|

市場調查報告書

商品編碼

1644943

亞太地區太陽能追蹤器:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Asia-Pacific Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

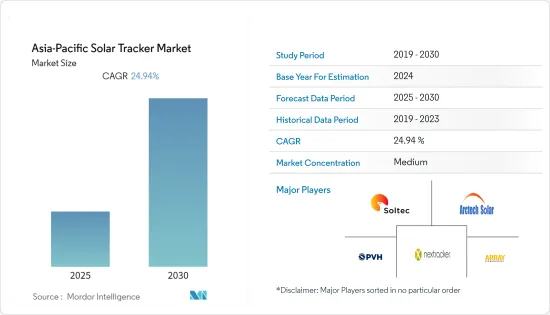

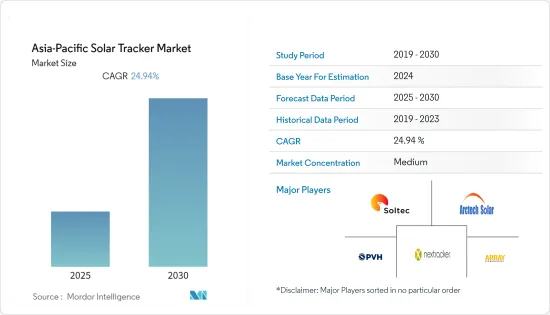

預計預測期內亞太太陽能追蹤器市場複合年成長率將達到 24.94%。

由於新冠疫情導致計劃延遲和供應鏈中斷,市場略受影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 預計在預測期內,對太陽能的需求不斷增加以及太陽能電池對綠色環境的貢獻將長期推動市場發展。

- 然而,預計在預測期內,技術升級和維護的限制以及資本成本的上升將阻礙市場的發展。

- 太陽能領域新技術的創新和採用、政府的支持措施以及利用再生能源來源滿足日益成長的電力需求的努力預計將為市場成長創造機會。

- 預計中國將成為預測期內最大的市場,大部分需求來自太陽能光電。

亞太地區太陽能追蹤器市場趨勢

單軸太陽能追蹤器佔據市場主導地位

- 太陽能追蹤系統通常透過移動反射面或太陽能板表面來追蹤太陽。與傳統太陽能板相比,太陽能追蹤器可從太陽能中產生高達 40% 的能量。由於更先進和有效的太陽捕獲技術,太陽能追蹤器被用於住宅和商務用太陽能電池板。

- 單軸追蹤器通常沿著太陽的方向從東向西移動。單軸追蹤器是僅使用一個角度作為旋轉軸的追蹤器。這種追蹤器可產生超過30%的電力。這些追蹤器描述了一種快速、簡單且經濟實惠的方法來改善太陽能裝置的性能。

- 此外,與雙軸追蹤器相比,單軸太陽能追蹤器價格相對便宜,結構也不太複雜,因此在全球市場上受到普遍歡迎。單軸太陽追蹤器根據傾斜度和排列方向提供幾種不同的配置。

- 增加正在進行和即將開展的計劃的電力容量對政府和能源公司來說是一個挑戰。單軸太陽能追蹤器可提供20%至30%的容量提升,非常有用。預計這將為預測期內從事單軸太陽能追蹤系統生產的企業創造巨大的前景。

- 2021年,亞太地區太陽能發電總量為581.5兆瓦時。預計發電量將成長,年增率與前一年同期比較24.9%。使用單軸太陽能追蹤器可以進一步增加發電能力,從而為預測期內單軸太陽能追蹤器市場創造機會。

- 考慮到上述因素,預計單軸太陽能追蹤器市場將在預測期內顯著成長。

中國可望主導市場

- 預計中國將在 2021 年佔太陽能光電發電成長的約 38%,預計 2020 年和 2021 年將大幅增加發電容量。由於中國對綠色能源的重視和支持政策,預計太陽能追蹤器市場在中國將會成長。

- 由於該公司在太陽能發電領域的投資不斷增加,預計太陽能追蹤器市場在預測期內將大幅成長。 2022年8月,中國中信博科技在印度建造的3GW太陽能追蹤器工廠生產了太陽能追蹤器設備的所有主要零件。

- 此外,2022 年 6 月,中國「十四五」規劃提出了一項雄心勃勃的目標,即到 2025 年將可再生能源發電量提高到 33%(高於 2021 年的 29%)。該目標包括18%來自風能和太陽能技術。因此,透過太陽能技術增加發電量可能會促進太陽能發電面板的安裝,從而推動太陽能追蹤器市場的發展。

- 2021年,中國太陽能發電裝置容量達30.64萬千瓦。以20.9%的複合年成長率,預計太陽能發電能力在預測期內將成長,這將推動太陽能追蹤器市場的發展。

- 由於所有這些原因,預計中國將在預測期內主導亞太太陽能追蹤器市場。

亞太地區太陽能追蹤器產業概況

亞太地區太陽能追蹤器市場適度整合。該市場的主要參與企業(不分先後順序)包括 NexTracker Inc.、Array Technologies Inc.、PV Hardware Solutions SLU、Arctech Solar Holding 和 Soltec Energias Renovables SL。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按軸類型

- 單軸

- 雙軸

- 按地區

- 印度

- 中國

- 日本

- 其他亞太地區

第6章 競爭格局

- 供應商市場佔有率

- 合併和收購

- 公司簡介

- Array Technologies Inc.

