|

市場調查報告書

商品編碼

1648098

雷射的全球市場:技術,市場,用途,未來趨勢(2025年)Global Lasers Market 2025: Technologies, Markets, Applications and Future Trends |

|||||||

雷射是一項具有彈性的行業,預計多個領域的市場都會成長。

儘管全球產量呈現溫和成長,但雷射產業仍保持彈性,與 2022 年相比實現了近 7% 的成長。

得益於製造業和高科技領域在後疫情時代的強勁表現,十大雷射器製造商在 2021-2022 年實現了超過 20% 的顯著收入增長。

然而,與先前的樂觀情緒相反,依賴雷射的關鍵產業表現並未如預期,這可能導致對 2024 年和 2025 年雷射市場的預測更加謹慎。

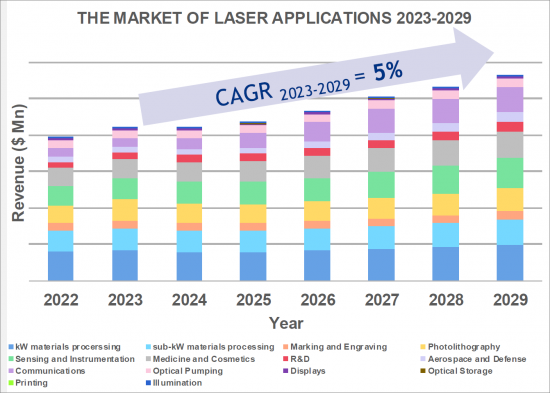

不過,我們相信雷射市場將在 2023 年至 2029 年期間繼續以 5% 的複合年增長率增長,到 2029 年將達到 200 億美元以上。

雷射市場各細分領域表現參差不齊。

- kW Materials Processing 取得了成長,但由於產業放緩,面臨未來的課題。

- 亞千瓦材料加工依然強勁,醫療器材製造業呈現強勁成長

- 標記和雕刻的銷售量增加,但由於價格下跌,收入減少。

- 光刻技術在 2023 年陷入困境,但預計到 2027 年將會復甦。

- 在人工智慧、資料中心擴展和 M2M 應用的推動下,通訊雷射將在 2024 年至 2025 年間實現成長。

- 感測和儀器儀表:醫療保健、必需品生產和能源轉換等領域的課題將推動生命科學和工業感測的發展,這些領域需要高精度雷射設備。在汽車和行動領域,隨著經濟高效的解決方案能夠在大眾市場車輛中廣泛採用,包括用於 ADAS 的 LiDAR 在內的雷射市場將大幅成長。在行動消費領域,在智慧型手機、相機和 AR/VR 系統中使用雷射的 ToF 感測器預計將在消費和專業應用中實現快速成長。

- 醫療與美容,價格實惠的二極體雷射技術擴大了醫療和美容應用的範圍,包括居家美容療程。

- 航空航天和國防、全球緊張局勢以及現代化軍火庫的需要將推動國防應用雷射器的銷量增長,包括軍事感測和高功率雷射武器。世界各地對雷射系統進行了巨額投資。

- 研究與開發:對綠色能源、創新藥物和新技術的追求將推動全球對研發項目的資助,從而使雷射市場受益。雷射是許多不同研究領域的必備工具,包括量子技術、物理學、化學、材料科學和生物學。

本報告提供全球雷射市場相關調查分析,提供與影響市場的要素與趨勢,雷射技術與那個用途,2023年的收益台數,2024年~2029年的各市場區隔的預測等資訊。

目錄

第1章 簡介

- 這個出版物的範圍

- 全球雷射光源市場概要(2023年)

- 一般的雷射技術和那個用途

- 雷射的全球市場:各技術(2023年)

- 雷射的全球市場:各用途(2023年)

- 雷射光源和系統的供應鏈

- 產業用,醫療用雷射系統

- 雷射市場預測:各技術(2024年~2029年)

