|

市場調查報告書

商品編碼

1644385

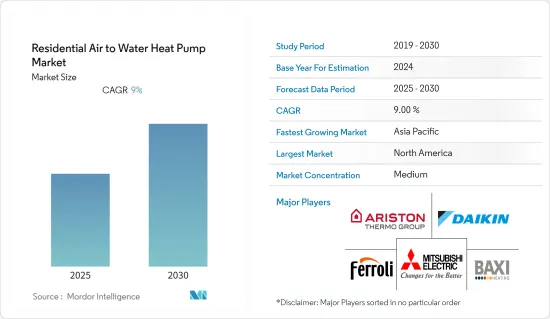

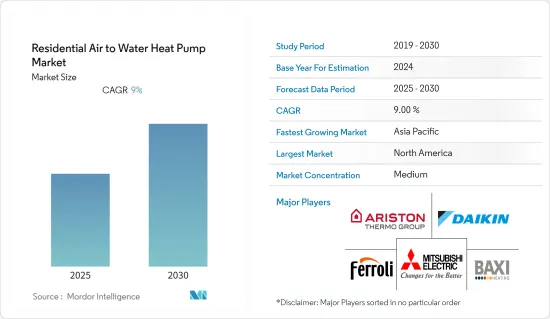

住宅空氣能熱泵:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Residential Air to Water Heat Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,住宅空氣到水 (ATW) 熱泵市場預計將實現 9% 的複合年成長率。

有利的法規結構加上鼓勵實施供暖、通風和空調 (HVAC) 裝置的清潔製冷和供暖計劃可能會對住宅空氣到水 (ATW) 熱泵市場佔有率產生積極影響。持續核准和部署永續系統以減少負面環境影響預計將進一步加速產品回歸。擴大轉向永續解決方案來減少能源消耗是推動住宅空氣到水 (ATW) 熱泵普及的關鍵因素之一。各地區政府在降低能源消耗方面發揮重要作用。

此外,由於城市人口成長而推動的住宅領域發展也是決定市場成長的因素。 FMI公司稱,儘管受到新冠疫情的影響,但2020年美國新住宅仍增加了150億美元。這種成長為市場帶來了新的機會。

根據國際能源總署(IEA)的數據,全球整體熱泵安裝數量預計將從2020年的1.8億台成長到未來幾年的6億台左右。熱泵的效率至少是傳統石化燃料鍋爐的三倍,預計未來幾年內,單棟建築中熱泵的安裝量將從目前的每月 150 萬台增加到每月 500 萬台左右。熱泵甚至成為許多國家新建住宅中最常見的技術,但它們僅滿足全球建築供暖需求的5.0%,為市場創造了新的機會。

新冠肺炎疫情影響了對節能技術的投資。根據國際能源總署 (IEA)《2020年世界能源投資》報告,由於景氣衰退, 2020年對節能技術的投資有所下降。此外,由於停工和營運能力有限,疫情也影響了市場主要企業的供應鏈。大金、富士通等公司因供應鏈中斷而遭遇了回程傳輸。

住宅ATW(空氣對水)熱泵市場趨勢

熱泵技術對減少二氧化碳排放的貢獻正在推動市場

- 能源是日常生活的必需品,因為它為企業、醫院、家庭、學校等提供動力。然而,能源生產會導致溫室氣體排放。根據美國能源資訊署的數據,2021年美國能源消耗排放48.7億噸二氧化碳(GtCO2),比2020年的水準成長6.5%。 2020年,新冠疫情對工業及旅遊業造成嚴重影響,導致排放急劇下降11%。

- 二氧化碳(CO2)是溫室氣體之一,在煤炭、石油、天然氣等石化燃料燃燒時會大量排放。許多國家正在採取措施限制環境中的溫室氣體,旨在減少因二氧化碳排放增加而導致的初級能源需求。住宅空氣到水(ATW)熱泵以節能的方式提供供暖,從而推動了市場的成長。

