|

市場調查報告書

商品編碼

1644926

歐洲浮體式海上風電 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Floating Offshore Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

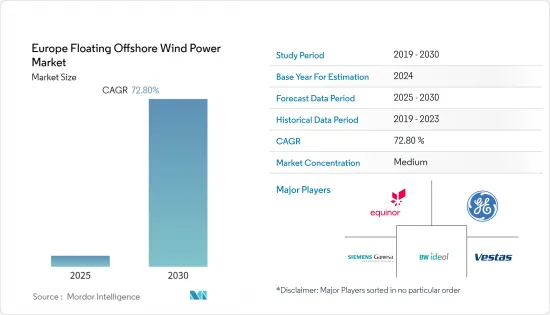

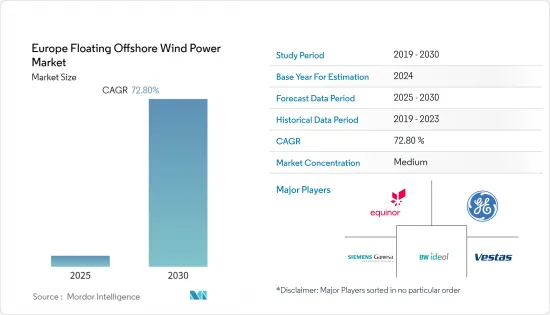

預計預測期內歐洲浮體式海上風電市場複合年成長率將達到 72.8%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

從長遠來看,離岸風力發電需求的增加預計將刺激歐洲浮體式海上風電市場的成長。此外,離岸風力發電計劃的深水域被認為是利用深水域豐富風能潛力的突破性技術,預計將推動市場成長。

同時,人們擴大採用替代清潔發電能源,主要是天然氣和太陽能。由於太陽能和燃氣發電是更清潔的能源生產方式,它們的普及預計會削弱對風電的需求。

新興市場和尚未開發市場對離岸風力發電的興趣日益濃厚,預計將在預測期內為歐洲浮體式海上風電市場帶來有利的成長機會。

預計英國將主導市場。預計在預測期內,其複合年成長率也將達到最高。這一成長歸因於投資的增加以及政府政策的實施。

歐洲浮體式海上風力發電市場趨勢

浮體式海上風電的政府政策與私人投資

浮體式海上風電被視為挪威石油和天然氣產業轉型為可再生能源的關鍵新興產業。 2020年12月,挪威石油和能源部長宣布將在挪威建立一個新的風電研究中心。諾斯風研究中心將專注於技術創新,離岸風力發電研究是其主要重點之一。

然而,由於擔心對景觀和生態系統的影響,挪威面臨當地對陸上風電發電工程的反對。因此,2022年5月,挪威宣布計畫在2040年大幅擴大離岸風力發電,旨在將這個依靠石油和天然氣累積財富的國家變成再生能源的出口國。該國政府因繼續支持石油和天然氣產業而受到環保人士的批評,並設定了到 2040 年開發 30 吉瓦(GW)離岸風力發電容量的目標。

目前已有多家公司報名加入挪威的行動,希望擴大其離岸風力發電項目,並利用其在石油和天然氣探勘行業的經驗展示新技術。

例如,殼牌和英國石油公司以及埃尼、Equinor和Orsted等公司都對挪威設施感興趣。 Vattenfall和挪威的Seagust公司也宣布,雙方已成立合資企業參與競標。 EDF Renewables表示,它將與挪威獨立電力生產商Deep Wind Offshore合作,並於2021年12月加入該進程。

法國浮體式海上風電市場是世界上最大的市場之一。該國還表示有興趣在 2050 年安裝 50 個離岸風力發電,總合40 吉瓦,這將減緩陸上風電的發展。作為增加離岸風力發電的一部分,法國政府於 2022 年 3 月啟動了競爭性競標程序,以開發地中海兩個 250 兆瓦的浮體式海上風電場。第一個風電場將建在納博訥海岸,距離海岸 22 多公里,第二個風電場將建在濱海福斯海岸 22 公里處。

根據愛爾蘭風能協會 (WEI) 在 2021 年第一季進行的最新開發商調查,凱爾特海擁有約 3GW 的浮體式海上風電發電工程處於開發初期。大西洋地區也提案另外 5GW浮體式海上風電發電工程。例如,2022 年 6 月,基利貝格斯漁民組織和辛巴達海洋服務公司提案在愛爾蘭多尼戈爾海岸建造一個浮體式海上風電場。他們與瑞典浮動式風力發電開發技術供應商Hexicon簽署了合作備忘錄。

截至 2021 年,歐洲已安裝新的風電容量 17.4 GW,其中陸上 14 GW,海上 3.4 GW。 2021年將成為風電裝置容量創紀錄的一年(超過2017年的17.1吉瓦),歐盟27國每年需要安裝32吉瓦的風電容量才能達到40%的可再生目標。

