|

市場調查報告書

商品編碼

1644931

美國氫氣生產:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)United States Hydrogen Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

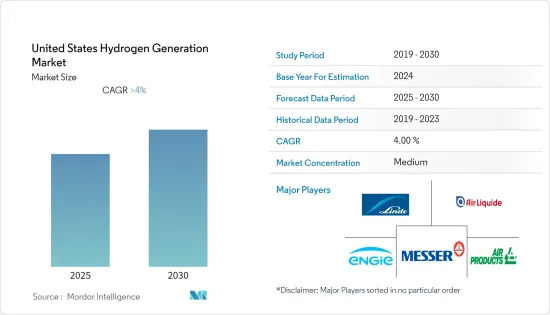

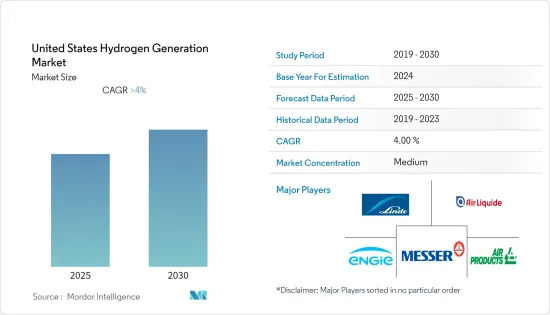

預計預測期內美國氫氣生產市場將以超過 4% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從中期來看,預計預測期內對氫氣生產工廠開發的投資增加將推動美國氫氣生產市場的發展。

- 同時,能源儲存的高資本成本預計將限制美國氫氣生產市場的發展。

- 從可再生資源中提取氫氣的技術進步以及氫氣作為燃料的使用增加可能會在預測期內為美國氫氣生產市場提供有利的成長機會。

美國氫氣生產市場趨勢

灰色氫氣主導市場

- 灰氫是最常見的氫氣生產形式,使用天然氣(透過甲烷重整)或煤(透過煤炭氣化)來生產氫氣。氫氣生產過程是碳密集的,生產過程中會向大氣中排放大量碳。

- 2021年,全球整體宣佈在2021年至2030年間開發522個氫能計劃,其中43個是千兆級綠色氫能計劃。北美約有67個活躍的氫計劃。北美國家正在投資尋找工業和交通運輸的替代性非碳密集型燃料,以加強區域價值鏈。預計這將為美國氫能發電市場創造重大機會。

- 根據全球碳捕集與封存研究院統計,全球每年約有1.2億噸氫氣產生,其中目前約98%的氫氣產量來自甲烷重整以及煤炭和類似石化燃料衍生材料(如石油焦和瀝青質)的氣化。

- 全球致力於減少排放,主要針對石化、鋼鐵和發電等重工業,從而最大限度地減少灰氫的生產和使用。因此,該領域的投資正在急劇下降,預計預測期內該領域的產能成長將保持很小。

- 然而,儘管藍氫和綠氫技術的成本下降,但預計在預測期內,灰氫生產仍將保持與這兩種類型氫的成本競爭力。受此影響,灰氫預計將佔據相當大的市場佔有率,儘管在預測期內市場佔有率預計會大幅下降。

- 因此,鑑於上述情況,預測期內,灰色氫氣部分可能會在美國氫氣生成市場中見證顯著成長。

蒸汽甲烷重整(SMR)實現大幅成長

- SMR(蒸汽甲烷重整)是天然氣生產產業中用於大規模生產氫氣的化學製程。在這個過程中,水和甲烷(通常是天然氣)會透過兩種化學反應轉化為純氫和二氧化碳。根據客戶的要求對氫氣進行進一步精製。 SMR 是生產氫氣最常見、最具成本效益的方法,可用於各種工業製程,包括發電和石油精製。

- 美國能源資訊署 (EIA) 報告稱,石油精製的淨氫氣投入量為 76,918,000 桶,比 2020 年增加 2.3%。氫氣也廣泛用於生產氨和甲醇,以及為化學和工業應用提供工業熱。

- SMR 工廠使用約 67% 的天然氣進行重整,33% 的天然氣用於提供熱量。一莫耳天然氣可提供四莫耳氫氣。

- 2022 年 4 月,伍德集團推出了新的蒸汽甲烷重整 (SMR) 技術,表示與傳統的氫氣生產工廠相比,該技術預計可將二氧化碳排放減少 95%。新技術旨在解決能源、熱力生產和工業程的低效率問題,這些問題佔全球整體溫室氣體排放的一半以上。

- 2022 年 6 月,能源部 (DOE) 根據《兩黨基礎設施法案》發布了一份意向通知 (NOI),為在全美各地開發區域清潔氫中心 (H2Hubs) 的計劃提供 80 億美元的資金。為了加速氫氣作為純能源載體的使用,H2Hubs 預計將創建一個氫氣生產商、消費者和本地連接基礎設施的網路。美國每年生產約1000萬噸氫氣。美國生產的氫氣大部分來自天然氣,透過蒸汽甲烷重整和電解技術。

- 因此,清潔技術的不斷進步和政府透過高效基礎設施生產氫氣的各種舉措,正在推動美國氫氣生成市場對蒸汽甲烷重整技術的需求。

美國氫氣生產產業概況

氫氣生產市場中等程度分散。市場上的主要企業(不分先後順序)包括林德公司、液化空氣集團公司、Engie SA、梅塞爾Group Limited和空氣產品及化學品公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 來源

- 藍氫

- 綠色氫氣

- 灰色氫氣

- 科技

- 蒸汽甲烷重整 (SMR)

- 煤炭氣化

- 其他

- 應用

- 精製

- 化學處理

- 鋼鐵生產

- 其他

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Linde Plc

- Air Liquide SA

- Messer Group GmbH

- ITM Power Plc

- Engie SA

- Cummins Inc.

