|

市場調查報告書

商品編碼

1645064

亞太活動物流:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Event Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

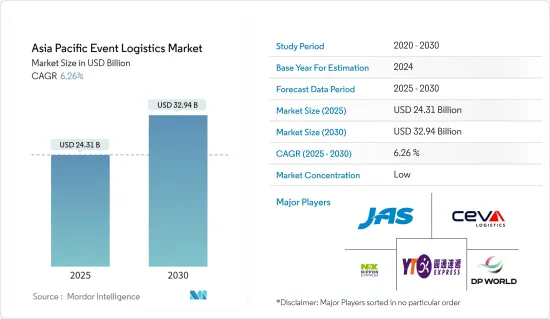

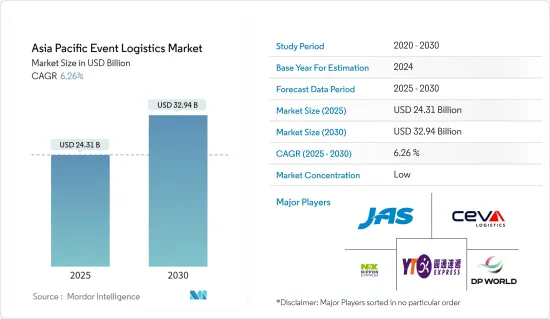

亞太地區活動物流市場規模預計在 2025 年為 243.1 億美元,預計到 2030 年將達到 329.4 億美元,預測期內(2025-2030 年)的複合年成長率為 6.26%。

關鍵亮點

- 由於亞太地區舉辦的活動、會議和展覽數量不斷增加,該地區的活動物流市場正在蓬勃發展。該地區快速的都市化和經濟成長正在推動對物流服務的需求。科技也幫助簡化亞太地區活動的物流業務。

- 為促進亞太地區的物流,印度政府在新德里舉行的G20高峰會上提出興建連接印度、中東和歐洲的鐵路、航空和海運運輸走廊。

- 例如,2023年9月,將舉辦東南亞運輸物流及航空貨運交易會,以新加坡為東南亞運輸物流及航空貨運展覽會。 MMI Asia 於 11 月 15 日與樟宜機場集團、SATS 有限公司和 DHL Express 等主要行業相關人員共同宣布了東南亞版運輸物流和航空貨運貿易展覽會的日期。 11 月 15 日,MMI Asia 與新加坡旅遊局 (STB) 簽署了一份合作備忘錄,將在新加坡舉辦多屆兩年一度的運輸物流和航空貨運展覽會。東南亞版將於 2023 年 9 月 13 日至 15 日在新加坡濱海灣金沙酒店舉行。該地區的展覽會和展覽會不斷增加,推動了對活動物流的需求。

- 例如,針對2023年10月在印度舉行的2023年世界杯,杜拜環球港務集團與國際板球理事會(ICC)建立了夥伴關係,杜拜環球港務集團與板球明星擊球手和國際板球理事會主席合作推出了一項新的“超越國界”舉措。杜拜環球港務集團將利用其完善的網路和智慧物流解決方案,向世界各地的當地板球俱樂部運送 50 個改裝的貨櫃。每個貨櫃都配備了必要的設備。

- 杜拜環球港務集團 (DP World) 的新全球大使已在 2023 年 ICC 男子 50 場板球世界盃前推出了其首個貨櫃,該賽事將於 10 月 5 日至 11 月 19 日在印度舉行。在孟買的國家板球中心,Tendulkar 揭開了第一個貨櫃,裡面裝有 40 套板球套件。 DP World 的第一個貨櫃將安裝在馬哈拉斯特拉邦的 Palghar 體育俱樂部。另外 210 套套件將分發給隸屬於 Achrekar 板球學院和 Shivaji Park Gymkhana 學院等學院的年輕板球運動員。

亞太地區活動物流市場趨勢

體育賽事推動該地區市場

北京冬奧京東物流為2022年北京冬奧提供物流服務。隨著中國體育產業不斷發展,由體育大國轉向體育強國轉變,其他產業也跟進。該公司將成為中國首個2022年冬季奧運物流服務供應商。京東物流成為2022年北京冬奧會和2022年冬季殘奧會的物流服務商,打破了京東物流擔任北京冬奧會物流服務商26年的傳統。 2020年11月3日,北京市政府採購網北京冬奧服務區發布消息稱,京東物流中標北京2022年冬奧會、北京2022年冬季殘奧會競標。據報道,2022年北京冬奧主辦權得標金額為6729萬元人民幣(944萬美元)。北京2022年奧運會和殘奧會物流計劃是北京奧運會和殘奧組委員會計劃。

