|

市場調查報告書

商品編碼

1644457

義大利低溫運輸物流:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Italy Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

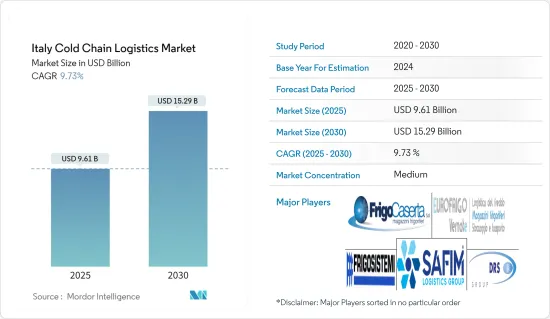

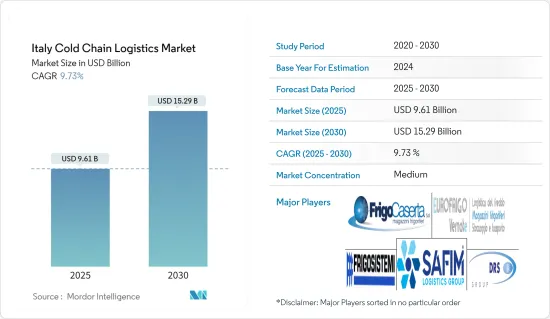

義大利低溫運輸物流市場規模預計在2025年為96.1億美元,預計到2030年將達到152.9億美元,預測期內(2025-2030年)的複合年成長率為9.73%。

關鍵亮點

- 義大利已成為貨運和低溫運輸物流的全球領跑者。義大利的國內鐵路運輸市場總量位居德國之後,位居歐洲第二。每年,義大利的鐵路和公路網路管理著約 160 萬個 20 英尺當量單位 (TEU) 和 1,230 萬公噸的貨物。

- 義大利蓬勃發展的電子商務正在推動網路購物的成長。最近的一項分析顯示,2024 年義大利食品和雜貨市場的規模將達到 755 億歐元(795.7 億美元),其中線上銷售額佔總銷售額的 6%,相當於 46 億歐元(48.5 億美元)。網路銷售額較去年同期成長 6.2%,超過實體店面銷售額 1.5% 的增幅。消息人士強調,食品採購在義大利網路購物趨勢中處於領先地位。主要的消費促進因素包括便利性,例如實惠的送貨、高效的運輸和無縫的購物體驗。

- 義大利線上雜貨店購物者表現出非凡的忠誠度,重複購買率超過 70%。個人護理和美容佔義大利數位零售市場的 9%,而食品和飲料佔 6%。包括家居和衛生產品在內的「近食品」物品的線上滲透率為 3%,這與歐洲的整體模式一致。 2024年,27.1%的義大利消費者將使用線上平台購買食品,比前一年成長8.8%。此外,21% 的義大利人打算在 2024 年在食物上花費更多,凸顯了他們更喜歡更健康的選擇。

- 總之,在交通運輸進步、轉向線上購物以及低溫運輸物流市場的推動下,義大利的物流和電子商務產業正在經歷顯著成長。

義大利低溫運輸物流市場趨勢

乳製品消費量增加推動市場

義大利在全球乳製品產業中發揮著至關重要的作用,其生產的乳製品將品質、生產和傳統完美地結合在一起。最先進的牛奶加工技術使得新鮮牛奶、超高溫牛奶和低脂牛奶等各種形式的牛奶得以廣泛供應,以滿足有特殊飲食和不耐症人群的需求。

37 種 PDO 起司和眾多的區域品種彰顯了義大利豐富的起司製作傳統。在這裡,傳統方法已經演變成工業流程,並與使用現代技術製作的乳酪共存。最終的成果是生產出種類繁多的乳酪,以滿足國內外消費者的挑剔偏好。

優格和發酵乳製品的口味、尺寸和特性種類繁多,適合各種消費場景。除了傳統產品外,益生菌發酵乳還迎合了現代注重健康的市場。乳製品產業在義大利食品市場佔據主導地位,銷售額達 142 億歐元(149.6 億美元)。值得注意的是,義大利75%的原乳產量來自北部。倫巴第大區、艾米利亞-羅馬涅大區、威尼託大區和皮埃蒙特大區。

