|

市場調查報告書

商品編碼

1644344

歐洲成套設備與服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Completion Equipment and Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

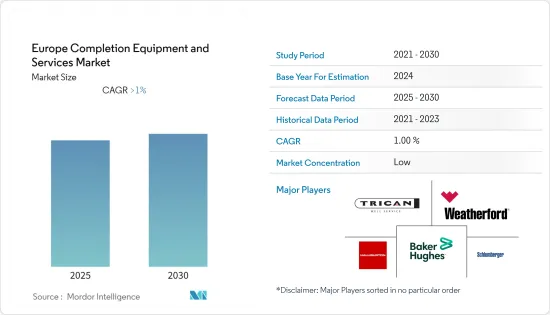

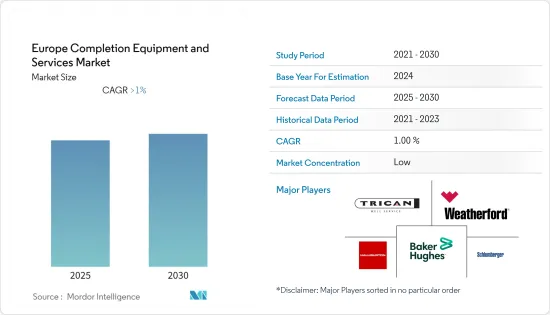

預計預測期內歐洲成套設備和服務市場將以超過 1% 的複合年成長率成長。

從長遠來看,預計傳統型和非傳統資源產量增加以及油井維修成本下降等因素將推動市場發展。

同時,歐盟和美國因戰爭對俄羅斯實施的製裁可能會使兩家公司之間的合資企業難以維持。有限的知識和經驗轉移是阻礙市場成長的主要因素。

不斷提高的技術進步,例如更好的完井技術,帶來高階自適應流入控制完井技術,有望使石油和天然氣生產更加可行和高效,為完井服務市場創造巨大的機會。

由於石油和天然氣產量豐富、技術進步以及對完整設備和服務市場的投資不斷增加,預計俄羅斯將在預測期內成為最大的市場。預計還會進一步成長。

歐洲成套設備與服務市場趨勢

陸上市場佔據主導地位

- 在陸上領域,完井設備和服務已證明其在管理多分支井、多層級水平井、非均質儲存、傳統型儲存和成熟儲存的生產方面具有價值。預計技術的進一步進步將有助於市場的成長。

- 頁岩地層中的井建設需要長水平段。這種需求正在推動更好的膠結機制的發展。一種稱為動態水泥化的新方法,該方法可保持管道運動直到水泥開始凝固,從而最大限度地提高泥漿和水泥的置換過程。最新的固井軟體與即時鑽機儀器相結合,確保了高品質的完井。

- 儘管該地區的頁岩氣仍處於休眠狀態,但技術領域的不斷進步可能會使市場更具活力,並在預測期內促進其成長。

- 貝克休斯公司估計2022年11月該區陸上鑽井鑽機數量約71座。探勘和生產的增加,例如在阿爾巴尼亞南部第 2 和第 4 區塊發現大量頁岩蘊藏量,可能促進市場成長。

- 因此,由於投資增加和技術進步,預計陸上部分將成為預測期內最大的部分。

俄羅斯佔據市場主導地位

- 2021年,俄羅斯是該地區最大的原油和天然氣生產國。這也是鑽井技術的主要應用之一,主要用於經濟有效地回收該國的傳統碳氫化合物資源。私營和政府公司利用鑽井設備和服務業,探索傳統儲存的替代方法,以有效開採石油和天然氣。

- 由於與烏克蘭戰爭而受到製裁,許多公司已撤出該國並將其股份出售給當地公司。國內石油公司正在透過內部研發實驗室在鑽井設備市場上尋求進口替代技術。然而,開發商業性可行的技術和完全實現基本設備的國產化預計需要時間。市場專業知識需要足夠的投資和努力才能達到所需的基準。

- 預計2021年國內原油產量將從2020年的1066.7萬桶/日增加2.6%至1094.4萬桶/日。預測期內產量可能會進一步增加,從而推動俄羅斯成品設備和服務市場的發展。

- 儘管俄羅斯將在2022年成為該地區最大的石油和天然氣生產國,但由於入侵烏克蘭和地緣政治限制,今年其鑽井活動已大幅下降。 2022年鑽井數量與2021年相比減少了28%以上。預計這一下降趨勢將持續到 2023 年。

- 儘管受到製裁,但許多亞洲國家仍加大購買俄羅斯廉價石油的力度。印度、中國和土耳其的需求與國內需求同步成長,減少了上游的損失。

- 根據國際能源總署 2022 年 8 月的分析,2022 年 7 月俄羅斯的產量為每天 31 萬桶,低於入侵前的水平,而總出口量每天下降了 58 萬桶。

- 因此,由於產量增加、技術進步和高效率有助於石油和天然氣生產,預計俄羅斯將在預測期內佔據市場主導地位。

歐洲已建成設施與服務業概況

歐洲成套設備和服務市場適度細分。該市場的主要企業(不分先後順序)包括斯倫貝謝有限公司、哈里伯頓公司、貝克休斯公司、威德福國際公司和 Trican Well Service 有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 石油產量及預測(截至 2027 年,單位:百萬桶/日)

- 天然氣產量及預測(至 2027 年,單位:十億立方英尺)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 部署位置

- 陸上

- 海上

- 地區

- 俄羅斯

- 挪威

- 英國

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Weatherford International plc

- Baker Hughes Company

- Trican Well Service Ltd

- Welltec AS

- Schlumberger Ltd

- Halliburton Company

- Schoeller-Bleckmann Oilfield Equipment AG

- Weir Group plc

- Superior Energy Services Inc.