- 雷射市場預測:各用途(2024年~2029年)

- 這個調查分析的前 100 家公司

- 定義和簡稱的清單

第2章 商業用雷射技術

- 二氧化碳雷射

- 準分子雷射

- 光纖雷射

- LPSSL

- DPSSL

- 碟式雷射

- 二極體雷射(EEL)

- VCSEL(表面電子雷射)

- 其他的雷射技術

第3章 雷射市場分析:各用途(2023年)

- 產業用雷射 - kW材料處理

- 產業用雷射 - 輔助kW材料加工

- 產業用雷射 - 標註·雕刻

- 產業用雷射 - 光刻

- 通訊

- 感測·儀器

- 感測·儀器 - 汽車·行動

- 感測·儀器 - 行動·消費者

- 其他的行動·消費者用途

- 光泵浦

- 醫療·化妝品

- 航太·防衛

- 研究開發

第4章 雷射市場地區分析

- 亞洲的著名的雷射廠商

- 歐洲的著名的雷射廠商

- 北美的著名的雷射廠商

- 全球雷射銷售額的分佈(2023年)

第5章 雷射市場未來趨勢與預測

- 產業用雷射市場趨勢

- 通訊市場趨勢

- 感測·儀器市場趨勢

- 產業用感測市場趨勢

- 汽車·行動市場趨勢

- 行動·消費者市場趨勢

- 其他的行動·消費者用途市場趨勢

- 光泵浦市場趨勢

- 醫藥品·化妝品市場趨勢

- 航太·國防市場趨勢

- 研究開發市場趨勢

第6章 結論

- 雷射的全球市場與未來趨勢(2023年)

第7章 附錄

第8章 關於TEMATYS,YOLE

Multiple aspects of everyday life activity such as industrial production, medical operations and communications rely on Lasers and without this technology which upon its conception was characterized as a "solution seeking a problem", many products and services which are taken for granted, would be unattainable.

The year 2023 faced challenges due to ongoing geopolitical tensions and the strained relations between East and West, which impacted global supply chains and demand across industries including that of lasers.

REPORT'S OBJECTIVES

The objectives of the report are to present a comprehensive overview of the global laser sources market for 2023, segmented by the most common technologies and their applications.

It includes a detailed definition of laser sources, systems, and sub-systems, as well as an analysis of the laser value chain. Key market figures such as revenues by application, average selling price (ASP), and unit sales by technology are discussed.

The report examines the factors influencing the 2023 and 2024 global laser market evolution, broader industry trends, and subsegments like industrial lasers, sensing, instrumentation, automotive, and consumer electronics.

Additionally, it provides a geographical revenue breakdown for APAC, EMEA, and North America, and offers a detailed forecast for 2024-2029, highlighting sales revenue and unit growth across segments and subsegments.

KEY FEATURES OF THE REPORT

- Overview of the factors and trends that influence the global market of Lasers

- Presentation of the most common Laser technologies and their applications

- For each type of application, the breakdown of the market by laser technology: revenue and number of units for 2023

- Study of selected applications' Subsegments

- Presentation of Laser source sales by geographical region

- Market forecast of the Laser market segments for the period 2024-2029

LASER IS A RESILIENT BUSINESS WITH EXPECTED MARKET GROWTH IN MANY SEGMENTS

While overall global production showed modest growth, the laser industry remained resilient, achieving nearly 7% growth compared to 2022.

The top 10 laser manufacturers saw a significant revenue increase of over 20%, driven by momentum from the strong post-COVID performance in manufacturing and high-tech sectors during 2021 and 2022.

However, despite earlier optimism, key industries relying on lasers did not perform as expected, which may lead to more cautious planning in the laser market for 2024 and 2025.

But we are confident the laser market will continue to grow with a 5% CAGR over 2023-2029 to exceed US$20b in 2029.

