|

市場調查報告書

商品編碼

1644935

亞太地區不斷電系統(UPS)市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

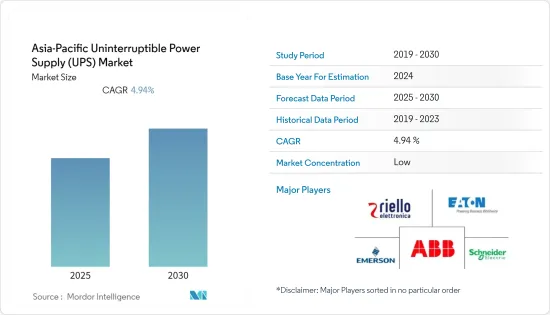

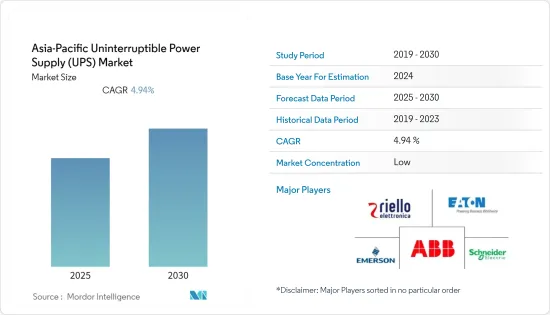

預計預測期內亞太地區不斷電系統市場複合年成長率將達到 4.94%。

市場在一定程度上受到了 COVID-19 疫情的影響,但已恢復並達到疫情前水準。

關鍵亮點

- 從長遠來看,預計預測期內資料中心投資的增加將推動市場發展。

- 然而,預計 UPS 系統的高資本和營運成本將在預測期內抑制市場成長。

- 人工智慧 (AI)、機器學習 (ML) 和物聯網等新技術的商業性整合將有助於提高 UPS 系統的效率和可靠性,預計這將成為預測期內市場的主要成長機會。

- 預計電力需求的快速成長、可再生能源發電的上升以及緊急備用系統需求的增加將使印度成為預測期內成長最快的區域市場。

亞太地區不斷電系統(UPS) 市場趨勢

資料中心需求不斷成長推動市場

- 資料中心是儲存大量敏感資料的設施。這些設施必須每天 24 小時運作,因此為了確保資料安全並減少停機時間,資料中心配備了不斷電系統。此外,資料中心連接到網際網路,借助不斷電系統,資料中心可以平穩運行,網際網路連接不會中斷。不斷電系統具有冗餘和雙匯流排功能,可確保低正常運作並保護整個設施中的敏感電子設備。此外,不斷電系統提供的電力不受停電、電壓降低、突波和雜訊干擾的影響。

- 資料中心對於任何組織都至關重要,旨在支援業務應用程式並提供資料儲存和管理等服務。不斷電系統(UPS)在資料中心提供備用電源以避免資料崩潰、資料遺失、硬體損壞等方面發揮至關重要的作用,因此資料中心預計將成為 UPS 系統應用最大的終端用戶領域之一。

- 亞太資料中心市場穩定成長,是全球成長最快的市場。全球都市化和不斷成長的網路存取正在推動用戶生成資料的激增,尤其是在亞太地區,從而刺激了對更多資料中心容量的需求。

- 根據Clouscene統計,亞太地區最大的資料中心市場是中國,目前共有442個資料中心投入運作。印度的成長尤其強勁,近年來網路普及率激增,導致產生的用戶資料量呈指數級成長。

- 由於這些因素,資料中心市場的快速成長預計將推動該領域對 UPS 系統的需求,並在預測期內推動市場發展。

印度是成長最快的市場

- 印度是全球成長最快的經濟體之一,預計在預測期內將成為 UPS 系統成長最快的市場,這得益於使用 UPS 系統的多個終端用戶群體的成長綜合影響。

- 印度是該地區成長最快的資料中心市場之一,其龐大人口中的網路普及率不斷提高,使得用戶資料和安全資料儲存至關重要。根據DataReportal數據顯示,印度網路普及率從2012年的12.6%成長至2021年的近47%,成為活躍網路用戶數量第二多的國家。這帶動了印度 IT 公司的顯著成長,許多資料中心計劃正在進行中。

