|

市場調查報告書

商品編碼

1636255

冷凍食品物流:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Frozen Food Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

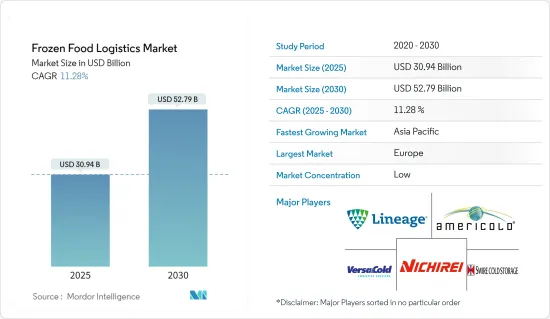

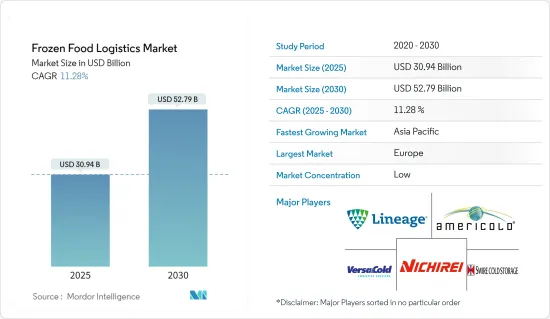

冷凍食品物流市場規模預估至2025年為309.4億美元,預估至2030年將達527.9億美元,預測期間(2025-2030年)複合年成長率為11.28%。

主要亮點

- 冷凍食品需求的快速成長和都市化進程的加速是冷凍食品物流市場的主要推動力。

- 在過去的幾年裡,優質冷凍食品產業經歷了顯著的成長。消費者對一流、方便和營養食品日益成長的需求是這一快速成長的主要推動力。這種趨勢在追求均衡飲食和即食食品的注重健康的人群中尤其明顯。

- 此外,消費者越來越欣賞現代冷凍技術所帶來的卓越產品品質,能夠有效地保留口味和營養價值。

- 值得注意的是,都市區的富人在這些高階冷凍食品的銷售中處於領先地位。這些產品通常擁有美食配方、負責任的原料採購和前沿的口味。

- 需求的激增反映了消費者轉向家庭烹飪、烹飪實驗以及對餐廳品質膳食的渴望。對於挑剔的美食家來說,這是一種趨勢,他們不會在品質、口味或營養上妥協。

- 2023年,冷凍食品零售額成長7.9%,達742億美元。正如最近的一份報告所強調的那樣,這意味著過去三年顯著增加了 100 億美元。與許多雜貨類別一樣,冷凍食品的美元金額成長主要是由通貨膨脹驅動的價格上漲所推動的。

- 因此,消費行為對冷凍食品的行為正在改變。美國冷凍食品研究所 (AFFI) 和食品工業研究所 (FMI) 共同發布的《2023 年冷凍食品零售力量》報告顯示,消費者平均為每件冷凍食品支付 4.99 美元。這比 2023 年成長了 13.5%,比過去三年大幅成長了 29.6%。

- 冷凍食品銷售以冷凍食品和甜點為主,到 2023 年將分別產生 266 億美元和 154 億美元的銷售額。其次是水果/蔬菜、水產品和肉類/家禽,同年銷售額分別為 81 億美元、70 億美元和 57 億美元。

冷凍食品物流市場趨勢

冷凍食品需求正在推動產業發展

近年來,隨著消費者偏好的變化,產品創新激增,已調理食品市場經歷了重大演變。這種轉變在印度尤其明顯,那裡的便利性和口味偏好至關重要。

消費者對已調理食品產業越來越要求更健康、更天然的選擇。因此,對具有清潔標籤、最少添加劑和有機成分的產品的需求不斷成長。此外,對植物性食品和純素食食品的需求正在增加。隨著越來越多的人採用植物性飲食或減少肉類消費量,對植物性和純素已調理食品的需求正在增加。

該行業發展的關鍵是老牌公司和新興企業堅定不移地致力於創新。尼爾森最近的一項研究強調,消費者擴大選擇更健康的已調理食品,尤其是在印度。根據同一項調查,72%的印度消費者正在積極尋求營養均衡的已調理食品,這表明健康意識不斷增強。