- Air Products and Chemicals Inc.

- Fuel Cell Energy Inc.

- Taiyo Nippon Sanso Holding Corporation

- McPhy Energy SA

- Enapter Srl

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93200

The United States Hydrogen Generation Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investment in the development of hydrogen plants will likely drive the United States hydrogen generation market during the forecast period.

- On the other hand, high capital costs of hydrogen energy storage are expected to restrain the United States hydrogen generation market.

- Nevertheless, technological advancements in extracting hydrogen from renewable sources and increased applications of hydrogen as a fuel will likely create lucrative growth opportunities for the United States hydrogen generation market in the forecast period.

US Hydrogen Generation Market Trends

Grey to Dominate the Market

- Grey hydrogen is the most common form of hydrogen production, and it uses natural gas (via stream methane reformation) or coal (via coal gasification) to produce hydrogen. The process of hydrogen production is carbon-intensive, as significant carbon emissions are released into the atmosphere during these production processes.

- In 2021, Globally, 522 hydrogen projects were announced to be developed between 2021 and 2030, of which 43 are giga-scale green hydrogen projects. North American region has significant hydrogen activity with about 67 hydrogen projects. North American countries have been invested in finding non-carbon-intensive alternatives for industrial and transportation usage to strengthen the local value chain. This is expected to witness significant opportunities for the United States hydrogen generation market.

- According to Global CCS Institute, nearly 120 Mt of hydrogen is produced annually, of which approximately 98% of current hydrogen production is from the reformation of methane or the gasification of coal or similar materials of fossil-fuel origin (e.g., petcoke or asphaltene).

- Due to global efforts to reduce emissions, mainly from heavy industries such as petrochemicals, iron, steel, and power generation, are being made to minimize grey hydrogen production and usage. Due to this, investments in the segment are falling rapidly, and the segment is expected to witness minimal capacity growth during the forecast period.

- However, despite falling costs of blue and green hydrogen technologies, grey hydrogen production is expected to remain cost competitive with both types during the forecast period. Due to this, grey hydrogen is expected to hold a significant share of the market, though its market share is expected to fall significantly during the forecast period.

- Hence, owing to the above points, the grey hydrogen segment is likely to witness significant growth in the United States hydrogen generation market during the forecast period.

Steam Methane Reforming (SMR) to Witness Significant Growth

- SMR (Steam Methane Reforming) is a chemical process used to produce hydrogen on a large scale in the gas manufacturing industry. In this process, two chemical reactions convert water and methane (usually natural gas) into pure hydrogen and carbon dioxide. Further purification of the hydrogen gas is accomplished according to the customer's specifications. SMR is the most common and cost-effective way to produce hydrogen gas, which is used for a wide variety of industrial processes, such as the production of electricity and refining oil.

- The United States Energy Information Administration (EIA) reported the net hydrogen input in oil refining as 76,918 thousand barrels, recording a growth of 2.3% compared to 2020 levels. Hydrogen is also used extensively in generating ammonia and methanol and providing industrial heat for chemicals and industrial applications.

- SMR plants use approximately 67 percent of the total natural gas for reforming, while 33 percent provides heat. One mole of natural gas feed provides four moles of hydrogen.

- In April 2022, Wood plc announced its new steam methane reforming (SMR) technology, which is expected to achieve 95% CO2 emissions reduction compared to a traditional hydrogen production plant. This new technology is designed to counter inefficiencies in energy, heat production, and industrial processes, which collectively account for more than half of all global greenhouse gas emissions.

- In June 2022, The Department of Energy (DOE) released a Notice of Intent (NOI) to fund the USD 8 billion program for the development of regional clean hydrogen hubs (H2Hubs) across the country under the Bipartisan Infrastructure Law. To accelerate the use of hydrogen as a pure energy carrier, H2Hubs are expected to create networks of hydrogen producers, consumers, and local connectivity infrastructure. The United States produces approximately 10 million metric tons of hydrogen yearly, compared to about 90 million tons worldwide. Most hydrogen produced in the United States comes from natural gas through steam methane reforming and electrolysis technology.

- Hence, increasing advancements in cleaner technology and various government initiatives for producing hydrogen through efficient infrastructures are driving the demand for steam methane reforming technology in the United States hydrogen generation market.

US Hydrogen Generation Industry Overview

Hydrogen generation market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Linde plc, Air Liquide SA, Engie S.A., Messer Group GmbH, and Air Products and Chemicals Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Blue hydrogen

- 5.1.2 Green hydrogen

- 5.1.3 Grey Hydrogen

- 5.2 Technology

- 5.2.1 Steam Methane Reforming (SMR)

- 5.2.2 Coal Gasification

- 5.2.3 Others

- 5.3 Application

- 5.3.1 Oil Refining

- 5.3.2 Chemical Processing

- 5.3.3 Iron & Steel Production

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Linde Plc

- 6.3.2 Air Liquide SA

- 6.3.3 Messer Group GmbH

- 6.3.4 ITM Power Plc

- 6.3.5 Engie S.A.

- 6.3.6 Cummins Inc.

- 6.3.7 Air Products and Chemicals Inc.

- 6.3.8 Fuel Cell Energy Inc.

- 6.3.9 Taiyo Nippon Sanso Holding Corporation

- 6.3.10 McPhy Energy S.A.

- 6.3.11 Enapter S.r.l.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219