|

市場調查報告書

商品編碼

1644895

日本 POS 終端:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan POS Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

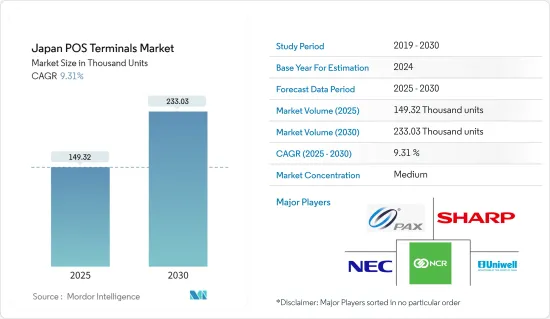

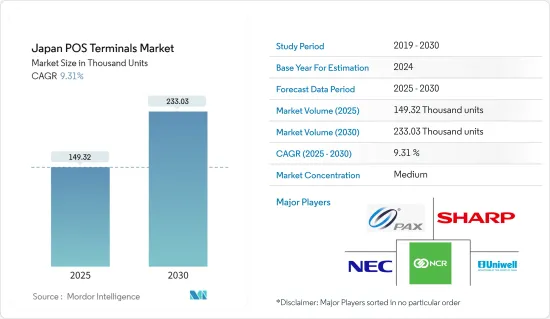

日本 POS 終端市場規模預計在 2025 年為 149,320 台,預計在 2030 年將達到 233,030 台,預測期(2025-2030 年)的複合年成長率為 9.31%。

由於投資收益的提高和訪問的便利性,POS 終端市場在過去幾年裡實現了顯著成長。 POS 系統促進了零售、酒店、運輸和銀行等一系列行業的核心業務交易,多年來,POS 系統對各種規模的企業都具有重要意義。

主要亮點

- 在當前的市場情況下,POS 終端系統已從以交易為導向的設備發展成為支援和整合公司 CRM 和其他金融解決方案的系統。在這種情況下,企業可以使用從 POS 終端收集的交易資料來提供業務洞察。

- 供應商一直支持行動付款的持續發展,尤其是智慧型手機的2D碼付款。同樣,生態系統的其他領域也取得了進展。無現金計劃取得了重大進展,包括政府資助的生物識別基礎設施的建立和基於EMV的非接觸式付款(在日本稱為NFC Pay)的日益普及。預計這一趨勢將成為日本 POS 終端普及的主要催化劑。

- 現代 POS 終端隨著時間的推移減少了設置、部署、維護和電力消耗成本,從而降低了整體擁有成本。各種供應商都提供模組化 POS 終端,具有觸控螢幕顯示器和低功耗等功能,有助於降低整體擁有成本。Sharp Corporation電子和 NEC 等公司提供配有觸控螢幕顯示器和強大處理器的固定 POS 解決方案,以幫助改善業務並減少故障。此外,Aures POS 設備配備無風扇溫度控制,減少了終端內部活動部件的數量。

- 經濟的日益數位化和 POS 平台在各個領域的日益廣泛應用可能會推動 POS 終端市場向前發展。人們對 POS 顯示器有效性的認知不斷提高、零售連鎖店數量的增加以及近距離場通訊系統的使用不斷增加,可能會推動市場成長。

- 簽帳金融卡、電子錢包和 Pasmo 和 Suica 等智慧付款等數位和電子付款技術的使用正在年輕人群和主要都市區廣泛普及。它們為消費者提供了一種方便有效的交易方式,無需實體貨幣或信用卡。此外,它非常安全並允許用戶監控他們的支出。日本交通運輸業者推出了 Suica 和 Pasmo IC 卡,可用於交通、自動販賣機和商店購物。

- 此外,日本政府也積極採取舉措,為日本無現金付款的發展營造支持氛圍,實施了“無現金願景”,旨在到2025年將無現金付款提高到40%,長期內提高到80%。我們也引進了獎勵制度,2019 年無現金付款的採用率增加。由於消費者在交易過程中避免接觸,疫情也促進了非現金支付的發展。

- 同樣,2022年1月,萬事達卡宣布與和歌山縣建立戰略夥伴關係,利用其全球標準付款網路促進旅遊業的發展,並加速該縣中小企業的無現金交易基礎設施和數位轉型。

- 此次合作將推動推出整合式IC卡和智慧型手機非接觸式付款的全球標準無現金付款系統。此外,兩家公司也將利用虛擬卡等技術為該地區的企業提供高效率的付款流程。

日本POS終端市場趨勢

行動 POS付款預計將實現市場大幅成長

- 零售、旅遊、電子商務等行業對具有發票管理、庫存管理、影像掃描器等便利功能的行動POS終端的需求日益成長,預計將推動POS終端市場的發展。此外,隨著簽帳金融卡和信用卡技術的發展,無需輸入密碼即可快速完成交易的非接觸式付款變得越來越普遍,從而推動了日本POS終端市場的需求。