義大利生產 1,100 萬噸牛奶,加工成 100 萬噸乳酪(超過 44 萬噸 PDO)、約 300 萬噸巴氏殺菌飲用乳和 19 萬噸優格和發酵產品。乳酪產量包括 130 萬噸巴氏殺菌牛奶和 160 萬噸超高溫牛奶。義大利起司出口額達14億歐元,出口量近25萬噸。主要出口品種有莫札瑞拉起司起司和其他新鮮起司(36.4%)、格拉娜帕達諾起司(PDO)和帕瑪森起司(PDO)(25%)、羅馬羊乳酪(PDO)、戈貢佐拉起司(PDO)和波羅伏洛起司(PDO)。為義大利乳品加工業和牲畜飼養者協會 Alleanza Cooperative Agroalimentari 準備的報告預測,未來五年義大利的牛奶產量將成長 +10/+15%,年均波動率為 +2/+3%,持續到 2030 年。

該報告還包括該國牛奶產量的估計值。義大利將在幾年內實現原料理論上的自給自足(目前為80%)。過去五年來,義大利的牛奶產量大幅增加。產量成長主要發生在義大利北部(Lombardia+19%、艾米利亞-羅馬涅 +15%、威尼托 +6.0%、Piemonte+15%),但也發生在一些南部地區(普利亞大區 +12%、Sicilia和巴西利卡塔 +11%、Calabria+17%)。國內乳製品使用量的不斷增加,推動了低溫運輸物流市場的發展。

義大利冷藏設施擴建推動市場

冷藏倉儲設施對於保存水果、蔬菜和魚貝類等生鮮產品至關重要。為滿足農業需求,氣候溫和的義大利冷藏設施正在迅速增加。冷藏和物流技術的進步使得這些設施更有效率,有助於促進義大利的農產品出口。例如,2024年9月,全球先進食品物流先驅Nucold在義大利中南部破土動工建造最大的恆溫倉庫。計劃位於弗羅西諾內省費倫蒂諾,投資 7,000 萬歐元(7,377 萬美元),將創造 150-200 個就業崗位,預計將於 2026 年投入營運。該工廠位置Froneri 的 Ferentino 工廠旁邊,地理位置優越,旨在簡化冷凍產品的存儲,提供顯著的環境效益並支持 Froneri 的業務擴展。 Froneri 是全球第二大包裝和冰淇淋公司,也是領先的自有品牌冰淇淋製造商。

該設施第一期將高 40 公尺(130 英尺),可容納 62,000 個托盤。最重要的是,這個最先進的倉庫利用可再生能源和自動化技術,比傳統倉庫節省 50% 的能源。其特點包括用於裝卸行李的自動車輛和全自動揀選系統。 NewCold 的 Ferentino 倉庫將擴大其在義大利的業務,補充其在皮亞琴察和博爾戈羅斯的現有設施。如果所有階段都得以實現,Nucold 在義大利的生產能力將飆升至 20 萬個托盤。總之,義大利先進冷藏倉庫的發展不僅將支持農業部門,也將為經濟成長和環境永續性做出重大貢獻。

義大利低溫運輸物流行業概況

義大利低溫運輸物流市場細分化,研究市場中有許多國內和國際參與者。市場上企業與新進者之間的聯盟日益增多,並且正在確立強勢地位。低溫運輸設施需求龐大,導致企業數量眾多,規模較小,專業化程度較低,營運成本較高,發展不平衡、不足。現有主要參與者包括 Safim Logistics、Frigocaserta SRL、Eurofrigo Vernate SRL、Frigoscandia SPA 和 DRS Depositi Regionali Surgelati SRL。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態與洞察

- 當前市場狀況

- 市場動態

- 驅動程式

- 電子商務成長

- 對永續產品的需求不斷增加

- 限制因素

- 促進要素短缺

- 能源燃料成本上漲

- 機會

- 自動化倉庫

- 驅動程式

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術趨勢和自動化

- 政府法規和舉措

- 產業價值鏈/供應鏈分析

- 專注於氣候和溫度控制存儲

- 排放標準和法規對低溫運輸產業的影響

- 地緣政治事件如何影響市場

第5章 市場區隔

- 按服務

- 貯存

- 運輸

- 附加價值服務(冷凍、標籤、庫存管理等)

- 按溫度類型

- 常溫

- 冷藏

- 冷凍

- 按應用

- 園藝(新鮮水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉類和魚類

- 加工食品

- 製藥、生命科學、化學

- 其他

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Safim Logistics

- Frigocaserta SRL

- Eurofrigo Vernate SRL

- Frigoscandia SPA

- DRS Depositi Regionali Surgelati SRL

- Frigogel SRL

- Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- Sodele Magazzini Generali Frigoriferi SRL

