|

市場調查報告書

商品編碼

1644908

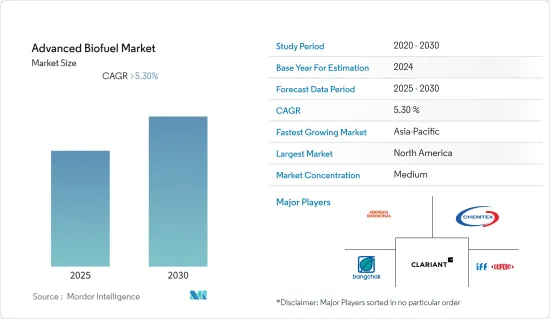

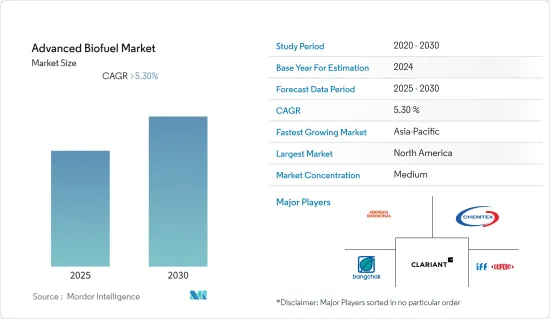

先進生質燃料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Advanced Biofuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,先進生質燃料市場預計將以超過 5.3% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長遠來看,對安全、永續、清潔能源的需求,加上政府要求增加將先進生物燃料混合到機動車輛燃料的要求,預計將推動全球對先進生質燃料的需求。

- 另一方面,對先進生質燃料益處的缺乏認知限制了市場的發展。因此,只有少數國家引入生質燃料。

- 目前,人們正在研究開發可用於生產生質燃料的新原料,以及更安全、對環境影響較小的製造程序,這可能會在未來帶來許多商機。

- 預測期內,北美可能見證先進生質燃料市場的顯著成長。

先進生質燃料市場的趨勢

生物柴油燃料大幅成長

- 生質柴油是從植物油等可再生生物來源中提取的長鏈脂肪酸單烷基酯的混合物。近年來,它已成為交通運輸領域的替代燃料。

- 生產生質柴油的傳統方法是均質相觸媒催化酯交換法。然而,下游精製製程生產成本的上升,正在推動更具成本效益和環保技術的開發。這種先進的生產技術包括非均質相觸媒、酶促和超臨界條件下非催化生產生質柴油的技術。

- 在過去的二十年裡,全球液體生質燃料的生產和消費呈指數級成長。生質燃料消費的增加是由允許甚至在許多情況下提倡使用生物燃料的公共所推動的。主要國家最廣泛使用的工具之一是強制使用生質燃料。

- 印尼、美國和巴西是世界上最大的生物柴油生產國之一,2021年產量分別達到約95億公升、69億公升和62億公升。全球生質柴油產量達 734,000 桶/天,比 2020 年(712,000 桶/天)增加約 3%。

- 2022年3月,Repsol開始在西班牙建造生質燃料工廠。該公司計劃對該計劃投資約2.1033億美元。該設施建成後,每年將能夠生產 25 萬噸先進生質燃料,包括生物柴油、生物噴射燃料、生物石腦油和生物丙烷。新設施計劃於 2023 年投入運作。該計劃將利用循環經濟,加速能源轉型,實現 Repsol 到 2050 年成為淨零排放公司的目標。

- 因此,由於上述因素,預測期內生質柴油燃料類型可能會在全球已開發生生質燃料市場中見證顯著成長。

北美預計將大幅成長

- 北美地區是最大的航空市場之一,擁有主要基於石化燃料的地理交通基礎設施。北美在減少排放、抑制溫室效應方面處於領先地位。

- 在北美,美國是最大的先進生質燃料生產國,在研發方面投入了大量資金,並擁有大量生質燃料專利。根據《BP世界能源統計評論2022》,2021年,美國日生產643,000桶油當量的生質燃料。