由於該地區擁有離岸風電資源並獲得政府支持,預計歐洲將在預測期內成為浮體式海上風電最大的市場之一。

英國主導市場成長

英國是全球最大的離岸風力發電市場之一,截至 2021 年,其在 38 個地點的累積設置容量超過 10GW。另有5GW正在前期建設中,另有11GW正在規劃中。

根據WindEurope預測,2021年英國海上裝置容量將達260萬千瓦,佔歐洲海上裝置容量的88%。海上設施建設主要受 Moray 酵母和 Triton Knoll 風電場的建成推動。英國陸上風電裝置容量略有增加,但仍處於2005年以來的第二低水準。

美國綠色工業革命十點計畫中提出,2030年安裝40吉瓦的離岸風力發電,這個目標推動了美國產業的成長。其中包括採用浮體式技術的1GW。 2022 年 4 月發布的英國能源安全戰略 (BESS) 進一步增強了這一目標,該戰略旨在到 2030 年實現離岸風力發電達到 50GW,其中浮體式海上風電將貢獻 5GW。

作為其淨零計畫的一部分,蘇格蘭政府設定了到 2030 年提供高達 11 吉瓦的離岸風力發電容量的目標,以支持蘇格蘭到 2045 年實現淨零排放的承諾。蘇格蘭是世界上第一個商業浮體式海上風電發電工程的所在地,即 Equinor/Masdar 的 Hywind Scotland 風電場,該項目於 2017 年開始營運,使用五台 SGRE 6 MW 渦輪機。

2022 年 8 月,Cerulean Winds 與英國Ping Petroleum 簽署了一項協議,將建造一個主要由離岸風電動力來源的海上油氣設施。根據契約,Cerulean Winds 將與層級工業合作夥伴聯盟一起提供大型浮體式海上風力發電機,並透過電纜連接到 Ping Petroleum 的浮體式生產和儲存船。該計劃預計於 2025 年投入運作。此計劃得益於 Cerulean Winds 透過浮體式海上風電示範計畫獲得的津貼。

因此,在英國政府的幫助下及其雄心勃勃的離岸風力發電計畫下,英國有望成為全球浮體式海上風電市場的主導國家。

歐洲浮體式海上風電產業概況

歐洲浮體式海上風電市場適度細分。市場的主要企業(不分先後順序)是 Equinor ASA、通用電氣公司、西門子歌美颯可再生能源、BW Ideol SA 和 Vestas Wind Systems AS。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027年浮體式海上風電潛在裝置容量設置容量預測(單位:MW)

- 2021年離岸風力發電產能預測(單位:MW)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 依深度(僅定性分析)

- 淺水(深度30公尺或以下)

- 過渡深度(30-60公尺)

- 深海(深度60公尺以上)

- 地區

- 英國

- 挪威

- 法國

- 丹麥

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Equinor ASA

- General Electric Company

- Siemens Gamesa Renewable Energy

- BW Ideol SA

- Vestas Wind Systems AS

- Renexia

- Saitec Offshore Technologies

- Orsted A/S

- Repsol SA

- Falck Renewables SpA

第7章 市場機會與未來趨勢

The Europe Floating Offshore Wind Power Market is expected to register a CAGR of 72.8% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Over the long term, the growing demand for offshore wind power is expected to stimulate the market growth of the Europe floating offshore wind power market. Furthermore, increasing the water depth of offshore wind power projects is considered a game-changing technology to exploit abundant wind potential in deeper waters and is also expected to drive the growth of the market studied.

On the other hand, the adoption of alternate sources of clean power generation, mainly gas and solar power, is increasing. As power generation from solar and gas resources are cleaner modes of energy production, the growing adoption of the same is expected to hamper the demand for wind power.

Nevertheless, the growing interest in offshore wind energy from developing and untapped markets is expected to create lucrative growth opportunities for the European floating offshore wind power market in the forecast period.

The United Kingdom is expected to dominate the market. It is also expected to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments coupled with the adoption of government policies.

Europe Floating Offshore Wind Power Market Trends

Government Policies and Private Investments in Floating Offshore Wind Power

Offshore wind is seen as a key new industry offering a potential transition for Norway's dominant oil and gas sector to a renewable energy future. In December 2020, the Norwegian Minister of Petroleum and Energy announced a new wind power research center in Norway. The NorthWind research center will focus on innovations, and one of its main priorities will be offshore wind power research.

However, Norway has faced local opposition to onshore wind power projects based on the perceived impact on landscapes and ecology. Accordingly, in May 2022, Norway unveiled plans for a major expansion in offshore wind energy by 2040, aiming to turn a country that has built its wealth on oil and gas into an exporter of renewable electricity. The government, which has come under fire from environmentalists for continuing to support the oil and gas industry, set a target to develop 30 gigawatts (GW) of offshore wind capacity by 2040.

Several companies are already lining up to participate in Norway's effort, looking to expand their own offshore wind ambitions and showcase new technology that draws on the experience with the oil and gas exploration industry.

