|

市場調查報告書

商品編碼

1644366

印度無線揚聲器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)India Wireless Speaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

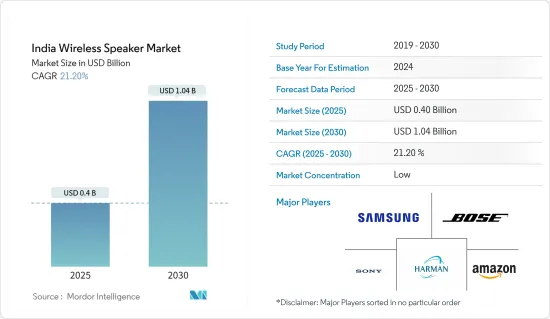

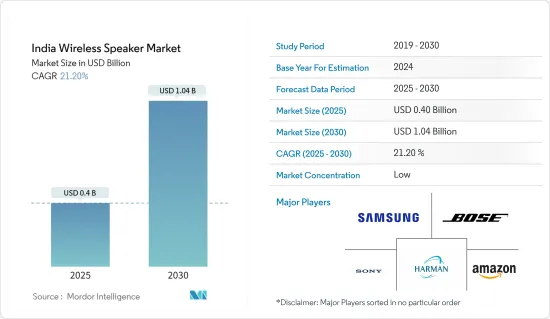

印度無線揚聲器市場規模預計在 2025 年為 4 億美元,預計到 2030 年將達到 10.4 億美元,預測期內(2025-2030 年)的複合年成長率為 21.2%。

這項市場發展的促進因素包括智慧型手機普及率的不斷提高、低成本的網路存取、對便攜性和靈活性的需求不斷成長、技術發展以及採用率的不斷提高。

關鍵亮點

- 揚聲器市場提供全面的產品,從提供全面聆聽體驗的家庭劇院系統到允許用戶在任何地點播放音訊/視訊的無線揚聲器。例如,2022 年 7 月,帶有紅外線發射器的小米智慧音箱在印度推出。這款智慧型手機公司的新款智慧揚聲器採用全新 LED手錶設計、紅外線發射器,並配備 Google Assistant 功能。

- 此外,2022 年 6 月,Bose 作為其 Soundlink 系列的一部分在印度推出了最好的藍牙揚聲器。揚聲器設計堅固,並配備該公司專有的 Bose PositionIQ 技術,可自動偵測揚聲器的方向以改善音訊播放。此類智慧揚聲器的發展預計將進一步推動市場成長。

- 市場發展主要受到智慧型手機和智慧型裝置用戶數量的不斷成長的推動。這些設備包括智慧揚聲器,使用者可以將任何具有內建無線連接的智慧型裝置連接到揚聲器。此外,根據 IBEF 報導,三星宣布計劃未來五年在印度投資 3.7 兆印度盧比(500 億美元)用於生產行動電話。根據 PLI 計劃,三星計劃生產價值 2.2 兆盧比(300 億美元)、售價超過 15,000 盧比(200 美元)的行動電話。

- 此外,印度的層級城市正迅速向中價格分佈價格分佈轉變,而小城鎮和村莊則擴大轉向價格分佈和中價格分佈的品牌產品,減少了對仿冒品和無標籤商品的依賴。因此,消費能力逐漸增強的消費者仍然對價格敏感,迫使市場供應商提供他們最佳、最具成本效益的選擇。

- COVID-19 疫情最初擾亂了所研究市場的供應鏈和生產。對於供應揚聲器晶片的半導體製造商來說,影響更加嚴重。勞動力短缺迫使全球半導體供應鏈中的許多參與者縮減甚至停止營運。這些因素擾亂了半導體產業的全球供應鏈,並嚴重影響了全球揚聲器市場。

印度無線揚聲器市場的趨勢

線上串流服務的普及率不斷提高

- 印度智慧音箱日益普及的一個主要原因是它們能夠以無線方式傳輸音訊內容並改善有線和無線的整體聲音體驗。此外,Google、亞馬遜等公司的語音助理的整合也正在推動客戶聽音樂行為的改變,進而推動市場的發展。

- 數位串流媒體服務的快速發展也推動了該國對無線揚聲器等可攜式、可互通設備的需求。印度的音訊串流市場分為國內參與企業JioSaavn、Gaana 和 Wynk,以及全球參與企業Spotify、Amazon Music、Apple Music 和新進者的 YouTube Music。此外,2022年3月,Krafton為印度音訊內容平台Kuku FM注入了1,950萬美元。

