|

市場調查報告書

商品編碼

1644389

行動學習 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Mobile Learning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

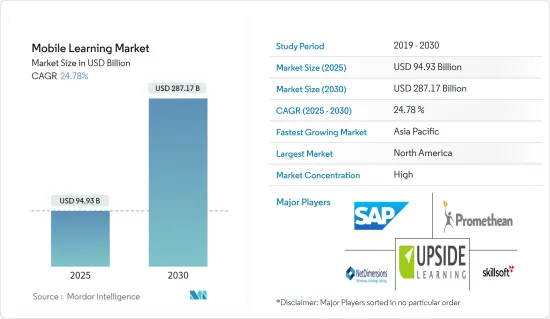

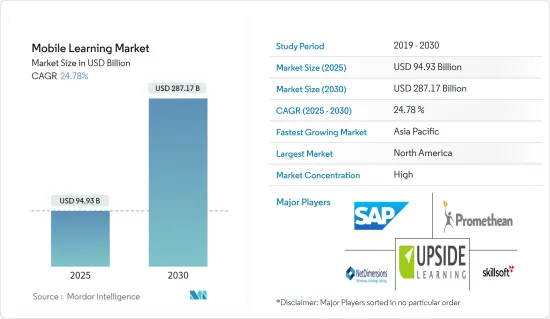

2025年行動學習市場規模預估為 949.3 億美元,預計到 2030 年將達到 2,871.7 億美元,預測期內(2025-2030 年)的複合年成長率為 24.78%。

教育機構快速採用電子設備、對資訊科技的投資不斷增加以及自帶設備(BYOD)文化的日益普及是推動行動學習市場成長的一些關鍵因素。

關鍵亮點

- 數位學習解決方案的最新進展加上行動裝置的廣泛使用使得學習者無論身在何處都可以存取學習材料,消除了界限並引入了增強整體學習體驗的互動式手段。此外,使用多種類型的數位媒體可以更有效地呈現訊息,有助於更好地理解和保留概念。

- 根據惠普印度公司最新的報告,63% 的印度受訪者認為數位化學習對於激發幼兒的創造性思考非常有效,而 57% 的受訪者認為體驗式學習能讓孩子更能理解。此外,由於這些原因,家長願意為年幼的孩子的教育花錢購買學習應用程式,這有望推動市場的發展。

- 學校和培訓中心也正在擺脫傳統的黑板教學方法,將智慧科技融入學習環境。在大學層面,教育機構正在採用智慧學習等創新方法,為學生提供替代的職業道路和獲得符合產業要求的相關和有價值技能的機會。

- 非營利組織「明日計畫」對超過 4,000 名相關人員進行了一項關於數位化學習的全球研究,結果表明,數位化學習可以提高學生的參與度,使教師能夠引入新的學習方式,並減少學生消化資訊所需的總體時間。此外,普羅米修斯最近的一項調查發現,大多數教師認為教育科技可以加速課堂學習(82%)。

- 隨著智慧型手機、筆記型電腦和平板電腦等行動裝置的普及,BYOD趨勢在學校越來越普遍,改變了學生的學習方式以及何時、何地和如何獲取教育資訊。

行動學習市場趨勢

企業部門將實現顯著成長並引領市場

- 行動學習是各行各業組織培訓和發展部門中成長最快的領域。大多數企業正在採用技術輔助學習,以使學習者能夠在職場產生、儲存和傳遞創新想法。研究表明,依賴行動學習解決方案的組織的生產力提高了 16%,員工的創造力和忠誠度也提高了。

- IBM 印度公司對各垂直產業的 CIO、CMO、CTO 和其他決策者進行的一項調查顯示,約有 57% 的企業計劃投資產業特定的 BYOD 和行動技術。相較之下,67.4% 的人表示對擁有這項技術有個人興趣,這反映了企業領域的行動學習成長。

- 為了降低培訓成本,大多數企業組織已經開始僱用更少的培訓師,並採用行動學習解決方案,例如Coursera、Udacity和Khan Academy等私人內容提供者以低成本提供的大規模開放課程(MOOC)。

