|

市場調查報告書

商品編碼

1644958

亞太地區空氣品質監測-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Air Quality Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

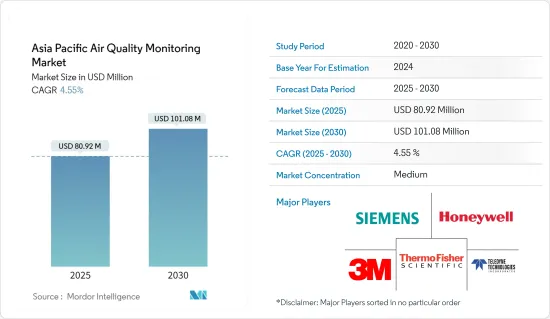

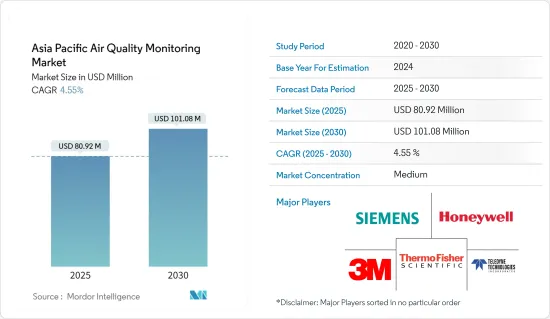

亞太地區空氣品質監測 (AQM) 市場規模預計在 2025 年為 8,092 萬美元,預計到 2030 年將達到 1.0108 億美元,預測期內(2025-2030 年)的複合年成長率為 4.55%。

關鍵亮點

- 從中期來看,人們意識的增強和政府遏制空氣污染的舉措預計將推動市場成長。

- 然而,預計空氣品質監測系統的高成本將在預測期內阻礙亞太空氣品質監測市場的成長。 \

- 預計空氣品質監測系統技術的不斷進步將在預測期內為亞太地區空氣品質監測市場帶來有利的成長機會。

亞太地區空氣品質監測市場趨勢

戶外市場將大幅成長

- 室外空氣品質監測系統可測量室外空氣(即開放空間)中的污染物、空氣中的粒狀物、濕度和溫度的濃度等級。檢測 CO2、O3、NO2、SO2、甲醛 (HCHO) 和總揮發性有機化合物 (TVOC) 等污染物的含量。

- 巴基斯坦2022年PM2.5平均濃度為70.9微克/立方公尺(μg/m3),是世界上污染最嚴重的國家之一。這比印度的平均PM2.5濃度高出近18μg/m3。

- 空氣品質監測系統通常由政府在特定州或國家的城市和公共場所部署。這些設備具有防風雨功能,並且必須符合某些環境測試和模擬要求才能獲得施工認證。

- 室外監測器進一步分為攜帶式室外監測器、固定式室外監測器、灰塵和顆粒物監測器以及空氣品質管理站。可攜式戶外監測器由於其操作優勢和易於部署而在全球範圍內得到最廣泛的部署。

- 隨著都市化進程的推進和越來越多的人口遷入都市區,都市區的空氣污染水平正在上升。預計到2050年,將有25億人居住在都市區。由於人口密度高,以及工業單位、都市廢棄物產生和交通堵塞等多種污染源,迫切需要改善空氣品質監測和應變系統。

- 2022 年 4 月,Oizom 宣布已在印度 9 個智慧城市安裝了 129 個空氣品質監測器。印度政府於 2015 年啟動了「100 個智慧城市」計劃,Oizom 成為提供強大、準確和緊湊的空氣品質監測解決方案的先驅。 Oizom 於 2017 年開始在卡基納達智慧城安裝,並在五年內擴展到瓦拉納西、甘地訥格爾、蘇拉特、伊塔那噶、達萬格雷、因帕爾和阿格拉等 8 個城市。

- 因此,預計預測期內此類發展將為戶外監測器市場的發展提供動力。

中國主導市場

- 根據《2021年世界空氣品質報告》,全球污染最嚴重的10個國家中有5個位於亞太地區。在污染最嚴重的20個國家中,有8個位於亞洲和太平洋地區。

- 截至2022年,根據世界空氣品質報告,中國人口加權平均PM2.5濃度排名第25位,為30.6μg/m3。根據世界空氣品質報告,2022年東亞地區污染最嚴重的18個區域城市都在中國。據估計,中國每年有一百多人因空氣污染而死亡。但現在中國正以創新的解決方案進行反擊。

