|

市場調查報告書

商品編碼

1644353

印度雷射:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

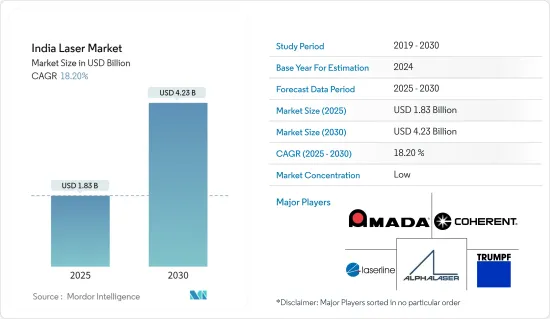

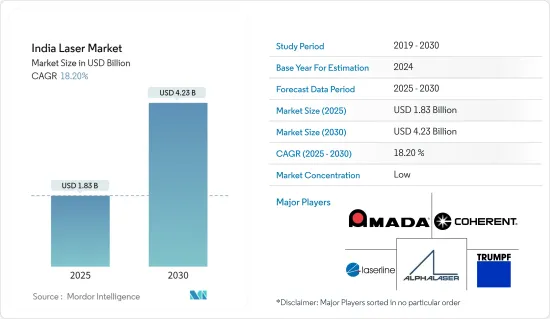

預計 2025 年印度雷射市場規模為 18.3 億美元,到 2030 年將達到 42.3 億美元,預測期內(2025-2030 年)的複合年成長率為 18.2%。

市場促進因素包括汽車、重工業、電子、基礎設施、鐵路、耐用消費品和其他行業。

主要亮點

- 傳統焊接技術在製造業領域已經佔有了一席之地。然而,高科技雷射焊接的進步使其在許多工業應用中變得經濟高效。一些雷射焊接系統可以進一步配置以執行附加功能,例如切割,鑽孔和序列化。在各種應用中,雷射焊接的行進速度比 TIG 焊接快 5 到 10 倍,比 MIG 焊接快 3 到 5 倍。

- 根據印度 Laser Technology Pvt. Ltd (LTPL) 的數據,雷射打標在設備銷售方面最為普遍,但雷射切割是 2021 年最大的收益貢獻者。雷射切割仍然是印度最受歡迎的雷射應用,預計至少在未來幾年仍將保持成長。這主要是由於雷射加工機成本下降以及政府對某些領域的干涉,尤其是基礎設施和汽車領域。然而,大多數機器都是從中國進口的。該公司預計未來幾年雷射切割產業將成長 1.5 倍。

- 然而,監管合規對市場是一個限制因素。雷射技術為固體雷射和光纖雷射提供了應用。這些雷射使用釹、鉻、鉺和鐿等稀土元素,稀土元素的加工和精製可能會對環境造成有害影響。其中一個主要影響是來自泥漿尾礦的放射性污染。

- COVID-19 對市場的影響可能會阻礙所研究市場的預期成長。由於一些製造廠被迫關閉或暫停生產,一些市場相關人員的收益出現下降。然而,預計預測期內市場開發創新將推動醫療保健產業的市場成長。

- 例如,2022 年 7 月,MaxiVision 眼科醫院推出了 Technolas Teneo 317 Model 2。德國技術團隊研發了最先進的高性能準分子雷射:Teneo M2。我們為各種患者提供個人化的護理,包括患有散光、遠視、近視和老花眼的患者。

印度雷射市場趨勢

汽車產業經歷顯著成長

- 印度雷射市場受汽車業推動。這些企業主要位於普納、班加羅爾、清奈、馬內薩爾(靠近德里)和艾哈默德巴德等汽車中心,佔據了金屬切割雷射加工車間市場的 80% 以上。工具機產業遍佈印度各地,但在旁遮普邦、昌迪加爾、盧迪亞納和哥印拜陀更為盛行。同時,鑽石加工雷射主要集中在蘇拉特,那裡有超過10,000-12,000台雷射正在使用中。

