|

市場調查報告書

商品編碼

1682716

醫藥品低溫物流輸送系統市場:各一次包裝形式,各二次包裝形式,使用法類別,各主要地區:2035年前的產業趨勢與全球預測Cold Chain Market for Pharmaceuticals by Type of Primary Packaging, Type of Secondary Packaging, Type of Usability and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035 |

||||||

全球醫藥冷鏈市場規模預計將從目前的 63.8 億美元增長到 2035 年的 96 億美元,預測期內的複合年增長率為 3.8%。

冷鍊是一個結合了科學、技術和製程開發三個面向的概念。冷鏈解決方案有助於維持供應鏈各階段的產品效力和完整性。此外,近年來,利害關係人一直致力於開發用於監測和追蹤的先進工具和技術,尤其是物聯網、RFID 和區塊鏈等即時監測技術。此外,連網冷鏈解決方案比傳統方法具有多種優勢,包括跨多個步驟的自動化和消除人為錯誤處理。

在不久的將來,連網冷鏈解決方案可能會在克服與溫度敏感產品相關的許多挑戰(例如追蹤/追蹤和交貨時間限制)中發揮關鍵作用,從而最大限度地減少產品損壞的可能性並節省額外成本。隨著技術不斷創新和進步,加上行業參與者的不斷努力,預計醫藥冷鏈市場將在未來實現顯著成長。

目前,有超過 70 家公司提供用於儲存和運輸對溫度敏感的醫藥產品的冷鏈貨櫃/托運人。大約 70% 的冷鏈貨櫃和托運人供應商提供被動冷鏈包裝解決方案,其中大多數中型市場公司提供冷鏈解決方案的設計、追蹤和再利用服務。超過 65 家公司提供數據記錄器和指示器來監測溫度、濕度、光照、衝擊、位置和冷鏈運輸條件等關鍵參數。由於競爭激烈,利害關係人正在穩步擴大其能力,以擴充各自的服務組合併滿足不斷變化的行業基準。

近 35% 的交易已簽署至 2022 年及以後,其中大多數 (40%) 是服務合約。過去幾年報道的併購交易數量反映出人們對該行業的興趣日益濃厚。其中約65%的努力集中在地理整合。產業內外的參與者已經提交並獲得了近90項與冷鏈貨櫃和托運人相關的專利,以保護該領域產生的智慧財產權。在生物製劑產品線不斷擴大和冷鏈行業技術進步的推動下,冷鏈包裝產品市場預計將在可預見的未來實現顯著成長。

本報告提供全球醫藥品低溫物流輸送系統市場相關調查,提供市場概要,以及各一次包裝形式,各二次包裝形式,使用法類別,各主要地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟以及其他的計劃特有的考慮事項

第4章 摘要整理

第5章 簡介

第6章 市場形勢:低溫運輸貨櫃(容器)/發送貨物業者

第7章 市場形勢狀況:數據記錄器供應商

第8章 基準分析

第9章 企業簡介

- 章概要

- Cold Chain Technologies

- Cryopak

- CSafe

- EMBALL'ISO

- Intelsius

- Nordic Cold Chain Solutions

- Peli BioThermal

- SEE

- SOFRIGAM

- Sonoco Thermosafe

- Tempack

- 其他的主要加入企業

第10章 夥伴關係和合作

第11章 專利分析

第12章 法規相關建議和指南

第13章 今後趨勢與今後的成長機會

第14章 對市場的影響分析:促進因素,阻礙因素,機會,課題

第15章 醫藥品的低溫運輸市場

第16章 醫藥品的低溫運輸市場,各一次包裝形式

第17章 醫藥品的低溫運輸市場,各二次包裝形式

第18章 醫藥品的低溫運輸市場,使用法各類型

第19章 醫藥品的低溫運輸市場,各主要地區

第20章 結論

第21章 執行洞察

第22章 附錄1:表格形式的資料

第23章 附錄2:企業·團體一覽

COLD CHAIN MARKET FOR PHARMACEUTICALS: OVERVIEW

As per Roots Analysis, the global cold chain market for pharmaceuticals is estimated to grow from USD 6.38 billion in the current year to USD 9.6 billion by 2035, at a CAGR of 3.8% during the forecast period, till 2035.

The market opportunity for cell and gene therapy supply chain software has been distributed across the following segments:

Type of Primary Packaging

- Vials

- Ampoules

- Pre-filled Syringes

- Bags

Type of Secondary Packaging

- Cold Boxes

- Vaccine Carriers

- Insulated Containers

Type of Usability

- Reusable

- Single-use

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

- Rest of the World

COLD CHAIN MARKET FOR PHARMACEUTICALS: GROWTH AND TRENDS

Cold chain is a three-fold concept, involving certain aspects that can be co-related to science, technology, and process development. Cold chain solutions aid in maintaining product efficacy and integrity at different stages of the supply chain. Moreover, over the last couple of years, stakeholders have been focused on the development of advanced tools and techniques for monitoring and tracking purposes, particularly real-time monitoring technologies, such as IoT, RFID and blockchain. Additionally, connected cold chain solutions have been observed to offer various advantages over conventional methodologies, including automation across several steps and elimination of human handling errors.

In the near future, connected cold chain solutions are likely to play an important role in overcoming many of the challenges (such as tracking / tracing and delivery time restrictions) that are associated with temperature-sensitive products, thereby minimizing the chances of product spoilage and saving additional costs. Given the ongoing pace of innovation, coupled with technological advancement and continuous efforts of industry players, the cold chain market for pharmaceuticals is expected to witness significant growth in the foreseen future.

COLD CHAIN MARKET FOR PHARMACEUTICALS: KEY INSIGHTS

The report delves into the current state of the cold chain market for pharmaceuticals and identifies potential growth opportunities within the industry. Some key findings from the report include:

1. More than 70 companies currently offer cold chain containers / shippers for the storage and transportation of temperature-sensitive pharmaceutical products.

2. Around 70% of the cold chain container / shipper providers offer passive cold chain packaging solutions; majority of the mid-sized players provide design, track and trace and reuse services for cold chain solutions.