- 一些城市從 20 世紀 70 年代開始監測空氣質量,並在 20 世紀 80 年代推出了第一個國家監測系統。 2000年,國家開始採用以NO2、PM10、SO2監測資料為基礎的日空氣污染指數(API)來評估42個城市的空氣品質。

- 近年來,中國政府顯著提高了空氣品質監測覆蓋率。 2012年至2020年間,中國各地的聯邦空氣監測站數量從661個增加到1800個。除此之外,地方政府也管理和資助了數千個空氣監測站。

- 近年來,中國空氣污染問題受到廣泛關注,空氣品質監測成為關注的焦點。近年來,中國空氣品質監測產業的發展速度超出了預期。

- 然而,這項技術主要集中在最需要它的都市區。隨著公眾興趣和監管機構對改善空氣品質的關注度不斷提高,預計中國空氣品質監測市場在預測期內將呈現積極的前景。

亞太地區空氣品質監測產業概況

亞太地區空氣品質監測市場本質上是半地方性的。市場的主要企業(不分先後順序)包括西門子股份公司、賽默飛世爾科技公司、3M公司、霍尼韋爾國際公司和Teledyne Technologies公司。

2022年2月,霍尼韋爾推出了室內空氣品質(IAQ)監測器。該監測器向建築物業主和營運商發出潛在問題的警報,使他們能夠主動改善室內空氣質量,從而降低傳播空氣污染物的風險。這款小型觸控螢幕設備是印度製造的產品,可測量相對濕度、溫度和室內空氣污染物等關鍵的室內空氣品質參數。 IAQ 指數是根據測量結果列出的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 意識提升並宣傳政府政策和非政府措施以遏制空氣污染

- 限制因素

- 空氣品質監測系統高成本

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 室內監控

- 戶外監視器

- 取樣方法

- 連續的

- 手動的

- 間歇性

- 污染物類型

- 化學污染物

- 物理污染物

- 生物污染物

- 最終用戶

- 住宅和商業

- 發電

- 石油化工

- 其他

- 地區

- 中國

- 印度

- 日本

- 新加坡

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Siemens AG

- Thermo Fisher Scientific Inc.

- Horiba Ltd

- Emerson Electric Co.

- 3M Co.

- Honeywell International Inc.

- Teledyne Technologies Inc.

- TSI Inc.

- Merck KGaA

- Agilent Technologies Inc.

- Aeroqual Limited

第7章 市場機會與未來趨勢

- 空氣品質監測系統的技術進步日益

The Asia Pacific Air Quality Monitoring Market size is estimated at USD 80.92 million in 2025, and is expected to reach USD 101.08 million by 2030, at a CAGR of 4.55% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing awareness and favorable government policies and non-government initiatives for curbing air pollution are expected to drive the market's growth.

- On the other hand, the high costs of air quality monitoring systems are expected to hamper the growth of the Asia Pacific air quality monitoring market during the forecast period. \

- Nevertheless, increasing technological advancements in air quality monitoring systems will likely create lucrative growth opportunities for the Asia Pacific air quality monitoring market in the forecast period.

Asia Pacific Air Quality Monitoring Market Trends

Outdoor Segment to Witness Significant Growth

- The outdoor air quality monitoring systems measure the concentration levels of pollutants, suspended particles, humidity, and temperature in outside air, i.e., in open spaces. They detect the levels of pollutants like CO2, O3, NO2, SO2, formaldehyde (HCHO), total volatile organic compounds (TVOC), etc.

- Pakistan had an average PM2.5 concentration of 70.9 micrograms per cubic meter of air (µg/m3) in 2022, making it one of the most polluted country in the world. This was almost 18 µg/m3 more than the average PM2.5 concentrations in India.

- Air quality monitoring systems are majorly deployed by the respective governments in cities and public spaces of a particular state or country. These devices are weather-resistant and must meet certain environmental tests and simulations to be confided by some building certifications.

