|

市場調查報告書

商品編碼

1644627

美國暖通空調設備與服務:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)United States HVAC Equipment & Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

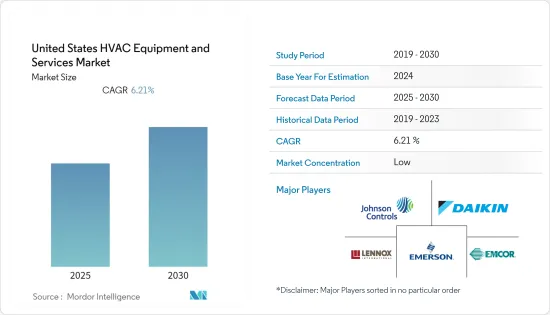

美國暖通空調設備和服務市場預計在預測期內的複合年成長率將達到 6.21%

關鍵亮點

- 商業辦公大樓和住宅中空調的使用日益增多是推動該國對暖通空調設備和服務需求的因素之一。例如,根據美國能源局的數據,美國大約四分之三的住宅都配備了空調。

- 此外,空調消耗了美國全部發電量的 6% 左右,每年對住宅造成約 290 億美元的損失。考慮到這些趨勢,我們正在做出多種努力來提高空調系統的能源效率。例如,2021年12月,美國國家可再生能源實驗室(NREL)獲得了兩個計劃的資助,重點在於液體乾燥劑在節能空調中的使用。

- 作為該研究計劃的一部分,NREL 將與 Blue Frontier 合作開發高效能的儲能暖氣、通風和空調 (HVAC) 系統。該系統利用具有獨立濕度控制的間接蒸發空調,預計可節省 80% 的能源。

- 儘管我們正在努力使 HVAC 系統更加能源高效,但這些設備的消費量仍然很高。這個問題,加上高昂的安裝和維護成本等因素,對市場的成長構成了挑戰。

- 由於需求和供應同時崩壞, COVID-19 疫情美國暖通空調設備和服務市場產生了重大影響。由於辦公大樓關閉和政府的多項限制,在市場上經營的供應商的需求下降。然而,隨著情況逐漸恢復正常,需求預計將獲得成長。

美國暖通空調設備與服務市場趨勢

新安裝推動成長

- 美國建設活動的增加將主要推動該國 HVAC 系統的新安裝。例如,根據經濟分析局的數據,2021 年建築業對國內生產總值(GDP) 的貢獻為 4.2%。

- 除非疫情造成短期影響,否則美國對暖通空調設備和服務的需求正在上升。例如,2021 年 10 月,Lennox Industries 與美國和加拿大的 HVAC 經銷商合作,安裝了 130 台 HVAC 裝置,這是該公司 Feel The Love 計畫的一部分。據該公司稱,這些 HVAC 裝置將安裝在美國37 個州和加拿大 5 個省份。

- 施工期間實施暖通空調需要遵守多項法規和標準。例如美國國家室外空氣通風統一標準為ASHRAE標準62.1-2010。此外,許多州法律還規定了能源效率、管道和風管絕緣、通風控制、系統尺寸和密封等的最低要求。

商業和工業部門推動對暖通空調設備和服務的需求

- 商業和工業設施長期以來一直是 HVAC 設備和服務的主要消費者。美國房地產行業的快速擴張,尤其是酒店、商場、辦公室和機場等商業空間,為研究市場創造了巨大的成長機會。例如,2021年1月,製藥巨頭默克公司宣布計劃建造新的製造工廠,以擴大膀胱癌治療藥物TICE BCG的生產能力。

- 根據美國人口普查局的數據,美國商業建築建設投資從 2020 年的 868.2 億美元增加到 2021 年的 910.3 億美元。此外,根據美國總承包商協會 (AGC) 的數據,建設業是美國經濟的主要貢獻者,每年的建築項目價值近 1.4 兆美元。

- 工業部門的成長也為所研究的市場創造了有利的市場格局。例如,根據經濟分析局的數據,2021年第四季私人商品及服務業成長1.5%、9.1%,政府成長1.4%。

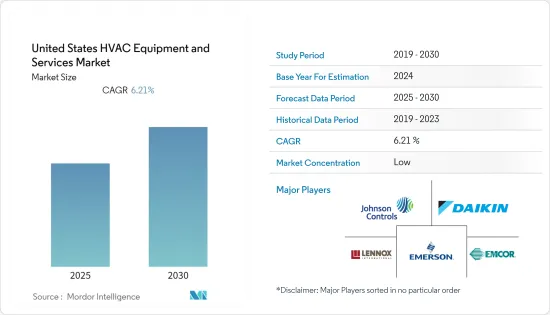

美國暖通空調設備及服務業概況

美國HVAC 設備和服務市場競爭激烈,有幾家老牌企業參與企業市場。不斷成長的需求也鼓勵了新企業的進入。供應商將策略聯盟和收購視為擴張市場的有利途徑。市場的一些主要參與企業包括江森自控國際有限公司、大金工業有限公司、伊萊克斯公司和艾默生電氣公司。

