|

市場調查報告書

商品編碼

1645098

歐洲內燃機市場:佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Internal Combustion Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

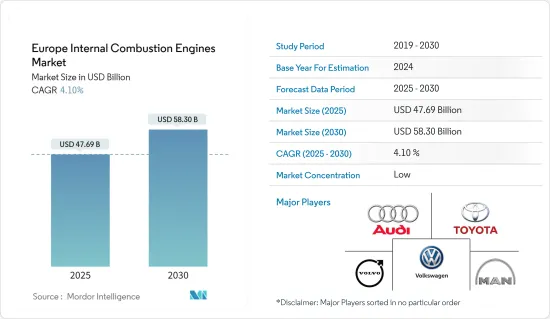

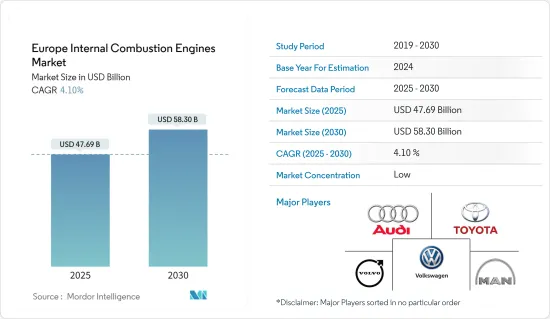

預計 2025 年歐洲內燃機市場規模將達到 476.9 億美元,到 2030 年預計將達到 583 億美元,預測期內(2025-2030 年)的複合年成長率為 4.1%。

關鍵亮點

- 從中期來看,預計對 ICE 二輪車的需求不斷增加以及插電式混合動力內燃機汽車 (PHEV) 的興起將在預測期內推動歐洲內燃機車市場的成長。

- 另一方面,預測期內電池電動車市場的興起以及綠色氣候目標對無污染燃料的採用需求預計將阻礙歐洲內燃機市場的成長。

- 預計預測期內,插電式混合動力汽車的技術創新和最新技術的採用將為歐洲內燃機市場創造機會。

- 德國佔據市場主導地位,並可能在預測期內實現最高成長率。

歐洲內燃機市場趨勢

柴油佔據了很大的市場佔有率

柴油引擎是最重要的內燃機之一,自 19 世紀 70 年代開始使用。這些引擎的設計目的是燃燒空氣-柴油混合物後產生機械能。它不使用火星塞等任何輔助部件來點燃空氣-柴油混合物,而是依靠引擎缸體內部移動的活塞壓縮空氣的溫度升高。

柴油內燃機比汽油引擎更省油,加速性、牽引力和牽引力都更強。這使得柴油引擎成為歐洲相當常見且受歡迎的燃料來源。

儘管歐盟努力採用更清潔的能源來源,但柴油仍然是歐洲重要的運輸燃料。 2023年,歐洲13.6%的新註冊車輛將配備柴油內燃機,代表強大的歐洲基本客群。

柴油內燃機車市場很大一部分佔有率集中在公車(商用和私人)、政府車輛、卡車和廂型車上。根據歐洲汽車工業協會(ACEA)的數據,到2023年,柴油客車仍將是歐盟最受歡迎的客車類型,佔新客車銷售量的62.3%。

2023年,柴油引擎在歐洲卡車領域也獲得了重要而牢固的立足點。根據歐洲汽車工業協會的數據,歐盟新註冊卡車中95.7%為柴油引擎卡車,1.5%為電動車。此外,歐洲的卡車產量也有所增加。 2023年,歐洲卡車產量為603,437輛,商用車總產量與前一年同期比較增加約20.3%。

2023年10月,全球最大的快遞公司聯邦快遞集團的子公司聯邦快遞歐洲公司宣布,將在英國開始試運行加氫植物油(HVO)可再生柴油作為其五輛自有卡車的燃料。這將鼓勵柴油引擎市場的參與企業修改其產品以適應可再生柴油,從而提供安全的未來前景。

因此,未來幾年,這種情況很可能在柴油引擎中佔據很大佔有率。

德國可能主導市場

近年來,德國所有商用和私人車輛,包括巴士、汽車、摩托車和卡車,都從石化燃料向電動車進行了重大轉變。然而,由於 PHEV 領域的技術進步,這些新興市場的發展並未對市場產生負面影響。