- 使用空氣到水 (ATW) 熱泵系統取代基於石化燃料的方法可以顯著減少與能源消耗和發電相關的二氧化碳排放。因此,越來越多用戶住宅安裝了節能熱泵。

- 同樣,美國環保署 (EPA) 於 2021 年 6 月宣布改進其能源之星計劃,到 2030 年將排放減少 50% 以上。該部門已升級了住宅熱水器以及推動創新熱泵技術的供暖和製冷設備的能源之星標準。

- 升級後的標準將成為減少碳污染、降低能源和暖氣成本的關鍵要素。據估計,如果在美國銷售的所有中央空調、熱泵和電熱水器都符合新的能源之星標準,每年可節省的費用可增加至 110 億美元。它還可以每年減少2550億磅的溫室氣體排放,相當於美國住宅和公寓直接溫室氣體排放的三分之一。

美國主導市場

- 空氣-水(ATW)熱泵已在美國大部分地區使用多年,除了那些長期經歷冰點以下氣溫的地區。然而,空氣到水 (ATW) 熱泵技術在過去幾年中取得了進步,現在即使在寒冷的氣候下也能提供合法的空間加熱選項。

- 隨著美國市場逐漸趕上中國和日本等其他地區,建築商正在利用性能係數(COP)競爭來開發節能環保的供暖和冷卻技術。

- 此外,由於人們越來越關注控制二氧化碳排放,以及政府推出激勵措施支持採用住宅空氣到水(ATW)熱泵機組,預計美國市場將顯著成長。根據美國能源資訊署估計,到2050年,美國商業領域的石油使用將排放6,200萬噸二氧化碳。

- 根據美國人口普查局和美國住房與城市發展部的數據,2021年8月私人住宅經季節性已調整的後年率升至161.5萬套,較2021年7月修訂後的155.4萬套高出3.9%,比2020年8月的137.6萬套高出17.45%。建設活動的增加對ATW(空氣到水)熱泵產生了新的需求。

- 預計,隨著美國水和空間供暖需求的不斷增加,加上建築業的快速復甦,以及修復和重建活動的推動,將推動住宅領域對技術先進、緊湊型供暖解決方案的需求。例如,根據美國經濟分析局的數據,高價值建築業貢獻了美國國內生產總值的 4.1%。到2023年,新建設預計將達到1.449兆美元。

住宅空氣能熱泵產業概況

住宅空氣對水(ATW)熱泵市場競爭適中,由幾家主要企業組成。由於大金工業有限公司、三菱電機歐洲有限公司、阿里斯頓熱能有限公司、法羅利有限公司和 Baxi Heating UK 有限公司等主要參與者的存在,住宅空氣源熱泵市場競爭公司之間的敵意相當高。不斷創新產品的力量使我們比市場上的其他參與企業更具競爭優勢。這些參與企業透過併購和研發活動擴大了其市場佔有率。

2022年9月,松下表示計畫投資約1.45億歐元(約1.448億美元),到2026年3月底將其捷克共和國工廠的熱泵產量提高到50萬台。 2018 年,松下開始在其位於皮爾森的電視工廠的一條生產線上生產空氣對水室內機。由於需求下降,松下去年決定停止該工廠的電視機生產,為熱泵生產騰出了閒置產能。 2021年9月,根據針對白色家電家用電子電器的生產連結獎勵計畫(PLI)計劃,日本空調公司大金購買了新工廠的土地。大金印度公司是這家跨國公司的印度分公司,它已完成對斯里城(安得拉邦)一塊 75 英畝土地的收購,將分階段建立一個大型空調 (AC) 製造廠。根據內部估計,大金在第一階段需要投資 100 億印度盧比。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 對熱泵產業的影響

第5章 市場動態

- 市場促進因素

- 節能系統的需求不斷增加

- 減少碳足跡的有利措施

- 市場問題

- 前期成本高

- 性能係數 (COP) 水準低

第6章 市場細分

- 地區

- 美國

- 中國

- 法國

- 義大利

- 其他

第7章 競爭格局

- 公司簡介

- Daikin Industries Ltd

- Mitsubishi Electric Europe BV

- Ariston Thermo SpA

- Ferroli SpA

- Baxi Heating UK Ltd(BDR Thermia Group)

- Aermec SpA

- Clivet SpA

- Tecnocasa climatizzazione srl

- Toshiba Corporation

- Panasonic Corporation

- Vaillant Group

- Swegon Group AB

- NIBE Industrier AB

第8章投資分析

第9章 市場機會與未來趨勢

The Residential Air to Water Heat Pump Market is expected to register a CAGR of 9% during the forecast period.

