|

市場調查報告書

商品編碼

1644551

新興非揮發性記憶體:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Emerging Non-Volatile Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

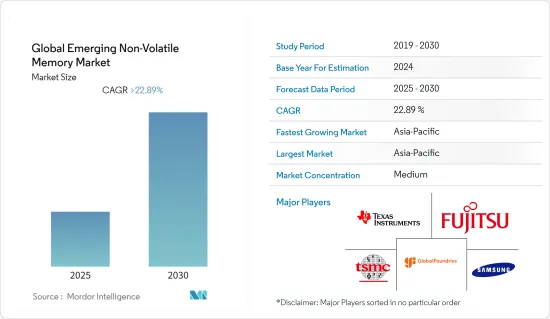

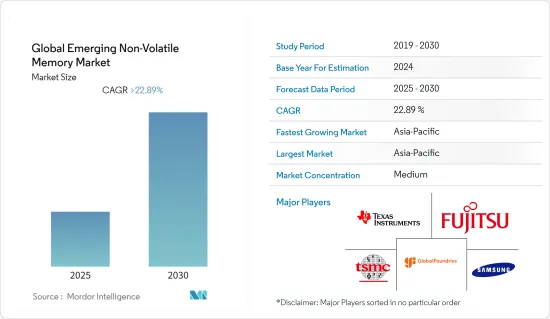

預計預測期內全球新興非揮發性記憶體市場複合年成長率將超過 22.89%。

主要亮點

- 對高速存取和低功耗儲存裝置的需求不斷成長,以及對連網型設備和穿戴式裝置中非揮發性記憶體的需求不斷成長是推動市場成長的關鍵因素。然而,新興非揮發性儲存設備的設計和製造非常複雜,預計這會在預測期內阻礙市場成長。

- 經過幾年的發展,嵌入式新興非揮發性記憶體技術已經相當成熟。 2021 年,多種基於嵌入式 MRAM 的設備投入量產,包括採用 GlobalFoundries eMRAM 的 GreenWave 的 AI 處理器(22nm FDSOI),以及由 Numen 和 Gyrfalcon 設計和開發的邊緣 AI 加速器(台積電的 22nm ULL)。

- 該領域研究活動的活性化正在推動市場的成長。例如,2021 年,三星宣布改進其 14nm 工藝,以支援旨在提高寫入速度和密度的快閃記憶體型嵌入式 MRAM,以及改進 MRAM 的 MTJ 功能。此外,該公司還瞄準穿戴式裝置、微控制器和物聯網裝置中的非揮發性記憶體應用。

- COVID-19 疫情及其全球封鎖對記憶體市場產生了影響。對筆記型電腦和資料中心的需求不斷成長,但智慧型手機和汽車的需求卻放緩。因此,記憶體需求保持相對平衡。新興非揮發性記憶體業務主要在資料中心市場擴張,受3D XPoint推動的儲存層級記憶體(SCM)應用驅動,不會對整體新興非揮發性記憶體市場的演變產生負面影響。 2020年上半年,疫情導致供應鏈中斷,但到下半年這些問題已基本解決。

新興非揮發性記憶體市場趨勢

資料中心需求不斷成長

- 受資料中心記憶體需求的推動,記憶體設備的需求不斷增加,預計將推動對新興非揮發性記憶體的需求。

- 對資料中心的需求是由對高效能運算、邊緣運算、巨量資料和雲端應用的不斷成長的需求所推動的。機器學習和人工智慧的日益普及正在推動供應商選擇更快的速度和更大的資料量。疫情期間遠距工作、線上教育課程和線上醫療援助的快速採用將進一步促進這一成長。

- 此外,英特爾和AMD近年來也持續推出新的伺服器處理器,以回應Google、亞馬遜網路服務、Facebook和微軟Azure的新資料中心建置計劃。預計類似的趨勢也將推動市場發展。

- 亞太資料中心市場受到中國和印度等新興經濟體的推動。預計中國資料中心市場的成長將受到政府支持和國際投資的推動。政府推動人工智慧在安全和智慧應用方面的發展,進一步增強了對新興非揮發性記憶體的需求。

- 據Nasscom稱,印度目前支援80個第三方資料中心。它正吸引國內外參與者的投資,預計到 2025 年每年的投資將達到 46 億美元。

預測期內亞太地區將佔據主要市場佔有率

- 亞太地區是全球最大的新興非揮發性記憶體市場之一。該地區幾乎所有終端用戶應用程式的需求都很高,主要受中國、印度和印尼等幾個新興國家對智慧型手機的需求所推動。

- 印度政府的國家投資促進和便利機構投資印度表示,憑藉印度龐大的行動電話消費基數,行動電話產值預計將從21會計年度的3,000萬美元進一步增加到26會計年度的1.26億美元。

- 此外,受線上娛樂、在家工作以及視訊和語音通話服務需求不斷成長的推動,中國正在經歷包括資料中心在內的新基礎設施建設。隨著數位經濟的快速發展,大型資料中心建置在國家層級凸顯。因此,這些資料中心擴大使用非揮發性記憶體,透過減少因斷電或系統崩潰造成的停機時間,它提供了巨大的經濟價值。