- Horigel SRL

- Fridocks General Warehouses and Frigoriferi SRL

- Lineage Logistics

- UPS*

- 其他公司

第7章:未來市場展望

第 8 章 附錄

- 宏觀經濟指標(GDP分佈、按活動分類、運輸和倉儲業對經濟的貢獻)

- 對外貿易統計 - 出口和進口(按產品分類)

The Italy Cold Chain Logistics Market size is estimated at USD 9.61 billion in 2025, and is expected to reach USD 15.29 billion by 2030, at a CAGR of 9.73% during the forecast period (2025-2030).

Key Highlights

- Italy has established itself as a global frontrunner in freight and cold chain logistics. Following Germany, Italy ranks as Europe's second-largest market for combined domestic rail transport. Each year, Italy's rail and road networks manage around 1.6 million twenty-foot equivalent units (TEU) and 12.3 million metric tons.

- Italy's burgeoning e-commerce landscape is fueling a rise in online grocery shopping. A recent analysis revealed that in 2024, Italy's food and grocery market, valued at EUR 75.5 billion (USD 79.57 billion), saw online sales accounting for 6% of the total, equating to EUR 4.6 billion (USD 4.85 billion). Online sales surged by 6.2% from the previous year, outpacing the 1.5% growth in brick-and-mortar stores. Sources emphasize that food purchases are at the forefront of Italy's online shopping trends. Key consumer drivers include conveniences such as affordable delivery, efficient shipping, and a seamless purchasing experience.

- Italian online grocery shoppers demonstrate notable loyalty, with repeat purchases exceeding 70%. While personal care and beauty account for 9% of Italy's digital retail market, food and beverage hold a 6% share. 'Near Food' items, which include household and hygiene products, show a 3% online penetration, aligning with broader European patterns. In 2024, 27.1% of Italian shoppers utilized online platforms for food purchases, an 8.8% increase from the previous year. Additionally, 21% of Italians intend to boost their food spending in 2024, emphasizing a preference for healthier options.

- In conclusion, Italy's logistics and e-commerce sectors are experiencing significant growth, driven by advancements in transportation and a shift towards online grocery shopping and cold chain logistics market.

Italy Cold Chain Logistics Market Trends

Increasing Usage of Dairy Products in the Country is Driving the Market

Italy stands as a pivotal player in the global dairy industry, seamlessly blending quality, volume, and tradition in its national production. Cutting-edge milk processing technologies have popularized milk in various forms - fresh, UHT, and LSL - catering to special diets and those with intolerances.

Italy's rich cheese-making heritage is underscored by 37 PDO cheeses and a plethora of local varieties. Here, traditional practices have evolved into industrial processes, coexisting with cheeses crafted through modern techniques. This results in a diverse array of cheeses tailored to meet the discerning tastes of both domestic and international consumers.

Yogurt and fermented milk products boast a vast array of flavors, sizes, and characteristics, making them versatile for various consumption occasions. Beyond traditional offerings, probiotic fermented milk caters to the contemporary health-conscious market. Dominating the Italian food landscape, the dairy sector boasts sales of EUR 14.2 billion (USD 14.96 bn). Notably, 75% of Italy's milk production hails from the northern regions: Lombardia, Emilia Romagna, Veneto, and Piemonte.

Italy produces 11 million tons of milk, converting it into 1 million tons of cheese (with over 440,000 tons being PDO), nearly 3 million tons of pasteurized drinking milk, and 190,000 tons of yogurt and fermented products. The cheese production includes 1.3 million tons of pasteurized milk and 1.6 million tons of UHT milk. Italy's cheese exports, valued at €1.4 billion, amount to nearly 250,000 tons. The leading exported varieties include Mozzarella and other fresh cheeses (36.4%), Grana Padano PDO and Parmigiano Reggiano PDO (25%), followed by Pecorino Romano PDO, Gorgonzola PDO, and Provolone. In a report carried out for the Italian association of farmers and breeders Alleanza Cooperative Agroalimentari, cow's milk production in Italy is expected to increase by +10/+15% in the next five years, with an average annual variation rate of + 2/+3% which is intended to continue until 2030.

