|

市場調查報告書

商品編碼

1644485

亞太現場服務管理:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Field Service Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

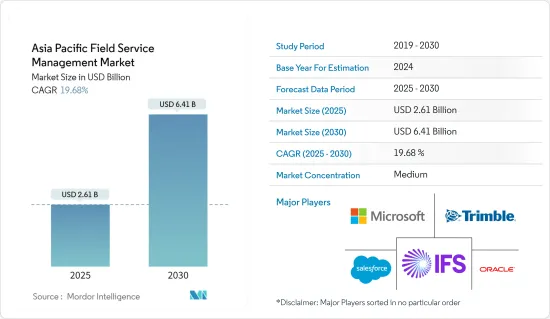

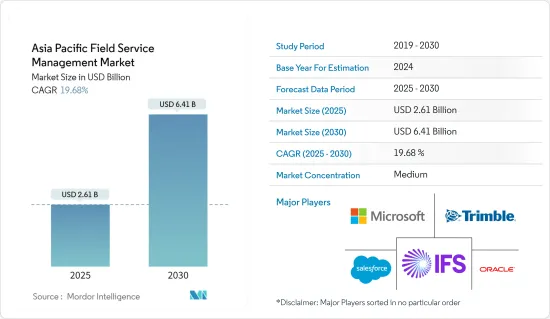

亞太地區現場服務管理市場規模預計在 2025 年為 26.1 億美元,預計到 2030 年將達到 64.1 億美元,預測期內(2025-2030 年)的複合年成長率為 19.68%。

過去幾年,由於對省時省錢的解決方案的需求不斷成長,現場服務管理行業發展迅速。現場服務組織已經意識到採用數位技術可以在彌補各種技術人員短缺方面發揮關鍵作用,並正在廣泛採用各種現場服務管理解決方案。

關鍵亮點

- 雖然現場服務在全球範圍內呈上升趨勢,但亞太地區卻主導打破了美國在該領域的主導地位。這一快速成長趨勢的推動力是該地區新興市場(如中國和印度)大量中小型企業 (SME) 的存在。根據經合組織的資料,2021年亞洲中小企業數量預計為1.861億家,高於2020年的1.8231億家。中小企業總數的增加預計將顯著促進亞太地區現場服務管理市場的發展。

- 中小企業數量不斷增加,競爭同步加劇。這反過來會推動各種新技術和創新技術的採用,例如工作發票、計費和調度、服務交付等各種業務流程的自動化。降低營運成本和提高生產力的壓力也越來越大。混合勞動模式和物聯網等新技術的出現也在推動市場成長。

- 亞太地區現場服務管理市場歷來因終端用戶擴大採用即時協作系統而見證了顯著的成長。預計這將在預測期內推動市場成長。此外,持續的新冠疫情也顯著促進了市場成長。

- 對於現場服務組織來說,處理零件和物流一直是最重要的業務挑戰之一。在亞太地區,SuiteCommerce 是與 NetSuite 預先整合的可擴展業務解決方案,其中包括用於訂單管理、客戶關係管理和我的帳戶的增強型客戶中心解決方案。現場服務公司傾向於主要使用該軟體透過其網站銷售產品,直接面向企業和直接面對消費者。

- COVID-19 對大型和小型企業都產生了重大影響。由於世界各國實施封鎖,製造業、汽車業、紡織業、運輸和物流業、旅遊和酒店業以及消費品等關鍵產業被迫關閉。此外,隨著經濟適應這些偏遠地區的新經營方式,COVID-19 再次證明了企業需要超越傳統的現場服務業務,並制定策略透過使用智慧技術來提高彈性。

亞太地區現場服務管理市場趨勢

印度加速採用現場服務管理解決方案

- 印度是現場服務管理解決方案、雲端和人工智慧的主要市場之一。中小企業對人工智慧和雲端運算的採用越來越多,以及所有終端用戶對人工智慧技術的投資不斷增加,是推動市場成長的一些關鍵因素。

- 由於中小企業的持續投資,該地區有望顯著成長。中小型企業正在投入巨額資金,以最大限度地全面採用雲端基礎的、技術先進的現場服務管理解決方案。此外,印度市場也提供了巨大的成長機會。

- 例如,根據印度中小微型企業部的數據,截至 2022 年 3 月,印度有超過 790 萬家 MSMEs(微型、小型和中型企業)。鑑於對可擴展 IT 解決方案和系統的依賴,中小微型企業和政府希望將敏感資訊和流程轉移到雲端是可以理解的。