2022年9月,北京市政府採購網再次發布消息稱,京東物流以2500萬元人民幣(351萬美元)中標北京2022年奧運會和殘奧會組委會行李運輸服務供應商計劃。同年12月,京東宣布再次以1,500萬元人民幣(210萬美元)的價格出售2022年北京奧運及殘奧會組委會運動員食品倉儲及物流服務採購計劃。京東是國內首個為奧運賽事提供服務的企業,從行李托運到食品運輸,全程物流服務均由京東物流提供。

中國佔市場主導地位的領域

圓通速遞總部位於中國東部浙江省省會杭州,將成為 2022 年杭州亞運會的官方物流服務贊助商。

第四屆亞運會今年已進入第三年,它是一場大型體育盛會,定於 2022 年 9 月舉行,將再次讓東部科技中心上海成為萬眾矚目的焦點。總部位於上海的宅配公司圓通速遞已與奧運組委達成協議,將以現金和現金等價物的方式為奧運提供資金。圓通速遞將為賽事客戶建置IT系統並提供通關、配送、倉儲等物流服務。作為贊助此賽事的回報,圓通速遞將獲得場館內的空間來推廣亞運會。該公司將成為 2026 年世界盃在日本愛知縣舉行的首個物流服務贊助商。

亞太地區活動物流產業概覽

活動物流市場高度分散,該地區有許多公司。許多公司專注於內部成長策略,例如新產品的發布、核准、專利和活動。我們也看到了諸如收購、夥伴關係和協作等無機成長策略。這些努力幫助市場參與企業擴大了業務和基本客群。隨著全球市場對活動物流的需求不斷擴大,活動物流市場的市場支付者將在未來受益於盈利的成長。該行業的一些主要企業包括 DHL Supply Chain、DP World、Agility 和 GWC Logistics。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 展覽和會議推動市場

- 體育賽事推動市場成長

- 市場限制

- 技術純熟勞工短缺

- 市場機會

- 活動中的技術創新

- 波特五力分析

- 供應商的議價能力

- 消費者/購買者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- COVID-19 對市場的影響

第5章 市場區隔

- 按類型

- 庫存管理

- 配送系統

- 物流解決方案

- 按應用

- 娛樂

- 運動的

- 展覽會

- 其他

- 按國家

- 中國

- 韓國

- 印度

- 日本

- 其他亞太地區

第6章 競爭格局

第7章 市場概況(市場集中度和主要企業)

第8章 公司簡介

- Nippon Express

- DP World

- YTO Express

- JAS Worldwide

- CEVA Logistics

- Air Cargo

- Kuhene+Nagel

- Geodis

- Yamato Transport

- Tokyo Freight Services

- Sankayu Inc.

- Sagwa Express

第 9 章 *此列表並非詳盡。

第10章 其他公司

第11章 市場機會與未來趨勢市場機會與未來趨勢

第12章 市場機會與未來趨勢 附錄

The Asia Pacific Event Logistics Market size is estimated at USD 24.31 billion in 2025, and is expected to reach USD 32.94 billion by 2030, at a CAGR of 6.26% during the forecast period (2025-2030).

Key Highlights

- The Asia Pacific event logistics market is growing rapidly as more events, conferences, and exhibitions are being held in the region. Rapid urbanization and the economic growth of the region are driving the demand for logistics services. Technology is also playing a role in the efficiency of logistics operations for Asia Pacific events.

- To promote the logistics in the Asia Pacific region, at the G20 Summit held in New Delhi, the government is taking initiatives to develop a transport corridor to link India, the Middle East, and Europe by rail, air, and sea.

- For Instance, in September 2023, The Transport Logistics and Air Cargo trade fair is in Southeast Asia with Singapore as the hub for transport logistics and air cargo in the region. MMI Asia announced the dates of the Southeast Asian edition of the transport logistics and air cargo show along with key industry stakeholders, including Changi Airport Group, SATS Ltd, and DHL Express, on 15 November. MMI Asia and the Singapore Tourism Board (STB) signed an MoU on 15 November for the organization of multiple biennial editions of the Transport Logistics & Air Cargo trade fair in Singapore. The Southeast Asian edition will be held at Marina Bay Sands in Singapore from 13 to 15 September 2023. The trade fairs and exhibitions are growing in the region, and so is the demand for event logistics is growing.

- For Instance, in October 2023, The World Cup 2023, which was held in India, the DP World and International Cricket Council (ICC) signed a partnership, and DP World launched its new 'Beyond Borders' initiative in collaboration with cricket star batsman and International Cricket Council (ICC) President. DP World utilizes its comprehensive network and intelligent logistics solutions to deliver 50 reused shipping containers to local cricket clubs across the globe. Each container is equipped with the necessary equipment.