- Android智慧付款POS比傳統付款終端具有許多優勢,包括易於使用、靈活性和更短的交易時間。它還支援多種付款方式,包括2D碼、數位錢包、NFC 和可專門為商家設計和客製化的應用程式,使其成為各種規模企業的理想解決方案。因此,預計預測期內行動 POS付款將佔據更大的市場佔有率。

- 智慧型手機普及率的提高、中小型企業和微企業數量的巨大成長、以及由於各種政府和銀行卡受理計劃而導致的卡採用率的不斷成長,正在推動日本 POS 市場的發展。

- 日本內務部預計,到2022年,約有93.4%的20-29歲人群、94.3%的30-39歲人群和92.2%的40-49歲人群將使用智慧型手機上網。隨著智慧型手機的普及,日本的行動網路使用量大幅成長。智慧型手機已成為最受歡迎的網路連線裝置。行動網際網路連接也用於付款(NFC 技術),推動了日本 POS 終端市場的發展。

- 個人和企業擴大採用數位付款方式可能會支持市場成長。此外,近年來,日本政府一直致力於建立無現金社會,以提高金融交易的便利性和效率,並降低處理現金相關的成本。

- 該地區的供應商正在透過推出新的解決方案來擴大其產品供應,從而推動市場成長。例如,2023 年 2 月,Ingenico 宣佈在日本推出 Android 智慧 POS 和付款創新。 Android AXIUM DX8000 提供一流的店內數位體驗,同時最佳化安全性、生產力和效能。 DX8000 支援多種付款方式,包括 EMV 晶片和 PIN、磁條、非接觸式、2D碼掃描器和數位錢包。

零售業可望強勁成長

- 各個地區的零售店數量不斷增加,他們透過大幅折扣和其他服務吸引顧客,但客戶維繫是市場維持的重大挑戰。這種競爭推動了創新經營模式的需要,以避免陷入價格戰,並平衡新技術的投資和收益。

- POS 終端機提供的銷售報告、庫存和財務管理以及客戶分析功能可以幫助零售商克服客戶維繫問題。因此,客戶維繫的需求和日益激烈的行業競爭正在推動 POS 終端的成長。

- 市場上已經出現了本地零售商和供應商之間的多種夥伴關係,以實現更有效的銷售並改善數位轉型和結帳體驗,從而創造了對 POS 系統的需求。例如,2022 年 8 月,ACI Worldwide 宣布與 CARDNET 建立策略合作夥伴關係,以實現日本數位付款的現代化。新的基礎設施將使公司能夠滿足日益成長的需求,並為客戶提供覆蓋國內和國際市場的更複雜的數位付款解決方案和服務。

- 該國的供應商為基於餐廳的 POS 系統提供了有效的解決方案。例如,2023 年 6 月, Oracle宣布推出 Oracle MICROS Workstation 8 系列。 Workstation 8系列提供多種設定選項。其中包括一個用於低調設置的支架,有助於消除客人和員工之間的障礙,以及一個帶有加重底座的垂直支架,用於流線型檯面設計,隱藏電纜,達到整潔的美感。餐廳可以單獨部署工作站,也可以利用周邊設備擴展模組 (PEM),它提供現金抽屜、秤和掃描器等選項。這將推動餐飲業 POS 終端的成長。

日本POS終端產業概況

日本的 POS 終端市場競爭適中,有相當數量的區域參與者。公司正在利用策略合作舉措和收購來增加市場佔有率和盈利。

2023 年 8 月,NCR 公司宣布與領先的企業技術供應商 Autobooks 建立策略合作夥伴關係,將複雜的數位發票、支付接受度和會計功能整合到 NCR 數位銀行中。該合作夥伴關係將使金融機構能夠向中小型企業提供專門的現金管理解決方案和全面的整合付款套件。

2023 年 3 月,Ingenico 宣布收購領先的純軟體銷售點解決方案 (SoftPoS) 供應商 Phos,擴大其透過智慧型手機接受商家支付的服務。 SoftPoS 將平板電腦和智慧型手機變成付款終端,同時遵守最高的付款安全標準。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 日本POS終端市場規模估算

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 行動 POS付款預計將實現顯著的市場成長

- 預計 POS 投資增加和付款產業數位化將推動市場成長

- 由於信用卡和簽帳金融卡用戶的增加,市場預計將大幅成長。

- 市場挑戰

- 由於使用重要資訊而產生的安全問題

- 市場機會

- 對無現金經濟的期望

- POS終端主要法規及申訴標準

- 關於非接觸式付款日益普及及其對產業影響的說明

- 重點案例分析

第6章 市場細分

- 按類型

- 固定POS系統

- 行動/可攜式POS 系統

- 按最終用戶產業

- 零售

- 飯店業

- 衛生保健

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- NEC Corporation

- NCR Corporation

- Pax Japan

- Sharp Electronics

- Uniwell Corporation

- Fujitsu Japan Limited

- Casio Computer Co. Ltd.