- 此外,印度擁有龐大的工業基礎,這意味著 FSM 市場基礎廣泛。由於該國地理區域發達且基本客群龐大,預計其現場服務管理市場將穩定成長。全國技術用戶數量的穩定成長進一步推動了現場服務管理市場的成長。

- 在新冠肺炎疫情爆發前,現場服務管理高峰會在印度舉行,高峰會涵蓋的主題包括滿足現場服務接觸點日益複雜的需求所需的技能、技術和變革管理策略,物聯網在現場服務管理中的未來,解決第三方勞動力管理和第三方計費中的關鍵挑戰,提高首次修復率以實現更高的客戶滿意度和利潤。

大公司佔有較大的市場佔有率

- 亞太地區大型企業對現場服務管理解決方案的採用相對比中小企業更為先進。大型企業的承受能力和規模經濟允許更大規模地部署客戶管理、保固管理、庫存管理、計費和工單管理解決方案。

- 在當今的現場服務管理軟體中,客戶關係管理已成為企業的首要任務之一,因為它可以提高組織的品牌知名度並有助於留住客戶。本公司廣泛注重為客戶提供快速且流暢的體驗,從而對該地區現場服務管理市場的需求和要求產生正面影響。

- 各行各業的公司都在踏上各種數位轉型之旅並投資於客戶參與解決方案。企業也明顯脫離了 CRM 等傳統平台。因此,企業計劃的這種轉變可能會在預測期內為市場上的製造商和供應商提供更好的前景。

- 此外,該地區的主要供應商正致力於建立策略聯盟,以擴大其地理覆蓋範圍。 2022 年 8 月,微軟(斯里蘭卡科倫坡)與領先的開放原始碼整合供應商 WSO2 宣布了一項戰略協議,將部署雲端原生解決方案,透過 Microsoft Azure 向全球地區安全地交付 API、應用程式和數位身分。該協議還意味著整合供應商將使用 Microsoft Azure 作為其主要雲端平台。

- 此外,由於數位轉型,大型企業正在採用雲端整合合約管理解決方案。它可以讓您更好地控制,允許在一個方便的地方創建、協商、簽署、核准、追蹤和更新公共和私營部門的合約。

- 除了大型企業採用現場服務管理軟體的好處之外,亞太成熟經濟體工業領域的崛起也為現場服務管理軟體整合帶來了新的機會。例如,根據亞洲開發銀行的數據,2021年,孟加拉工業部門的增加價值與前一年同期比較10.3%。

亞太地區現場服務管理產業概覽

亞太地區現場服務管理市場競爭激烈,有大量全球和區域參與企業。這些公司採取的關鍵策略包括併購、產品創新和業務擴張。主導市場的主要企業是 Salesforce.Com Inc.、Microsoft Corporation、IFS AB、Trimble Inc 和 Oracle Corporation。

- 2021 年 8 月 - Mize Inc.,一家服務零件和合約管理的領導者,包括庫存、定價和基於物聯網的預防性維修監控解決方案,與 Syncron 合併。合併後的公司將使用 Syncron 名稱,專注於提供連網服務體驗並加速以服務為中心的新經營模式。此外,兩家公司都致力於對創新進行大量投資並擴大全球覆蓋範圍,包括亞洲市場。

- 2021 年 7 月-以資產為中心的現場服務管理公司 ServiceMax 宣布已簽署最終協議,收購行動現場營運管理解決方案供應商 LiquidFrameworks。此次收購旨在擴大 ServiceMax 針對工業、環境和石油天然氣服務的現場服務管理解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎對市場的影響

- FSM 的關鍵使用案例分析(AR/VR 遠端協助、專注於客戶維繫和服務的預測性維護、逐步轉向後端自動化)

第5章 市場動態

- 市場促進因素

- 客戶對更快回應時間的需求使得 FMS 公司可以投資新技術。

- 更加重視最大限度地提高工作效率

- 市場問題

- 實施/整合問題和授權成本(成本和投資報酬率挑戰)

第6章 市場細分

- 依實施類型

- 本地

- 雲

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶

- Allied FM(硬體:建築和空調,軟體:園林綠化和清潔)

- 資訊科技和電訊

- 醫療保健和生命科學

- 能源和公共產業

- 石油和天然氣

- 製造業

- 其他最終使用者(運輸、房地產等)

- 按國家

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Field Aware US, Inc.

- Oracle Corporation(OFSC)

- IFS AB

- ServiceMax Inc.