3. Over 65 companies provide data loggers and indicators to monitor crucial parameters, such as temperature, humidity, light, shock, location and status of the cold chain shipment.

4. Owing to the high competition, stakeholders are steadily expanding their capabilities in order to augment their respective service portfolios and comply to the evolving industry benchmarks.

5. A considerable increase in partnership activity has been observed in the recent years; close to 35% of the deals have been inked since 2022, of which, majority (40%) are service agreements.

6. The rising interest in this domain is reflected in the number of mergers and acquisitions reported in the last few years; around 65% of such initiatives were focused on geographical consolidation.

7. Close to 90 patents have been filed / granted for cold chain containers / shippers by industry and non-industry players to protect intellectual property generated within this field.

8. Driven by the expanding pipeline of biologics, and technological advancements in cold chain industry, the market for cold chain packaging products is poised to witness significant growth in foreseeable future.

COLD CHAIN MARKET FOR PHARMACEUTICALS: KEY SEGMENTS

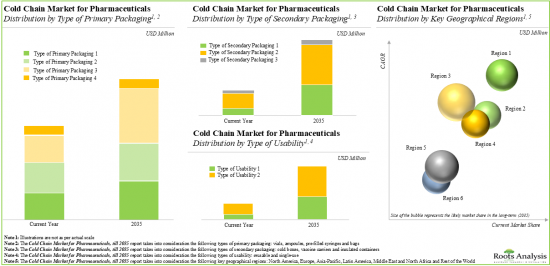

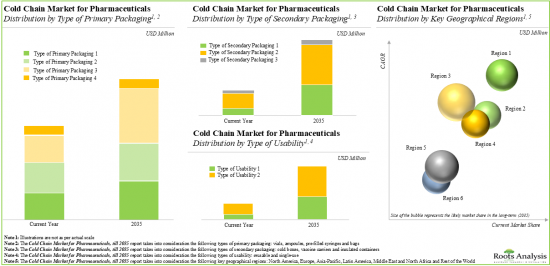

Currently, Vials Occupies the Largest Share of the Cold Chain Market for Pharmaceuticals

Based on the type of primary packaging, the market is segmented into vials, ampoules, pre-filled syringes and bags. At present, vials hold the maximum share of the cold chain market for pharmaceuticals. This trend is unlikely to change in the near future.

Insulated Container is the Fastest Growing Segment of the Cold Chain Market for Pharmaceuticals During the Forecast Period

Based on the type of secondary packaging, the market is segmented into cold boxes, vaccine carriers and insulated containers. At present, cold boxes hold the maximum share of the cold chain market for pharmaceuticals. However, insulated containers are likely to drive the market in the coming decade.

Reusable Packaging is Likely to Dominate the Cold Chain Market for Pharmaceuticals During the Forecast Period

Based on the type of usability, the market is segmented into reusable and single-use. At present, reusable packaging holds the maximum share of the cold chain market for pharmaceuticals. This trend is likely to remain the same in the forthcoming years.

Asia-Pacific Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, Latin America, and Rest of the World. Majority share is expected to be captured by players based in Asia-Pacific. It is worth highlighting that, over the years, the market in Europe is expected to grow at a higher CAGR.

Example Players in the Cold Chain Market for Pharmaceuticals

- Cold Chain Technologies

- Cryopak

- CSafe

- EMBALL'ISO

- Intelsius

- Nordic Cold Chain Solutions

- Peli BioThermal

- SEE

- SOFRIGAM

- Sonoco Thermosafe

- Tempack

COLD CHAIN MARKET FOR PHARMACEUTICALS: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the cold chain market for pharmaceuticals, focusing on key market segments, including [A] type of primary packaging, [B] type of secondary packaging, [C] type of usability and [D] key geographical regions.

- Market Landscape 1: A comprehensive evaluation of cold chain container / shipper providers, considering various parameters, such as [A] year of establishment, [B] company size (in terms of the number of employees), [C] location of headquarters, [D] type of cold chain solution, [E] type of product offered, [F] type of product material, [G] type of product packaged, [H] storage temperature and [I] service offered.

- Market Landscape 2: A comprehensive evaluation of data logger providers, considering various parameters, such as [A] year of establishment, [B] company size (in terms of the number of employees), [C] location of headquarters, [D] types of product offered, [E] mode of data transmission, [F] type of data captured, [G] type of pharmaceutical monitored, [H] temperature range.

- Regulatory and Reimbursement Landscape Analysis: A discussion on general regulatory guidelines established and issued by major regulatory bodies for cold chain market for pharmaceuticals. In addition, it includes an insightful analysis, featuring a comparison of the contemporary regulatory scenarios in key geographies across the globe.

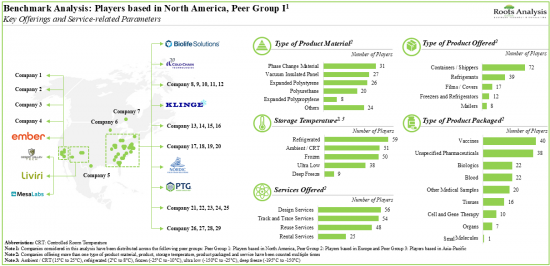

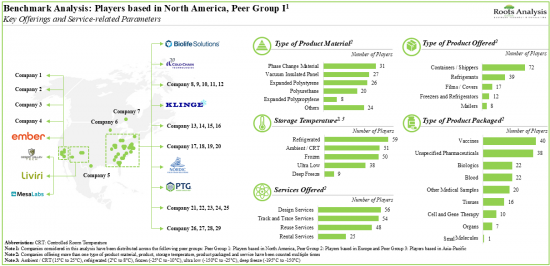

- Competitive Benchmarking Analysis: A competitive benchmarking analysis that emphasizes the primary focus areas of cold chain container / shipper providers. This analysis compares their existing capabilities within and beyond their respective peer groups based in North America, Europe and Asia-Pacific. It offers stakeholders insights into potential strategies for achieving a competitive edge in the industry.