For instance, Shell and BP are among the companies with an interest in Norwegian installations, along with Eni, Equinor, and Orsted. Vattenfall and Norway's Seagust also announced that they had formed a joint venture to bid in the auction. EDF Renewables declared that it had partnered with Deep Wind Offshore, a Norwegian independent power producer, to participate in the process in December 2021.

The floating offshore wind power market in France is one of the largest in the world. The country also showcased its interest to install 50 offshore wind farms by 2050, with a total capacity of 40 GW, and to slow down the development of onshore wind power. As part of the process of increasing the offshore wind capacity, the government of France launched the competitive tendering procedure for the development of two 250 MW floating offshore wind farms in the Mediterranean Seain in March 2022. The first wind farm will be located off Narbonne, more than 22 km from the coast, while the second wind farm is located 22 km off Fos-sur-Mer, subject to the results of ongoing environmental studies.

According to Wind Energy Ireland's (WEI) most recent developer survey carried out in Q1 2021, there are approximately 3 GW of floating offshore wind energy projects in the early stages of development in the Celtic Sea. An additional 5 GW of floating offshore wind energy projects are proposed for the Atlantic. For instance, in June 2022, the Killybegs Fishermen's Organization and Sinbad Marine Services proposed a floating wind farm to be built offshore Donegal, Ireland. They signed a Memorandum of Understanding with Swedish floating wind developer and technology provider, Hexicon.

As of 2021, there were 17.4 GW of new wind installations in Europe, with 14 GW onshore and 3.4 GW offshore. As 2021 marks a record year for wind installations (surpassing 2017's 17.1 GW figure), the EU-27 will need to install 32 GW of wind capacity each year in order to achieve the 40% renewable energy target.

With great access to offshore wind resources in the region and support from the various country governments, Europe is anticipated to be one of the biggest markets for floating offshore wind energy during the forecast period.

United Kingdom to Dominate the Market Growth

The United Kingdom is one of the world's largest markets for offshore wind power, with more than 10 GW of cumulative installed capacity across 38 sites as of 2021. There is a further 5 GW in pre-construction, and there are plans for a further 11 GW.

According to WindEurope, in 2021, the United Kingdom had 2.6 GW of offshore installations, accounting for 88% of Europe's offshore installations. The completion of the Moray East and Triton Knoll wind farms primarily drove offshore installations. Despite a slight increase in onshore installations in the United Kingdom, they remain the second lowest since 2005.

The growth of the sector was encouraged by the United Kingdom's target of 40 GW of offshore wind energy by 2030, as stated in the Ten Point Plan for a Green Industrial Revolution. This includes 1 GW generated by floating technologies. This ambition was increased through the British Energy Security Strategy (BESS), published in April 2022, which aims to achieve up to 50 GW of offshore wind by 2030, of which floating offshore wind would contribute 5 GW.

As part of the plan to net zero, the Scottish government has set a target to deliver up to 11 GW of offshore wind capacity by 2030 to support Scotland's commitment to net zero emissions by 2045. Scotland is home to the world's first commercial floating offshore wind project, Equinor/Masdar's Hywind Scotland wind farm, which used 5 SGRE 6 MW turbines, commissioned in 2017.

In August 2022, Cerulean Winds and Ping Petroleum UK signed an agreement on offshore oil and gas facilities powered mainly by offshore wind. Under the agreement, Cerulean Winds, with its consortium of Tier 1 industrial partners, will provide a large floating offshore wind turbine that will be connected via a cable to Ping Petroleum's Floating Production & Storage vessel. The project is expected to come online in 2025. The project was enabled by a grant to Cerulean Winds through the Floating Offshore Wind Demonstration Program.

Therefore, with the help of the UK government and its ambitious plans for the offshore wind segment, the United Kingdom is predicted to be a dominant country in the floating offshore wind power market worldwide.

Europe Floating Offshore Wind Power Industry Overview

The European floating offshore wind power market is moderately fragmented. Some of the major players in the market (in no particular order) are Equinor ASA, General Electric Company, Siemens Gamesa Renewable Energy, BW Ideol SA, and Vestas Wind Systems AS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Floating Offshore Wind Power Potential Installed Capacity Forecast in MW, until 2027

- 4.3 Offshore Wind Energy Installed Capacity in MW, until 2021

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Water Depth (Qualitative Analysis Only)

- 5.1.1 Shallow Water ( less than 30 m Depth)

- 5.1.2 Transitional Water (30 m to 60 m Depth)

- 5.1.3 Deep Water (higher than 60 m Depth)

- 5.2 Geography

- 5.2.1 United Kingdom

- 5.2.2 Norway

- 5.2.3 France

- 5.2.4 Denmark

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Equinor ASA

- 6.3.2 General Electric Company

- 6.3.3 Siemens Gamesa Renewable Energy

- 6.3.4 BW Ideol SA

- 6.3.5 Vestas Wind Systems AS

- 6.3.6 Renexia

- 6.3.7 Saitec Offshore Technologies

- 6.3.8 Orsted A/S

- 6.3.9 Repsol SA

- 6.3.10 Falck Renewables SpA