,預計預測期內海上部門將成為成長最快的部門。

中國主導市場

- 2021年,中國成為該地區最大的石油生產國。它也是鑽井技術的最大用戶之一,特別是在該國頁岩層中經濟可行的傳統型碳氫化合物資源回收方面。這是因為頁岩油氣儲存的操作比傳統油井更複雜,而且成熟速度更快。因此,傳統型的儲存需要更多地使用完井設備和服務來生產石油。

- 國內原油產量從2020年的390.1萬桶/日增加2.4%至2021年的399.4萬桶/日。預測期內產量可能進一步增加,進而推動中國成品設備和服務市場的發展。

- 此外,預計該國石油和天然氣探勘和生產的增加將推動該國完井設備和服務市場的發展。例如,2022年1月,中國海洋石油總公司(中海油)將2022年的產量目標設定為比去年的目標高出10%,同時預計國內原油產量將在2030年達到穩定水平,國內天然氣產量將在2035年達到穩定水平,與中國燃料需求達到峰值相一致。

- 這家海上石油和天然氣生產商的目標是到 2022 年產量達到創紀錄的 6 億至 6.1 億桶,而 2021 年的產量為 5.45 億至 5.55 億桶。

- 因此,由於產量增加、技術進步和高效率有助於石油和天然氣生產,預計中國將在預測期內佔據市場主導地位。

亞太地區已建成設施及服務業概況

亞太地區成套設備和服務市場呈現細分化。該市場的主要企業(不分先後順序)包括斯倫貝謝有限公司、哈里伯頓公司、貝克休斯公司、威德福國際公司和中海油田服務股份有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 至2027年原油產量及需求預測(單位:百萬桶/日)

- 天然氣產量及預測(至 2027 年,單位:十億立方英尺)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 部署位置

- 陸上

- 海上

- 地區

- 中國

- 馬來西亞

- 印度

- 印尼

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Weatherford International PLC

- FTS International Inc.

- Baker Hughes Company

- National-Oilwell Varco Inc.

- Trican Well Service Ltd

- Superior Energy Services Inc.

- Weir Group PLC

- Welltec AS

- Schoeller-Bleckmann Oilfield Equipment AG

- Schlumberger Ltd

- China Oilfield Services Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 71210

The Asia-Pacific Completion Equipment and Services Market is expected to register a CAGR of greater than 2% during the forecast period.

Key Highlights

- Over the long term, factors like increased production of conventional and unconventional resources and lower well-maintenance costs are expected to drive the market.

- On the other hand, difficulty in extracting oil and gas in countries like China and India due to weak lithologies are the major restraints hindering the market's growth.

- Nevertheless, the increasing technological advancements in various technologies like well completion, which results in high-end self-adaptive inflow control completion technology, are expected to make the production of oil and gas more feasible and efficient and are expected to create enormous opportunities for well completion and services market.

- China is expected to be the largest market in the forecast period due to its abundant oil and gas production, technological advancements, and increasing investment in the completion equipment and services market. It is expected to facilitate further growth.

APAC Completion Equipment & Services Market Trends

Offshore Segment to Witness Significant Growth

- In the offshore segment, the well intervention is expensive and high-risk, well completions equipment and services have proven their value in managing production from multilateral wells, and horizontal wells with multiple zones. Further advancements in technologies are expected to aid the growth of the market.

- The improvements in the completion equipment have incorporated new paradigms in the sector, like intelligent or smart well completion. Intelligent completions include permanent downhole sensors that transmit data to the surface for local or remote monitoring in a digital well platform.

- All these data could or could not be automated but delivered to increase the production of the well. These systems are being used in the offshore segment as a method to decrease the production of water from the wells.

- The offshore rig count in the Asian-Pacific region is estimated by Baker Hughes Company to be around 84 units. An increase in exploration and production in areas such as the South China Sea and the Bay of Bengal may aid the growth of the offshore segment of the market.

- Hence, the offshore sector is expected to be the fastest-growing segment in the forecast period due to an increase in investments, technological advancement, and oil production.

China to Dominate the Market

- China was the largest producer of oil in the region in 2021. It is also among the largest user of well-completion techniques, which, among others, are used in the economically viable recovery of unconventional sources of hydrocarbons in the country's shale plays. This is because shale oil and gas reservoirs are more complicated to handle and tend to mature faster than conventional wells. Therefore, unconventional reservoir wells require higher usage of well completion equipment and services to produce the oil.

- Crude oil production in the country has increased by 2.4%, to 3994 thousand barrels per day, in 2021 from 3901 thousand barrels per day in 2020. The output may increase further in the forecast period and boost the China completion equipment and services market.

- Furthermore, the increasing oil and gas exploration and production in the country is expected to drive the well completion equipment and services market in the country. For instance, in January 2022, China's China National Offshore Oil Corporation (CNOOC) Ltd set its 2022 production target at 10% above last year's goal while expecting its domestic crude oil output to hit a plateau by 2030 and domestic natural gas by 2035 in line with China's peak fuel demand.

- The offshore oil and gas producer targeted a record output of 600 million-610 million barrels of oil equivalent (boe) in 2022 versus 545 million-555 million boe in 2021.

- Hence, China is expected to dominate the market in the forecast period due to an increase in production, advancements in technologies, and high efficiency in aiding oil and gas production.

APAC Completion Equipment & Services Industry Overview

The Asian-Pacific completion equipment and services market is fragmented. Some key players in this market (in no particular order) are Schlumberger Ltd, Halliburton Company, Baker Hughes Company, Weatherford International PLC, and China Oilfield Services Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2027

- 4.3 Crude Oil Production and Forecast, in million barrels per day, till 2027

- 4.4 Natural Gas Production and Forecast, in billion cubic feet, till 2027

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 China

- 5.2.2 Malaysia

- 5.2.3 India

- 5.2.4 Indonesia

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Weatherford International PLC

- 6.3.2 FTS International Inc.

- 6.3.3 Baker Hughes Company

- 6.3.4 National-Oilwell Varco Inc.

- 6.3.5 Trican Well Service Ltd

- 6.3.6 Superior Energy Services Inc.

- 6.3.7 Weir Group PLC

- 6.3.8 Welltec AS

- 6.3.9 Schoeller-Bleckmann Oilfield Equipment AG

- 6.3.10 Schlumberger Ltd

- 6.3.11 China Oilfield Services Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219