- 例如,根據 Music Ally Ltd. 的數據,Spotify 在印度的用戶在一年內加倍。每月有效用戶(MAU) 為 4.33 億,與前一年同期比較增加 1,900 萬,比公司預期高出 500 萬。此外,亞馬遜於 2022 年 11 月推出了自己的 Prime Video 行動版本,每年售價 599 印度盧比。此項新訂閱服務針對的是行動用戶,價格比標準套餐低很多。行動版是單人、僅限行動裝置的年度計劃,可讓您存取最新電影、亞馬遜原創作品、現場板球、歌曲等。

- 此外,印度上層和中產階級人士對在 OTT 平台上體驗電影和節目的優質音質的興趣日益濃厚,預計將推動市場成長並推動對揚聲器的需求。

- 2022年1月,FiiO在印度推出了其可攜式桌面級音樂參與企業M17。左右聲道皆採用桌面級8聲道旗艦DAC ES9038PRO。每個音軌均有八個並行輸出,可總合極其純淨的音頻,並具有出色的解析度和最小的失真。

預計網上銷售管道將大幅成長

- 線上通路正在幫助規模較小的本地參與企業進入市場。例如,專注於滿足層級和三層級城市需求的揚聲器製造商 Obage 透過亞馬遜和 Flipkart 銷售其產品。此外,據 IBEF 稱,該領域的成長得益於 YouTube 等平台繼續提供與影片內容相關的現代免費音樂,預計這將幫助付費 OTT 音樂領域覆蓋 500 萬終端用戶,到 2023 年創造 20 億印度盧比(2700 萬美元)的收益。

- 為了提高品牌產品在層級城市的可得性,企業正在努力改善配送網路。這將大大提高品牌產品在這些市場的滲透率。與現有的本地配送公司、新興配送新興企業和印度郵局的合作幫助該地區的公司形成了強大的配送網路。

- 根據IBEF預測,到2030年,印度智慧型手機用戶數量預計將達到8.874億。此外,印度是世界上資料消費量最高的國家,每人每月的數據消耗量為 14.1GB。到2025年,印度將擁有6.5億短影片消費者。此外,印度的行動資料價格低廉、可靠且廣泛可用,消費者可以瀏覽電子商務網站,根據自己的喜好和價格分佈進行比較和選擇。根據IBEF預測,到2024年,印度電子商務產業規模預計將達到990億美元。

- 2022 年 9 月,亞馬遜在印度推出了兩種版本的 Echo Dot 揚聲器——帶手錶和不帶手錶。入門級 Echo Dot 揚聲器提供更好的音訊品質、溫度感測器和手勢控制。

- 該公司還透過自己的線上入口網站獨家推出新款揚聲器,這有助於推動印度線上銷售的成長。蘋果智慧音箱Mini Homepod目前已在網路上直接販售,售價為9,900印度盧比(約121.23美元)。該公司在從其網路商店購買揚聲器時提供 EMI 選項。

- 網際網路普及率的提高也支持了該國電子商務產業的發展。隨著數位化應用的興起,我們預計揚聲器的線上銷售將會增加,尤其是在二線和三線城市。根據印度網路和行動協會(IAMAI)發布的報告,到2025年,印度網路用戶預計將達到9億。

- 市場供應商和電子商務平台之間的合作也推動了這一領域的成長。例如,Flipkart 的船舶藍牙音箱促銷活動提供高達 70% 的藍牙音箱折扣。此外,線上電子商務公司提供無憂的退貨、優惠券和快速送貨選項,使購買電子產品和其他產品變得可行。

印度無線揚聲器產業概況

印度無線揚聲器市場詳細情形良好,不斷變化的消費者需求迫使無線揚聲器供應商推動該領域的技術創新,以吸引更多消費者。這個市場競爭逐年激烈,各公司推出越來越多的產品來吸引消費者。

- 2022 年 6 月-三星在印度推出了支援杜比全景聲 (Dolby Atmos) 的無線條形音箱 Q 系列和 S 系列。 Q 系列具有內建杜比全景聲 (Dolby Atmos) 連接功能,適用於世界上首款無線三星電視和條形音箱。同時,S系列是世界上最薄的條形音箱系列。

- 2022 年 4 月-索尼公司宣佈為其高級條形音箱 HT-A7,000 和 HT-A5,000 提供無線 (OTA)韌體更新。此更新增強了兩款產品的創新 360 空間聲音映射功能,可透過將條形音箱連接到 SA-RS3S 後置揚聲器或全新 SA-RS5 無線後置揚聲器來存取此功能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 線上串流服務的需求和使用日益增加