- Company Profiles: In-depth profiles of key cold chain container / shipper providers, focusing on [A] company overviews, [B] product portfolio, [C] service portfolio [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2019, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] application, [D] type of product, [E] geography and [F] most active players (in terms of number of partnerships). In addition, it includes an insightful analysis of the mergers and acquisitions that have been inked between various stakeholders since 2019, based on relevant parameters, such as [A] year of acquisition, [B] type of acquisition, [C] application, [D] type of product, [E] geography, [F] most active players (in terms of number of partnerships), [G] ownership exchange matrix and [H] key value drivers.

- Patent Analysis: Detailed analysis of various patents filed / granted related to cold chain market for pharmaceuticals based on [A] type of patent, [B] publication year, [C] application year, [D] type of organization, [E] patent jurisdiction, [F] CPC symbols, [G] emerging focus areas, [H] leading industry players. It also includes a patent benchmarking analysis and a detailed valuation analysis.

- Upcoming Trends and Future Growth Opportunities: An detailed discussion on the upcoming trends and future opportunities in the cold chain pharmaceutical industry, featuring details on key tools and technologies associated with connected cold chain (artificial intelligence, augmented reality, automation and robotics, big data analytics, block chain technology, cloud computing, internet of things, radio frequency identification tags). It also presents information on real-time monitoring, methods for its integration in cold chain, growth opportunities and cost benefits associated with real-time monitoring in cold chain.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What are the factors that are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Cold Chain Market for Pharmaceuticals

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Introduction to Cold Chain Packaging

- 5.3. Historical Timeline of Cold Chain

- 5.4. Cold Chain Solutions for Pharmaceutical Industry

- 5.4.1. Cold Chain Packaging Solutions: Containers and Shippers

- 5.4.1.1. Active Cold Chain Packaging Solutions

- 5.4.1.2. Passive Cold Chain Packaging Solutions

- 5.4.1.3. Insulated Cold Chain Packaging Solutions

- 5.4.2. Cold Chain Monitoring Solutions: Data Loggers

- 5.4.2.1. Data Loggers

- 5.4.2.2. Indicators

- 5.4.1. Cold Chain Packaging Solutions: Containers and Shippers

- 5.5. Applications of Cold Chain in Pharmaceutical Industry

- 5.6. Current Challenges and Future Perspectives

6. OVERALL MARKET LANDSCAPE: COLD CHAIN CONTAINER / SHIPPER PROVIDERS

- 6.1. Chapter Overview

- 6.2. Cold Chain Container / Shipper Providers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters (Region)

- 6.2.4. Analysis by Location of Headquarters (Country)

- 6.2.5. Analysis by Type of Cold

Chain Solution

- 6.2.6. Analysis by Type of Product Offered

- 6.2.7. Analysis by Type of Product

Material

- 6.2.8. Analysis by Type of Product

Packaged

6.2.9. Analysis by Storage

Temperature

6.2.10. Analysis by Type of Service Offered

6.2.11. Analysis by Company Size

and Type of Service Offered

7. OVERALL MARKET LANDSCAPE: DATA LOGGER PROVIDERS

- 7.1. Chapter Overview

- 7.2. Data Logger Providers: Overall Market Landscape

7.3. Analysis by Year of Establishment

7.4. Analysis by Company Size

7.5. Analysis by Location of Headquarters (Region)

- 7.6. Analysis by Location of Headquarters (Country)

- 7.7. Analysis by Type of Product

Offered

- 7.8. Analysis by Mode of Data Transmission

- 7.9. Analysis by Type of Data Captured

- 7.10. Analysis by Type of Pharmaceutical Monitored

- 7.11. Analysis by Temperature Range

- 7.12. Analysis by Type of Product Offered and Mode of Data

Transmission

7.13. Analysis by Type of Product Offered and Type of Data Captured

8. BENCHMARKING ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Methodology

- 8.3. Benchmarking Analysis of Cold Chain Container / Shipper Providers

- 8.3.1. Benchmarking Analysis: Players based in North America (Peer Group I)

- 8.3.2. Benchmarking Analysis: Players based in Europe (Peer Group II)

- 8.3.3. Benchmarking Analysis: Large Players based in Asia-Pacific and RoW (Peer Group III)

- 8.4. Concluding Remarks

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Cold Chain Technologies

- 9.2.1. Company Overview

- 9.2.2. Product Portfolio

- 9.2.3. Service Portfolio

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Cryopak

- 9.3.1. Company Overview

- 9.3.2. Product Portfolio

- 9.3.3. Service Portfolio

- 9.3.4. Recent Developments and Future Outlook

- 9.4. CSafe

- 9.4.1. Company Overview

- 9.4.2. Product Portfolio

- 9.4.3. Service Portfolio

- 9.4.4. Recent Developments and Future Outlook

- 9.5. EMBALL'ISO

- 9.5.1. Company Overview

- 9.5.2. Product Portfolio

- 9.5.3. Service Portfolio

- 9.5.4. Recent Developments and Future Outlook

- 9.6. Intelsius

- 9.6.1. Company Overview

- 9.6.2. Product Portfolio

- 9.6.3. Service Portfolio

- 9.6.4. Recent Developments and Future Outlook

- 9.7. Nordic Cold Chain Solutions

- 9.7.1. Company Overview

- 9.7.2. Product Portfolio

- 9.7.3. Service Portfolio

- 9.7.4. Recent Developments and Future Outlook

- 9.8. Peli BioThermal

- 9.8.1. Company Overview

- 9.8.2. Product Portfolio

- 9.8.3. Service Portfolio

- 9.8.4. Recent Developments and Future Outlook

- 9.9. SEE

- 9.9.1. Company Overview

- 9.9.2. Product Portfolio

- 9.9.3. Service Portfolio

- 9.9.4. Recent Developments and Future Outlook

- 9.10. SOFRIGAM

- 9.10.1. Company Overview

- 9.10.2. Product Portfolio

- 9.10.3. Service Portfolio

- 9.10.4. Recent Developments and Future Outlook

- 9.11. Sonoco Thermosafe

- 9.11.1. Company Overview

- 9.11.2. Product Portfolio

- 9.11.3. Service Portfolio

- 9.11.4. Recent Developments and Future Outlook

- 9.12. Tempack

- 9.12.1. Company Overview

- 9.12.2. Product Portfolio

- 9.12.3. Service Portfolio

- 9.12.4. Recent Developments and Future Outlook

- 9.13. Other Leading Players

- 9.13.1. Almac

- 9.13.2. B Medical Systems

- 9.13.3. BioLife Solutions

- 9.13.4. CRS Mobile Cold Storage

- 9.13.5. Desert Valley Tech

- 9.13.6. Dubai Instruments

- 9.13.7. Envirotainer

- 9.13.8. Global Cold Chain Solutions (Headquartered in Australia)