- The outdoor monitors are further segmented into portable outdoor monitors, fixed outdoor monitors, dust and particulate monitors, and AQM stations. Portable outdoor monitors are the most widely deployed globally due to their operational advantage and easy deployment.

- With the increasing urbanization and more people moving to urban areas, the air pollution levels in urban areas have increased. It is estimated that by 2050, 2.5 billion more people will live in urban areas. The high population density and diverse pollution sources like industrial facilities, municipal waste generation, and transport congestion lead to an urge for better air quality monitoring and addressal systems.

- In April 2022, Oizom stated that the company installed 129 air quality monitors across nine smart cities in India. The Government launched the 100 Smart Cities program in 2015, for which Oizom has pioneered in providing robust, accurate, and compact solutions for air quality monitoring. Oizom initiated its installation in Kakinada Smart City in 2017 and eventually expanded to eight other cities over five years, such as Varanasi, Gandhinagar, Surat, Itanagar, Davangere, Imphal, and Agra.

- Therefore, owing to such developments are expected to give a thrust to the outdoor monitor segment of the market during the forecast period.

China to Dominate the Market

- According to the World Air Quality Report 2021, among the top 10 most polluted countries in the world, five were from the Asia-Pacific region. Among the top 20 polluted countries, eight were from the region.

- As of 2022, China stands at 25th position with an average of 30.6 µg/m3 PM2.5 concentration weighted by population according to the World Air Quality Report. According to the world air quality report, in 2022, the 18 most polluted regional cities in East Asia were from China. Over a million people are estimated to die annually from air pollution in China. However, currently, the country is fighting back with innovative solutions.

- China has a long history of using air quality monitoring systems; the country started monitoring air quality in a few cities in the 1970s and set up an initial national monitoring system in the 1980s. In 2000, the daily Air Pollution Index (API) based on NO2, PM10, and SO2 monitoring data was introduced in the country to assess air quality in 42 cities.

- In recent years, the Government of China has significantly improved air quality monitor coverage. The number of federal air monitoring stations across China increased from 661 to 1,800 between 2012 and 2020. This is in addition to thousands of air monitoring stations being managed and funded by the local governments.

- In recent years, air quality monitoring has drawn attention due to the extensive concerns regarding air pollution in China. China's air quality monitoring industry has grown faster than expected in recent years.

- However, this technology has been concentrated mainly in urban where it is most required. As public interest and regulatory bodies focus on improving air quality, the Chinese air quality monitoring market is expected to have a positive outlook during the forecast period.

Asia Pacific Air Quality Monitoring Industry Overview

The Asia Pacific air quality monitoring market is semi-consolidated in nature. Some of the major players in the market (in no particular order) include Siemens AG, Thermo Fisher Scientific Inc., 3M Co., Honeywell International Inc., and Teledyne Technologies Inc., among others.

In February 2022, Honeywell launched its Indoor Air Quality (IAQ) monitor, which forewarns building owners and operators of potential issues to proactively enhance indoor air quality, thereby potentially reducing the risk of transmitting airborne contaminants. A Make in India product, the compact, touchscreen-enabled device measures key IAQ parameters, including relative humidity, temperature, and indoor air pollutants. It provides an IAQ index based on the readings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 4.5.2 Restraints

- 4.5.2.1 High Costs of Air Quality Monitoring Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Indoor Monitor

- 5.1.2 Outdoor Monitor

- 5.2 Sampling Method

- 5.2.1 Continuous

- 5.2.2 Manual

- 5.2.3 Intermittent

- 5.3 Pollutant Type

- 5.3.1 Chemical Pollutants

- 5.3.2 Physical Pollutants

- 5.3.3 Biological Pollutants

- 5.4 End User

- 5.4.1 Residential and Commercial

- 5.4.2 Power Generation

- 5.4.3 Petrochemicals

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Singapore

- 5.5.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Horiba Ltd

- 6.3.4 Emerson Electric Co.

- 6.3.5 3M Co.

- 6.3.6 Honeywell International Inc.

- 6.3.7 Teledyne Technologies Inc.

- 6.3.8 TSI Inc.

- 6.3.9 Merck KGaA

- 6.3.10 Agilent Technologies Inc.

- 6.3.11 Aeroqual Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Advancements in Air Quality Monitoring Systems