- 汽車業佔印度製造業GDP的49%和該國整體GDP的7.1%,而該行業一年多來一直在放緩。然而,新冠疫情爆發後,出現了V型復甦。根據印度品牌股權基金會(IBEF)預測,到2026年,印度汽車產業(包括零件製造)的規模將達到2,514億至2,828億美元。預計這將成為一個重要的成長要素。自從新冠疫情爆發以來,人們對個人化、更安全的出行選擇的需求以及新車客戶數量的增加推動了新車需求的持續成長。預計預測期內汽車產業的成長將推動市場發展。

- 印度政府也制定了電動車(EV)政策、印度第六階段(BSVI)法規和安全政策。汽車產業需要時間來適應這些變化,因此預計市場將暫時放緩。然而,預計在預測期內它將以前所未有的成長率反彈。

- 此類雷射切割設備的本地生產是不斷變化的環境中的關鍵要素之一。印度已有許多機械製造商生產和整合雷射切割機,包括 SIL Pune、SLTL Ahmedabad、Proteck Chennai 和 Delta Automation。另有十幾家公司正在製定在地化設備的策略。印度政府透過「印度製造」計畫等措施提供的政府補貼和財政援助成為本土生產的主要動力。根據該計劃,印度政府向中小微型企業提供高達 80% 的補貼。

- 此外,Intech Additive Solutions Pvt. Ltd(前身為Intech DMLS Pvt. Ltd)宣布,隨著新系列金屬3D列印機的推出,它將為印度製造業設計、開發和提供真正的「印度製造」技術解決方案。 iFusion 系列金屬 3D 列印機基於選擇性雷射熔融技術,旨在以高精度、穩定性、可靠性和更快的建造速度提供無與倫比的性能。

- Intech Additive Solutions 是日本金屬積層製造領域的領先公司。該公司為印度汽車行業等各個行業提供從概念設計到功能齊全的生產部件的端到端解決方案。

光纖雷射正在快速發展

- 光纖雷射切割機市場是印度成長最快的雷射市場。光纖雷射具有動態工作功率範圍,其中光束焦點及其位置隨著雷射功率的變化而保持不變。此外,透過改變光學配置可以實現各種光斑尺寸。這些功能可讓您選擇適當的功率密度來切割不同的金屬,例如碳鋼、不銹鋼和工具鋼。

- 用於工業應用的光纖雷射切割機的銷量正在迅速成長。主要是中國機械製造商,例如HSG Laser、Bodor Laser和Han's Laser,透過經銷商/經銷商進行銷售,其中包括Laser Technologies Mumbai、Laser Lab Delhi、Han's Laser和Golden Laser等在印度設有辦事處的印度企業,以及其他25-30家銷售中國切割機的經銷商。

- 印度的鋼鐵工業正在逐步發展,而鋼鐵是一種利用率很高的金屬。需求的成長可能會極大地有利於主要使用光纖雷射切割機的金屬成型產業。此外,根據印度焊接學會(IIW)的統計,印度幾乎 90% 的鋼材是在焊接過程中消耗的。預計預測期內這將進一步增加對雷射焊接設備的需求。根據世界鋼鐵協會2022年4月發布的資料,印度是全球十大產鋼國中唯一2022年1-3月鋼產量年增的國家,產量為3,190萬噸,成長5.9%。

- 在需要精密微切割的電氣和醫療行業中,光纖雷射正在取代化學分層和固體雷射切割。這些變數以及對窄幅板材切割和精加工設備日益成長的需求將推動該行業在研究期間擴張。

- 由於光纖雷射的功能不斷增強,預計其使用量在預測期內將持續成長。 2021 年 1 月,OmniGuide 宣布其 OTO-U CO2 雷射系統光纖已獲得 FDA 批准並商業化,用於耳鼻喉和耳部手術。這有助於增強可視性、147 微米的小組織目標尺寸,以及使用其他先進的雷射能量系統和靈活的儀器進行機器人手術。