PHEV,即插電式混合動力電動車,是一種混合動力電動車,將柴油或汽油引擎與馬達以及可以在電動車充電站充電的大容量電池組相結合。傳統的 PHEV 配有馬達和電池組,但其所有動力均來自汽油或柴油。

德國動力來源汽油和柴油作為動力的內燃機汽車數量正在增加,這些汽車同時使用石化燃料燃料和非石化燃料。

除插電式混合動力汽車外,德國共用大量柴油和汽油內燃機汽車。根據德國聯邦運輸署(KBA)預測,2023年德國新車銷量將比2022年銷售資料成長7.3%,其中汽油車銷量增幅最大,達13.3%至97.9萬輛,汽油和柴油車的市場佔有率整體提升。

2023年3月,歐盟與德國宣布達成協議,允許在2035年後銷售部分內燃機,包括乘用車和卡車的汽油和柴油引擎。這項決定為德國市場相關人員提供了強勁的未來前景。

根據德國聯邦運輸局(KBA)的數據,到2023年12月,新四輪乘用車註冊量中柴油和汽油引擎汽車的總合銷量將佔所有動力傳動系統汽車總銷量的45.5%。

總體而言,預計德國將在預測期內主導歐洲內燃機市場。

歐洲內燃機產業概況

歐洲內燃機市場規模減少了一半。該市場的主要企業包括奧迪、大眾汽車集團、沃爾沃汽車公司、曼恩汽車公司、德國汽車公司、現代汽車、豐田汽車公司等(不分先後順序)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 內燃機摩托車需求增加

- 插電式混合動力內燃機汽車 (PHEV) 的興起

- 限制因素

- 電動車市場成長

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 按容量

- 50~200 cm3

- 201~800 cm3

- 801~1,500 cm3

- 1,501~3,000 cm3

- 按燃料類型

- 汽油

- 柴油引擎

- 其他

- 按地區

- 英國

- 義大利

- 法國

- 德國

- 俄羅斯

- 北歐的

- 土耳其

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- 市場參與企業

- Volkswagen Group

- Volvo AB

- MAN SE

- Bayerische Motoren Werke AG

- Hyundai Motors

- Toyota Motor Corporation

- 市場參與企業

- 市場排名分析

- 其他知名公司名單

第7章 市場機會與未來趨勢

- 插電式混合動力汽車的技術創新與最新技術的採用

The Europe Internal Combustion Engines Market size is estimated at USD 47.69 billion in 2025, and is expected to reach USD 58.30 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing demand for ICE two-wheelers and the rise of plug-in hybrid ICE vehicles (PHEV) are expected to drive the growth of the Europe Internal Combustion Engines Market during the forecast period.

- On the other hand, the rising battery electric vehicle market and demand for the adoption of cleaner fuels in regard to the green climate goals are expected to hinder the growth of Europe's internal combustion engine market during the forecast period.

- Nevertheless, technological innovation and adaptation of the latest technologies in plug-in hybrid vehicles are likely to create opportunities for the European internal combustion engine market during the forecast period.

- Germany dominates the market and is also likely to witness the highest grwoth during the forecast period.

Europe Internal Combustion Engines Market Trends

Diesel to have Significant Share in the Market

Diesel engines are one of the most significant internal combustion engines that have been in use since the 1870s. These engines are designed to generate mechanical energy after the combustion of an air-diesel mixture. No auxiliary component like a spark plug is used to ignite the air-diesel mixture; instead, it uses the elevating temperature of the air, which is compressed by a piston moving inside an engine block.

Diesel ICE engines are fuel-efficient and have better acceleration, towing, and hauling potential than gasoline engines. Thus, they have been quite a familiar and popular fuel source in Europe.

Diesel has been an important transportation fuel in Europe despite the European Union's initiatives to adopt cleaner energy sources. In 2023, 13.6 % of the newly registered vehicles in Europe had internal combustion engines that used diesel, thus accounting for a strong customer base in Europe.

