|

市場調查報告書

商品編碼

1645112

全球內燃機 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Internal Combustion Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

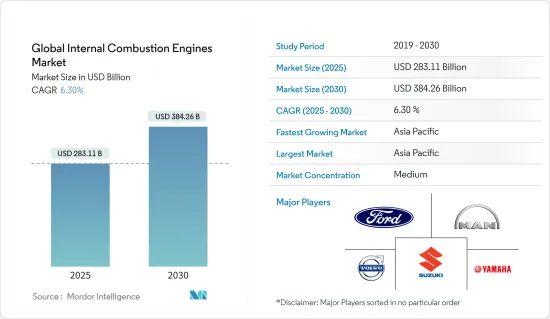

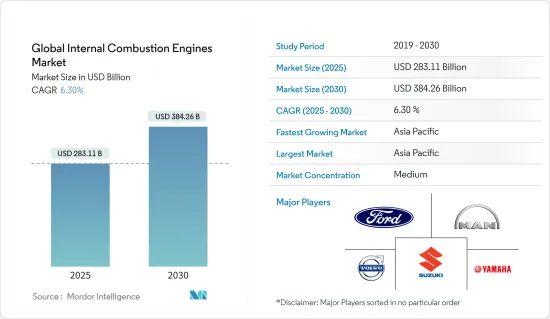

2025 年全球內燃機市場規模預計為 2,831.1 億美元,預計到 2030 年將達到 3,842.6 億美元,預測期內(2025-2030 年)的複合年成長率為 6.3%。

關鍵亮點

- 預計預測期內亞太地區對汽車和二輪車的需求不斷增加將推動市場發展。

- 然而,對非溫室氣體排放汽車的不斷成長的需求以及引入替代燃料汽車的支持政策預計會阻礙市場成長。

- 預計在預測期內,內燃機設計的不斷研發和技術進步將為市場提供巨大的成長機會。

- 由於工業和商業活動的增加,預計亞太地區將佔據市場的大部分佔有率,這將導致預測期內汽車銷量增加。

全球內燃機市場趨勢

柴油市場預計將出現強勁成長

- 柴油引擎是最重要的內燃機之一,自 19 世紀 70 年代開始使用。該引擎的設計目的是燃燒空氣-柴油混合物後產生機械能。它不使用火星塞等任何輔助部件來點燃空氣和柴油混合物,而是利用空氣的升高溫度,然後由引擎缸體內移動的活塞壓縮。

- 這些引擎以前是為動力來源火車和工廠而設計的。然而,多年來它已被用於各種應用,包括發電、汽車、建築和農業機械。

- 柴油引擎的一大優點是比汽油引擎更節省燃料。它的零件比汽油引擎少,因此維護問題也更少。柴油引擎比汽油引擎具有更好的加速性、牽引力和牽引力。柴油引擎的設計可承受高壓縮和重負荷運行,因此使用壽命長。

- 隨著柴油引擎進行技術創新以實現更高的效率,預計預測期內柴油消費量將會增加。根據美國能源資訊署的數據,2023 年 12 月美國柴油總消費量為每天 375 萬桶。由於柴油引擎技術的進步,預計消費量將會增加。

- 2023年2月,康明斯宣布將於2026年在北美推出下一代燃料無關引擎(X10)。該引擎預計將符合美國環保署 2027 年的規定。該引擎的柴油版本將首先推出。

- 因此,由於技術發展和柴油消費量的增加,預計該領域將顯著成長。

亞太地區可望主導市場

- 亞太地區擁有印度、中國和日本等一系列新興國家,這些國家正在經歷快速的都市化和工業化。隨著這些國家經濟的發展,電子商務產業也崛起,從而產生了對內燃機的需求。

- 過去五年來,電子商務產業取得了長足發展,這主要歸功於新冠疫情。電子商務在人們的日常生活中發揮著重要作用。它正在重新定義世界各地的商業。除了電子商務領域外,汽車在旅行和其他用途的使用也在增加。汽車使用量的增加預計將推動對內燃機的需求,因為內燃機是汽車的初級能源。

- 根據國際汽車工業理事會的預測,2023年亞太地區汽車產量將達55,115,837輛,與前一年同期比較年成長率約為10%。該地區汽車產量的上升預計將推動對內燃機的需求。

- 根據汽車製造商 Stellantis 在 2023 年 9 月發布的公告,內燃機汽車 (ICE) 預計將在道路上行駛到 2050 年,並且需要抑制二氧化碳排放,直到全電動汽車最終取代它們。

- 因此,由於電子商務領域的發展和汽車使用的增加,尤其是在新興國家,預計亞太地區將在預測期內佔據市場主導地位。

全球內燃機產業概況

全球內燃機市場規模減少了一半。該市場的一些主要企業包括沃爾沃汽車公司、曼恩汽車公司、雅馬哈摩托車公司、鈴木汽車公司和福特汽車公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 汽車需求增加

- 摩托車需求不斷增加

- 限制因素

- 對無溫室氣體排放汽車的需求不斷增加

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 容量

- 50~200 cm3

- 201~800 cm3

- 801~1,500 cm3

- 1,501~3,000 cm3

- 燃料類型

- 汽油

- 柴油引擎

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 挪威

- 德國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 馬來西亞

- 印尼

- 泰國

- 越南

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Volvo AB

- Man SE

- Yamaha Motor Co. Ltd

- Suzuki Motor Corp

- Ford Motor Company

- Volkswagen Group

- Toyota Motor Corporation

- Hyundai Motor Company

- Ducati Motor Holding SpA

- Fiat Chrysler Automobiles NV

- 市場排名/佔有率(%)分析

- 其他知名公司名單

第7章 市場機會與未來趨勢

- 加強內燃機設計的研究、開發和技術進步

簡介目錄

Product Code: 50002227

The Global Internal Combustion Engines Market size is estimated at USD 283.11 billion in 2025, and is expected to reach USD 384.26 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for automobiles and two-wheeler vehicles in Asia-Pacific is expected to drive the market during the forecast period.