印度雷射產業概況

印度雷射市場高度分散,進入門檻較低,再加上雷射設備製造商收入的不斷增加,導致競爭對手之間的競爭非常激烈。競爭策略主要包括設備和技術創新、產品發布、合作等。主要參與者包括AMADA、Coherent Corporation、Alpha Laser、Trumpf Group、Laserline GmbH 等。

2022 年 6 月,Bharat Fritz Werner Group 在印度推出了首款由 Meltio 驅動的雷射定向能量沉積 (L-DED) 機器:Photon 1000H 和 Photon 1000R。

2022 年 4 月,印度領先的 CNC 和工業 4.0 設備和技術公司 Bharat Fritz Werner Ltd (BFW) 和 m2nxt(BFW 的子公司)推出了 PHOTON 4000G 雷射定向能量沉積 (L-DED) 機器,該機器在印度製造並在全球發售。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 產業相關人員分析(OEM| 經銷商 | 整合商 | 最終使用者組織)

- 市場促進因素

- 市場集中度和產品可得性的提高有助於降低成本

- 雷射切割相關應用需求旺盛

- 更換現有設施,印度成為主要製造地點之一(受有利政策變化的支持)

- 市場挑戰

- 高度依賴海外供應商來滿足需求

- 供應問題

- 缺乏技術專業知識與在地生態系統

- 市場機會

- 雷射打標的可能性

- 預期買家槓桿發展

- 積極的成長前景

- 主要行業標準和法規

- COVID-19對印度雷射產業的影響評估

第5章 技術簡介

- 印度雷射光電產業的發展

- 按應用程式映射關鍵機會和使用案例

- 預計採用的主要世界/隊列

第6章 市場細分

- 按類型

- Co2雷射

- 光纖雷射

- Nd:YaG雷射

- 其他類型

- 按最終用戶

- 車

- 鐵路

- 建造

- 農業

- 通訊

- 太陽能產業

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- Trumf Group

- Amada Co. Limited

- Coherent Inc.

- Alpha Laser

- Laserline

- IPG Photonics

- Max Photonics Co. Limited

- Wuhan Raycus Fiber Laser Technologies Co. Limited

- nLight Inc.

第8章投資分析

第9章 未來市場展望

The India Laser Market size is estimated at USD 1.83 billion in 2025, and is expected to reach USD 4.23 billion by 2030, at a CAGR of 18.2% during the forecast period (2025-2030).

The automotive, heavy industrial, electronics, infrastructure, rail, consumer durables, and other sectors are the main drivers of the market.

Key Highlights

- The conventional techniques of welding have established a niche in the manufacturing sector. However, high-tech laser welding advancements operate economically and efficiently in several industrial applications. Some laser welding systems can be further configured to do additional functions such as cutting, drilling, and serializing. Laser welding offers travel speeds that can be five to ten times faster than TIG welding and three to five times faster than MIG welding in various applications.

- According to Laser Technology Pvt. Ltd (LTPL) India, laser marking is the most popular in terms of equipment sales, although laser cutting was the leading revenue contributor in 2021. In India, laser cutting is still the most popular laser application, and it is anticipated to develop for at least another couple of years. The primary cause is a decline in laser machine prices and government intervention in specific sectors, particularly infrastructure and automotive. Most of the machinery, however, is imported from China. The company anticipates the laser cutting industry to have 1.5X growth in the coming years.

- However, regulatory compliances act as restraints for the market. Laser technology provides the application of solid and fiber lasers. These lasers use rare elements such as neodymium, chromium, erbium, and ytterbium, where the processing and refining these rare earth elements may cause potentially hazardous environmental consequences. One of the significant consequences is radioactive pollution caused by slurry tailings.

- The COVID-19 impact on the market is likely to impede the anticipated growth in the studied market. With several manufacturing units observing shutdowns and temporary halts in production, several market players observed a dip in revenues. However, with innovations in product development, the market is expected to grow in the healthcare sector over the forecast period.