- 9.13.9. Global Cold Chain Solutions (Headquartered in Singapore)

- 9.13.10. Klinge

- 9.13.11. Krautz-temax

- 9.13.12. Meds2go

- 9.13.13. phasetwo

- 9.13.14. Polar Tech Industries

- 9.13.15. Skycell

- 9.13.16. UPS Healthcare

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Cold Chain for Pharmaceuticals: Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Year and Type of Partnership

- 10.3.4. Analysis by Application Area

- 10.3.5. Analysis by Type of Product / Technology Targeted

- 10.3.6. Analysis by Geography

- 10.3.6.1. Local and International Agreements

- 10.3.6.2. Intercontinental and Intracontinental Agreements

- 10.3.7. Most Active Players: Analysis by Number of Partnerships

- 10.4. Cold Chain for Pharmaceuticals: Acquisitions

- 10.4.1. Analysis by Year of Acquisition

- 10.4.2. Analysis by Type of Acquisition

- 10.4.3. Analysis by Year and Type of Acquisition

- 10.4.4. Analysis by Application Area

- 10.4.5. Analysis by Type of Product / Technology Targeted

- 10.4.6. Analysis by Geography

- 10.4.6.1. Local and International Agreements

- 10.4.6.2. Intercontinental and Intracontinental Agreements

- 10.4.7. Ownership Change Matrix

- 10.4.8. Analysis by Key Value Drivers

11. PATENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Cold Chain for Pharmaceuticals: Patent Analysis

- 11.3.1. Analysis by Type of Patent

- 11.3.2. Analysis by Publication Year

- 11.3.3. Analysis by Type of Patent and Publication Year

- 11.3.4. Analysis by Application Year

- 11.3.5. Analysis by Type of Organization

- 11.3.6. Analysis by Patent Jurisdiction

- 11.3.7. Analysis by CPC Symbols

- 11.3.8. Analysis by Emerging Focus Area

- 11.3.9. Leading Industry Players: Analysis by Number of Patents

- 11.4. Cold Chain for Pharmaceuticals: Patent Benchmarking Analysis

- 11.4.1. Analysis by Patent Characteristics

- 11.4.1.1. Cold Chain Technologies and Ember LifeSciences

- 11.4.1.2. Other Leading Patent Assignees

- 11.4.1. Analysis by Patent Characteristics

- 11.5. Patent Valuation Analysis

12. REGULATORY RECOMMENDATIONS AND GUIDELINES

- 12.1. Chapter Overview

- 12.2. Regulatory Guidelines Issued by International Authorities

- 12.2.1. World Health Organization (WHO)

- 12.2.2. International Air Transport Association (IATA)

- 12.2.3. International Safe Transit Association (ISTA)

- 12.3. Regulatory Guidelines Issued by Regional Authorities

- 12.3.1. Regulatory Guidelines for Cold Chain Management in the US

- 12.3.1.1. United States Food and Drug Administration (USFDA)

- 12.3.2. United States Pharmacopeia (USP)

- 12.3.3. Regulatory Guidelines for Cold Chain Management in Canada

- 12.3.3.1. Health Canada

- 12.3.4. Regulatory Guidelines for Cold Chain Management in Europe

- 12.3.4.1. European Medicine Agency

- 12.3.1. Regulatory Guidelines for Cold Chain Management in the US

- 12.4. Recommendations for Different Steps of Cold Chain

- 12.5. Comparative Analysis of Regulatory Authorities

13. UPCOMING TRENDS AND FUTURE GROWTH OPPORTUNITIES

- 13.1. Chapter Overview

- 13.2. Connected Cold Chain: Key Tools and Technologies

- 13.2.1. Artificial Intelligence

- 13.2.2. Augmented Reality

- 13.2.3. Automation and Robotics

- 13.2.4. Big Data Analytics

- 13.2.5. Block Chain Technology

- 13.2.6. Cloud Computing

- 13.2.7. Internet of Things

- 13.2.8. Radio Frequency Identification (RFID) Tags

- 13.3. Connected Cold Chain: Future Growth Opportunities

- 13.4. Real-Time Monitoring: An Application of Connected Cold Chain Solutions

- 13.4.1. Methods for Integration of Real-Time Monitoring in Cold Chain

- 13.4.1.1. RFID Based Real-Time Monitoring

- 13.4.1.2. Blockchain And IoT Based Real-Time Monitoring

- 13.4.2. Growth Opportunities for Real-Time Monitoring in Connected Cold Chain

- 13.4.3. Cost Benefits of Real-Time Monitoring in Cold Chain

- 13.4.1. Methods for Integration of Real-Time Monitoring in Cold Chain

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. COLD CHAIN MARKET FOR PHARMACEUTICALS

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Global Cold Chain Market for Pharmaceuticals, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.1. Scenario Analysis

- 15.4. Key Market Segmentations

- 15.5. Dynamic Dashboard

16. COLD CHAIN MARKET FOR PHARMACEUTICALS, BY TYPE OF PRIMARY PACKAGING

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Cold Chain for Pharmaceuticals: Analysis by Type of Primary Packaging (2019, current year and 2035)

- 16.3.1. Vials: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.2. Ampoules: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.3. Pre-filled Syringes: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.4. Bags: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.4. Data Triangulation and Validation