為此,該公司正在利用技術和烹飪技術來創造滿足營養需求並迎合印度人多樣化口味的產品。這包括介紹無麩質、有機和當地風味的選擇。

已調理食品品牌與營養研究機構和專家之間的合作正在擴大產品範圍並重塑消費者的觀念,將已調理食品定位為更健康的飲食選擇。

歐洲在市場上佔據顯著地位。

2023年,德國冷凍食品總銷量達404.3萬噸,較2022年的390.9萬噸增加3.4%。這一激增導致銷量首次突破 400 萬噸里程碑。

非本土市場成長了6.5%,從2022年的193.5萬噸增加到2023年的206.1萬噸。這一成長已推動市場突破 200 萬噸大關。

在食品零售與家庭服務業,2023年冷凍食品銷售量達198.2萬噸,比2022年的197.4萬噸微增0.4%。值得注意的是,這一數字比 2019 年 COVID-19 大流行前的 186.1 萬噸水平高出 6.5%。

人均冷凍食品消費量從2022年的47.7公斤上升到2023年的49.4公斤,創歷史新高。在家庭層面,消費量增加了3公斤,從2022年的96.4公斤增加到2023年的99.4公斤。

冷凍食品物流業概況

冷凍食品物流市場本質上是分散的。 Lineage Logistics、Americold Logistics、Swire Cold Storage、Nichirei Logistics、VersaCold Logistics Services 等主要公司在低溫運輸物流行業處於領先地位。

這些主要企業提供一系列服務,包括溫控儲存、運輸和配送,以滿足冷凍食品產業的特定需求。這些公司利用廣泛的網路、最尖端科技和冷凍食品管理方面的專業知識,在市場上擁有強大的競爭優勢。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場動態與洞察

- 目前的市場狀況

- 市場動態

- 促進因素

- 電子商務的崛起推動市場

- 消費者生活方式的變化推動市場

- 抑制因素

- 維持低溫運輸物流相關的高營運成本

- 影響市場的監理合規性

- 機會

- 市場驅動的技術進步

- 促進因素

- 價值鏈/供應鏈分析

- 政府法規、貿易協定和舉措

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 依產品

- RTE

- RTC

- 依產品類型

- 冷凍水果和蔬菜

- 冷凍肉/魚

- 冷凍已烹調調理食品

- 冷凍甜點

- 冷凍零食

- 其他產品類型

- 交通方式

- 路

- 鐵路

- 海上航線

- 航空

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Lineage Logistics

- Americold Logistics

- Swire Cold Storage

- Nichirei Logistics

- VersaCold Logistics Services

- Burris Logistics

- Kloosterboer

- NewCold

- Interstate Cold Storage

- Preferred Freezer Services*

- 其他公司

第7章 市場的未來

第8章附錄

- 總體經濟指標

- 資金流向洞察(運輸和倉儲領域的投資)

- 電子商務及消費統計

- 對外貿易統計

The Frozen Food Logistics Market size is estimated at USD 30.94 billion in 2025, and is expected to reach USD 52.79 billion by 2030, at a CAGR of 11.28% during the forecast period (2025-2030).

Key Highlights

- A surge in demand for frozen food products and growing urbanization mainly drive the frozen food logistics market.

- Over the past few years, the premium frozen food industry has witnessed remarkable growth. A heightened consumer appetite for top-tier, convenient, and nutritious food choices predominantly propels this upsurge. This trend is especially pronounced among health-conscious individuals seeking balanced diets and the swiftness of ready-to-eat meals.

- Moreover, consumers increasingly acknowledge the superior quality of products made possible by modern freezing technologies, which effectively retain taste and nutritional value.

- Notably, affluent urban households are spearheading the sales of these premium frozen offerings. These products often boast gourmet recipes, responsibly sourced ingredients, and cutting-edge flavors.

- This surge in demand mirrors a broader consumer shift toward home cooking, culinary experimentation, and a desire for restaurant-grade meals-all enjoyed from the comfort of their homes. It is a trend tailored for discerning food enthusiasts unwilling to compromise on quality, taste, or nutrition.

- In 2023, retail sales of frozen foods surged by 7.9%, hitting USD 74.2 billion. This marked a notable USD 10 billion increase over the last three years, as highlighted in a recent report. Like many grocery segments, the growth of frozen food's value in dollars was primarily fueled by inflation-driven price hikes.

- Consequently, consumer behavior toward frozen food is changing. The Power of Frozen in Retail 2023 report, a collaboration between the American Frozen Food Institute (AFFI) and the Food Industry Association (FMI), revealed that consumers shelled out an average of USD 4.99 per unit for frozen items. This represented a 13.5% uptick from 2023 and a substantial 29.6% leap in the last three years.