- 此外,許多組織正在尋求採用行動學習解決方案,以便在旅途中和使用者的工作流程中提供培訓。培訓的靈活性在於使用者可以輕鬆地按照自己的步調和方便進行學習,最終以有效的方式建立專業知識。

預計亞太地區將出現顯著成長

- 預計亞太國家將對行動學習市場的成長做出重大貢獻。行動學習解決方案的採用正在該地區明顯展開,以衡量創新學習技術的力量。內在實力和快速的經濟成長使該地區成為國際上成長最快的教育市場之一。

- 此外,由於頻寬的可用性、具有成本效益的資料方案以及意識的不斷增強,網際網路在許多國家迅速普及,也導致包括教育在內的各個領域採用數位化技術,從而推動了市場的發展。此外,根據CNNIC的數據,到2023年,約有99.9%的中國網路用戶將使用行動電話上網。到2023年12月,中國將有約10.9億人透過行動裝置上網。

- 許多西方公司正在中國尋找合格的畢業生,以滿足日益成長的技術員工需求。最近的研究表明,儘管人們非常重視學術,但該國仍然嚴重缺乏合格的候選人。為了解決這個問題,中國發起了智慧教育中國計畫。

- 此外,該地區大規模開放線上課程(MOOC)的成長預計將推動所調查市場的成長。例如,中國國務院新聞辦公室(SCIO)在 2023 年 2 月發布的中國智慧教育報告中稱,目前全國有超過 64,500 個 MOOC。在北京舉行的世界數位教育大會上,據報道有超過10億人觀看了這些課程。

- 此外,根據GSMA的預測,到2022年,亞太地區行動網路用戶比例將從2018年的45%增加到49%。相較之下,到2022年,大中華區將有79%的人口使用行動網路。該地區行動網際網路普及率的大幅成長預計將在未來幾年對行動學習產業產生重大影響,促進該地區市場實現可觀的成長。

行動學習產業概況

行動學習市場競爭激烈,由幾家大公司主導,包括 Upside Learning、NetDimensions Limited、SAP AG、Promethean World Ltd 和 Skillsoft。這些佔據了絕對市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來擴大市場佔有率並提高盈利。然而,隨著技術進步和產品創新,中小企業透過贏得新契約和探索新市場來擴大其市場佔有率。

2023 年 5 月,澳洲教育科技公司 Go1 收購行動學習應用程式 Blinkist,擴大了其平台的覆蓋範圍,這是其今年的第二筆收購。 Go1 表示,此次收購擴大了對尋求學習新技能和獲取按需更新的商業和個人發展內容的市場的吸引力。學習者可以透過企業學習管理系統 (LMS) 存取 Blinkist 內容,並且首次可以透過行動裝置上的 CarPlay 隨時隨地存取。

2023 年 3 月,為整個學習者生命週期提供學習解決方案的著名供應商 Anthology 和行動教育技術參與企業Navengage 宣佈建立新的夥伴關係關係,將 Navengage 的適應性學生參與行動應用程式與學生社群參與動態平台 Anthology Engage 結合起來。此整合解決方案允許學生在任何裝置上使用 Anthology 的學生參與平台,從而提供了額外的靈活性。

2022 年 11 月,全球模擬網路釣魚和安全意識提升培訓提供者 KnowBe4 宣布推出新的 KnowBe4 行動學習者應用程式。這為最終用戶提供了隨時隨地獲取安全意識提升和合規性培訓的機會,無需支付額外費用,從而提高了用戶參與度並加強了安全文化。最終用戶將全年可以存取這個新程序,並可以透過平板電腦或智慧型手機輕鬆完成安全意識提升和合規培訓。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 市場定義和範圍

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 企業部門迅速採用數位學習解決方案來提高工作效率和生產力,並正在推動市場

- 擴展 BYOD 概念

- 智慧型手機、平板電腦和筆記型電腦等行動裝置日益普及

- 市場限制

- 增加對技術基礎設施的初始投資

- 評估新冠肺炎對市場的影響

第6章 市場細分

- 軟體

- 電子書

- 互動評估

- 移動和基於影片的課件

- 其他軟體

- 應用

- 課堂學習

- 公司內部學習

- 模擬學習

- 網路在職訓練

- 自學

- 最終用戶

- 學術學習

- 企業學習

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Promethean World Ltd

- NetDimensions Limited(Learning Technologies Group)

- Upside Learning Solutions Pvt. Ltd.