- Samsung Electronics Co. Ltd.

- Ingenico Japan Co. Ltd.

- Vesca Co., Ltd.

- Micros POS Systems(Oracle)

- 主要企業市場佔有率

第8章投資分析

第9章:未來市場展望

The Japan POS Terminals Market size is estimated at 149.32 thousand units in 2025, and is expected to reach 233.03 thousand units by 2030, at a CAGR of 9.31% during the forecast period (2025-2030).

The POS terminal market has grown significantly over the past few years, owing to its ability to offer an increased return on investment and ease of access. POS systems that facilitate transactions from the central component of businesses across industries, like retail, hospitality, transportation, and banking, have gained importance in companies of small and big sizes over the years.

Key Highlights

- POS terminal systems have grown from transaction-oriented devices to systems that support and integrate into firms' CRM and other financial solutions in the present market scenario. Companies could use collected transactional data from POS terminals to provide business insight in this case.

- Vendors have supported consistent development in mobile payments, particularly smartphone-enabled QR-code payments. Similarly, progress has been made in other sectors of the ecosystem. Cashless projects are making tremendous progress, with the establishment of a government-funded biometrics infrastructure and a rise in the use of EMV-based contactless payments (or NFC Pay as it is known in Japan). Such trends are expected to act as major catalysts for the increase in the adoption of POS terminals in the country.

- Modern POS terminals reduce the cost of setup, deployment, maintenance, and power consumption over time, leading to the total cost of ownership. Various vendors offer modular POS terminals with attributes such as touchscreen displays and low power consumption, which helps in reducing the overall cost of ownership. Companies such as Sharp Electronics, NEC Corporation, and others offer fixed POS solutions with touchscreen displays and robust processors that help improve operations and reduce failures. In addition, the POS offered by Aures comes with fanless temperature control to reduce the number of moving parts in a terminal.

- The expanding digitization of the economy and the increasing application of POS platforms across sectors will drive the POS Terminals market forward. Growing awareness of the effectiveness of POS displays, an increase in retail chains, and the increasing usage of near-field communication-enabled systems are all likely to help the market's growth.

- The utilization of digital and electronic payment techniques, like debit and credit cards, e-wallets, and smart cards, such as Pasmo and Suica, is extensively growing among younger buyers and in major urban areas. They provide a convenient and effective method for consumers to conduct transactions without requiring physical currency or a credit card. Additionally, they are extremely safe and enable users to monitor their expenditures. Japan's transportation enterprises created Suica and Pasmo smart cards, which can be utilized for transportation, automated vending machines, and in-store acquisitions.

- Moreover, the government of Japan has been taking proactive initiative and striving to establish a supportive atmosphere for the growth of cashless payments in Japan by implementing a "Cashless Vision" with the aim of raising cashless transactions to 40% by 2025 and 80% by the long run. They have also introduced a reward system, which increased cashless payments adoption in 2019. The pandemic also boosted non-cash payments as consumers avoid contact during transactions.

- Similarly, in January 2022, Mastercard announced a strategic partnership with Wakayama Prefecture to leverage its global standard payment network to boost the development of the tourism sector and accelerate the cashless transaction infrastructure and digital transformation for small and medium businesses in the prefecture.

- This partnership will encourage the adoption of global standard cashless payment systems, which involve the integration of contactless payments using IC cards and smartphones. Moreover, both parties will promote effective payment procedures at businesses in the region through the utilization of technologies like virtual cards.

Japan POS Terminals Market Trends

Mobile POS Payments is Expected to Witness Significant Growth in the Market

- The growing need for mobile POS terminals with convenience features like invoice management, inventory management, and image scanners across industry verticals, including retail, tourism, and e-commerce, will push the POS terminal market forward. Furthermore, as debit and credit card technology evolved, contactless payments became popular for completing a rapid transaction without inputting a PIN, driving up demand for the POS terminal market in Japan.

- Android Smart POS offers various advantages over traditional payment terminals, such as user-friendliness, greater flexibility, and faster transaction times. It can also provide access to accept a diverse range of payments such as QR codes, digital wallets, NFC, and apps that can be designed and customized specifically for the merchant, making them the ideal solution for all sizes of businesses. As a result, mobile POS payments are projected to further acquire a portion of the market in the forecasted time period.