A fair share of the diesel ICE engine market can be seen in the buses (commercial and private), government vehicles, trucks, and vans. According to the European Automobile Manufacturers' Association (ACEA), in 2023, diesel-powered buses remained the most popular in the EU, accounting for 62.3% of all new bus sales.

In 2023, diesel-powered ICE engines also saw a significant and strong base in the European trucking sector. According to ACEA, 95.7% of all newly registered trucks in the European Union run on diesel, while 1.5% were electric. Further, truck production increased in the European region. In 2023, nearly 603437 trucks were manufactured in Europe, which increased the total commercial vehicle production by around 20.3%, as compared to the previous year.

In October 2023, FedEx Corp. subsidiary company FedEx Express Europe, the world's largest express transportation company, announced the beginning of trialing hydrotreated vegetable oil (HVO) renewable diesel to fuel five of its company-owned trucks in the United Kingdom. This will provide a safe future outlook for the diesel engine market players, making changes in their products to adapt to renewable diesel.

Hence, such a scenario is likely to have a significant share of diesel engines in the coming years.

Germany to Likely to Dominate the Market

In recent years, Germany has seen a huge transition from Fossil fuels to Electric vehicles in all commercial and private vehicles, including Buses, Cars, Two-wheelers, and Trucks. Still, these developments have not negatively affected the market due to technological advancements in the PHEV sector.

A PHEV or a plug-in hybrid electric vehicle is a type of hybrid EV that combines a diesel or gasoline engine with a large battery pack and an electric motor that an EV charging station can recharge. Conventional PHEV automobiles have an electric motor and battery pack but derive all their power from gasoline or diesel.

The growing popularity among the nations' family households and the use of Plug-In Hybrid Electric vehicles in public transport and commercial heavy vehicles is key to the growth of Gasoline and Diesel powered ICE engines in Germany, showing a resonant use of both Fossil and Non-Fossil use.

Even apart from the PHEVs, Germany shares a significant number of diesel- and petrol-ICE-powered cars. According to the German KBA Federal Transport Authority, new sales of cars in Germany marked a rise of 7.3% in 2023, when compared to 2022 sales data, in which Petrol vehicle sales saw the most significant boost, rising by 13.3% to 979,000, leading to an overall market share increase for petrol and diesel-powered cars.

In March 2023, the European Union and Germany announced having reached an agreement allowing some internal combustion engines, including petrol and diesel engines, for Passenger cars and Trucks to be sold beyond 2035. The decision thus provides a strong future outlook for the market players in Germany.

According to the German KBA Federal Transport Authority, among the registration of new four-wheeler passenger vehicles in December 2023, the combined share of diesel and gasoline-powered vehicles was 45.5% of the total cars sold of all powertrains.

Thus, on the basis of the above points, Germany will dominate the European internal combustion engine market during the forecast period.

Europe Internal Combustion Engines Industry Overview

The Europe Internal Combustion Engines Market is semi-fragmented. The key players in this market include(in no particular order) Audi, Volkswagen Group, Volvo AB, MAN SE, Bayerische Motoren Werke AG, Hyundai Motors, and Toyota Motor Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing demand for ICE two-wheelers

- 4.5.1.2 Rise of plug-in hybrid ICE vehicles (PHEV)

- 4.5.2 Restraints

- 4.5.2.1 Rising Battery electric vehicle market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By capacity

- 5.1.1 50 cm3 to 200 cm3

- 5.1.2 201 cm3 to 800 cm3

- 5.1.3 801 cm3 to 1500 cm3

- 5.1.4 1501 cm3 to 3000 cm3

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Italy

- 5.3.3 France

- 5.3.4 Germany

- 5.3.5 Russia

- 5.3.6 NORDIC

- 5.3.7 Turkey

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Market Players

- 6.3.1.1 Volkswagen Group

- 6.3.1.2 Volvo AB

- 6.3.1.3 MAN SE

- 6.3.1.4 Bayerische Motoren Werke AG

- 6.3.1.5 Hyundai Motors

- 6.3.1.6 Toyota Motor Corporation

- 6.3.1 Market Players

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological innovation and adaptation of the latest technologies in plug-in hybrid vehicles