|

市場調查報告書

商品編碼

1645079

英國化學物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)United Kingdom Chemical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

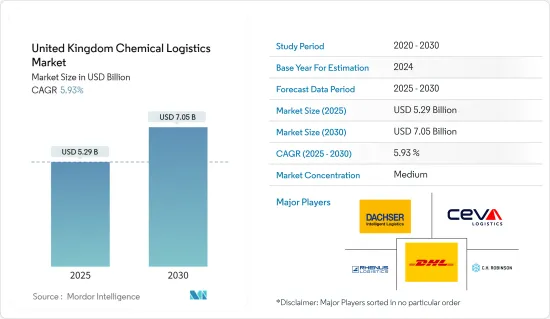

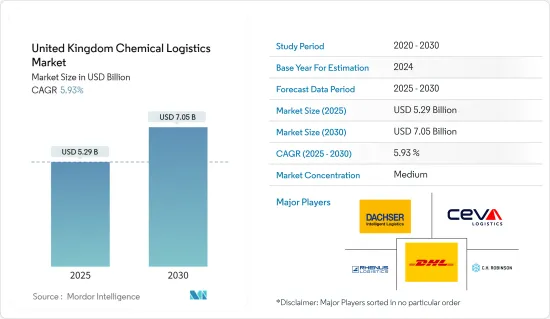

英國化學物流市場規模預計在 2025 年為 52.9 億美元,預計到 2030 年將達到 70.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.93%。

在英國,化學品物流業務有嚴格的法律要求。 2001 年 6 月 27 日歐洲議會和理事會指令 2001/45/EEC 修訂了有關工人在工作中使用工作設備的最低安全和健康要求的理事會指令 89/655/EEC。 (根據理事會指令 89/391/EEC 第 16(1) 條的第二項具體指令)。

產業專家預測,肥皂和清潔劑、香水、清潔劑、拋光劑或盥洗用品類別的化學品和化學產品的收益將到 2023 年成長 92.8 億美元,到 2024 年達到 95.6 億美元。

據報道,英國化學品市場增加價值額在 2023 年將達到 122.8 億美元,在 2024 年將達到 127.6 億美元。創新和技術進步是化學工業發展的常見驅動力。投資研發並推出新的和改進的產品和製程可以幫助英國化學市場的公司增加價值。

英國化學品物流市場趨勢

英國脫歐對與英國貿易的影響

英國化工產品進口量大幅下降,顯現脫歐的影響。根據業界專家介紹,2021年交易金額為132.2億美元,但2022年僅達成100.2億美元。該國在此期間下降了近 24%。

中英國之間的商業往來被徹底顛覆。化學品進口額從 2021 年的 60 億美元大幅下降至 2022 年的 29.5 億美元。

英國對非歐盟國家(尤其是美國)的出口陷入困境。部分原因是,衰退似乎主要發生在非出口市場,導致英國在從需求成長中獲益方面處於較弱的地位。對美國的雜項化學品出口額將從 2021 年的 12.5 億美元下降到 2022 年的 11.1 億美元。

英國化學品消費量

英國的化肥進口費用正在增加,顯示該國的化學品消耗和物流需求。據Statista稱,2022年英國將進口價值26.2億美元的化肥。

Croda International Plc 是英國最大的化學公司,其次是 Johnson Matthey Plc。業內專家表示,2022 年英國的淨利潤分別為 1.939 億英鎊(2.4412 億美元)和 1.77 億英鎊(2.2284 億美元)。這顯示了該國的化學品消耗量。

同樣在 2023 年 11 月,化學工業聚烯供應商利安德巴塞爾 (LyondellBasell) 宣布將在英國建立一個新的產品配銷中心。這項策略性舉措是公司努力的延續,也是公司致力於透過在客戶工廠放置庫存來縮短訂單前置作業時間和改善客戶體驗的一部分。這個英國物流中心是利安德巴塞爾全球業務的重要組成部分。

英國化學品物流產業概況

英國化學品物流市場競爭激烈,各類公司林立。英國電子商務物流市場中等分散,市場參與者競爭激烈。競爭格局是動態的,不斷發展和競爭推動公司適應新趨勢、技術進步和不斷變化的消費者偏好。 DHL 等全球物流巨頭擁有強大的影響力,提供從快遞到供應鏈管理的廣泛服務。然而,由於法規嚴格、安全和環境標準嚴格,英國化學品物流業進入門檻相對較高。 DHL International Gmbh、Dachser 和 Rhenus Logistics 是該領域最重要的參與者。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 科技趨勢

- 產業價值鏈分析

- 政府法規和舉措

- 3PL 洞察

- 價值鏈/供應鏈分析

- 需求和供應分析

第5章 市場動態

- 驅動程式

- 遵守嚴格規定

- 供應鏈全球化

- 限制因素

- 環境問題

- 機會

- 綠色物流

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/購買者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 按服務

- 運輸

- 倉儲、配送和庫存管理

- 諮詢和管理服務

- 海關和安全

- 綠色物流

- 其他服務

- 交通方式

- 路

- 鐵路

- 航空

- 水路

- 管道

- 按最終用戶

- 製藥業

- 化妝品產業

- 石油和天然氣

- 特種化學品產業

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- DHL

- DACHSER

- Rhenus Logistics

- CH Robinson

- CEVA Logistics

- Den Hartogh

- BDP International

- Streamline Shipping

- Hoyer Group

- Suttons Group*

- 其他公司

第8章 市場機會與未來趨勢

第 9 章 附錄

The United Kingdom Chemical Logistics Market size is estimated at USD 5.29 billion in 2025, and is expected to reach USD 7.05 billion by 2030, at a CAGR of 5.93% during the forecast period (2025-2030).

