|

市場調查報告書

商品編碼

1644822

歐洲交流 (AC) 馬達:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Alternating Current (AC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

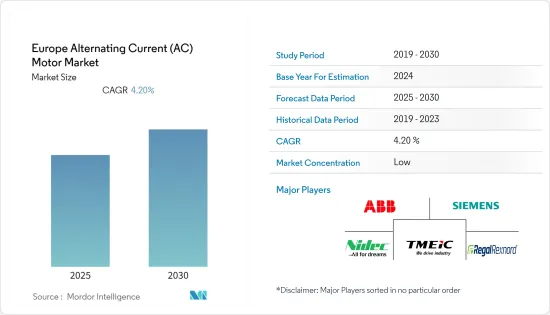

預計預測期內歐洲交流 (AC) 馬達市場的複合年成長率將達到 4.2%。

主要亮點

- 交流(AC)馬達相對容易維護,在汽車生產上的應用越來越多。此外,工業應用中節能馬達的採用和較低的消費量也是推動歐洲馬達需求增加的主要因素。

- 2021 年 7 月 1 日,歐盟針對電動馬達和變速驅動裝置的新生態設計措施生效,旨在提高整個歐盟範圍內這些產品的能源效率。新法規反映了技術進步和市場的發展。此外,歐盟委員會表示,新修訂法規的整體效果將是2030年增加110TWh的電力消耗,相當於荷蘭的電力消耗量。歐盟致力於廣泛採用超高效電器產品,並且越來越關注節能電動馬達和驅動器,這些舉措正在推動該地區對交流馬達的需求。

- 此外,交流電機在工業製程自動化中的應用越來越廣泛,對由交流電機驅動的電器產品的需求不斷成長,以及在暖通空調應用中的使用不斷增加,都推動了電動交流電機市場的成長。然而,高功率馬達產生的振動很大,並且需要高維護,這阻礙了市場的成長。

- 據外交部稱,歐洲是交流電機的較大市場,因為德國是交流電機的最大進口國之一,其次是義大利、法國和荷蘭。中國是一個強大的、具有價格競爭力的供應商,佔據歐洲交流電機供應的主導地位。

- 由於 COVID-19 疫情導致的全球供應鏈中斷是影響該地區交流電機的最新案例。由於停工停產導致多個行業成長放緩,對市場造成了影響。此外,美國貿易戰導致歐洲與中國之間的汽車零件供應鏈中斷,因為該地區主要國家主要從中國進口汽車及相關零件。

歐洲交流馬達市場趨勢

離散製造業可望大幅成長

- 交流電機在離散製造業中廣泛應用,包括汽車、飛機、國防設備、電子、半導體和紡織品的大規模生產。

- 為了提高速度並減少停機時間,汽車OEM擴大採用工廠自動化解決方案,導致先進交流馬達的快速普及。因此,越來越多的公司開始將電氣方面引入其產品中。例如,豐田、日產、雪鐵龍、寶馬、賓士、起亞、歐寶、飛雅特、現代和大眾都在其產品組合中增加電動車型。

- 2019年,英國政府通過立法,到2050年實現溫室氣體淨零排放,綠色工業革命舉措承諾在2030年停止銷售石化燃料汽車。

- 製造和研發支出不斷增加,過去幾年各行各業的大型公司每年都在歐盟地區投資。例如,2022年3月,英特爾宣布了未來10年向歐盟投資800億歐元計畫的第一階段,涵蓋從研發到製造和先進封裝技術的整個半導體價值鏈。隨著製造業務的成長,預計該市場將大幅擴張。

預計德國將佔很大佔有率

- 各行各業工業化程度的提高和自動化的採用正在推動該國對電動馬達的需求。此外,由於需要更大、更節能的馬達來最大限度地降低生產中的額外成本,各個終端用戶產業對交流馬達的需求日益增加。

- 根據經濟合作暨發展組織(OECD)的數據,德國將其GDP的2.88%投資於製造業創新,高於OECD 2.4%的平均值。近年來,德國汽車工業顯著加強了在全球汽車製造業的地位。此外,製造業的永續性預計將成為市場的主要驅動力。