17. COLD CHAIN MARKET FOR PHARMACEUTICALS, BY TYPE OF SECONDARY PACKAGING

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Cold Chain for Pharmaceuticals: Analysis by Type of Secondary Packaging (2019, current year and 2035)

- 17.3.1. Cold Boxes: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.2. Vaccine Carriers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.3. Insulated Containers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.4. Data Triangulation and Validation

18. COLD CHAIN MARKET FOR PHARMACEUTICALS, BY TYPE OF USABILITY

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Cold Chain for Pharmaceuticals: Analysis by Type of Usability (2019, current year and 2035)

- 18.3.1. Reusable Containers / Shippers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 18.3.2. Single-use Containers / Shippers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 18.4. Data Triangulation and Validation

19. COLD CHAIN MARKET FOR PHARMACEUTICALS, BY KEY GEOGRAPHICAL REGIONS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Cold Chain for Pharmaceuticals: Analysis by Key Geographical Regions (2019, current year and 2035)

- 19.3.1. North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.2. Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.3. Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.4. Middle East and North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.5. Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.6. Rest of the World: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.4. Data Triangulation and Validation

20. CONCLUSION

21. EXECUTIVE INSIGHTS

- 21.1. Chapter Overview

- 21.2. EMBALL'ISO

- 21.2.1. Company Snapshot

- 21.2.2. Interview Transcript

- 21.3. Tower Cold Chain

- 21.3.1. Company Snapshot

- 21.3.2. Interview Transcript

22. APPENDIX 1: TABULATED DATA

23. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Cold Chain Container / Shipper Providers: List of Companies

- Table 6.2 Cold Chain Container / Shipper Providers: Information on Product Material

- Table 6.3 Cold Chain Container / Shipper Providers: Information on Type of Product Packaged

- Table 6.4 Cold Chain Container / Shipper Providers: Information on Storage Temperature and Type of Service Offered

- Table 7.1 Cold Chain Data Logger Providers: List of Companies

- Table 7.2 Cold Chain Data Logger Providers: Information on Type of Data Captured

- Table 7.3 Cold Chain Data Logger Providers: Information on Type of Pharmaceutical Monitored

- Table 7.4 Cold Chain Data Logger Providers: Information on Temperature Range

- Table 8.1 Benchmarking Analysis: Peer Groups Definitions and Inclusions

- Table 9.1 Cold Chain for Pharmaceuticals: List of Companies Profiled

- Table 9.2 Cold Chain for Pharmaceuticals: Other Leading Players Profiled

- Table 9.3 Cold Chain Technologies: Company Overview

- Table 9.4 Cold Chain Technologies: Recent Developments and Future Outlook

- Table 9.5 Cryopak: Company Overview

- Table 9.6 Cyropak: Recent Developments and Future Outlook

- Table 9.7 CSafe: Company Overview

- Table 9.8 CSafe: Recent Developments and Future Outlook

- Table 9.9 EMBALL'ISO: Company Overview

- Table 9.10 EMBALL'ISO: Recent Developments and Future Outlook

- Table 9.11 Intelsius: Company Overview

- Table 9.12 Intelsius: Recent Developments and Future Outlook

- Table 9.13 Nordic Cold Chain Solutions: Company Overview

- Table 9.14 Peli BioThermal: Company Overview

- Table 9.15 Peli BioThermal: Recent Developments and Future Outlook

- Table 9.16 SEE: Company Overview

- Table 9.17 SEE: Recent Developments and Future Outlook

- Table 9.18 SOFRIGAM: Company Overview

- Table 9.19 SOFRIGAM: Recent Developments and Future Outlook

- Table 9.20 Sonoco Thermosafe: Company Overview

- Table 9.21 Sonoco Thermosafe: Recent Developments and Future Outlook

- Table 9.22 Tempack: Company Overview

- Table 9.23 Almac: Company Overview

- Table 9.24 B Medical Systems: Company Overview

- Table 9.25 BioLife Solutions: Company Overview

- Table 9.26 CRS Mobile Cold Storage: Company Overview

- Table 9.27 Desert Valley Tech: Company Overview

- Table 9.28 Dubai Instruments: Company Overview

- Table 9.29 Envirotainer: Company Overview

- Table 9.30 Global Cold Chain Solutions (Headquartered in Australia): Company Overview

- Table 9.31 Global Cold Chain Solutions (Headquartered in Singapore): Company Overview

- Table 9.32 Klinge: Company Overview

- Table 9.33 Krautz-temax: Company Overview

- Table 9.34 Meds2go: Company Overview

- Table 9.35 phasetwo: Company Overview

- Table 9.36 Polar Tech Industries: Company Overview

- Table 9.37 Skycell: Company Overview

- Table 9.38 UPS Healthcare: Company Overview

- Table 10.1 Cold Chain for Pharmaceuticals: List of Partnerships and Collaborations, Since 2019

- Table 10.2 Partnerships and Collaborations: Information on Application Area and Type of Product

- Table 10.3 Cold Chain for Pharmaceuticals: List of Acquisitions, Since 2019

- Table 10.4 Acquisitions: Information on Application Area and Type of Product

- Table 10.5 Acquisitions: Information on Key Value Drivers

- Table 11.1 Patent Analysis: Top CPC Sections

- Table 11.2 Patent Analysis: Most Popular CPC Symbols

- Table 11.3 Patent Analysis: Top Ten CPC Symbols

- Table 11.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 11.5 Patent Analysis: List of Leading Patents (by Highest Relative Valuation)

- Table 13.1 Artificial Intelligence in Cold Chain: List of Companies

- Table 13.2 Automation and Robotics in Cold Chain: List of Companies

- Table 13.3 Big Data Analytics in Cold Chain: List of Companies

- Table 13.4 Blockchain Technology in Cold Chain: List of Companies

- Table 13.5 Cloud Computing in Cold Chain: List of Companies

- Table 13.6 Internet of Things in Cold Chain: List of Companies

- Table 13.7 RFID Tags in Cold Chain: List of Companies

- Table 22.1 Cold Chain Container / Shipper Providers: Distribution by Year of Establishment

- Table 22.2 Cold Chain Container / Shipper Providers: Distribution by Company Size