- The new DP World Global ambassador launched the first container ahead of the 2023 edition of ICC Men's 50 Over Cricket World Cup in India, which will be held in the country from October 5 to November 19. At NSCI in Mumbai, Tendulkar unveiled the first container along with 40 Cricket kits. The first container of DP World will be placed at Palghar Sports Club in Maharashtra. Another 210 kits will be distributed among young cricketers coming from academies such as the one at Achrekar Cricket Academy and the one at Shivaji Park Gymkhana Academy.

Asia Pacific Event Logistics Market Trends

Sports Events are Driving the Market in the Region

Beijing Winter Olympics: JD Logistics has provided logistics services at the Beijing 2022 Winter Olympics. As China's sports industry continues to grow and transition from a large sports nation to a strong sports nation, other industries are also following suit. They are China's first logistics service provider at the 2022 Winter Olympics. JD Logistics, the logistics service provider for the 2022 Beijing Winter Olympics and 2022 Winter Paralympics, broke the 26-year tradition of the logistics service providers for the Beijing Winter Olympics. On 3 November 2020, the Beijing Winter Olympic Service Area of the Beijing municipal government procurement network announced that the bid for the 2022 Beijing 2022 Winter Olympic and 2022 Beijing Winter Paralympics was won by JD Logistics. The bid price for 2022 Beijing 2022 was reported to be 67.29 million RMB (USD 9.44 mn). The 2022 Beijing Olympic and 2022 Beijing Paralympic Logistics project is a project of the Beijing Olympic and Paralympic Organizing Committee.

In September 2022, it was announced again by the Beijing municipal government procurement network that the bid was won by JD Logistics for the project of the baggage transportation service provider for the Beijing 2022 Olympic and Paralympic Organizing Committee, amounting to 25 million RMB (USD 3.51 mn). The following year, in December 2022, another announcement revealed that JD.com had once again sold the project of athlete ingredients warehouse and logistics service procurement for the Beijing 2022 Beijing Olympic and Paralympic Organizing Committee, amounting to 15 million RMB (USD 2.10 mn). JD.com has served Olympic events for the first time in China, from the check-in of baggage to the food transportation to the overall logistics services done by JD Logistics.

China Dominates the Region in the Market

YTO Express, in the eastern Chinese province of Zhejiang's capital, Hangzhou, will be the Official Logistics Services Sponsor of the 2022 Asian Games in Hangzhou.

Shanghai, the eastern tech hub that will host the games every four years for the third time, is set to re-emerge with a bang with the mega-sports competition scheduled for September 2022. YTO Express, a courier firm based in Shanghai, has agreed with the organizing committee to fund the event through cash and cash equivalent. YTO Express will set up an IT system and provide logistics services to event clients, including customs clearance and delivery, as well as warehousing and other logistics, the company said. In exchange for sponsoring the event, YTO Express will be given space inside the venue to promote the Asian Games. It will be considered the first logistics service sponsor for the 2026 games, which will be held in the Japanese prefecture of Aichi.

Asia Pacific Event Logistics Industry Overview

The event logistics market is highly fragmented, with many companies in the region. Many companies are focusing on organic growth strategies such as new product launches, approvals, patents, and events. Inorganic growth strategies such as acquisitions, partnerships, and collaborations have been observed in the market. These initiatives have allowed market participants to grow their business and customer base. As the demand for event logistics continues to grow in the global market, market payers within the event logistics market stand to gain from profitable growth in the future. Some of the leading companies in this industry are DHL Supply Chain, DP World, Agility, GWC Logistics, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exhibitions and Conferences are driving the market

- 4.2.2 Sports Events are driving the market growth

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Labor

- 4.4 Market Opportunities

- 4.4.1 Technological Innovations in the Events

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers/Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Value Chain/ Supply Chain Analysis

- 4.7 Impact of Covid-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Inventory Control

- 5.1.2 Distribution Systems

- 5.1.3 Logistics Solutions

- 5.2 By Application

- 5.2.1 Entertainment

- 5.2.2 Sports

- 5.2.3 Trade fair

- 5.2.4 Others

- 5.3 By Country

- 5.3.1 China

- 5.3.2 South Korea

- 5.3.3 India

- 5.3.4 Japan

- 5.3.5 Rest of the Asia Pacific region

6 COMPETITIVE LANDSCAPE

7 Overview (Market Concentration and Major Players)

8 Company Profiles

- 8.1 Nippon Express

- 8.2 DP World

- 8.3 YTO Express

- 8.4 JAS Worldwide

- 8.5 CEVA Logistics

- 8.6 Air Cargo

- 8.7 Kuhene + Nagel

- 8.8 Geodis

- 8.9 Yamato Transport

- 8.10 Tokyo Freight Services

- 8.11 Sankayu Inc.

- 8.12 Sagwa Express