|

市場調查報告書

商品編碼

1644448

中國 UPVC 門窗:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China UPVC Doors And Windows - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

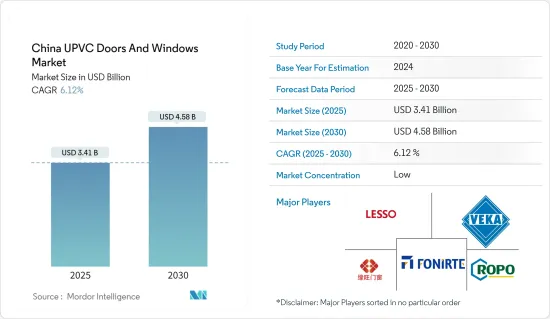

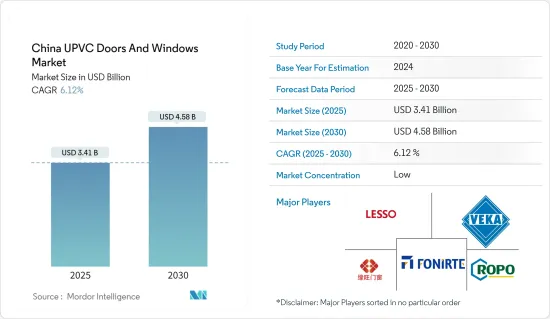

預計2025年中國UPVC門窗市場規模將達34.1億美元,預計2030年將達到45.8億美元,預測期內(2025-2030年)的複合年成長率為6.12%。

消費者對商業建築和住宅的建設和重建的支出不斷增加,將推動中國UPVC門窗市場的成長。對永續和抗衝擊住宅基礎設施的需求不斷成長,可能會推動該行業走向更具創新性的生產材料。預計該行業的成長動力包括人們對 UPVC 產品優勢的認知不斷提高、持續的工業化、不斷成長的城市人口、擴大的外國投資基金、提高個人收入水平以及中國人口和家庭的進一步增加。中國是最大的消費國和生產國之一,向許多國家出口用於生產 UPVC 成品的多種投入品。

此外,政府為維持製造業成長、改善基礎設施、擴大公共工程和減少地區經濟差距所做的努力也可能支持建築支出的成長。政府為改善低收入者生活條件而採取的舉措,例如對都市區經濟適用住宅建設和農村危舊農房重建提供補貼,也可能進一步刺激此產業的成長。

中國UPVC門窗市場趨勢

中國住宅建設和基礎設施建設的增加正在推動市場

建築和基礎設施行業的發展以及建築中 UPVC 材料成本的下降可能會促進 UPVC 門窗市場的成長。此外,支持農村基礎設施發展的公共合作計劃預計將為該產業帶來巨大潛力。由於政府計劃重點關注中小城市的基礎設施建設,建設產業預計將保持持續成長。中國消費者在製成品和服務方面的支出強勁成長、政府政策以及政府改善生活水準的努力可能會刺激住宅基礎設施的成長。

政府措施和改造投資預計將推動 UPVC 產品的成長

今年工業和建築業將佔中國GDP的48%左右。在住宅維修計劃中使用時,UPVC 窗戶和門可以使您的住宅社區極其節能,並減少碳足跡。中國政府計劃維修約22萬個老舊住宅小區。 UPVC 門窗是傳統門窗的永續替代品,維護要求低,隔熱性能好,減少了住宅對供暖和製冷系統的需求,使整個住宅社會更加節能。由於這些優勢,中國的改造計劃正在推動對 UPVC 門窗的需求。

中國UPVC門窗產業概況

本報告介紹了中國 UPVC 門窗市場的主要國際參與者。從市場佔有率來看,目前市場主要被少數幾家大公司佔據。然而,隨著技術進步和產品創新,中小企業透過贏得新契約和探索新市場來擴大其市場佔有率。市場的主要企業包括Fonirte、聯合中國、浙江遠望門窗、Ropo和維卡塑膠(上海)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察與動態

- 市場概況

- 市場促進因素

- 環保材料正在推動市場

- 增加建築和基礎設施建設

- 市場限制

- 壽命短是市場限制因素

- 市場機會

- 技術創新和進步將進一步最佳化產品性能,並為新進入者創造機會

- 客製化產品和大規模生產的興起

- 產業價值鏈/供應鏈分析

- 洞察市場技術進步

- 產業吸引力波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場區隔

- 依產品類型

- UPVC 門

- UPVC 窗戶

- 按最終用戶

- 住宅

- 商業的

- 工業和建築

- 其他最終用戶

- 按分銷管道

- 線下門市

- 網路商店

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Fonirte

- Lesso

- Zhejiang Yuanwang Windows and Doors Co. Ltd

- Ropo

- Reaching Build

- VEKA Plastics(Shanghai)Co. Ltd.