- Table 22.3 Cold Chain Container / Shipper Providers: Distribution by Location of Headquarters (Region)

- Table 22.4 Cold Chain Container / Shipper Providers: Distribution by Location of Headquarters (Country)

- Table 22.5 Cold Chain Container / Shipper Providers: Distribution by Type of Cold Chain Solution

- Table 22.6 Cold Chain Container / Shipper Providers: Distribution by Type of Product Offered

- Table 22.7 Cold Chain Container / Shipper Providers: Distribution by Type of Product Material

- Table 22.8 Cold Chain Container / Shipper Providers: Distribution by Type of Product Packaged

- Table 22.9 Cold Chain Container / Shipper Providers: Distribution by Storage Temperature

- Table 22.10 Cold Chain Container / Shipper Providers: Distribution by Type of Service Offered

- Table 22.11 Cold Chain Container / Shipper Providers: Distribution by Company Size and Type of Service Offered

- Table 22.12 Cold Chain Data Logger Providers: Distribution by Year of Establishment

- Table 22.13 Cold Chain Data Logger Providers: Distribution by Company Size

- Table 22.14 Cold Chain Data Logger Providers: Distribution by Location of Headquarters (Region)

- Table 22.15 Cold Chain Data Logger Providers: Distribution by Location of Headquarters (Country)

- Table 22.16 Cold Chain Data Logger Providers: Distribution by Type of Product Offered

- Table 22.17 Cold Chain Data Logger Providers: Distribution by Mode of Data Transmission

- Table 22.18 Cold Chain Data Logger Providers: Distribution by Type of Data Captured

- Table 22.19 Cold Chain Data Logger Providers: Distribution by Type of Pharmaceutical Monitored

- Table 22.20 Cold Chain Data Logger Providers: Distribution by Temperature Range

- Table 22.21 Cold Chain Data Logger Providers: Distribution by Type of Product Offered and Mode of Data Transmission

- Table 22.22 Cold Chain Data Logger Providers: Distribution by Type of Product Offered and Type of Data Captured

- Table 22.23 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 22.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 22.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 22.26 Partnerships and Collaborations: Distribution by Application Area

- Table 22.27 Partnerships and Collaborations: Distribution by Year and Application Area of the Partnership

- Table 22.28 Partnerships and Collaborations: Distribution by Type of Product

- Table 22.29 Partnerships and Collaborations: Local and International Agreements

- Table 22.30 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 22.31 Most Active Players: Distribution by Number of Partnerships

- Table 22.32 Acquisitions: Distribution by Year of Acquisition

- Table 22.33 Acquisitions: Distribution by Type of Acquisition

- Table 22.34 Acquisitions: Distribution by Year and Type of Acquisition

- Table 22.35 Acquisitions: Distribution by Application Area

- Table 22.36 Acquisitions: Distribution by Type of Product

- Table 22.37 Acquisitions: Local and International Agreements

- Table 22.38 Acquisitions: Intercontinental and Intracontinental Agreements

- Table 22.39 Acquisitions: Ownership Change Matrix

- Table 22.40 Acquisitions: Distribution by Key Value Drivers

- Table 22.41 Patent Analysis: Distribution by Type of Patent

- Table 22.42 Patent Analysis: Distribution by Publication Year

- Table 22.43 Patent Analysis: Distribution by Type of Patent and Publication Year

- Table 22.44 Patent Analysis: Distribution by Type of Organization

- Table 22.45 Patent Analysis: Distribution by Patent Jurisdiction

- Table 22.46 Patent Analysis: Distribution by Application Year

- Table 22.47 Leading Industry Players: Distribution by Number of Patents

- Table 22.48 Patent Analysis: Distribution by Patent Age

- Table 22.49 Cold Chain Market for Pharmaceuticals: Patent Valuation Analysis

- Table 22.50 Global Cold Chain Market for Pharmaceuticals, Historical Trends (Since 2019)

- Table 22.51 Global Cold Chain Market for Pharmaceuticals, Forecasted Estimates (till 2035), Base Scenario (USD Billion)

- Table 22.52 Global Cold Chain Market for Pharmaceuticals, Forecasted Estimates (till 2035), Conservative Scenario (USD Billion)

- Table 22.53 Global Cold Chain Market for Pharmaceuticals, Forecasted Estimates (till 2035), Optimistic Scenario (USD Billion)

- Table 22.54 Global Cold Chain Market for Pharmaceuticals: Distribution by Type of Primary Packaging, 2019, current year and 2035 (USD Billion)

- Table 22.55 Cold Chain Market for Vials, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.56 Cold Chain Market for Ampoules, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.57 Cold Chain Market for Pre-filled Syringes, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.58 Cold Chain Market for Bags, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.59 Global Cold Chain Market for Pharmaceuticals: Distribution by Type of Secondary Packaging, 2019, current year and 2035 (USD Billion)

- Table 22.60 Cold Chain Market for Cold Boxes, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.61 Cold Chain Market for Vaccine Carriers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.62 Cold Chain Market for Insulated Containers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.63 Global Cold Chain Market for Pharmaceuticals: Distribution by Type of Usability, 2019, current year and 2035 (USD Billion)

- Table 22.64 Cold Chain Market for Reusable Containers / Shipper, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.65 Cold Chain Market for Single-use Containers / Shippers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.66 Global Cold Chain Market for Pharmaceuticals: Distribution by Key Geographical Regions, 2019, current year and 2035 (USD Billion)

- Table 22.67 Cold Chain Market for Pharmaceuticals in North America, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.68 Cold Chain Market for Pharmaceuticals in Europe, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.69 Cold Chain Market for Pharmaceuticals in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.70 Cold Chain Market for Pharmaceuticals in Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.71 Cold Chain Market for Pharmaceuticals in Latin America, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 22.72 Cold Chain Market for Pharmaceuticals in Rest of the World, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

List of Figures

- Figure 4.1 Executive Summary: Overall Market Landscape of Cold Chain Container / Shipper Providers

- Figure 4.2 Executive Summary: Overall Market Landscape of Data Logger Providers