A favorable regulatory framework, coupled with clean cooling & heating programs to promote the enactment of heating, ventilation, and air conditioning (HVAC) units, will positively influence the residential air-to-water heat pump market share. Continuous approval and deployment of sustainable systems to lessen the adverse environmental influence are expected to further accelerate product regression. The growing shift toward sustainable solutions to reduce energy consumption is one of the major factors that is driving the adoption of air-to-water heat pumps for residential use. Governments across all regions play a major role in reducing energy consumption.

The development in the residential sector in line with the growing urban population is also a factor influencing the market's growth. According to FMI Corporation, in 2020, new residential construction in the United States increased by USD 15.0 billion, despite the impact of the COVID-19 pandemic. Such growth creates new opportunities for the market.

According to International Energy Agency, the number of heat pumps installed globally is expected to rise from 180.0 million in 2020 to around 600.0 million in the next few years. At least three times more efficient than traditional fossil fuel boilers, the installation of heat pumps in individual buildings is expected to rise from 1.5 million per month currently to around 5.0 million in the next few years. Although heat pumps have even become the most common technology in newly built houses in many countries, they meet only 5.0% of the global building heating demand, thus creating new opportunities for the market.

The COVID-19 pandemic affected investments in energy-efficient technologies. According to International Energy Agency (IEA) World Energy Investment 2020, investment in energy-efficient technologies in 2020 fell due to the economic downturn. In addition, the pandemic led to an effect on the supply chain of the major players in the market owing to the lockdowns and restrictions on working capacity. Companies, such as Daikin and Fujitsu, among others, experienced backhauls due to supply chain disruptions.

Residential Air to Water Heat Pump Market Trends

Meaningful Contribution of Heat Pumping Technology in Reduction of CO2 Emissions Drives Market

- Energy is necessary for daily life as it fuels businesses, hospitals, powered homes, and schools. However, energy generation leads to the discharge of greenhouse gases. As per EIA, energy consumption in the United States produced 4.87 billion metric tons of carbon dioxide (GtCO2) in 2021, an increase of 6.5% from 2020 levels. In 2020, emissions plummeted by 11% as a result of the outbreak of COVID-19, which heavily disrupted industry and travel.

- Carbon dioxide (CO2), which is one of the greenhouse gases, is released substantially through the burning of fossil fuels, such as coal, oil, and natural gas. Many countries aim to reduce their primary energy demand due to rising CO2 emissions and implement policies to limit greenhouse gases in the environment. The Residential Air to Water Heat Pump offers an energy-efficient way to provide space heating, thus fueling the market's growth.

- Carbon emissions associated with energy consumption and generation can be decreased considerably when air-to-water heat pump systems are utilized instead of fossil-fueled methods. This is driving a rise in the number of residential complexes with energy-efficient heat pump installations.

- On similar lines, in June 2021, the United States Environmental Protection Agency (EPA) announced advancements to the Energy Star program to reduce emissions by more than 50% by 2030. The authority upgraded the Energy Star standards for residential water heaters and heating/cooling equipment that advance innovative heat pump technology.

- The upgraded standards will be used as a key component to reduce carbon pollution and reduce energy and heating costs. It is estimated that if all central air conditioners, heat pumps, and electric water heaters sold in the United States met the new Energy Star standards, the savings are expected to increase to USD 11.0 billion a year. It may also avoid 255.0 billion pounds of greenhouse gases per year, which equals one-third of all direct greenhouse gas emissions from homes and apartments in the United States.