- 2022 年 3 月 - 康乃狄克州州長提案立法建立一項補助計劃,幫助公立學區承擔學校建築供暖、通風和製冷 (HVAC) 和其他室內空氣品質改善的費用。為啟動該計劃,州長的預算提案包括承諾康乃狄克州將從美國救援計劃法案中獲得 9,000 萬美元的資金。

- 2022 年 1 月-Turntide Technologies 推出一個新的智慧平台,以提高工業和商業建築的 HVAC 系統、風扇和泵浦的能源效率。根據該公司介紹,新推出的HVAC 平台整合了智慧馬達系統,可將 HVAC 能耗平均降低 64%。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對產業的影響

- 產業價值鏈分析

- 監管和市場影響

- 分銷通路分析

第5章 市場動態

- 市場促進因素

- 住宅和非住宅用戶增加

- 市場問題

- 暖通空調設備消費量高

第6章市場細分:設備

- 按設備

- 分離系統(管道式和無管道式)

- 室內包裝和屋頂

- 冷卻器

- 空氣調節機

- 爐

- 費因科爾

- 穿窗/穿牆式,可移動,PTAC

- 鍋爐

- 熱泵

- 加濕器和除濕器

- 其他設備類型

- 按最終用戶

- 住宅

- 工商

第7章 空調服務市場分析

- 市場概況

- 市場區隔

- 按類型

- 新安裝

- 維修

- 按最終用戶

- 住宅

- 工商

- 按類型

第8章 競爭格局

- 公司簡介

- Johnson Controls International PLC

- Daikin Industries Ltd.

- Lennox International Inc.

- EMCOR Group

- Emerson Electric Company

- Carrier Corporation

- Goodman Manufacturing Company

- Uponor Corp

- Trane Technologies

- Raheem Manufacturing Company Ltd.

第9章 投資分析及未來展望

簡介目錄

Product Code: 90984

The United States HVAC Equipment & Services Market is expected to register a CAGR of 6.21% during the forecast period.

Key Highlights

- The growing use of air conditioners in commercial office buildings and residential properties are some of the leading factors driving the demand for HVAC equipment and services in the country. For instance, according to the U.S. Department of Energy, about three-quarters of all homes in the United States have air conditioners.

- Additionally, air conditioners use about 6% of the total electricity produced in the United States, at an annual cost of about USD 29 billion to homeowners. Considering such trends, several initiatives are being taken to enhance the energy efficiency of air conditioning systems. For instance, in December 2021, The USA's National Renewable Energy Laboratory (NREL) received funding for two projects focused on using liquid desiccant in energy-efficient air conditioning.

- As part of this research program, NREL has partnered with Blue Frontier to develop an energy-storing efficient heating, ventilation, and air conditioning (HVAC) system. The system is expected to offer 80% energy savings by leveraging indirect evaporative air conditioning with separate humidity control.

- Although initiatives are being taken to enhance the energy efficiency of HVAC systems, the energy consumption of these devices is still high. This, along with factors such as high installation and maintenance costs, is challenging the growth of the studied market.

- The COVID-19 pandemic has significantly impacted the HVAC equipment and services market in the United States, owing to a simultaneous collapse of both the demand and supply. The vendors operating in the market experienced a fall in demand due to the closure of office buildings and several restrictions imposed by the government. However, the demand is expected to gain traction with the condition moving towards normalcy.

US HVAC Equipment & Services Market Trends

New Installations to Drive the Growth

- Increasing construction activities in the country primarily drive new installations of HVAC systems in the country. For instance, according to the Bureau of Economic Analysis, the construction industry's contribution to the country's GDP was 4.2% in 2021.

- Barring the short-term impact of the pandemic, the demand for HVAC equipment & services has been on the rise in the United States. For instance, in October 2021, Lennox Industries partnered with HVAC dealers across the U.S. and Canada to install 130 HVAC units as part of the company's Feel The Love program. According to the company, these HVACs will be installed in 37 U.S. states and 5 Canadian provinces.