- For instance, in July 2022, MaxiVision Eye Hospital released the Technolas Teneo 317 Model 2. A skilled German technical team created a cutting-edge, high-performance excimer laser, the Teneo M2. It offers individualized care for various patients, including astigmatism, hyperopia, myopia, and presbyopia.

India Laser Market Trends

Automotive Sector to Witness Significant Growth

- The market for lasers in India is driven by the automotive sector; thus, job shops for sheet metal cutting. These are mainly located in automotive hubs such as Pune, Bangalore, Chennai, Manesar (near Delhi), and Ahmedabad, which account for more than 80% of the job shop market for metal-cutting lasers. While the machine tool industry is spread throughout India, it is more prevalent in Punjab, Chandigarh, Ludhiana, and Coimbatore. At the same time, lasers for diamond processing are mainly focused in Surat, with more than 10,000 to 12,000 lasers used.

- The automobile sector, which accounts for 49% of India's manufactured GDP and 7.1% of the country's overall GDP, has been slowing for more than a year. However, post-COVID-19 pandemic, it recovered in a V-shape. According to the India Brand Equity Foundation (IBEF), the Indian automobile sector (including component manufacturing) is predicted to reach USD 251.4-282.8 billion by 2026. It is expected to be a significant growth contributor. Because of the need for individualized, safer transportation and the growing number of new automobile customers, the demand for new cars has been continually on the rise since the COVID-19 pandemic. The growth in the automobile sector will drive the market in the forecast period.

- Also, the government is putting in place a policy for electric vehicles (EVs), Bharat Stage VI (BSVI) norms, and safety regulations. It will take some time for the automotive sector to prepare for these changes, and the market is expected to witness a temporary slowdown in this sector. Nevertheless, it is anticipated to revive with unprecedented growth rates in the forecast period.

- Local production of these laser-cutting devices, which is gaining traction, is one crucial part of a changing environment. Many machine makers in India already manufacture/integrate laser cutting machines, including SIL Pune, SLTL Ahmedabad, Proteck Chennai, Delta Automation, and others. A dozen other companies are developing strategies to incorporate the devices locally. Government subsidies and financial aid provide a primary drive for local manufacturing through initiatives like the 'Make In India' scheme of the Government of India. Under the scheme, the Government of India (GoI) provides up to 80% subsidy to MSMEs.

- Further, Intech Additive Solutions Pvt. Ltd (formerly known as Intech DMLS Pvt. Ltd) announced that it designed, developed, and delivered a true 'Made in India' technological solution to the Indian Manufacturing Industry with the launch of its new range of Metal 3D Printers. The iFusion series of Metal 3D Printers, based on Selective Laser Melting technology, is designed for high precision, stability, and reliability and to deliver unmatched performance with higher build rates.

- Intech Additive Solutions has been a spearhead in Metal Additive Manufacturing in the country. It helps to provide end-to-end solutions starting from concept design to fully functional production parts for various industries, including automotive segments in India.

Fiber Lasers to Grow Significantly

- The fiber laser cutting machine market is India's fastest-growing laser market. Fiber lasers have a dynamic operating power range allowing the beam focus and its position to remain constant even when the laser power is changed. In addition, changing the optics configuration can achieve a wide range of spot sizes. These features enable in to choose an appropriate power density for cutting various metals such as carbon steel, stainless steel, and tool steel.

- The number of fiber laser cutting machines sold to industrial applications is rapidly increasing. It is dominated mainly by Chinese machine manufacturers such as HSG Laser, Bodor Laser, Han's Laser, and many others through their distributors/resellers that include Indian players such as Laser Technologies Mumbai, Laser Lab Delhi, and another 25-30 distributors selling Chinese cutting machines, apart from Han's Laser and Golden Laser, which have their own offices in India.