- 改變消費行為

- 市場問題

- 對兒童的健康危害和政府對運作頻率的限制

第6章 市場細分

- 依設備類型

- 僅藍牙

- Wi-Fi(不含智慧音箱和組合音箱)

- 智慧音箱

- 按分銷管道

- 線上(包括電子零售商和供應商自己的網站)

- 離線

第7章 競爭格局

- 公司簡介

- Amazon Retail India Private Limited

- HARMAN International India Pvt. Ltd.(JBL)

- Sony India Private Limited

- Samsung India Electronics Private Limited

- Bose Corporation India Private Limited

- Google India Private Limited

- Xiaomi Technology India Private Limited

- Imagine Marketing Pvt Ltd(Boat)

- GN Audio A/S(Jabra)

- Koninklijke Philips NV

第8章投資分析

第9章:市場的未來

The India Wireless Speaker Market size is estimated at USD 0.40 billion in 2025, and is expected to reach USD 1.04 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

The market's growth is influenced by the increased penetration of smartphones, internet access at lower rates, increased demand for portability and flexibility, and increased technology development and adoption rate.

Key Highlights

- The speaker market offers a comprehensive range of products, from home theatre systems that provide an inclusive listening experience to wireless speakers that can help users play audio/video anywhere they wish. For instance, in July 2022, Xiaomi Smart Speaker with IR Blaster was launched in India. The new smart speaker from the smartphone company comes with New LED Clock Design and an IR blaster, with Google Assistant powers.

- Moreover, in June 2022, Bose launched its most delinquent Bluetooth speaker as part of its Soundlink series in India. The speaker features a robust design and comes with the company's proprietary Bose PositionIQ technology, which automatically detects the speaker's orientation to deliver improved audio playback. Such developments in smart speakers will further drive market growth.

- The studied market is highly driven by the increase in users of smartphones and smart devices. These devices use smart speakers that allow users to connect the speakers with any smart devices incorporated with wireless connections. Furthermore, according to IBEF, Samsung announced plans to invest Rs. 3.7 lakh crore (USD 50 billion) in India over the next five years to manufacture phones. It intends to produce phones worth Rs. 2.2 lakh crore (USD 30 billion), priced above Rs. 15,000 (USD 200), under the PLI scheme.

- Moreover, Tier 2 cities in India are rapidly moving toward medium and premium price categories, while smaller towns and villages are upgrading to low and medium-priced branded products, reducing the region's reliance on counterfeit and unlabeled goods. As a result, even though consumer spending power is gradually increasing, consumers remain price-sensitive, and market vendors must offer the best and most cost-effective option.

- The outbreak of COVID-19 across the globe significantly disrupted the supply chain and production of the studied market during the initial phase. The impact was more severe for semiconductor manufacturers, who provide semiconductors used in speakers. Due to labor shortages, many of the global semiconductor supply chain players had to reduce or even suspend their operations. These factors disrupted the global supply chain for semiconductors industries and have majorly impacted the speaker market globally.

India Wireless Speaker Market Trends

Increased Adoption of Online Streaming Services

- The primary reason for the increasing adoption of smart speakers in India is their ability to wirelessly stream audio content and enhance the overall sound experience for both wired and non-wired counterparts. Moreover, the integration of voice assistants, such as Google and Amazon, is also driving a shift in customer behavior of listening to music, thereby driving the market.

- The rapid transformation of digital streaming services has also increased the demand for portable and interoperable devices, such as wireless speakers in the country has seen an upward trend. India's audio streaming market is divided among domestic players, JioSaavn, Gaana, and Wynk, and global players Spotify, Amazon Music, Apple Music, and recent entrant YouTube Music. Furthermore, In March 2022, Krafton infused USD 19.5 million into the Indian audio content platform Kuku FM.

- For instance, according to Music Ally Ltd, Spotify doubled its subscribers in India over the year. It has hit 433 million monthly active users (MAUs), up 19 million (year-on-year) and above the company's guidance by 5 million. Moreover, in November 2022, Amazon launched a unique Prime Video Mobile Edition at INR 599 per year. This new subscription will target mobile users at a much lower cost than the standard plan. The Mobile Edition is a single-user, mobile-only annual program that will provide access to all the latest movies, Amazon Originals, LIVE cricket, Songs, and many more.

- Further, the growing interests of the country's higher class and the middle-class population toward experiencing premium sound quality for movies and shows over the OTT platforms are expected to boost the market's growth, driving the need for speakers.

- In January 2022, FiiO launched India's M17 Portable Desktop Class Music Player. The left and right audio channels contain a desktop-class, 8-channel ES9038PRO flagship DAC. Each audio track has eight parallel outputs summed together for superior resolution and minimal distortion for extremely pure audio reproduction.