- National-Oilwell Varco Inc.

第7章 市場機會與未來趨勢

The Europe Completion Equipment and Services Market is expected to register a CAGR of greater than 1% during the forecast period.

Over the long term, factors like increased production of conventional and unconventional resources and lower well-maintenance costs are expected to drive the market.

On the other hand, sanctions imposed on Russia by the European Union and the United States due to the war may make it difficult to maintain joint ventures between the companies. Restricting knowledge and experience transfer are the major restraints hindering the market growth.

Nevertheless, the increasing technological advancements in various technologies like good completion, which results in high-end self-adaptive inflow control completion technology, are expected to make the production of oil and gas more feasible and efficient and create enormous opportunities for the well completion and services market.

Russia is expected to be the largest market in the forecast period due to its abundant oil and gas production, technological advancements, and increasing investment in the completion equipment and services market. It is expected to facilitate further growth.

Europe Completion Equipment & Services Market Trends

Onshore Segment to Dominate the Market

- In the onshore segment, well completion equipment and services have proven their value in managing production from multilateral wells, horizontal wells with multiple zones, wells in heterogeneous reservoirs, unconventional reservoirs, and mature reservoirs. Further advancements in technologies are expected to aid the growth of the market.

- Well construction in shale reserves requires long laterals. This need has pushed the development of better cementation mechanisms. The new method of dynamic cementation, where pipe movement is maintained until cement begins to set, maximizes the mud-cement displacement process. It can achieve high-quality completion using a combination of modern cementing software and real-time rig instrumentation.

- Although shale is in dormant stages in the region, increasing advancements in the technological field may make the market more viable and aid growth in the forecast period.

- Baker Hughes Company estimated the onshore rig count in the region to be around 71 units in November 2022. An increase in exploration and production, like the discovery of major shale reserves in Block 2 and Block 4 in the southern part of Albania, may aid in the market's growth.

- Hence, the onshore segment is expected to be the largest segment in the forecast period due to increased investments and technological advancement.

Russia to Dominate the Market

- In 2021, Russia was the region's top crude oil and natural gas producer. It is also one of the main uses of well-completion techniques, mostly used in the country's economically viable recovery of traditional hydrocarbon sources. Using the well-completion equipment and services industry, private and governmental firms are seeking alternative approaches for their conventional reservoirs to extract oil and gas efficiently.

- As a result of the country's sanctions due to its war with Ukraine, numerous companies have withdrawn from the country and sold their stakes to local players. Through in-house research and development institutes, domestic oil companies in the country are pursuing import substitution techniques in the well-completion equipment market. However, it is envisaged that the development of commercially viable technologies and entirely localized production of the essential equipment would take time. Market expertise necessitates sufficient investments and effort to meet the required benchmarks.

- Crude oil production in the country increased by 2.6%, to 10,944 thousand barrels per day, in 2021 from 10,667 thousand barrels per day in 2020. The output may increase further in the forecast period and boost the Russian completion equipment and services market.

- Even though Russia was the largest oil and gas producer in the region in 2022, Russia already witnessed a significant decline in drilling activity this year, owing to its invasion of Ukraine and geopolitical constraints. In 2022, the number of wells drilled fell by over 28% compared to 2021. This downward trend is predicted to continue till 2023.

- Despite the sanctions, many Asian countries stepped in to buy inexpensive Russian crude. Demand from India, China, and Turkey has increased in line with domestic demand, reducing upstream losses.

- According to an International Energy Agency analysis in August 2022, Russia produced 310,000 barrels per day in July 2022, a drop from pre-invasion levels, while total export levels were down by 580,000 barrels daily.

- Hence, Russia is expected to dominate the market in the forecast period due to increased production, technological advancements, and high efficiency in aiding oil and gas production.

Europe Completion Equipment & Services Industry Overview

The Europe completion equipment and services market is moderately fragmented. Some of the key players in this market (in no particular order) are Schlumberger Ltd, Halliburton Company, Baker Hughes Company, Weatherford International PLC, and Trican Well Service Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2027

- 4.3 Oil Production and Forecast, in million barrels per day, till 2027

- 4.4 Natural Gas Production and Forecast, in billion cubic feet, till 2027

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Russia

- 5.2.2 Norway

- 5.2.3 United Kingdom

- 5.2.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Weatherford International plc

- 6.3.2 Baker Hughes Company

- 6.3.3 Trican Well Service Ltd

- 6.3.4 Welltec AS

- 6.3.5 Schlumberger Ltd

- 6.3.6 Halliburton Company

- 6.3.7 Schoeller-Bleckmann Oilfield Equipment AG

- 6.3.8 Weir Group plc

- 6.3.9 Superior Energy Services Inc.

- 6.3.10 National-Oilwell Varco Inc.