The report also includes estimates of the national production of cow's milk: Italy will reach theoretical self-sufficiency in the raw material in a few years (today it is 80%). In the last five years, the production of cow's milk in Italy has increased significantly. Most of the increase in production took place in the northern Italian regions (Lombardy +19%, Emilia Romagna +15%, Veneto +6.0%, Piedmont +15%), but also in some southern regions (Puglia +12%, Sicily and Basilicata) +11%, Calabria +17%). The increasing usage of dairy products in the country is driving the cold chain logistics market.

Expanding Cold Storage Facilities in Italy is Driving the Market

Cold storage facilities are crucial for preserving perishable goods like fruits, vegetables, and seafood. In response to its agricultural industry's needs, Italy, benefiting from a temperate climate, has witnessed a surge in cold storage facilities. Due to advancements in refrigeration and logistics technologies, these facilities have become more efficient, bolstering Italy's agricultural exports. For instance, in September 2024, NewCold, a global frontrunner in advanced food logistics, broke ground on Central and Southern Italy's largest temperature-controlled warehouse. Located in Ferentino, Frosinone, this EUR 70 million (USD 73.77 mn) project is poised to create 150 to 200 jobs and commence operations by 2026. Strategically situated next to Froneri's Ferentino plant, the facility aims to streamline frozen product storage, offering notable environmental advantages and bolstering Froneri's expansion. Froneri stands out as the globe's second-largest packaged ice cream entity and a prominent private-label ice cream manufacturer.

The facility's inaugural phase will see it rise to 40 meters (130 feet) with a capacity of 62,000 pallet spaces. Notably, this state-of-the-art warehouse is engineered to consume 50% less energy than its conventional counterparts, harnessing renewable energy and automation. Features include automated vehicle loading/unloading and a fully automated picking system. Expanding its Italian footprint, NewCold's Ferentino warehouse will complement its existing facilities in Piacenza and Borgorose. Once all phases are realized, NewCold's Italian capacity will soar to 200,000 pallet positions. In conclusion, the development of advanced cold storage facilities in Italy not only supports the agricultural sector but also contributes significantly to the economic growth and environmental sustainability.

Italy Cold Chain Logistics Industry Overview

The Italian cold chain logistics market is fragmented, with several domestic and international companies present in the market studied. The market is experiencing collaborations and new entries of companies to set up their firm foot. The demand for cold chain facilities has led to many small players with a low degree of specialization, leading to problems like high operating costs and unbalanced and insufficient development. Some existing major players in the market include Safim Logistics, Frigocaserta SRL, Eurofrigo Vernate SRL, Frigoscandia SPA, and DRS Depositi Regionali Surgelati SRL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rise in Ecommerce

- 4.2.1.2 Increase in Demand for Persiable Products

- 4.2.2 Restraints

- 4.2.2.1 Shortage of Drivers

- 4.2.2.2 Increasing Energy and Fuel Costs

- 4.2.3 Opportunities

- 4.2.3.1 Automated Warehouses

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technological Trends and Automation

- 4.5 Government Regulations and Initiatives

- 4.6 Industry Value Chain/Supply Chain Analysis

- 4.7 Spotlight on Ambient/Temperature-controlled Storage

- 4.8 Impact of Emission Standards and Regulations on Cold Chain Industry

- 4.9 Effect of Geopolitical Events on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Storage

- 5.1.2 Transportation

- 5.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 5.2 By Temperature Type

- 5.2.1 Ambient

- 5.2.2 Chilled

- 5.2.3 Frozen

- 5.3 By Application

- 5.3.1 Horticulture (Fresh Fruits and Vegetables)

- 5.3.2 Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3 Meats and Fish

- 5.3.4 Processed Food Products

- 5.3.5 Pharma, Life Sciences, and Chemicals

- 5.3.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Safim Logistics

- 6.2.2 Frigocaserta SRL

- 6.2.3 Eurofrigo Vernate SRL

- 6.2.4 Frigoscandia SPA

- 6.2.5 DRS Depositi Regionali Surgelati SRL

- 6.2.6 Frigogel SRL

- 6.2.7 Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- 6.2.8 Sodele Magazzini Generali Frigoriferi SRL

- 6.2.9 Horigel SRL

- 6.2.10 Fridocks General Warehouses and Frigoriferi SRL

- 6.2.11 Lineage Logistics

- 6.2.12 UPS*

- 6.3 Other Companies

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of Transport, and Storage Sector to economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product