- 強而有力的指令正在推動該國先進的生質燃料市場的發展。有一些政策,例如加州的低碳燃料標準,旨在降低燃料的生命週期碳強度。這些措施將刺激對生質燃料的需求並促進生質燃料的推廣。

- 美國新可再生燃料標準(RFS)作為修正能源法案的一部分最近簽署成為法律,為該國的生質燃料產業設定了高標準。該方案設定了每年生產 360 億加侖生質燃料的目標,重點是乙醇和生物柴油,其中 210 億加侖來自“先進生質燃料”,可使用多種原料和技術生產。

- RFS 也設定了生產約 160 億加侖「纖維素生質燃料」的目標,植物來源。纖維素乙醇的潛力仍然巨大,美國能源部發現光在美國就有 13 億噸可收穫的纖維素生質能。這可以滿足該國三分之一以上的運輸燃料需求。對於纖維素乙醇和 HVO 等先進生質燃料而言,北美佔有最大佔有率,佔全球產量的 94%。

- 由於上述因素,預測期內北美預計將見證全球先進生質燃料市場的顯著成長。

先進生質燃料產業概況

從本質上來說,先進生質燃料市場是適度細分的。市場的主要企業(不分先後順序)包括 Abengoa Bioenergy、杜邦工業生物科學、Chemtex Group、Bankchak Petroleum 和 Clariant Produkte GmbH。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2027年先進生質燃料市場規模及預測(單位:千桶原油當量/天)

- 截至 2021 年的主要現有和即將實施的先進生質燃料計劃

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 市場促進因素

- 市場限制

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 按原料

- 痲瘋樹

- 木質纖維素

- 藻類

- 其他成分

- 依生質燃料類型

- 纖維素生物生質燃料

- 生質柴油

- 沼氣

- 生物丁醇

- 其他生質燃料

- 依技術分類

- 生化

- 熱化學

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Abengoa Bioenergy

- Chemtex Group

- Bankchak Petroleum

- Clariant Produkte GmbH

- DuPont Industrial Biosciences

- Fujian Zhongde Energy Co. Ltd

- INEOS Bio

- KiOR Inc.

- Sundrop Fuels Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 92814

The Advanced Biofuel Market is expected to register a CAGR of greater than 5.3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. The market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the demand for secure, sustainable, and clean energy coupled with government mandates for increasing blending in automotive fuels is expected to propel the demand for advanced biofuels globally.

- On the flip side, the lack of awareness regarding the advantages of advanced biofuels is restraining the market. Due to this, the adoption of biofuels is limited to some countries only.

- Nevertheless, research is underway to develop additional feedstocks that could be used to make biofuels, along with production processes that are safe for the environment and take less toll on it, which is likely to present many opportunities in the future.

- North America is likely to witness significant growth in the advanced biofuels market during the forecast period.

Advanced Biofuel Market Trends

Biodiesel Fuel Type to Witness Significant Growth

- Biodiesel is a mixture of monoalkyl esters of long-chain fatty acids derived from renewable biological sources such as vegetable oils. It emerged as an alternative fuel for the transportation sector in recent years.

- The conventional method of producing biodiesel is through homogeneous catalytic transesterification. However, increased production costs associated with downstream purification steps have led to the development of more cost-effective and environment-friendly technologies. These advanced production technologies involve heterogeneous or enzymatic catalysts to produce biodiesel, as well as no catalysts in supercritical conditions.

- In the last two decades, the production and consumption of liquid biofuels increased exponentially worldwide. The rising consumption of biofuels is driven by public policies that authorize and, in many cases, advocate for their use. One of the most used instruments by major countries is biofuel use mandates.