- Implementing HVAC during construction should comply with several regulations and standards. For instance, the national consensus standard for outside air ventilation in the United States is ASHRAE Standard 62.1-2010. Additionally, many state codes specify minimum energy efficiency requirements, pipe, and duct insulation, ventilation controls, and system sizing and sealing, among other factors.

Commercial and Industrial Sector to Drive the Demand for HVAC Equipments & Services

- Commercial and industrial establishments have long been major consumers of HVAC equipment and services. The rapid expansion of the real-estate sector in the U.S., particularly commercial spaces, such as hotels, malls, offices, and airports, has created significant growth opportunities for the studied market. For instance, in January 2021, Merck, a leading medicine manufacturer, announced its plans to construct a new manufacturing facility to expand its production capacity for TICE BCG, a medicine for treating certain forms of bladder cancer.

- According to the U.S Census Bureau, the value of commercial construction in the United States has increased to USD 91.03 billion in 2021, from USD 86.82 billion in 2020. Furthermore, according to the Associated General Contractors of America (AGC), construction is a major contributor to the U.S. economy and creates nearly USD 1.4 trillion worth of structures each year.

- The growth of the industrial sector is also creating a favorable market scenario for the studied market as these companies' increasing investments in new facilities are being made, which drives the demand for HVACs. For instance, according to the Bureau of Economic Analysis, in the fourth Quarter of 2021, private goods-producing industries grew by 1.5 percent, private services-producing industries increased by 9.1 percent, and government increased by 1.4 percent.

US HVAC Equipment & Services Industry Overview

The United States HVAC Equipment & Services market is competitive due to several established players. The growing demand is also encouraging new players to enter the market. The market vendors view strategic partnerships and acquisitions as a lucrative path to market expansion. Some major players operating in the market include Johnson Controls International PLC, Daikin Industries Ltd., Electrolux AB, and Emerson Electric Company.

- March 2022 - The governor of Connecticut proposed legislation to establish a grant program to assist public school districts in paying for heating, ventilation, and cooling (HVAC) and other indoor air quality improvements to school buildings. To launch the program, the governor's budget proposal includes an investment of USD 90 million in funding that Connecticut received from the American Rescue Plan Act.

- January 2022 - Turntide Technologies launched a new smart platform to improve the energy efficiency of HVAC systems, fans, and pumps for industrial and commercial buildings. According to the company, the newly launched HVAC platform integrates a smart motor system and can cut HVAC energy use by an average of 64%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry

- 4.4 Industry Value Chain Analysis

- 4.5 Regulations and Their Impact on the Market

- 4.6 Distribution Channel Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Residential and Non-residential Users

- 5.2 Market Challenges

- 5.2.1 High Energy Consumption of HVAC Equipment

6 MARKET SEGMENTATION - EQUIPMENT

- 6.1 By Equipment

- 6.1.1 Split Systems (Ducted & Ductless)

- 6.1.2 Indoor Packaged & Roof Tops

- 6.1.3 Chillers

- 6.1.4 Air Handling Units

- 6.1.5 Furnaces

- 6.1.6 Fain Coils

- 6.1.7 Window/through the Wall, Moveable & PTAC

- 6.1.8 Boilers

- 6.1.9 Heat Pumps

- 6.1.10 Humidifiers and Dehumidifiers

- 6.1.11 Other Equipment Types

- 6.2 By End-User

- 6.2.1 Residential

- 6.2.2 Industrial & Commercial

7 MARKET ANALYSIS OF HVAC SERVICES

- 7.1 Market Overvies

- 7.2 Market Segmentation

- 7.2.1 By Type

- 7.2.1.1 New Installations

- 7.2.1.2 Retrofits

- 7.2.2 By End-User

- 7.2.2.1 Residential

- 7.2.2.2 Industrial & Commercial

- 7.2.1 By Type

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Johnson Controls International PLC

- 8.1.2 Daikin Industries Ltd.

- 8.1.3 Lennox International Inc.

- 8.1.4 EMCOR Group

- 8.1.5 Emerson Electric Company

- 8.1.6 Carrier Corporation

- 8.1.7 Goodman Manufacturing Company

- 8.1.8 Uponor Corp

- 8.1.9 Trane Technologies

- 8.1.10 Raheem Manufacturing Company Ltd.

9 INVESTMENT ANALYSIS AND FUTURE

02-2729-4219

+886-2-2729-4219