- 中國、韓國和新加坡等國家的半導體製造設施非常活躍。跨國記憶體製造商正大力投資中國市場,尤其是在「中國製造2025」等政府措施的推動下。該國雄心勃勃的目標是到 2030 年實現半導體產值達到 3,050 億美元,滿足該國約 80% 的國內半導體需求。因此,預計預測期內該國的投資將進一步增加。

- 此外,該地區領先的研究機構和大學正在開發一系列與新興非揮發性記憶體相關的技術。例如,2022年1月,由工業工業大學電氣電子工程系副教授範南海領導的國際研究團隊與加州大學的其他研究人員一起,創建了磁隧道接點(MTJ)和拓撲絕緣體的自旋軌道扭矩電阻式記憶體(SOT-MRAM)設備。已經證明了使用相對較高的隧道磁阻效應進行讀出以及使用拓撲絕緣體中的低電流密度進行寫入。

- 因此,由於上述因素,預計預測期內亞太地區的收益佔有率將比其他地區成長更快。

新興非揮發性記憶體產業概況

全球新興非揮發性記憶體市場競爭適中,主要參與者包括:台積電、德州儀器公司、英特爾公司、微晶片科技公司、英飛凌科技股份公司、富士通有限公司、GlobalFoundries 公司、CrossBar 公司等。 就市場佔有率而言,目前只有少數幾家主要公司佔據市場主導地位。

- 2022 年 3 月-富士通有限公司推出了 12Mbit ReRAM(電阻式隨機存取記憶體)MB85AS12MT,是富士通 ReRAM 產品系列中密度最高的產品。這款新產品是一種非揮發性記憶體,具有 12 Mbit 的高儲存密度,並且封裝尺寸超緊湊,約為 2 mm x 3 mm。此外,它還適用於智慧型手錶和助聽器等穿戴式裝置。

- 2021 年 10 月 - CrossBar Inc. 宣布電阻式記憶體(ReRAM) 技術在一次性可編程 (OTP) 和幾次可編程 (FTP) 非揮發性記憶體 (NVM) 應用中的新用途。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 驅動程式

- 對高速存取和低功耗儲存設備的需求不斷增加

- 連網型設備和穿戴式裝置對非揮發性記憶體的需求不斷增加

- 限制因素

- 新興非揮發性記憶體的設計和製造複雜性不斷增加

第6章 市場細分

- 按類型

- 獨立

- 嵌入式

- 按最終用戶產業

- 產業

- 消費性電子產品

- 企業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- TSMC

- Samsung Electronics Co. Ltd.

- GlobalFoundries Inc.

- Texas Instruments Inc.

- Fujitsu Ltd.

- SK Hynix Inc.

- Western Digital Corp.

- CrossBar Inc.

- Microchip Technology Inc.

- Intel Corporation

- Infineon Technologies AG

- United Microelectronics Corporation(UMC)

- Toshiba Corp.

- Nantero Inc.

第8章投資分析

第9章 市場機會與未來趨勢

第 10 章:出版商

The Global Emerging Non-Volatile Memory Market is expected to register a CAGR of greater than 22.89% during the forecast period.

Key Highlights

- The rising demand for fast access and low power consuming memory devices, as well as increasing demand for non-volatile memory in connected and wearable devices, are some of the major factors propelling the market growth. However, high complexity in designing and manufacturing emerging non-volatile memory devices is anticipated to hamper the market growth during the forecast period.

- After several years of development, embedded emerging non-volatile memory technologies have gained substantial maturity. Several embedded MRAM-based devices entered volume production in 2021, among which are GreenWave's AI processors with GlobalFoundries' eMRAM (22nm FDSOI) and edge-AI accelerators designed and developed by Numen and Gyrfalcon (22nm ULL at TSMC).

- The increasing research activities in this space are driving the market's growth. For instance, in 2021, Samsung announced the improvement of the MTJ function of its MRAM along with advancing its 14 nm process to support its flash-type embedded MRAM designed to increase the write speed and density. In addition, the company targets the IC's emerging non-volatile memory application in wearables, microcontrollers, and IoT devices.

- COVID-19 pandemic and its global lockdowns combined impacted the memory market. Laptops and Datacentres demand grew, whereas smartphones and automotive faced a slowdown. The net result has been a comparatively balanced memory demand. As the emerging non-volatile memory business is expanding mostly on the datacentre market with storage class memory (SCM) applications facilitated by 3D XPoint, there has not been a negative impact on the overall emerging non-volatile memory market evolution. Though the pandemic created supply-chain disruptions in the first half of 2020, these were mostly cleared by the beginning of the second half of 2020.

Emerging Non-Volatile Memory Market Trends

Growing Demand for Data Centers

- The increasing demand for memory devices, buoyed by the requirement of data centers for memory, is expected to drive the demand for emerging non-volatile memories.

- This demand for data centers is driven by the increasing demand for high-performance computing, edge computing, big data, and cloud applications. The rising adoption of machine learning and artificial intelligence bolsters the vendors to opt for faster and higher data capacities. The rapid adoption of remote work, online educational classes, and online medical assistance during the pandemic further complemented the growth.