- Weifang Beidi Plastic Industry Co. Ltd.

- Oridow

- Yingde Conch Profiles Co. Ltd

- Tianjin Jinpeng Group*

第7章 市場趨勢

第8章 免責聲明及發布者

The China UPVC Doors And Windows Market size is estimated at USD 3.41 billion in 2025, and is expected to reach USD 4.58 billion by 2030, at a CAGR of 6.12% during the forecast period (2025-2030).

Increasing consumer spending on the construction and renovation of commercial and residential buildings will drive the China UPVC doors and windows market growth. The booming demand for sustainable and impact-resistant housing infrastructure will lead the industry toward more innovative product materials. Growth is expected to be driven by growing awareness about the benefits of UPVC products, ongoing industrialization, an increasingly urban population, expanding foreign investment funding, rising personal income levels, and further population and household growth in China. China is one of the largest consumers and producers and caters to a wide range of countries by exporting several input supplies used to produce UPVC finished goods.

In addition, the government's effort to sustain growth in the manufacturing sector, improve the country's infrastructure, expand municipal utilities, and balance regional economic disparity will help growth in construction spending. Government efforts to improve living conditions for low-income earners (such as the construction of affordable and low-rent houses in urban areas and subsidies for alterations of dilapidated farmhouses in rural areas) will also further gains in this segment.

China UPVC Doors and Windows Market Trends

Increasing Residential Construction and Infrastructure Development in China is Driving the Market

Growth of the construction and infrastructure development industry and low UPVC material costs in construction may boost UPVC windows and door market growth. In addition, private and public partnership projects to support infrastructure development in rural areas are expected to induce immense potential to the industry size. As the government has planned to focus on improving the infrastructure in small and medium-sized cities, the construction industry is forecasted to maintain continuous growth. Robust growth in consumer spending for manufactured goods and services, government policies, as well as government efforts to improve standards of living in China, may help to spur gains in residential infrastructure.

Government Plans and Investment in Renovation is Expected to Drive the Growth of UPVC Products

Industry and construction account for about 48% of China's GDP in the current year. UPVC windows and doors, if used in residential renovation projects, make residential communities incredibly energy efficient and have a low carbon footprint. The government in China has planned to renovate around 220,000 old residential communities. UPVC doors and windows are a sustainable alternative to traditional doors and windows as they offer low maintenance and are a sustainable option with higher insulation; this insulation provides less need for a heating and cooling system for the house, hence increasing the energy efficiency of overall residential societies. Due to these benefits, renovation projects in China propel the UPVC doors and windows demand.

China UPVC Doors and Windows Industry Overview

The report covers major international players operating in the Chinese UPVC doors and windows market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Some of the major companies in the market include Fonirte, Lesso China, Zhejiang Yuanwang Windows and Doors Co., Ltd., Ropo, and VEKA Plastics (Shanghai) Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Eco-Friendly Material in Nature is Driving the Market

- 4.2.2 Increasing Construction and Infrastructure Development

- 4.3 Market Restraints

- 4.3.1 Shorter Life Span is a Restraining Factor the Market

- 4.4 Market Opportunities

- 4.4.1 Technological Innovation and Advancement will Further Optimize the Performance of the Product which will Create Opportunities to New Entrants

- 4.4.2 Customized Products and Increase Mass production

- 4.5 Industry Value Chain/Supply Chain Analysis

- 4.6 Insights on Technological Advancements in the Market

- 4.7 Industry Attractiveness: Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 UPVC Doors

- 5.1.2 UPVC Windows

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial and Construction

- 5.2.4 Other End-Users

- 5.3 Distribution Channel

- 5.3.1 Offline Stores

- 5.3.2 Online Stores

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Fonirte

- 6.2.2 Lesso

- 6.2.3 Zhejiang Yuanwang Windows and Doors Co. Ltd

- 6.2.4 Ropo

- 6.2.5 Reaching Build

- 6.2.6 VEKA Plastics (Shanghai) Co. Ltd.

- 6.2.7 Weifang Beidi Plastic Industry Co. Ltd.

- 6.2.8 Oridow

- 6.2.9 Yingde Conch Profiles Co. Ltd

- 6.2.10 Tianjin Jinpeng Group*

![PVC 窗戶市場:趨勢、機會與競爭分析 [2024-2030]](/sample/img/cover/42/1448492.png)

![uPVC門窗市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1289750.png)