- 例如,2022年5月,思科在印度開設了第一個資料中心。該公司旨在滿足客戶對網路防禦和資料本地化日益成長的需求。因此,思科公司在印度建立了第一個資料中心。此外,透過這項投資,思科旨在印度建構面向未來、資料驅動的安全基礎設施。此外,該資料中心還服務於多個行業,包括公共部門、醫療保健、銀行和金融服務以及保險。

- 同樣,2022 年 1 月,多元化的阿達尼集團宣布計劃在印度北方邦的兩個資料中心計劃投資超過 5,500 萬美元。根據北方邦政府介紹,這兩個資料中心將分別建在諾伊達62區和80區。

- 此外,阿達尼集團也成立了子公司Adani-EdgeConneX印度合資公司,在印度孟買建造資料中心。此外,該公司還計劃在未來十年內開發 1GW 的資料中心容量。這些計劃將分佈在印度各個城市,包括清奈、新孟買、諾伊達、維扎格和海得拉巴。

- 印度是新冠肺炎疫情期間受災最嚴重的國家之一,導致該國在衛生領域投入大量資金擴建醫療設施。根據國家衛生使命,中央向各州提供資金,用於升級現有的衛生基礎設施和建造新的衛生基礎設施。

- 根據農村衛生統計數據,截至 2021 年 3 月,印度共有約 5,951 個社區健康中心,比 2020 年成長約 5.3%。累計擁有分院、區級醫院和醫學院2,295所,與前一年同期比較增加近0.8%。預計預測期內印度不斷成長的醫療保健產業將推動對 UPS 系統的需求。

- 此外,快速的工業化和通訊服務用戶數量的激增也推動了印度市場的發展,預計印度市場將成為預測期內該地區成長最快的市場領域。

亞太地區不斷電系統(UPS) 產業概況

不斷電系統(UPS)市場是細分。主要企業(不分先後順序)包括 Riello Elettronica SpA、EATON Corporation PLC、Emerson Electric Co.、ABB Ltd 和 Schneider Electric SE。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 容量

- 10kVA以下

- 10至100kVA或以下

- 100kVA以上

- 類型

- 支援

- 線上

- 線上互動

- 應用

- 資料中心

- 通訊

- 醫療(醫院、診所等)

- 工業的

- 其他

- 按地區

- 中國

- 日本

- 印度

- 澳洲

- 印尼

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- Companies Profiles

- Riello Elettronica SpA

- EATON Corporation PLC

- Emerson Electric Co.

- Delta Electronics Inc.

- Enersys

- Schneider Electric SE

- ABB Ltd

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Toshiba Corporation

- Vertiv Co.

- Legrand SA

第7章 市場潛力及未來趨勢

簡介目錄

Product Code: 93215

The Asia-Pacific Uninterruptible Power Supply Market is expected to register a CAGR of 4.94% during the forecast period.

The market was moderately affected by the Covid-19 pandemic; however, the market has recovered and reached pre-pandemic values.

Key Highlights

- Over the long term, growing investments in data centers are expected to drive the market during the forecast period.

- On the other hand, UPS systems' high capital cost and operational expenditure are expected to restrain the market's growth during the forecast period.

- Nevertheless, the commercial integration of new technologies, such as Artificial intelligence (AI), Machine Learning (ML), IoT, etc., to provide increased efficiency and reliability in UPS systems is expected to be a significant growth opportunity for the market during the forecast period.

- Due to burgeoning power demand, increasing renewable energy generation, and growing demand for emergency backup systems, India is expected to be the fastest-growing geographical segment in the market during the forecast period.

APAC Uninterruptible Power Supply (UPS) Market Trends

Rising demand for data centres to drive the market

- Data centers are facilities that store vast amounts of sensitive data. These facilities are needed to be operational throughout the clock and to maintain data safety and reduce downtime; the data centers are equipped with an uninterrupted power supply. Furthermore, the data centers are connected to the internet, and with the help of an uninterruptible power supply, the data centers work smoothly without any interruption in internet connectivity. An uninterruptible power supply has redundant configurations and dual bus capabilities; thus, it requires less uptime and can provide facility-wide protection for sensitive electronics. Moreover, an uninterruptible power supply provides power without blackouts, brownouts, sags, surges, and noise interference.

- Data centers are integral to organizations designed to support business applications and provide services such as data storage, management, etc. An Uninterruptible Power Supply (UPS) plays a crucial role in data centers in providing backup power and avoiding data crashes, data loss, hardware damage, etc., due to which data centers are expected to be one of the largest end-user segments by application for UPS systems.

