|

市場調查報告書

商品編碼

1699258

冷鏈物流市場機會、成長動力、產業趨勢分析及2025-2034年預測Cold Chain Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

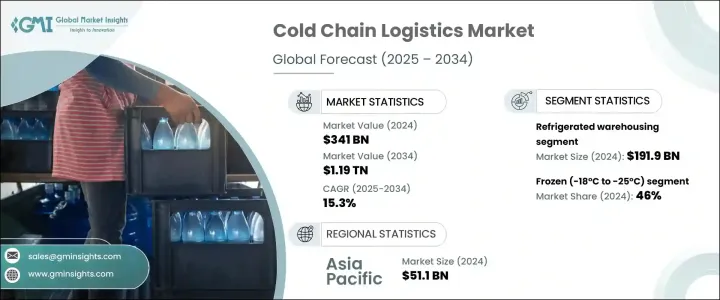

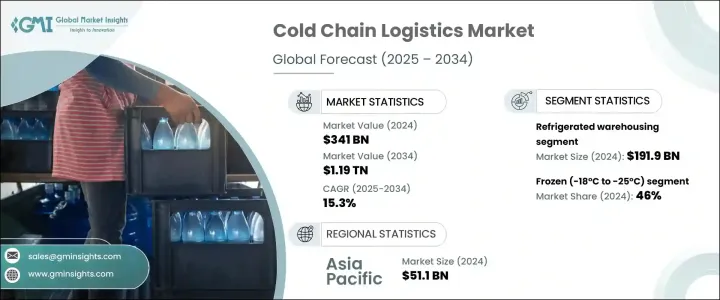

2024 年全球冷鏈物流市場價值為 3,410 億美元,預估 2025 年至 2034 年期間的複合年成長率為 15.3%。物聯網、人工智慧和區塊鏈的整合正在推動該行業的重大轉型,實現即時追蹤、最佳化庫存和路線,並確保交易安全透明。電子商務的興起進一步刺激了對高效物流服務的需求,促使企業加強物流網路以管理不斷增加的訂單量。因此,物流公司正在大力投資倉儲、最後一哩交付和自動化系統。冷藏倉儲領域在 2024 年創造了 1,919 億美元的市場規模,預計到 2034 年將以 15% 左右的複合年成長率成長,原因是對確保食品、藥品和生物技術產品等易腐貨物溫度控制的儲存解決方案的需求不斷增加。

冷藏倉儲是服務經濟的重要組成部分,涉及先進的冷卻系統和精確的控制,以保持儲存貨物的最佳溫度。這一領域的成長是由冷凍和冷藏產品需求的不斷成長以及對防止變質的可靠儲存解決方案的需求所推動的。創新 IT 解決方案在冷藏領域越來越受歡迎,其中無人值守的基於雲端的系統可以與現有基礎設施無縫整合,從而降低成本並提高營運效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3410億美元 |

| 預測值 | 1.19兆美元 |

| 複合年成長率 | 15.3% |

根據溫度範圍,市場分為冷藏(0°C 至 8°C)、冷凍(-18°C 至 -25°C)和深度冷凍(-25°C 至 -60°C)。 2024 年,冷凍食品佔據市場主導地位,佔有 46% 的佔有率,預計 2025 年至 2034 年期間的複合年成長率將超過 15.5%。這一成長是由對預煮冷凍食品、乳製品和加工肉類的需求不斷成長所推動的,這些產品需要嚴格的溫度調節來保持新鮮度和安全。此外,全球肉類和魚類貿易嚴重依賴深度冷凍技術來維持運輸和儲存過程中的品質。

根據應用,市場還細分為水果和蔬菜、乳製品和冷凍甜點、烘焙和糖果、肉類、魚類和海鮮、藥品等。由於藥物開發、製造和供應鏈管理方面的進步,製藥業預計將保持其主導地位。生物製藥和個人化醫療的成長大大增加了對溫度敏感物流的需求,以確保藥物的安全性和有效性。此外,疫苗的全球分發導致對冷鏈系統的投資增加,以有效支持醫藥和醫療保健供應鏈。

亞太地區引領冷鏈物流市場,2024 年市佔率為 35%,其中中國創造 511 億美元的收入。該地區的主導地位得益於中國、印度和日本等國家的快速經濟成長、技術進步和不斷擴大的工業基礎。製造業、基礎設施和數位產業的大量投資進一步推動了該地區冷鏈物流的發展。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 生產商和製造商

- 冷藏供應商

- 運輸提供者

- 技術提供者

- 物流整合商

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對溫度敏感商品的需求不斷增加

- 電子商務產業的成長

- 冷凍技術的進步

- 全球化和國際食品貿易的不斷成長

- 嚴格的食品安全法規

- 產業陷阱與挑戰

- 建立和運行冷鏈的成本高昂

- 保持溫度完整性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按服務,2021 - 2034 年

- 主要趨勢

- 冷藏倉儲

- 冷藏運輸

- 冷藏公路運輸

- 冷藏鐵路運輸

- 冷藏空運

- 冷藏海運

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 基於雲端

- 本地

第7章:市場估計與預測:依溫度範圍,2021 - 2034 年

- 主要趨勢

- 冷藏(0°C 至 8°C)

- 冷凍(-18°C 至 -25°C)