The laser market showed diverse performance across segments:

- kW materials processing grew but faces challenges ahead due to industry slowdowns

- sub-kW materials processing remains robust, with significant growth in medical device manufacturing

- Marking and engraving grew in units but saw revenue declines due to price drops

- Photolithography struggled in 2023 but is expected to recover by 2027

- Communications lasers are set to grow in 2024-2025, driven by AI, datacentre expansion, and M2M applications.

- Sensing and Instrumentation: Growth in life sciences and industrial sensing is driven by challenges in healthcare, essential goods production, and energy transition requiring precise laser-based devices. In Automotive and Mobility, the laser market, including LiDAR for ADAS, will grow significantly as cost-effective solutions enable wider adoption in mass-market vehicles. For Mobile and Consume,: ToF sensors using lasers in smartphones, cameras, and AR/VR systems are expected to grow rapidly for consumer and professional applications.

- In Medicine and Cosmetics, affordable diode laser technologies expand accessibility to medical and cosmetic applications, including home-based cosmetic treatments.

- In Aerospace and Defense, the global tensions and the need for modernized arsenals will drive increased sales of lasers for defense, including military sensing and high-power laser weapons. Significant investments are being made worldwide in laser systems.

- For R&D, the push for greener energy, innovative medicines, and new technologies will boost global funding for R&D projects, benefiting the laser market. Lasers are vital tools in various research fields, including quantum technologies, physics, chemistry, materials science, and biology.

INFORMATION SOURCES

- In-house knowledge of Laser technologies, their applications and their markets.

- Market data based on financial & business information on 400+ Laser Technologies' market players.

- Interviews with key companies that manufacture Laser sources and with Laser integrators and suppliers.

- Literature research.

- Participation in international conferences and webinars in the universe of Lasers.

TABLE OF CONTENTS

1. INTRODUCTION

- Scope of this publication

- Overview of the Global Market of Laser Sources for 2023

- Common laser technologies and their applications

- The Global Market of Lasers by Technologies for 2023

- The Global Market of Lasers by Applications for 2023

- Supply chain of laser sources and systems

- Laser systems for the industry and medicine

- 2024-2029 market forecast by laser technologies

- 2024-2029 market forecast by laser applications

- The top 100 companies analysed for this study

- List of definitions and abbreviations

2. COMMERCIAL LASER TECHNOLOGIES

- CO2 Lasers

- Excimer Lasers

- Fiber Lasers

- LPSSLs

- DPSSLs

- Disk Lasers

- Diode Lasers (EELs)

- VCSELs

- Other laser technologies

3. MARKET ANALYSIS OF LASERS BASED ON THEIR APPLICATIONS FOR 2023

- Industrial Lasers - kW materials processing

- Industrial Lasers - sub-kW materials processing

- Industrial Lasers - Marking and Engraving

- Industrial Lasers - Photolithography

- Communications

- Sensing and Instrumentation

- Sensing and Instrumentation - Automotive and Mobility

- Sensing and Instrumentation - Mobile and Consumer

- Other Mobile and Consumer Applications

- Optical Pumping

- Medicine and Cosmetics

- Aerospace and Defense

- Research and Development

4. REGIONAL ANALYSIS OF THE MARKET OF LASERS

- Notable laser manufacturers in Asia

- Notable laser manufacturers in Europe

- Notable laser manufacturers in North America

- Global distribution of laser sales for 2023

5. FUTURE TRENDS AND FORECAST OF THE LASER MARKET

- Industrial Lasers market trends

- Communications market trends

- Sensing and Instrumentation market trends

- Industrial Sensing market trends

- Automotive and Mobility market trends

- Mobile and Consumer market trends

- Other Mobile and Consumer applications market trends

- Optical Pumping market trends

- Medicine and Cosmetics market trends

- Aerospace and Defense market trends

- Research and Development market trends

6. CONCLUSIONS

- The global market of Lasers for 2023 and future trends

7. APPENDICES

- 2011 - 2023 trends of the global industry

- Diode Laser sources

- The evolution of DUV and EUV systems sales