There are strict legal requirements for chemical logistics operations in the United Kingdom. Directive 2001/45/EEC of the European Parliament and of the Council of 27 June 2001, which amends Council Directive 89 /655 / EEC on the minimum health and safety requirements for the application of work equipment to workers at work. (Second individual Directive under Article 16 (1) of Council Directive 89 /391 / EEC).

According to industry experts, the revenue from chemicals and chemical products is set to increase by USD 9.28 billion in 2023 up to USD 9.56 billion in 2024 for the category of soap and detergents, perfumes, cleaners, and polishings or toilet preparations.

The value added in the UK chemicals market is reported to amount to USD 12.76 billion in 2024 from USD 12.28 billion in 2023. Innovation and technical progress are frequent drivers of the chemicals sector. Investing in R&D and introducing new and improved products or processes can increase the value added by companies in the United Kingdom chemical market.

United Kingdom Chemical Logistics Market Trends

The Impact of Brexit on Trade with the United Kingdom

Chemical products imported into the United Kingdom have severely declined, indicating an effect of Brexit. According to industry experts, while transactions worth USD 13.22 billion were done in 2021, only USD 10.02 billion was done in 2022. The country saw a decline of almost 24% in the period.

Business transactions between China and the UK have taken a turn. The import value of chemical products has fallen sharply from USD 6.0 billion in 2021 to USD 2.95 billion in 2022.

The United Kingdom's exports to non-EU countries, particularly to the United States, have performed poorly. Partially, this is due to the United Kingdom being in a weaker position to benefit from increased demand, as it seems to be declining mainly in non-exporting markets. The export value of miscellaneous chemical products to the United States has fallen from USD 1.25 billion in 2021 to USD 1.11 billion in 2022.

Chemical Consumption in the United Kingdom

The United Kingdom's import value of fertilizers has been rising, indicating the country's consumption of chemicals and the need for logistics. According to Statista, in 2022, the United Kingdom imported USD 2.62 billion worth of fertilizers.

Croda International Plc is the largest chemical company in the United Kingdom in terms of revenue, followed by Johnson Matthey Plc. According to industry experts, their 2022 net income in the United Kingdom was GBP 193.9 million (USD 244.12 million) and GBP 177 million (USD 222.84 million), respectively. This indicates the value of the country's consumption of chemicals.

Also, in November 2023, LyondellBasell, a supplier of polyolefins in the chemical industry, announced that it is setting up a new distribution center for its grades in the United Kingdom. As part of their commitment to improve the customer experience by placing stocks in customers' facilities, which reduces lead times for orders, this strategic move is a continuation of these efforts. This distribution hub in the United Kingdom is an integral part of LyondellBasell's global footprint.

United Kingdom Chemical Logistics Industry Overview

The market for chemical logistics in the United Kingdom is competitive, owing to the presence of various companies. The e-commerce logistics market in the United Kingdom is moderately fragmented and depicts competition among the market players. The competitive landscape is dynamic, with ongoing developments and competition driving companies to adapt to emerging trends, technological progress, and changing consumer preferences. Global logistics giants such as DHL have a strong presence, providing a range of services from express delivery to supply chain management. However, the chemical logistics industry in the United Kingdom has relatively high entry barriers due to stringent regulations and strict safety and environmental standards. DHL International Gmbh, Dachser, and Rhenus Logistics are among the most important players in this sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Insights into the 3PL

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Demand and Supply Analysis

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Adherence to Stringent Regulations

- 5.1.2 Globalization of Supply Chains

- 5.2 Restraints

- 5.2.1 Environmental Concerns

- 5.3 Opportunities

- 5.3.1 Green Logistics

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution, and Inventory Management

- 6.1.3 Consulting & Management Services

- 6.1.4 Customs & Security

- 6.1.5 Green Logistics

- 6.1.6 Other Services

- 6.2 By Mode of Transportation

- 6.2.1 Roadways

- 6.2.2 Railways

- 6.2.3 Airways

- 6.2.4 Waterways

- 6.2.5 Pipelines

- 6.3 By End User

- 6.3.1 Pharmaceutical Industry

- 6.3.2 Cosmetic Industry

- 6.3.3 Oil and Gas Industry

- 6.3.4 Specialty Chemicals Industry

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 DHL

- 7.2.2 DACHSER

- 7.2.3 Rhenus Logistics

- 7.2.4 C.H. Robinson

- 7.2.5 CEVA Logistics

- 7.2.6 Den Hartogh

- 7.2.7 BDP International

- 7.2.8 Streamline Shipping

- 7.2.9 Hoyer Group

- 7.2.10 Suttons Group*

- 7.3 Other Companies