- Indonesia, the United States, and Brazil are among the largest biodiesel producers in the world, totaling some 9.5, 6.9, and 6.2 billion liters, respectively, in 2021. Global biodiesel production reached 734 thousand barrels of oil equivalent per day, i.e., an increase of about 3% when compared to 2020 (712 thousand barrels of oil equivalent per day).

- In March 2022, Repsol started its construction of a biofuel plant in Spain. The company is planning to invest an amount of nearly USD 210.33 million in the project. After completion, the plant can produce 250,000 tons of advanced biofuels per year, such as biodiesel, bio-jet, bio naphtha, and bio-propane. The new facility is expected to be operational in 2023. The project uses the circular economy, accelerating the energy transition and achieving Repsol's goal of becoming a net-zero emissions company by 2050.

- Therefore, based on the above-mentioned factors, biodiesel fuel type is likely to witness significant growth in the global advanced biofuel market during the forecast period.

North America Expected to Witness Significant Growth

- The North American region houses one of the biggest aviation markets and a well-established terrain transportation infrastructure primarily on fossil fuels. North America has been at the forefront of lowering emissions to limit the greenhouse effect.

- In North America, the United States is the largest producer of advanced biofuels, with significant investments in R&D with a substantial number of patents for biofuels to their credit. In 2021, according to the BP Statistical Review of World Energy 2022, the United States produced 643 thousand barrels of oil equivalent of biofuel per day, i.e., an increase of about 7.1% when compared to the previous year's value (602 thousand barrels of oil equivalent per day).

- Strong mandates drive the advanced biofuel market in the country. There are policies that specify reductions in fuel life-cycle carbon intensity, such as California's low carbon fuel standard. These policies may boost the demand for biofuel and support the deployment of novel and advanced biofuels.

- The new US Renewable Fuels Standard (RFS), signed recently as part of the revised Energy Bill, set high goals for the country's biofuel industry. It set a production target of 36 billion gallons of biofuels annually, mainly ethanol and biodiesel, with 21 billion gallons coming from "advanced biofuels," which can be produced using multiple feedstocks and technologies.

- The RFS also set a production target of roughly 16 billion gallons of "cellulosic biofuels," derived from plant sources such as trees and grasses. The potential of cellulosic ethanol remains enormous, with the Department of Energy having identified 1.3 billion tons of harvestable cellulosic biomass in the United States alone. This can meet more than one-third of the domestic demand for transportation fuel. For advanced biofuels, such as cellulosic ethanol and HVO, North America accounts for the largest share, i.e., 94% of global production.

- Based on the above factors, North America is expected to witness significant growth in the global advanced biofuel market during the forecast period.

Advanced Biofuel Industry Overview

The advanced biofuel market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Abengoa Bioenergy, DuPont Industrial Biosciences, Chemtex Group, Bankchak Petroleum, and Clariant Produkte GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Advanced Biofuel Market Size and Forecast, In Thousand Barrels of Oil Equivalent Per Day, Till 2027

- 4.3 Key Existing and Upcoming Advanced Biofuel Projects, as of 2021

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.2 Market Restraints

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Raw Material

- 5.1.1 Jatropha

- 5.1.2 Lignocellulose

- 5.1.3 Algae

- 5.1.4 Other Raw Materials

- 5.2 By Biofuel Type

- 5.2.1 Cellulosic Biofuel

- 5.2.2 Biodiesel

- 5.2.3 Biogas

- 5.2.4 Biobutanol

- 5.2.5 Other Biofuel Types

- 5.3 By Technology

- 5.3.1 Biochemical

- 5.3.2 Thermochemical

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abengoa Bioenergy

- 6.3.2 Chemtex Group

- 6.3.3 Bankchak Petroleum

- 6.3.4 Clariant Produkte GmbH

- 6.3.5 DuPont Industrial Biosciences

- 6.3.6 Fujian Zhongde Energy Co. Ltd

- 6.3.7 INEOS Bio

- 6.3.8 KiOR Inc.

- 6.3.9 Sundrop Fuels Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219