- Figure 4.3 Executive Summary: Benchmarking Analysis

- Figure 4.4 Executive Summary: Partnerships and Collaborations

- Figure 4.5 Executive Summary: Mergers and Acquisitions

- Figure 4.6 Executive Summary: Patent Analysis

- Figure 4.7 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 5.1 Elements of Cold Chain Packaging

- Figure 5.2 Historical Timeline of Cold Chain

- Figure 5.3 Types of Active Cold Chain Refrigerators / Freezers

- Figure 5.4 Types of Material used in Passive Cold Chain Containers

- Figure 5.5 Types of Insulated Cold Chain Containers

- Figure 5.6 Applications of Cold Chain in Pharmaceutical Industry

- Figure 6.1 Cold Chain Container / Shipper Providers: Distribution by Year of Establishment

- Figure 6.2 Cold Chain Container / Shipper Providers: Distribution by Company Size

- Figure 6.3 Cold Chain Container / Shipper Providers: Distribution by Location of Headquarters (Region)

- Figure 6.4 Cold Chain Container / Shipper Providers: Distribution by Location of Headquarters (Country)

- Figure 6.5 Cold Chain Container / Shipper Providers: Distribution by Type of Cold Chain Solution

- Figure 6.6 Cold Chain Container / Shipper Providers: Distribution by Type of Product Offered

- Figure 6.7 Cold Chain Container / Shipper Providers: Distribution by Type of Product Material

- Figure 6.8 Cold Chain Container / Shipper Providers: Distribution by Type of Product Packaged

- Figure 6.9 Cold Chain Container / Shipper Providers: Distribution by Storage Temperature

- Figure 6.10 Cold Chain Container / Shipper Providers: Distribution by Type of Service Offered

- Figure 6.11 Cold Chain Container / Shipper Providers: Distribution by Company Size and Type of Service Offered

- Figure 7.1 Cold Chain Data Logger Providers: Distribution by Year of Establishment

- Figure 7.2 Cold Chain Data Logger Providers: Distribution by Company Size

- Figure 7.3 Cold Chain Data Logger Providers: Distribution by Location of Headquarters (Region)

- Figure 7.4 Cold Chain Data Logger Providers: Distribution by Location of Headquarters (Country)

- Figure 7.5 Cold Chain Data Logger Providers: Distribution by Type of Product Offered

- Figure 7.6 Cold Chain Data Logger Providers: Distribution by Mode of Data Transmission

- Figure 7.7 Cold Chain Data Logger Providers: Distribution by Type of Data Captured

- Figure 7.8 Cold Chain Data Logger Providers: Distribution by Type of Pharmaceutical Monitored

- Figure 7.9 Cold Chain Data Logger Providers: Distribution by Temperature Range

- Figure 7.10 Cold Chain Data Logger Providers: Distribution by Type of Product Offered and Mode of Data Transmission

- Figure 7.11 Cold Chain Data Logger Providers: Distribution by Type of Product Offered and Type of Data Captured

- Figure 8.1 Benchmarking Analysis: Players based in North America (Peer Group I)

- Figure 8.2 Benchmarking Analysis: Players based in Europe (Peer Group II)

- Figure 8.3 Benchmarking Analysis: Players based in Asia-Pacific and RoW (Peer Group III)

- Figure 9.1 Cold Chain Technologies: Product Portfolio

- Figure 9.2 Cold Chain Technologies: Cold Chain Packaging Service Portfolio

- Figure 9.3 Cryopak: Product Portfolio

- Figure 9.4 Cryopak: Cold Chain Packaging Service Portfolio

- Figure 9.5 CSafe: Product Portfolio

- Figure 9.6 CSafe: Cold Chain Packaging Service Portfolio

- Figure 9.7 EMBALL'ISO: Product Portfolio

- Figure 9.8 EMBALL'ISO: Cold Chain Packaging Service Portfolio

- Figure 9.9 Intelsius: Product Portfolio

- Figure 9.10 Intelsius: Cold Chain Packaging Service Portfolio

- Figure 9.11 Nordic Cold Chain Solutions: Product Portfolio

- Figure 9.12 Nordic Cold Chain Solutions: Cold Chain Packaging Service Portfolio

- Figure 9.13 Peli BioThermal: Product Portfolio

- Figure 9.14 Peli BioThermal: Cold Chain Packaging Service Portfolio

- Figure 9.15 SEE: Product Portfolio

- Figure 9.16 SEE: Cold Chain Packaging Service Portfolio

- Figure 9.17 SOFRIGAM: Product Portfolio

- Figure 9.18 SOFRIGAM: Cold Chain Packaging Service Portfolio

- Figure 9.19 Sonoco Thermosafe: Product Portfolio

- Figure 9.20 Sonoco Thermosafe: Cold Chain Packaging Service Portfolio

- Figure 9.21 Tempack: Product Portfolio

- Figure 9.22 Tempack: Cold Chain Packaging Service Portfolio

- Figure 10.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 10.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 10.4 Partnerships and Collaborations: Distribution by Application Area

- Figure 10.5 Partnerships and Collaborations: Distribution by Type of Product

- Figure 10.6 Partnerships and Collaborations: Local and International Agreements

- Figure 10.7 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 10.8 Most Active Players: Distribution by Number of Partnerships

- Figure 10.9 Acquisitions: Distribution by Year of Acquisition

- Figure 10.10 Acquisitions: Distribution by Type of Acquisition

- Figure 10.11 Acquisitions: Distribution by Year and Type of Acquisition

- Figure 10.12 Acquisitions: Distribution by Application Area

- Figure 10.13 Acquisitions: Distribution by Type of Product

- Figure 10.14 Acquisitions: Local and International Agreements

- Figure 10.15 Acquisitions: Intercontinental and Intracontinental Agreements

- Figure 10.16 Most Active Players: Distribution by Number of Acquisitions

- Figure 10.17 Acquisitions: Ownership Change Matrix

- Figure 10.18 Acquisitions: Distribution by Key Value Drivers

- Figure 11.1 Patent Analysis: Distribution by Type of Patent

- Figure 11.2 Patent Analysis: Distribution by Publication Year

- Figure 11.3 Patent Analysis: Distribution by Type of Patent and Publication Year