- Furthermore, in response to the new data center construction projects by Google, Amazon Web Service, Facebook, and Microsoft Azure, Intel and AMD introduced new server processors in the last few years. Similar trends are expected to drive the market.

- The Asia-Pacific data center market is buoyed by the developing economies of China and India. The growth in the Chinese data center market is expected to be bolstered by supportive government initiatives and international investments. The government push for AI in security and intelligence use further strengthens the demand for emerging non-volatile memories.

- According to NASSCOM, India is currently supporting 80 third-party data centers. It is witnessing investment from local and international players expected to touch USD 4.6 billion per annum by 2025.

Asia-Pacific to Register a Significant Market Share During the Forecast Period

- Asia-Pacific is one of the largest markets for emerging non-volatile memories globally. The region has high demand from almost all end-user applications, primarily led by demand for smartphones in multiple developing countries, such as China, India, Indonesia, etc.

- India has a large consumer base for mobile phones; hence the production of mobile handsets is further slated to increase in value from USD 30 million in FY 21 to USD 126 million in FY 26, as stated by Invest in India, the National Investment Promotion and Facilitation Agency of the Government of India.

- Further, the development of new infrastructure, including data centers, has been growing in China, driven by an increase in demand for online entertainment, telecommuting, and video and voice call services. With the fast development of the digital economy, building large, big data centers in the country is becoming more notable. This has led to the growth of emerging non-volatile memory usage in such data centers, which helps reduce downtime caused by a power failure or system crash event, thereby providing significant financial value.

- The semiconductor fabrication facilities in countries like China, Korea, and Singapore, are highly active. Several multinational memory manufacturers direct an immense amount of capital into the Chinese market, especially boosted by the country's government initiatives, such as Made in China 2025. The country's ambitious goal is to reach a value of USD 305 billion in semiconductor output by the year 2030 and meet about 80% of the domestic demand for semiconductors. This factor is expected to draw more investments into the country over the forecast period.

- Moreover, leading regional research institutes and universities are developing various technologies related to emerging non-volatile memory. For instance, in January 2022, an international research team led by Associate Professor Pham Nam Hai of the Department of Electrical and Electronic Engineering, Tokyo Institute of Technology, along with other researchers from the University of California, created spin-orbit torque magnetoresistive RAM (SOT-MRAM) devices that integrate magnetic tunneling junctions (MTJs) and topological insulators. A readout through a relatively high tunneling magnetoresistance effect and writing utilizing low current density by a topological insulator was demonstrated.

- Thus, owing to the aforementioned factors, the revenue share from Asia-Pacific is anticipated to grow faster than the other geographical regions during the forecast period.

Emerging Non-Volatile Memory Industry Overview

The Global Emerging Non-Volatile Memory Market is moderately competitive and consists of several major players such as TSMC, Texas Instruments Inc., Intel Corporation, Microchip Technology Inc., Infineon Technologies AG, Fujitsu Ltd., GlobalFoundries Inc., CrossBar Inc., etc. In terms of market share, few major players currently dominate the market. However, with innovations and technological advancements, many companies are increasing their market presence through organic and inorganic growth strategies and tapping new markets. Some of the recent developments in the market are:

- March 2022 - Fujitsu Ltd. launched a 12Mbit ReRAM (Resistive Random Access Memory), MB85AS12MT, which is the largest density in Fujitsu's ReRAM product family. This novel product is a non-volatile memory having a large memory density of 12Mbit in a very tiny package size of around 2mm x 3mm. Additionally, it is suitable for wearable devices such as smartwatches and hearing aids.

- October 2021 - CrossBar Inc. announced new applications of its Resistive RAM (ReRAM) technology for usage in one-time-programmable (OTP) and few-time programmable (FTP) non-volatile memory (NVM) applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute

- 4.2.5 Intensity Of Competition Rivarly

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Rising demand for fast access and low power consuming memory devices

- 5.1.2 Increasing demand for non-volatile memory in connected and wearable devices

- 5.2 Restraints

- 5.2.1 High complexity in designing and manufacturing emerging non-volatile memory devices

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Stand-alone

- 6.1.2 Embedded

- 6.2 End-user Industry

- 6.2.1 Industrial

- 6.2.2 Consumer Electronics

- 6.2.3 Enterprise

- 6.2.4 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TSMC

- 7.1.2 Samsung Electronics Co. Ltd.

- 7.1.3 GlobalFoundries Inc.

- 7.1.4 Texas Instruments Inc.

- 7.1.5 Fujitsu Ltd.

- 7.1.6 SK Hynix Inc.

- 7.1.7 Western Digital Corp.

- 7.1.8 CrossBar Inc.

- 7.1.9 Microchip Technology Inc.

- 7.1.10 Intel Corporation

- 7.1.11 Infineon Technologies AG

- 7.1.12 United Microelectronics Corporation (UMC)

- 7.1.13 Toshiba Corp.

- 7.1.14 Nantero Inc.