- As India gradually advances in the steel manufacturing sector, steel is among the highly utilized metal. The increase in demand will significantly benefit the metal forming industry, which primarily uses fiber laser cutting machines. Further, according to the Indian Institute of Welding (IIW), almost 90% of steel is consumed in the country through the welding process. This is further anticipated to boost the demand for laser welding equipment in the forecast period. According to data issued by the World Steel Association in April 2022, India is the only country amongst the top 10 producers of steel in the world to have experienced an increase in steel output from January to March 2022 as compared to the same period previously, producing 31.9 million tonnes of steel, an increase of 5.9%.

- In the electrical and medical industries, where precise micro-cutting is required, fiber lasers are substituting chemical stripping and solids phase laser cutting. Due to these variables and the rising demand for narrow sheet cutting and finishing equipment, the industry will expand during the study period.

- With the increasing capabilities of fiber lasers, their usage is expected to continue to grow over the forecasted period. In Jan 2021, OmniGuide announced the FDA clearance and commercial launch of OTO-U CO2 laser system fiber for use in ENT and otology surgery. It helps provide enhanced visibility, a small 147-micron tissue target size, and the use of other advanced laser energy systems and flexible Instruments for robotic surgery.

India Laser Industry Overview

The Indian laser market is fragmented in nature, where barriers to entry of new players are fairly low, coupled with laser equipment manufacturers witnessing an increase in revenue, by which the competitive rivalry in the studied market is increasing significantly. The competitive strategy is majorly comprised of innovations in equipment and technology, product launches, collaboration, and others. Key players include Amada Co. Ltd, Coherent Inc., Alpha Laser, Trumpf Group, and Laserline GmbH.

In June 2022, Bharat Fritz Werner Group introduced the first Laser-Directed Energy Deposition (L-DED) equipment, the Photon 1000H and Photon 1000R, driven by the Meltio in India, with Hybrid and Robotic versions to be made commercially accessible in India.

In April 2022, Bharat Fritz Werner Ltd (BFW) and m2nxt (a BFW subsidiary), India's top CNC and Industry 4.0 equipment and technologies firms, released the PHOTON 4000G Laser-Directed-Energy-Deposition (L-DED) machine, that is made in India and accessible globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Stakeholder Analysis (OEM| Distributors| Integrators| End-user Organizations)

- 4.4 Market Drivers

- 4.4.1 Growing Market Concentration Coupled with Increased Availability of Products has Played a Role in Cost Decline

- 4.4.2 High Demand for Laser Cutting Related Applications

- 4.4.3 Replacement of Existing Installations and the Emergence of India as One of the Major Manufacturing Destinations (Driven by Favorable Policy Changes)

- 4.5 Market Challenges

- 4.5.1 High Dependence on International Vendors to Address Demand

- 4.5.2 Supply Related Concerns

- 4.5.3 Lack of Technical Expertise and Local Ecosystem

- 4.6 Market Opportunities

- 4.6.1 Potential for Laser Marking

- 4.6.2 Anticipated Developments in Buyer's Leverage

- 4.6.3 Positive Growth Outlook

- 4.7 Key Industry Standards and Regulations

- 4.8 Assessment of the Impact of COVID-19 on the India Laser Industry

5 TECHNOLOGY SNAPSHOT

- 5.1 Evolution of Laser & Photonics Industry in India

- 5.2 Application-wise Mapping of Key Opportunities and Use-cases

- 5.3 Key Global Cues Expected to Find Adoption

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Co2 Laser

- 6.1.2 Fiber Laser

- 6.1.3 Nd YaG Laser

- 6.1.4 Other Types

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Railways

- 6.2.3 Construction

- 6.2.4 Agriculture

- 6.2.5 Communications

- 6.2.6 Solar Industry

- 6.2.7 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trumf Group

- 7.1.2 Amada Co. Limited

- 7.1.3 Coherent Inc.

- 7.1.4 Alpha Laser

- 7.1.5 Laserline

- 7.1.6 IPG Photonics

- 7.1.7 Max Photonics Co. Limited

- 7.1.8 Wuhan Raycus Fiber Laser Technologies Co. Limited

- 7.1.9 nLight Inc.