- The Asia-Pacific data center market has been expanding steadily and is one of the fastest globally. Due to growing urbanization and internet access globally, especially in Asia-Pacific, user-generated data has skyrocketed, mandating the demand for expanded data center capacity.

- According to Clouscene, China is the biggest market for data centers in the Asia-pacific region, with 442 operational data centers in the country, followed by Australia, India, and Japan. The market is growing especially fast in India, where due to a rapid rise in internet penetration over the recent years, the amount of user data generated has grown exponentially.

- Due to such factors, the rapid growth of the data center market is expected to drive the demand for UPS systems in the sector, driving the market during the forecast period.

India to be the fastest-growing segment

- India is one of the fastest-growing economies globally, and due to the combined impact of the growth of several end-user segments utilizing UPS systems, the country is expected to be the fastest-growing market for UPS systems during the forecast period.

- India is one of the region's fastest-growing markets for data centers, and as internet penetration has increased among its vast population, user data and safe data storage have become vital. According to DataReportal, internet penetration in India grew from 12.6% in 2012 to nearly 47% in 2021, making India the country with the second-largest number of active internet users. This has significantly boosted the country's IT companies, with many data center projects in the pipeline.

- For instance, In May 2022, Cisco launched its first data center in India. The company aims to cater to rising customer demands for cyber-defense and data localization. Thus, Cisco's Duo has established its first data center in India. Furthermore, with this investment, Cisco aims to build future-ready, data-compliant security infrastructure in India. Moreover, this data center would serve various industries, such as the public sector, healthcare, banking, financial services, and insurance.

- Similarly, In January 2022, the diversified Adani Group announced plans to invest more than USD 55 million in two data center projects in Uttar Pradesh, India. According to the Uttar Pradesh government, the two data centers are expected to be built in Noida sectors 62 and 80, respectively.

- Furthermore, Adani Group has formed a subsidiary, Adani-EdgeConneX Indian Joint Venture, to create a data center in Mumbai, India. Moreover, the company aims to develop 1GW of data center capacity in the next ten years. These projects are expected to be located in various cities in India, including Chennai, Navi Mumbai, Noida, Vizag, and Hyderabad.

- India was one of the worst-hit countries during the Covid-19 pandemic, and in response, considerable investments were made in the healthcare sector to expand facilities. Under the National Health Mission, central funding is provided to individual states for the upgradation of existing or constructing new medical infrastructure.

- As of March 2021, according to Rural Health Statistics, India has nearly 5,951 community health centers, up by nearly 5.3% from 2020. The country had a cumulative 2295 sub-divisional and district hospitals and medical colleges, up by nearly 0.8% year-on-year. As India's healthcare sector grows, it is expected to drive the demand for UPS systems during the forecast period.

- Additionally, rising industrialization, and a burgeoning number of telecom service users, are also expected to drive the market in India, making India the fastest-growing market segment in the region during the forecast period.

APAC Uninterruptible Power Supply (UPS) Industry Overview

The Uninterruptible Power Supply (UPS) Market is fragmented. Some of the major players (not in particular order) include Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., ABB Ltd, and Schneider Electric SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Capacity

- 5.1.1 less than 10 kVA

- 5.1.2 10-100 kVA

- 5.1.3 greater than 100 kVA

- 5.2 Type

- 5.2.1 Standby

- 5.2.2 Online

- 5.2.3 Line-interactive

- 5.3 Application

- 5.3.1 Data Centers

- 5.3.2 Telecommunications

- 5.3.3 Healthcare (Hospitals, Clinics, Etc.)

- 5.3.4 Industrial

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 India

- 5.4.4 Australia

- 5.4.5 Indonesia

- 5.4.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Riello Elettronica SpA

- 6.3.2 EATON Corporation PLC

- 6.3.3 Emerson Electric Co.

- 6.3.4 Delta Electronics Inc.

- 6.3.5 Enersys

- 6.3.6 Schneider Electric SE

- 6.3.7 ABB Ltd

- 6.3.8 Huawei Technologies Co., Ltd.

- 6.3.9 Mitsubishi Electric Corporation

- 6.3.10 Siemens AG

- 6.3.11 Toshiba Corporation

- 6.3.12 Vertiv Co.

- 6.3.13 Legrand S.A.

7 MARKET OPPORTUNITIES and FUTURE TRENDS

02-2729-4219

+886-2-2729-4219