- Figure 11.4 Patent Analysis: Distribution by CPC Symbols

- Figure 11.5 Patent Analysis: Distribution by Type of Organization

- Figure 11.6 Patent Analysis: Distribution by Patent Jurisdiction

- Figure 11.7 Word Cloud: Emerging Focus Areas

- Figure 11.8 Patent Analysis: Distribution by Application Year

- Figure 11.9 Leading Industry Players: Distribution by Number of Patents

- Figure 11.10 Patent Analysis (Cold Chain Technologies and Ember LifeSciences): Benchmarking by Patent Characteristics

- Figure 11.11 Patent Analysis (Other Leading Patent Assignees): Benchmarking by Patent Characteristics

- Figure 11.12 Patent Analysis: Distribution by Patent Age

- Figure 11.13 Patent Analysis: Categorizations based on Weighted Valuation Scores

- Figure 11.14 Cold Chain Market for Pharmaceuticals: Patent Valuation Analysis

- Figure 12.1 Cold Chain in Pharmaceuticals: International and Regional Regulatory Authorities

- Figure 12.2 WHO Guidelines for Cold Chain Management

- Figure 12.3 IATA (CEIV Pharma) Guidelines for Cold Chain Management

- Figure 12.4 ISTA Guidelines for Cold Chain Management

- Figure 12.5 USFDA Guidelines for Cold Chain

- Figure 12.6 USFDA Form483s Excerpts: Challenges and Solutions Related to Cold Chain

- Figure 12.7 USP Guidelines for Cold Chain

- Figure 12.8 EMA Guidelines for Cold Chain

- Figure 12.9 Regulatory Requirements for Various Steps of Cold Chain

- Figure 12.10 Comparative Analysis of Regulatory Authorities

- Figure 13.1 Connected Cold Chain: Process Flow Model

- Figure 13.2 Artificial Intelligence in Cold Chain: Key Benefits and Challenges

- Figure 13.3 Augmented Reality in Cold Chain: Key Benefits and Challenges

- Figure 13.4 Automation and Robotics in Cold Chain: Key Benefits and Challenges

- Figure 13.5 Big Data Analytics in Cold Chain: Key Benefits and Challenges

- Figure 13.6 Blockchain Technology in Cold Chain: Key Benefits and Challenges

- Figure 13.7 Cloud Computing in Cold Chain: Key Benefits and Challenges

- Figure 13.8 Internet of Things in Cold Chain: Schematic Representation

- Figure 13.9 Internet of Things in Cold Chain Logistics: Key Benefits and Challenges

- Figure 13.10 RFID Tags in Cold Chain Logistics: Key Benefits and Challenges

- Figure 13.11 Connected Cold Chain: Future Growth Opportunities (Harvey Ball Analysis)

- Figure 13.12 Real-Time Monitoring: Conventional Devices

- Figure 13.13 RFID Based Real-Time Monitoring in Cold Chain

- Figure 13.14 Key Contributions of Blockchain Technology and IoT in Real-Time Monitoring

- Figure 13.15 Blockchain Technology and IoT Based Real-Time Monitoring: Flow Diagram

- Figure 13.16 Real-Time Monitoring in Cold Chain Management: Growth Opportunities

- Figure 13.17 Real-Time Monitoring: Reduction in Cold Chain Cost

- Figure 15.1 Global Cold Chain Market for Pharmaceuticals, Historical Trends (Since 2019)

- Figure 15.2 Global Cold Chain Market for Pharmaceuticals, Forecasted Estimates (till 2035), Base Scenario (USD Million)

- Figure 15.3 Global Cold Chain Market for Pharmaceuticals, Forecasted Estimates (till 2035), Conservative Scenario (USD Billion)

- Figure 15.4 Global Cold Chain Market for Pharmaceuticals, Forecasted Estimates (till 2035), Optimistic Scenario (USD Billion)

- Figure 16.1 Global Cold Chain Market for Pharmaceuticals: Distribution by Type of Primary Packaging, 2019, current year and 2035 (USD Billion)

- Figure 16.2 Cold Chain Market for Vials, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.3 Cold Chain Market for Ampoules Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.4 Cold Chain Market for Pre-filled Syringes, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.5 Cold Chain Market for Bags, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.1 Global Cold Chain Market for Pharmaceuticals: Distribution by Type of Secondary Packaging, 2019, current year and 2035 (USD Billion)

- Figure 17.2 Cold Chain Market for Cold Boxes, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.3 Cold Chain Market for Vaccine Carriers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.4 Cold Chain Market for Insulated Containers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.1 Global Cold Chain Market for Pharmaceuticals: Distribution by Type of Usability, 2019, current year and 2035 (USD Billion)

- Figure 18.2 Cold Chain Market for Reusable Containers / Shipper, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.3 Cold Chain Market for Single-use Containers / Shippers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.1 Global Cold Chain Market for Pharmaceuticals: Distribution by Key Geographical Regions, 2019, current year and 2035 (USD Billion)

- Figure 19.2 Cold Chain Market for Pharmaceuticals in North America, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.3 Cold Chain Market for Pharmaceuticals in Europe, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.4 Cold Chain Market for Pharmaceuticals in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.5 Cold Chain Market for Pharmaceuticals in Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.6 Cold Chain Market for Pharmaceuticals in Latin America, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.7 Cold Chain Market for Pharmaceuticals in Rest of the World, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.1 Concluding Remarks: Overall Market Landscape of Cold Chain Container / Shipper Providers

- Figure 20.2 Concluding Remarks: Overall Market Landscape of Data Logger Providers

- Figure 20.3 Concluding Remarks: Benchmarking Analysis

- Figure 20.4 Concluding Remarks: Partnerships and Collaborations

- Figure 20.5 Concluding Remarks: Mergers and Acquisitions

- Figure 20.6 Concluding Remarks: Patent Analysis

- Figure 20.7 Concluding Remarks: Market Forecast and Opportunity Analysis