- Growth in smartphone penetration, a large base of SMEs and micro-merchants, and an expansion of card user base due to different government and bank card acceptance programs are boosting the Japan POS market.

- According to Japan's Ministry of Internal Affairs and Communications, in 2022, approximately 93.4% of people aged 20 to 29 years old, 94.3% (30 to 39 years old), and 92.2% (40 to 49 years old) used smartphones to access the internet. Because of the adoption of smartphones, mobile internet usage has grown significantly in Japan. Smartphones have become the most popular internet access device. Mobile internet connections are also used for payment(NFC technology), propelling the POS terminal market in Japan forward.

- The increasing number of individuals and businesses embracing digital payment options will support market growth. Furthermore, in recent years, the government of Japan has also taken initiatives to push toward a cashless society to improve the convenience and efficiency of financial transactions and reduce the costs linked with handling cash.

- The vendors in this region are expanding their product line by launching new solutions and promoting market growth. For instance, in February 2023, Ingenico announced the introduction of Android Smart POS and payment innovation in Japan. Android AXIUM DX8000 offers a best-in-class digital experience in-store while optimizing security, productivity, and performance. The DX8000 is equipped with EMV Chip & PIN, magstripe, contactless, QR-code scanner, and digital wallets to accept various payment methods.

The Retail Segment is Expected to Grow Significantly

- The increasing number of retail stores across regions attract customers due to large discounts and other services; however, customer retention becomes the major challenge for them to sustain in the market. This competition increases the need to reinvent their business models to keep away from the competition concerning price and find the balance between investing in new technologies and revenue.

- The sales reporting, inventory and financial management, and customer analytics features that POS terminals provide assist retailers in overcoming the issues related to customer retention. Hence, the need for customer retention and competition growth in the industry promotes the growth of POS terminals.

- The market is witnessing several partnerships between retail stores and vendors in the region to deliver more effective sales and improve digital transformation and the checkout experience, which creates the demand for POS systems. For instance, in August 2022, ACI Worldwide announced a strategic partnership with CARDNET to modernize digital payments in Japan. The new infrastructure will allow the company to fulfill increasing demand and provide its customers with more sophisticated digital payment solutions and services covering both Japan's domestic and international markets.

- The vendors in this country are providing effective solutions for Restaurant-based POS systems. For instance, in June 2023, Oracle announced the launch of the Oracle MICROS Workstation 8 series. The Workstation 8 Series features multiple configuration options. This includes a mount for a low-profile setup that helps remove any barriers between guests and staff or a vertical stand with a weighted base for a streamlined countertop design that conceals cabling for a clean aesthetic. Restaurants can implement a workstation on its own or leverage the Peripheral Expansion Module (PEM), which provides options for a cash drawer, scale, or scanner. This promotes the growth of the POS terminals in the Restaurant division.

Japan POS Terminals Industry Overview

The Japan POS Terminal Market is moderately competitive, with a considerable number of regional players. The companies are leveraging strategic collaborative initiatives and acquisitions to increase market share and profitability.

In August 2023, NCR Corporation announced a strategic partnership with Autobooks, a leading enterprise technology provider, to integrate sophisticated digital invoicing, payment acceptance, and accounting features into NCR Digital Banking. The partnership will allow financial institutions to provide cash management solutions and a comprehensive, integrated payment suite built specifically for small businesses.

In March 2023, Ingenico announced the acquisition of Phos, a leading provider of software-only Point of Sale Solutions (SoftPoS), to extend its offer for merchant payment acceptance via smartphone. SoftPoS will allow tablets or smartphones to become payment terminals while adhering to the highest payment security standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates of Japan POS Terminals Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Mobile POS Payments is Expected to Witness Significant Growth in the Market

- 5.1.2 Growing Investments in POS and Digitalization in the Payment Industry are Expected to Boost the Market Growth

- 5.1.3 Increase in Credit & Debit Card Users Expects Significant Growth in the Market

- 5.2 Market Challenges

- 5.2.1 Security Concerns Owing to the Use of Critical Information

- 5.3 Market Opportunities

- 5.3.1 Anticipating a Cashless Economy

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the rising use of contactless payment and its impact on the industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By End-User Industry

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NEC Corporation

- 7.1.2 NCR Corporation

- 7.1.3 Pax Japan

- 7.1.4 Sharp Electronics

- 7.1.5 Uniwell Corporation

- 7.1.6 Fujitsu Japan Limited

- 7.1.7 Casio Computer Co. Ltd.

- 7.1.8 Samsung Electronics Co. Ltd.

- 7.1.9 Ingenico Japan Co. Ltd.

- 7.1.10 Vesca Co., Ltd.

- 7.1.11 Micros POS Systems (Oracle)

- 7.2 Market Share of Key Players