- ServicePower, Inc.

- Coresystems(SAP SE)

- Microsoft Corporation(Dynamics 365 for Field Service)

- Accruent LLC(Fortive Corp)

- Mize, Inc.

- Salesforce.com, Inc.(Field Service Cloud)

- Zinier, Inc.

- Trimble Inc.

- The simPRO Group Pty Limited

- Kirona Solutions Limited(Advanced)

第8章投資分析

第9章:未來展望

The Asia Pacific Field Service Management Market size is estimated at USD 2.61 billion in 2025, and is expected to reach USD 6.41 billion by 2030, at a CAGR of 19.68% during the forecast period (2025-2030).

The field service management industry has been seeing rapid growth over the last few years, lifted by the growing demand for time and cost-effective solutions. The Field service organizations realize that adopting digital technology can play a very significant role in terms of closing the gap for various technician workforce shortages, and so they are widely adopting various field service management solutions.

Key Highlights

- Field service is on an upward trajectory globally, and one region leading the charge to challenge the overall US dominance of the sector is the Asia-Pacific. The reason behind this rapid growth trend is attributed to the fact that the region's emerging markets (such as China and India) are home to a wide range of small and medium-sized enterprises (SMEs). As per the data from OECD, the estimated number of small and medium-sized enterprises (SMEs) in Asia in 2021 was 186.1 million, whereas, in the year 2020, it was 182.31 million. This rise in the total number of SMEs will significantly boost the market for field service management in the Asia Pacific region.

- The continuous increase in the number of these enterprises leads to a sympathetic growth in the competition. This, in turn, fuels the introduction of various new innovative technology, such as automation for various business processes like job invoicing, billing and scheduling, and service delivery. There is also a rising demand to reduce operating costs and increase productivity. The emergence of new technologies such as mixed labor models and IoT are also promoting the growth of the market.

- The market for Asia Pacific field service management has historically been subjected to significant growth owing to the rising adoption of real-time collaboration systems at the end-user segments. This is anticipated to foster the growth of the market during the forecast period. Moreover, the ongoing COVID-19 pandemic has resulted in a significant boost in market growth.

- One of the top business challenges for the organizations related to field service, was dealing with parts and logistics. In the Asia-Pacific region, SuiteCommerce is a demanding scalable business solution pre-integrated into NetSuite, involving order management, customers, and an enhanced customer center solution for My Account. The Field service companies primarily tend to use this software to sell their products via the website, both direct to business and direct to consumer.

- The COVID-19 had significantly impact on both large corporations and SMEs. Key industries include manufacturing, automotive, textile, transportation and logistics, tourism and hospitality, and consumer goods have been forced to close due to global country-level lockdowns. Furthermore, as the economy adjusts to this new, remote manner of conducting business, COVID-19 reaffirmed the necessity for enterprises to think beyond their conventional field service operations and create strategies to be resilient through the use of intelligent technologies.

APAC Field Service Management Market Trends

Adoption of Field Service Management Solutions in India is Increasing at a High Pace

- India is one of the crucial markets for field service management solutions, cloud, and AI. The rising AI and cloud adoption among SMEs and the growing investments by all the end-users in AI technology are some of the significant factors enhancing the market's growth.

- The region is anticipated to witness massive growth, owing to the ongoing investments by small and medium organizations. SMEs are investing a huge sum of money to maximize the overall adoption of cloud-based and technologically advanced solutions for field service management. Moreover, the country India offers significant growth opportunities in the market.

- For instance, as of March 2022, as per the Ministry of Micro, Small & Medium Enterprises, India has over 7.9 million MSMEs (micro, small and medium enterprises). Given that the MSMEs and government are relying on scalable IT solutions and systems, it is quite understandable that they would like to shift their sensitive information and processes to the cloud.

- Moreover, the FSM market has a wide scope in India, primarily due to large-scale industrialization. The country is anticipated to exhibit steady growth in the field service management market with advanced geographic zones and a high client base. The steady rise in the overall number of technology users in the country further propels the growth of the field service management market.

- Before COVID-19, Field Service Management Summit occurted in India, which covered the topics such as skills, technology, and change management strategies required to fulfill the rising complexity of the field service touchpoint, the future of IoT for field services management, addressing the key challenges in third-party workforce management and third billing, enhancing first-time fix rates to achieve higher customer satisfaction, profits, etc.