- SAP SE

- Skillsoft

- Citrix Systems Inc.

- Cisco Systems Inc.

- Dell Inc.

- IBM Corporation

- AT&T Inc.

第8章投資分析

第9章:市場的未來

The Mobile Learning Market size is estimated at USD 94.93 billion in 2025, and is expected to reach USD 287.17 billion by 2030, at a CAGR of 24.78% during the forecast period (2025-2030).

The rapid adoption of electronic devices in educational institutions, increasing investment in information technology, and growing adoption of Bring Your Own Device (BYOD) culture are some of the major factors driving the growth of the mobile learning market.

Key Highlights

- The recent advancements in digital learning solutions owing to the higher penetration of mobile devices have empowered learners with access to material, irrespective of their location, by erasing boundaries and introducing interactive means through which the overall learning experience has been enhanced. Moreover, the information is being presented in a more effective way by using numerous types of digital media, which helps in better understanding and retention of concepts.

- According to a recent HP India report, 63% of respondents in the country believed that digital learning is much more effective in fuelling their children's creative thinking, and 57% of the respondents believed that experiential learning could enable better comprehension. Additionally, owing to this reason, parents are willing to spend on learning apps for their child's education, which is expected to drive the market.

- Schools and training centers are also moving from their traditional blackboard approach to integrating smart technology into learning environments. At the university level, institutions are adopting innovative methods, such as smart learning, to provide alternative pathways and opportunities for students to develop relevant and valuable skills in line with industry requirements.

- A survey conducted by Project Tomorrow (a non-profit organization) worldwide on digital learning with a sample size of more than 4 lakh stakeholders revealed that digital learning led to an increase in student engagement, enabled teachers to introduce new forms of learning styles, and reduced the overall time taken by students to digest information. Additionally, according to Promethean's recent study, the majority of teachers believe that educational technology accelerates learning in their classrooms (82%).

- With the proliferation of mobile devices, such as smartphones, laptops, and tablets, the BYOD trend is increasingly growing in schools, transforming the way students learn and how, where, and when they consume educational information.

Mobile Learning Market Trends

Corporate Segment Would Experience Significant Growth and Drive the Market

- Mobile learning is a rapidly growing area for training and development departments in organizations of all industries. Most corporate companies adopt technology-aided learning, which enables learners to create, store, and deliver innovative ideas at the workplace. According to the study, organizations that rely on mobile learning solutions saw a 16% boost in productivity and improvements in the creativity and loyalty of their employees.

- A survey conducted by IBM India among CIOs, CMOs, CTOs, and other decision-makers across various verticals indicated that about 57% of enterprises are planning to invest in BYOD and mobile technology. In comparison, 67.4% expressed personal interest in owning this technology, which reflects the growth of mobile learning in the corporate segment.

- In order to reduce training costs, most corporate organizations have reduced the hiring of trainers and started adopting mobile learning solutions such as Massively Organized Open Courses (MOOCs), which are offered by private content providers such as Coursera, Udacity, Khan Academy, etc. at a lower expense.

- Additionally, many corporate organizations are trying to implement mobile learning solutions to offer training that can be taken on the go and within the users' workflow. The flexibility of the training resides on the user's hand, and they can learn at their own pace and convenience and ultimately gain expertise in an effective manner.

Asia Pacific is Expected to Experience Significant Growth

- Asia Pacific countries are expected to contribute significantly to the growth of the mobile learning market. The adoption of mobile learning solutions is explicitly deployed in this region to determine the power of innovative learning methodologies; the intrinsic strength and rapid economic growth are aiding this region in becoming one of the fastest-growing education markets internationally.