- 深度冷凍(-25°C 至 -60°C)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 水果和蔬菜

- 乳製品和冷凍甜點

- 烘焙和糖果

- 肉類、魚類和海鮮

- 製藥

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Americold Logistics

- Burris Logistics

- CH Robinson Worldwide

- CEVA Logistics

- Cold Box Express

- Conestoga Cold Storage

- Congebec Logistics

- DB Schenker

- DHL International

- Kloosterboer

- Lineage Logistics Holding

- Maersk

- NewCold Coöperatief UA

- Nichirei Logistics Group (Nichirei Corporation)

- Polar International

- Tippmann Group

- US Cold Storage

- UPS Supply Chain Solutions

- Versacold Logistics Services

- YUSEN LOGISTICS

The Global Cold Chain Logistics Market was valued at USD 341 billion in 2024 and is projected to grow at a CAGR of 15.3% between 2025 and 2034. The integration of IoT, AI, and blockchain is driving a significant transformation in this industry by enabling real-time tracking, optimizing inventory and routes, and ensuring secure, transparent transactions. The rise of e-commerce has further fueled demand for efficient logistics services, prompting businesses to strengthen their logistics networks to manage increased order volumes. As a result, logistics companies are investing heavily in warehousing, last-mile delivery, and automated systems. The refrigerated warehousing segment, which generated USD 191.9 billion in 2024, is expected to grow at a CAGR of around 15% through 2034 due to increasing demand for storage solutions that ensure temperature control for perishable goods like food, pharmaceuticals, and biotechnology products.

Refrigerated warehousing, a critical part of the service economy, involves advanced refrigeration systems and precise controls to maintain optimal temperatures for stored goods. The growth of this segment is being driven by rising demand for frozen and chilled products, coupled with the need for reliable storage solutions that prevent spoilage. Innovative IT solutions are gaining traction in refrigerated storage, where unmanned, cloud-based systems can integrate seamlessly with existing infrastructure, reducing costs and enhancing operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $341 Billion |

| Forecast Value | $1.19 Trillion |

| CAGR | 15.3% |

By temperature range, the market is categorized into chilled (0°C to 8°C), frozen (-18°C to -25°C), and deep frozen (-25°C to -60°C). In 2024, the frozen segment dominated the market with a 46% share and is expected to grow at a CAGR of over 15.5% between 2025 and 2034. This growth is driven by increasing demand for pre-cooked frozen meals, dairy products, and processed meat that require strict temperature regulation to preserve freshness and safety. Additionally, the global trade of meat and fish relies heavily on deep freezing technology to maintain quality during transport and storage.

The market is also segmented by application into fruits and vegetables, dairy and frozen desserts, bakery and confectionery, meat, fish, and seafood, pharmaceuticals, and others. The pharmaceutical segment is expected to maintain its dominance due to advancements in drug development, manufacturing, and supply chain management. The growth of biopharmaceuticals and personalized medicine has significantly increased the need for temperature-sensitive logistics to ensure the safety and efficacy of drugs. Moreover, the global distribution of vaccines has led to increased investment in cold chain systems to support pharmaceutical and healthcare supply chains effectively.

Asia-Pacific leads the cold chain logistics market, holding a 35% market share in 2024, with China generating USD 51.1 billion in revenue. The region's dominance is fueled by rapid economic growth, technological advancements, and expanding industrial bases in countries such as China, India, and Japan. Significant investments in manufacturing, infrastructure, and digital industries are further propelling the growth of cold chain logistics in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Producers & manufacturers

- 3.2.2 Cold storage providers

- 3.2.3 Transportation providers

- 3.2.4 Technology providers

- 3.2.5 Logistics integrators

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for temperature-sensitive goods

- 3.8.1.2 Growth of the e-commerce sector

- 3.8.1.3 Advancements in refrigeration technologies

- 3.8.1.4 Globalization and increasing international trade in food products

- 3.8.1.5 Stringent food safety regulations

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High costs of setting up and running a cold chain

- 3.8.2.2 Maintaining temperature integrity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Refrigerated warehousing

- 5.3 Refrigerated transportation

- 5.3.1 Refrigerated road transport

- 5.3.2 Refrigerated rail transport

- 5.3.3 Refrigerated air transport

- 5.3.4 Refrigerated sea transport

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Temperature Range, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Chilled (0°C to 8°C)

- 7.3 Frozen (-18°C to -25°C)

- 7.4 Deep Frozen (-25°C to -60°C)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Fruits & vegetables

- 8.3 Dairy & frozen desserts

- 8.4 Bakery & confectionery

- 8.5 Meat, fish, and seafood

- 8.6 Pharmaceuticals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Americold Logistics

- 10.2 Burris Logistics

- 10.3 C.H. Robinson Worldwide

- 10.4 CEVA Logistics

- 10.5 Cold Box Express

- 10.6 Conestoga Cold Storage

- 10.7 Congebec Logistics

- 10.8 DB Schenker

- 10.9 DHL International

- 10.10 Kloosterboer

- 10.11 Lineage Logistics Holding

- 10.12 Maersk

- 10.13 NewCold Coöperatief UA

- 10.14 Nichirei Logistics Group (Nichirei Corporation)

- 10.15 Polar International

- 10.16 Tippmann Group

- 10.17 U.S. Cold Storage

- 10.18 UPS Supply Chain Solutions

- 10.19 Versacold Logistics Services

- 10.20 YUSEN LOGISTICS