United States to Dominate the Market

- Air-to-water heat pumps have been utilized for many years in almost all parts of the United States except those that experienced extended periods of subfreezing temperatures. However, air-to-water heat pump technology has advanced in the last few years, which now offers a legitimate space heating alternative in colder regions.

- The US market is gradually catching up with other regions, such as China and Japan, as contractors embrace the coefficient of performance (COP) race, developing energy savings and environmentally friendly heating and cooling technology.

- Additionally, the US market is anticipated to witness substantial growth due to the growing concerns about controlling carbon footprints, coupled with the installation of government drives to support the adoption of residential air-to-water heat pump units. According to the EIA, it is estimated that 62.0 million metric tons of CO2 emissions will be produced using petroleum in the commercial sector in the United States by 2050.

- According to the United States Census Bureau and the US Department of Housing and Urban Development, privately owned housing started in August 2021 at a seasonally adjusted annual rate of 1,615,000, 3.9% above the revised July 2021 estimate of 1,554,000 and was 17.45% above the August 2020 rate of 1,376,000. The increase in construction activities creates new demand for air-to-water heat pumps.

- Growing demand for water and space heating, coupled with a rapidly recovering construction industry in the United States and complemented with repair and renovation activities, is projected to drive the demand for technologically advanced and compact heating solutions in the residential sector. For instance, according to BEA, the value-added construction industry contributed to 4.1% of the gross domestic product in the United States. It is anticipated that new construction put in place will total USD 1,449 billion by 2023.

Residential Air to Water Heat Pump Industry Overview

The Residential Air to Water Heat Pump Market is moderately competitive and consists of several major players. The competitive rivalry in the residential air-to-water heat pump market is moderately high due to the presence of some major players, such as Daikin Industries Ltd, Mitsubishi Electric Europe BV, Ariston Thermo SpA, Ferroli S.p.A, and Baxi Heating UK Ltd, among others. Their strength to continually innovate their offerings has given them a competitive advantage over other players in the market. These players have increased their market footprint through mergers and acquisitions and research and development activities.

In September 2022, Panasonic stated that it plans to invest approximately EUR 145.0 million (around USD 144.8 million) to increase heat pump production at its Czech Republic factory to 500,000 units by the end of March 2026. In 2018, Panasonic began production of air-to-water indoor units with a single line at its TV factory in Plzen. Panasonic's decision to discontinue TV production at the plant last year due to the falling demand created extra capacity for heat pump production. In September 2021, under the production-linked incentive (PLI) plan for white goods, Daikin, a Japanese air conditioning company, purchased land for a new factory. Daikin India, the multinational's India unit, completed the acquisition deal for a 75-acre site in Sri City (Andhra Pradesh) to build a huge air-conditioning (AC) manufacturing plant in phases. According to internal estimations, Daikin will have to invest INR 1,000 crore in the first phase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Impact of COVID-19 on the Heat Pump Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy-efficient Systems

- 5.1.2 Favorable Measures to Reduce Carbon Footprints

- 5.2 Market Challenges

- 5.2.1 High Upfront Costs

- 5.2.2 Low Co-efficient of Performance (COP) Levels

6 MARKET SEGMENTATION

- 6.1 Geography

- 6.1.1 United States

- 6.1.2 China

- 6.1.3 France

- 6.1.4 Italy

- 6.1.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd

- 7.1.2 Mitsubishi Electric Europe B.V

- 7.1.3 Ariston Thermo SpA

- 7.1.4 Ferroli S.p.A

- 7.1.5 Baxi Heating UK Ltd (BDR Thermia Group)

- 7.1.6 Aermec SpA

- 7.1.7 Clivet S.p.A

- 7.1.8 Tecnocasa climatizzazione s.r.l.

- 7.1.9 Toshiba Corporation

- 7.1.10 Panasonic Corporation

- 7.1.11 Vaillant Group

- 7.1.12 Swegon Group AB

- 7.1.13 NIBE Industrier AB