- Moreover, rapid internet growth in multiple countries owing to the availability of bandwidth, cost-effective data plans, and increased awareness has also led to the digital adoption of various sectors, including education, and is thereby driving the market. Moreover, according to the CNNIC, Around 99.9 percent of Chinese internet users utilized mobile phones for internet access in 2023. By December 2023, approximately 1.09 billion people in China were using the internet on their mobile devices.

- Many Western companies are looking for qualified graduates in China to meet the growing demand for skilled employees. Recent studies show that although there is a significant focus on academics, there is a considerable shortfall of qualified personnel in the country. To tackle this issue, China started a Smart Education China initiative, which aims at increasing the qualification of graduates in China in the medium term to meet the growing demand for qualified personnel.

- Furthermore, the growth of the massive open online courses (MOOC) in the region is anticipated to boost the growth of the market studied. For instance, according to a report on China's smart education issued in February 2023, the State Council Information Office (SCIO) in China reports that there are currently more than 64,500 MOOCs available in the country. The World Digital Education Conference started in Beijing with a report stating that over 1 billion people have viewed these courses.

- Moreover, according to GSMA, the percentage of mobile internet users in the Asia-Pacific region increased from 45 percent in 2018 to 49 percent in 2022. In comparison, 79% of people in Greater China used mobile internet in 2022. Such significant growth in mobile internet penetration in the region would substantially influence the mobile learning industry in the coming years, contributing to the considerable regional growth in the market.

Mobile Learning Industry Overview

The mobile learning market is competitive and is dominated by a few major players like Upside Learning, NetDimensions Limited, SAP AG, Promethean World Ltd, and Skillsoft. These major players with a prominent share of the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

In May 2023, Go1, an Australia-based edtech firm, expanded the reach of its platform by acquiring Blinkist, a mobile learning app, as its second acquisition of the year. Go1 claims the acquisition broadens the company's appeal to a market looking to pick up new skills and keep updated on business and self-improvement content on demand. Learners can access Blinkist content through their corporate learning management system (LMS) and, for the first time, on their mobile device, in CarPlay, irrespective of time and location.

In March 2023, Anthology, a prominent supplier of learning solutions for the whole learner lifecycle, and Navengage, a mobile education technology player, announced a new partnership that will combine Navengage's adaptable student engagement mobile app with Anthology Engage, a dynamic platform for student community engagement. The integrated solution will add even more flexibility by allowing students to use Anthology's student engagement platform from any device.

In November 2022, KnowBe4, a global provider of simulated phishing and security awareness training, announced the launch of the new KnowBe4 Mobile Learner App to allow end users on-the-go access to security awareness and compliance training at no extra cost, enhancing user engagement and strengthening security culture. End users will have all-year-round access to this new program, making it easy to finish their security awareness and compliance training from tablets or smartphones.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption for Digital Learning Solutions in Corporate Sector to boost overall work Efficinecy and Productivity to drive the market

- 5.1.2 Growing Concept of BYOD

- 5.1.3 Increasing Penetration of Mobile Device such as Smartphone, Tablet and Laptops

- 5.2 Market Restraints

- 5.2.1 Increasing Initial Investment in Technology Infrastructure

- 5.3 Assessment of Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 Software

- 6.1.1 E-Books

- 6.1.2 Interactive Assessment

- 6.1.3 Mobile and Video-Based Courseware

- 6.1.4 Other Softwares

- 6.2 Application

- 6.2.1 In-Class Learning

- 6.2.2 Corporate Learning

- 6.2.3 Simulation-Based Learning

- 6.2.4 Online-on-the Job Training

- 6.2.5 Independent Learning

- 6.3 End User

- 6.3.1 Academic Learning

- 6.3.2 Corporate Learning

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Promethean World Ltd

- 7.1.2 NetDimensions Limited (Learning Technologies Group)

- 7.1.3 Upside Learning Solutions Pvt. Ltd.

- 7.1.4 SAP SE

- 7.1.5 Skillsoft

- 7.1.6 Citrix Systems Inc.

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Dell Inc.

- 7.1.9 IBM Corporation

- 7.1.10 AT&T Inc.