Large Enterprises to Hold Significant Market Share

- The growing adoption of field service management solutions in large enterprises is relatively greater than SMEs in the Asia Pacific region. The affordability and the large scale of economies of the Large organizations enable them to deploy customer management, warranty management, inventory management, and billing and work order management solutions on a greater scale.

- Among the current field service management software, customer management has become one of the key priorities for the companies as it allows the organizations' brand recognition and assists in retaining customers. Enterprises are widely focusing on offering a fast and smooth experience to the customer, which has positively impacted the demand and requirement for the field service management market in the region.

- Enterprises across various industries are seeing various digital transformations and investing in customer engagement solutions. Also, a change from the traditional platforms, like CRM, is notably evident across enterprises. Therefore, such a shift among the enterprise projects may provide more excellent prospects to the manufacturers and vendors in the market over the forecasted time period.

- Moreover, key vendors in this region concentrate on strategic alliances to increase their geographical reach. In August 2022, Microsoft (COLOMBO, Sri Lanka) and WSO2, a key open-source integration vendor, announced a strategic agreement to roll out cloud-native solutions for securely delivering APIs, applications, and digital identities to areas all over the world via Microsoft Azure. Due to the agreement, the integration vendor will also use Microsoft Azure as its primary cloud platform.

- Additionally, as a result of digital transformation, Larger enterprises are adopting cloud-integrated contract management solutions. Better management is made possible by it, and businesses in both the public and private sectors are able to write, negotiate, sign, approve, track, and renew contracts in one convenient spot.

- Alongside the advantages of deploying field service management software for large enterprises, the rising industrial sector in the maturing economies of the APAC region opens up new opportunities for the integration of field service management software. For example, according to the Asian Development Bank, in 2021, the value added in the industry sector in Bangladesh registered a growth rate of 10.3% year-on-year.

APAC Field Service Management Industry Overview

The market for Asia Pacific Field Service Management studied is moderately competitive, which is due to the presence of considerable number of global and regional players. The primary strategies adopted by these firms involve mergers and acquisitions, product innovations, and expansions. The key players dominating the market are Salesforce.Com Inc., Microsoft Corporation, IFS AB, Trimble Inc, and Oracle Corporation.

- August 2021 - A leader in service parts and contracts management, including inventory, pricing, and IoT-based preventive repair monitoring solutions, Mize Inc. combined with Syncron. The combined company will, in the future, utilize the Syncron name and will focus on delivering connected service experiences and accelerating new service-centric business models. Moreover, the companies are focusing on investing significantly in innovation and expanding their global coverage, including Asian markets.

- July 2021 - ServiceMax, a firm dealing with asset-centric field service management, declared that it has entered into a definitive agreement to obtain LiquidFrameworks, a provider of mobile field operations management solutions. The acquisition aims to advance ServiceMax's field service management solutions for industrial, environmental, and oil and gas services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definiton

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Analysis of the Major FSM Use-cases (Emergence of AR/VR for Remote Assistanc, Focus on Predictive Maintenance for Customer Retention and Service, Gradual Transition Toward Back-end Automation)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Customer Demand for Quicker Response Time enabling FMS Companies to Invest in New Technologies

- 5.1.2 Growing Emphasis on Maximizing Work Efficiency

- 5.2 Market Challenges

- 5.2.1 Implementation/Integration Issues and Licensing Costs (Cost and ROI challenges)

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-User

- 6.3.1 Allied FM (Hard - Building and HVAC and Soft - Landscaping and Cleaning)

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare and Lifesciences

- 6.3.4 Energy and Utilities

- 6.3.5 Oil and Gas

- 6.3.6 Manufacturing

- 6.3.7 Other End-Users (Transportation, Real Estate, etc.)

- 6.4 By Country

- 6.4.1 India

- 6.4.2 China

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Field Aware US, Inc.

- 7.1.2 Oracle Corporation (OFSC)

- 7.1.3 IFS AB

- 7.1.4 ServiceMax Inc.

- 7.1.5 ServicePower, Inc.

- 7.1.6 Coresystems (SAP SE)

- 7.1.7 Microsoft Corporation (Dynamics 365 for Field Service)

- 7.1.8 Accruent LLC (Fortive Corp)

- 7.1.9 Mize, Inc.

- 7.1.10 Salesforce.com, Inc. (Field Service Cloud)

- 7.1.11 Zinier, Inc.

- 7.1.12 Trimble Inc.

- 7.1.13 The simPRO Group Pty Limited

- 7.1.14 Kirona Solutions Limited (Advanced)