- Frozen meals and desserts are leading the pack in frozen food sales, raking in USD 26.6 billion and USD 15.4 billion, respectively, in 2023. These are followed by fruits/vegetables, seafood, and meat/poultry, each boasting sales figures of USD 8.1 billion, USD 7 billion, and USD 5.7 billion, respectively, in the same year.

Frozen Food Logistics Market Trends

Demand for Frozen Food Products Gaining Traction in the Industry

The ready-to-eat market has witnessed a significant evolution in recent years, driven by a surge in product innovation tailored to changing consumer preferences. This transformation is especially pronounced in India, where convenience and taste preferences are paramount.

Consumers are increasingly gravitating toward healthier, natural options in the ready-to-eat industry. This has increased demand for products with clean labels, minimal additives, and organic ingredients. Furthermore, there is a growing appetite for plant-based and vegan choices. As more individuals adopt plant-based diets or reduce meat consumption, the demand for plant-based or vegan-friendly ready-to-eat options is rising.

Key to the industry's growth is the unwavering commitment to innovation by both established players and startups. Recent research from Nielsen underscores a significant consumer pivot toward healthier ready-to-eat choices, particularly in India. The study indicates that 72% of Indian consumers actively seek nutritious, well-balanced, ready-to-eat meals, showcasing a heightened health consciousness.

In response, companies are harnessing technology and culinary skills to craft products that meet nutritional needs and cater to the diverse Indian palate. This includes the introduction of gluten-free, organic, and locally-inspired options.

Partnerships between ready-to-eat brands and nutrition institutes or experts are broadening product offerings and reshaping consumer perceptions, positioning ready-to-eat foods as a healthier meal choice.

Europe is Holding a Prominent Position in the Market

In 2023, Germany's total frozen food sales reached 4.043 million tonnes, marking a 3.4% increase from 3.909 million tonnes in 2022. This surge pushed sales past the 4-million-tonne milestone for the first time.

The out-of-home market saw a notable 6.5% uptick in sales, hitting 2.061 million tonnes in 2023, up from 1.935 million tonnes in 2022. This growth propelled the market past the 2-million-tonne threshold.

Within the food retail and home services industry, frozen food sales in 2023 reached 1.982 million tonnes, reflecting a modest 0.4% increase from 1.974 million tonnes in 2022. Notably, this figure stood 6.5% higher than the pre-COVID-19-pandemic levels in 2019, which were at 1.861 million tonnes.

Individually, per capita consumption of frozen food hit a record high of 49.4 kg in 2023, up from 47.7 kg in 2022. At the household level, consumption saw a 3 kg increase, reaching 99.4 kg in 2023, compared to 96.4 kg in 2022.

Frozen Food Logistics Industry Overview

The frozen food logistics market is fragmented in nature. Giants like Lineage Logistics, Americold Logistics, Swire Cold Storage, Nichirei Logistics, and VersaCold Logistics Services are leading the pack in the cold chain logistics industry.

These key players provide a suite of services, including temperature-controlled storage, transportation, and distribution, tailored to the specific needs of the frozen food industry. These companies have solidified their competitive edge in the market by leveraging expansive networks, cutting-edge technologies, and specialized know-how in frozen goods management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rise in E-Commerce Driving The Market

- 4.2.1.2 Changing Consumer Lifestyles Driving The Market

- 4.2.2 Restraints

- 4.2.2.1 High Operating Costs Associated With Maintaining Cold Chain Logistics

- 4.2.2.2 Regulatory Compliances Affecting The Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving The Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ready-to-eat

- 5.1.2 Ready-to-cook

- 5.2 By Product Type

- 5.2.1 Frozen Fruits and Vegetables

- 5.2.2 Frozen Meat and Fish

- 5.2.3 Frozen-Cooked Ready Meals

- 5.2.4 Frozen Desserts

- 5.2.5 Frozen Snacks

- 5.2.6 Other Product Types

- 5.3 By Transportation

- 5.3.1 Roadways

- 5.3.2 Railways

- 5.3.3 Seaways

- 5.3.4 Airways

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lineage Logistics

- 6.2.2 Americold Logistics

- 6.2.3 Swire Cold Storage

- 6.2.4 Nichirei Logistics

- 6.2.5 VersaCold Logistics Services

- 6.2.6 Burris Logistics

- 6.2.7 Kloosterboer

- 6.2.8 NewCold

- 6.2.9 Interstate Cold Storage

- 6.2.10 Preferred Freezer Services*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 8.3 E-commerce and Consumer Spending-related Statistics

- 8.4 External Trade Statistics