- NexTracker Inc.

- FIMER SpA

- PV Hardware Solutions SLU

- Arctech Solar Holding Co.

- Soltec Energias Renovables SL

- Valmont Industries Inc.

- Trina Solar

第7章 市場機會與未來趨勢

The Asia-Pacific Solar Tracker Market is expected to register a CAGR of 24.94% during the forecast period.

The market was slightly affected in terms of project delays and supply chain disruptions by COVID-19. Presently, the market has reached pre-pandemic levels.

Key Highlights

- The growing demand for solar energy and solar contribution to a greener environment is expected to drive the market in the forecast period over the long term.

- On the other hand, limited technological upgradation, maintenance, and higher capital costs are expected to hinder the market in the forecast period.

- Innovating and adapting new technologies in the solar energy sector, supportive government policies, and efforts to meet the increasing power demand using renewable energy sources are expected to create opportunities for the market to grow.

- China is expected to be the largest market during the forecast period, with the majority of the demand coming from solar photovoltaic energy.

APAC Solar Tracker Market Trends

Single Axis Solar Trackers to Dominate the Market

- Typically, a solar tracking system moves reflecting surfaces or the solar panel's face to track the sun. Solar trackers can produce up to 40% more energy from the sun compared to conventional panels. Due to more advanced and effective sun-trapping technology, solar trackers are being employed in both household and commercial-grade solar panels.

- Single-axis trackers typically follow the sun's direction and travel from east to west. Single-axis trackers only use one angle as the rotational axis. More than 30% more electricity can be produced with this kind of tracker. These trackers offer a quick, easy, and affordable approach to enhance the performance of solar installations.

- Moreover, Due to their relatively low cost and less sophisticated construction than dual-axis trackers, single-axis solar trackers are generally accepted on the global market. Single-axis solar trackers are offered in several different configurations depending on their tilt and alignment direction.

- Increasing the electricity capacity for ongoing and upcoming projects is challenging for governments and energy firms. The 20%-30% capacity increase on single-axis solar trackers can be quit helpful. This, in turn, is anticipated to generate sizable prospects for businesses engaged in the production of single-axis solar tracking systems during the forecast period.

- In 2021, the total solar generation in Asia-Pacific accounted for 581.5 terawatt hours. With an annual growth rate of 24.9 % as compared to the previous year, the generation is expected to grow. Using the single-axis solar trackers can increase the generation capacity further, thus creating an opportunity for the Single Axis Solar Trackers segment in the forecast period.

- Hence, owing to the above points, the Single Axis Solar Trackers segment will likely see significant market growth during the forecast period.

China is Expected to Dominate the Market.

- In 2021, China was responsible for about 38% of solar PV generation growth, with significant capacity additions in 2020 and 2021. With the country's focus on greener energy and supportive policies, the solar tracker market is expected to grow in china.

- With the increasing investment by companies in the solar PV sector, the solar tracker market is expected to hike during the forecast period. In August 2022, the 3 GW solar tracker facility that China's Arctech constructed in India manufactured all of the main parts for its solar tracker devices.

- Moreover, In June 2022, the ambitious goal of 33% of power generation coming from renewable sources by 2025 (up from 29% in 2021) was included in China's 14th Five-Year Plan. This aim includes 18% for wind and solar technology. Thus, the increase in power generation through solar technology will boost solar PV panels installations driving the solar tracker market.

- In 2021, the total solar PV capacity of china accounted for 306.4 thousand MW. With an annual growth rate of 20.9 %, the solar PV capacity is expected to grow in the forecast period, which, in turn, is expected to drive the solar tracker market.

- Therefore, owing to the above points, China is expected to dominate the Asia-Pacific solar tracker market during the forecast period.

APAC Solar Tracker Industry Overview

The Asia-Pacific solar tracker market is moderately consolidated. Some of the major players in this market ( not in the particular order) include NexTracker Inc., Array Technologies Inc., PV Hardware Solutions S.L.U., Arctech Solar Holding Co. Ltd, and Soltec Energias Renovables SL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion Till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Axis Type

- 5.1.1 Single Axis

- 5.1.2 Dual Axis

- 5.2 By Geography

- 5.2.1 India

- 5.2.2 China

- 5.2.3 Japan

- 5.2.4 Rest of the Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Array Technologies Inc.

- 6.3.2 NexTracker Inc.

- 6.3.3 FIMER SpA

- 6.3.4 PV Hardware Solutions S.L.U.

- 6.3.5 Arctech Solar Holding Co.

- 6.3.6 Soltec Energias Renovables S.L.

- 6.3.7 Valmont Industries Inc.

- 6.3.8 Trina Solar