Online Distribution Channels is Expected to Witness Significant Growth

- Online channels are boosting smaller local players to venture into the market. For instance, Obage, a speaker manufacturer focusing on meeting the demand from Tier II and Tier III cities, sells its products through Amazon and Flipkart. Further, according to IBEF, the Growth of the sector is attributable to the trend of platforms such as YouTube that continues to offer contemporary and video content-linked music for free, which is expected to drive the paid OTT music sector to reach 5 million end-users by 2023, generating revenue of Rs. 2 billion (USD 27 million).

- To improve the availability of branded products in tier 2 cities, companies are working on improving the delivery network in smaller towns and villages. This will significantly help in the penetration of branded products in these markets. Collaborating with existing local delivery companies, emerging delivery startups, and Indian posts has helped to form a strong distribution network for companies in the region.

- According to IBEF, the number of smartphone users in India is expected to reach 887.4 million by 2030. Further, India has the highest data consumption rate worldwide, at 14.1 GB of data per person a month. By 2025, India will be home to 650 million users who consume short-form videos. Further, Mobile data in India is cheap, reliable, and widely available, allowing consumers to browse through E-commerce sites to compare, pick and choose according to their choice and price brackets. According to IBEF, India's E-commerce industry is expected to reach USD 99 billion in size by 2024.

- The programs from the e-commerce giants in the country, such as Amazon and Flipkart, also create new opportunities for the local players to expand their reach in the market.In September 2022, Amazon announced two Echo Dot speakers in India, one with a clock and one without a clock. The entry-level Echo Dot speaker includes improved audio, temperature sensors, and gesture control qualities.

- The launch of new speakers by companies exclusively on their online portals is also propelling the Growth of online sales in the country. Apple's intelligent Mini Homepod speaker was directly launched online for INR 9,900 (~USD 121.23). The company offers EMI options to purchase speakers from their online store.

- The increasing internet penetration also supports the Growth of the e-commerce sector in the country. With the digital penetration increase, there is an expected rise in the online sales of speakers, especially from second and third-tier cities. According to a report published by IAMAI, India's internet users are expected to reach 900 million by 2025.

- The partnerships between the vendors in the market and e-commerce platforms also push the segment's Growth. For instance, the Flipkart Boat Bluetooth Speaker sales offered up to 70% discounts on Bluetooth speakers. Furthermore, online e-commerce companies offer hassle-free returns, vouchers, and fast delivery options, making them viable to buy electronics and other products.

India Wireless Speaker Industry Overview

The Indian market for wireless speakers is favorably fragmented, owing to constantly changing consumer demands propelling wireless speaker vendors to innovate in the space to attract more consumers. The competitors in this market have intensified over the years, with companies launching many products to attract consumers.

- June 2022- Samsung launched the Q and S series of wireless soundbars with Dolby Atmos support in India. The Q series is expressed to have the world's first built-in wireless Samsung TV-to-Soundbar Dolby Atmos connection. In contrast, the S series is the world's slimmest soundbar series.

- April 2022- Sony Corporation announced an over-the-air (OTA) firmware update for the premium HT-A7000 and HT-A5000 soundbars. The update enhances both products' innovative 360 spatial sound mapping capabilities and can be accessed when connecting either soundbar to the SA-RS3S rear speakers or the new SA-RS5 wireless rare speaker.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand and Access to Online Streaming Services

- 5.1.2 Shift in Consumer Behavior

- 5.2 Market Challenges

- 5.2.1 Harmful Health Effects on Children and Operating Frequency Rules and Regulations by the Government

6 MARKET SEGMENTATION

- 6.1 By Type of Device

- 6.1.1 Bluetooth-Only

- 6.1.2 Wi-Fi (Excl. Smart Speakers and Incl. combo speakers)

- 6.1.3 Smart Speakers

- 6.2 By Distribution Channel

- 6.2.1 Online (Incl. e-tailers and vendors own websites)

- 6.2.2 Offline

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Retail India Private Limited

- 7.1.2 HARMAN International India Pvt. Ltd. (JBL)

- 7.1.3 Sony India Private Limited

- 7.1.4 Samsung India Electronics Private Limited

- 7.1.5 Bose Corporation India Private Limited

- 7.1.6 Google India Private Limited

- 7.1.7 Xiaomi Technology India Private Limited

- 7.1.8 Imagine Marketing Pvt Ltd (Boat)

- 7.1.9 GN Audio A/S (Jabra)

- 7.1.10 Koninklijke Philips NV