- 甚至該國的污水處理廠也必須遵守嚴格的污水治療方法,而歐盟立法規定降低泵浦的消費量,則推動了該國對節能交流馬達的需求。

- 此外,隨著人口成長和向都市區的轉移,政府正致力於改善基礎設施和現有的公共水利基礎設施。預計預測期內對交流電機的需求將進一步增加。

歐洲交流馬達產業概況

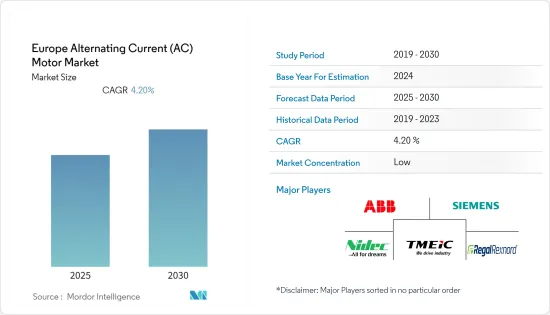

歐洲交流(AC)電機市場由於國內和全球參與者的存在而變得分散,例如: ABB、日本電產、西門子等公司在市場上提供技術先進、可靠的產品。

- 2021年10月-NORD DRIVESYSTEMS推出通風版或平滑版IE5+永磁同步馬達,輸出功率高達4.0 kW。此馬達效率高,扭力範圍寬。這些新型 IE5+ 馬達也適用於食品和製藥業的物流和衛生敏感區域。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 主要國家工業自動化成長

- 政府法規推動能源效率需求

- 市場挑戰

- 初始電機成本及維修成本高

第 6 章 分割

- 按類型

- 感應交流電機

- 單相

- 變形怪

- 同步交流電機

- 直流勵磁轉子

- 永久磁鐵

- 磁滯馬達

- 磁阻電動機

- 感應交流電機

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 發電

- 用水和污水

- 金屬與礦業

- 飲食

- 離散製造業

- 其他最終用戶產業

- 按國家

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

第 7 章 供應商市場佔有率

第8章 競爭格局

- 公司簡介

- ABB Ltd.

- Siemens AG

- Nidec Corporation

- Regal Rexnord Corporation

- Toshiba Mitsubishi-Electric Industrial Systems Corporation

- Baldor Electric

- Brook Crompton

- Johnson Electric Holdings Limited

- Fuji Electric Co., Ltd.

- TECO Electric Europe Ltd.

第9章投資分析

第10章:市場的未來

簡介目錄

Product Code: 91160

The Europe Alternating Current Motor Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- The AC motors are comparatively easy to maintain and are being used increasingly in the production of motor vehicles. Also, the growing adoption of energy-efficient motors for industrial applications and low energy consumption are the major factors responsible for the increasing demand for electric motors in Europe.

- The new EU eco-design measures for electric motors and variable speed drives came into effect on 1 July 2021, aimed at improving the energy efficiency of these products across the EU. The new regulation reflects technological progress and market evolution. Furthermore, according to European Commission, the overall effect of the newly revised regulation will increase to 110 TWh by 2030, which is equivalent to the electricity consumption of the Netherlands. Such initiatives of the EU for the deployment of super-efficient appliances and increasing focus on energy-efficient electric motors & drives are creating demand for AC motors in the region.

- Moreover, the growing adoption of AC motors in the automation of industrial processes, increasing demand for electric AC motor-operated household appliances, and growing use in HVAC applications are responsible for the growth of the electric AC motors market. However, motors with high powers generate extensive vibration and require high maintenance, hindering market growth.

- According to the Ministry of Foreign Affairs, Europe is a larger market for AC motors as Germany is one of the large importers of AC motors, followed by Italy, France, and the Netherlands. China is a strong and price-competitive supplier, dominating supplies of AC motors to Europe.

- The global supply chain disruptions due to the Covid-19 pandemic are the recent case of impacts on the AC motors in the region. The slowdown of several industries created due to the shutdown affected the market. Further, the trade war between the US and China halted the supply chain between Europe and China for motor components and spare parts as the major regional countries largely import the motors and related spare parts from China.

Europe Alternating Current (AC) Motor Market Trends

Discrete Industry is Expected to Grow Significantly

- AC motors find robust applications across the discrete manufacturing industry, which deals with the mass production of automobiles, aircraft, defense equipment, electronic products, semiconductors, and textiles.

- In an effort to increase speed and reduce downtime, automotive OEMs are increasingly adopting factory automation solutions, giving rise to the rapid adoption of advanced AC motors. As a result, more and more companies are increasingly moving toward implementing electric aspects into their offerings. For instance, Toyota, Nissan, Citroen, BMW, Mercedes, Kia, Opel, Fiat, Hyundai, and Volkswagen have added a selection of electric models to their portfolio.

- The UK government passed the law in 2019 to reduce greenhouse gas emissions to net-zero by 2050, and the green industrial revolution initiative pledges to stop the sale of fossil fuel vehicles by 2030, which could boost the adoption of electric cars creating the demand for AC motors.

- The spending on manufacturing and R&D has increased, with the annual investments in the EU region in the past few years by the major players of different industries. For instance, in March 2022, Intel announced the first phase of its plan to invest EUR 80 billion in the EU over the next decade along the entire semiconductor value chain from research and development (R&D) to manufacturing to state-of-the-art packaging technologies. The growth in the manufacturing operations is expected to create a wide scope for the market.

Germany is Expected to Hold Significant Share

- Rising industrialization and the growing adoption of automation across various industries are propelling the demand for electric motors in the country. Further, the demand for AC motors is rising in various end-user industry verticals as large, and energy-efficient motors are required to minimize the additional cost of production.

- According to the Organization for Economic Co-operation and Development (OECD), Germany invests 2.88% of its GDP in manufacturing innovation, above the OECD average of 2.4%. The German automotive sector has drastically strengthened its global position in car manufacturing during the last few years. Furthermore, the manufacturing sector's sustainability is projected to be a significant driver for the market.

- The strict wastewater treatment laws, which even domestic sewage treatment facilities need to abide by, and the requirement to reduce the energy consumption of pumps, as laid down in the European Union (EU) legislation, will drive the demand for energy-efficient AC motors in the country.

- Furthermore, as the population is rising and shifting towards urban areas, the government is focusing on improving infrastructure and existing utility water infrastructure. This is expected to further propel the demand for AC motors during the forecast period.

Europe Alternating Current (AC) Motor Industry Overview

The Europe alternating current motor market is fragmented owing to the presence of domestic and global players such as ABB, Nidec Corporation, Siemens, etc., in the market that offers reliable products with technological advancement. The competition will likely intensify due to rising activities such as mergers & acquisitions, capacity expansion, and product innovation by vendors to enhance their presence in the market.

- October 2021 - NORD DRIVESYSTEMS introduced the IE5+ permanent magnet synchronous motors with ventilated or smooth versions up to a power of 4.0 kW. The motors are characterized by high efficiency and a wide torque range. These new IE5+ motors are equally interesting for intralogistics and hygiene-sensitive areas in the food and pharmaceutical industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industrial Automation in Major Economies

- 5.1.2 Demand for Energy Efficiency Owning to Government Regulations

- 5.2 Market Challenges

- 5.2.1 High Initial Cost and Maintenance of Motors

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 Induction AC Motors

- 6.1.1.1 Single Phase

- 6.1.1.2 Poly Phase

- 6.1.2 Synchronous AC Motors

- 6.1.2.1 DC Excited Rotor

- 6.1.2.2 Permanent Magnet

- 6.1.2.3 Hysteresis Motor

- 6.1.2.4 Reluctance Motor

- 6.1.1 Induction AC Motors

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Metal & Mining

- 6.2.6 Food & Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 Italy

- 6.3.4 France

- 6.3.5 Russia

- 6.3.6 Rest of Europe

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Ltd.

- 8.1.2 Siemens AG

- 8.1.3 Nidec Corporation

- 8.1.4 Regal Rexnord Corporation

- 8.1.5 Toshiba Mitsubishi-Electric Industrial Systems Corporation

- 8.1.6 Baldor Electric

- 8.1.7 Brook Crompton

- 8.1.8 Johnson Electric Holdings Limited

- 8.1.9 Fuji Electric Co., Ltd.

- 8.1.10 TECO Electric Europe Ltd.

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219