- On the other hand, rising demand for non-GHG-emitting vehicles and supportive policies to adopt alternate fuel vehicles are expected to hamper the market's growth.

- Nevertheless, the increasing research & development and technological advancements in the internal combustion engine design are expected to present significant growth opportunities for the market during the forecast period.

- Asia-Pacific is expected to have a significant share of the market due to increasing industrial and commercial activities, which will translate to more vehicle sales during the forecast period.

Global Internal Combustion Engines Market Trends

The Diesel Segment is Expected to Witness Significant Growth

- Diesel engines are among the most significant internal combustion engines that have been in use since the 1870s. These engines are designed to generate mechanical energy after the combustion of an air-diesel mixture. No auxiliary component, such as a spark plug, is used to ignite the air-diesel mixture; instead, the elevating temperature of the air is used, which is compressed by a piston moving inside an engine block.

- These engines were earlier designed to power trains and factories. However, over the years, they have been used in several applications, such as power generation, automotive, construction, and agriculture equipment.

- The significant advantage of diesel engines is that they are more fuel-efficient than gasoline engines. They have fewer components than gasoline engines and, hence, have fewer maintenance issues. Diesel engines provide better acceleration, towing, and hauling potential than gasoline engines. They are designed to handle high compression and hard work and, hence, have a long lifespan.

- With increasing technological innovations in diesel engines to achieve better efficiency, the consumption of diesel is expected to increase over the forecast period. According to the Energy Information Administration, the total diesel consumption in the United States in December 2023 was 3.75 million barrels per day. The consumption is expected to increase with technological innovations in diesel engines.

- In February 2023, Cummins Inc. announced that it would launch the next engine in the fuel-agnostic series (the X10) in North America in 2026. The engine is expected to comply with US EPA's 2027 regulations. The diesel version of the engine is expected to be launched first.

- Thus, owing to the technological developments and increasing consumption of diesel, the segment is expected to witness significant growth.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has various developing countries, such as India, China, and Japan, where urbanization and industrialization are growing rapidly. With the development of the economies of these countries, the e-commerce division is also increasing, thereby generating the need for internal combustion engines.

- The e-commerce sector has grown significantly in the past five years, mainly driven by the COVID-19 pandemic. E-commerce plays a vital role in people's daily lives. It is redefining commercial activities around the world. Apart from the e-commerce sector, the use of automobiles for traveling and other purposes has increased. As internal combustion engines are used as a primary source of energy in automobiles, an increase in the use of automobiles is expected to drive the demand for internal combustion engines.

- According to International Organization of Motor Vehicle Manufacturers, in 2023, motor vehicle production in Asia-Pacific amounted to 55,115,837 units, an annual growth rate of approximately 10% compared to previous year. Increase in the manufacturing of motor vehicle in the region is expected to increase the demand for internal combustion engines.

- According to an announcement by Carmaker Stellantis in September 2023, internal combustion engine (ICE) vehicles are expected to be on the road until 2050, making it necessary to contain carbon emissions until fully electric ones finally replace them.

- Thus, owing to the developments in the e-commerce segment and the rise in automobile usage, especially in developing countries, Asia-Pacific is expected to dominate the market during the forecast period.

Global Internal Combustion Engines Industry Overview

The global internal combustion engine market is semi-fragmented. Some of the key players in this market include Volvo Ab, Man SE, Yamaha Motor Co. Ltd, Suzuki Motor Corp, and Ford Motor Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Automobiles

- 4.5.1.2 Increasing Demand for Two-Wheeler Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Rising Demand for Non-GHG Emitting Vehicles

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 50 cm3 to 200 cm3

- 5.1.2 201 cm3 to 800 cm3

- 5.1.3 801 cm3 to 1500 cm3

- 5.1.4 1501 cm3 to 3000 cm3

- 5.2 Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Spain

- 5.3.2.3 Russia

- 5.3.2.4 Turkey

- 5.3.2.5 Nordic Countries

- 5.3.2.6 Norway

- 5.3.2.7 Germany

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Malaysia

- 5.3.3.5 Indonesia

- 5.3.3.6 Thailand

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 United Arab Emirates

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Nigeria

- 5.3.4.4 Qatar

- 5.3.4.5 Egypt

- 5.3.4.6 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Volvo AB

- 6.3.2 Man SE

- 6.3.3 Yamaha Motor Co. Ltd

- 6.3.4 Suzuki Motor Corp

- 6.3.5 Ford Motor Company

- 6.3.6 Volkswagen Group

- 6.3.7 Toyota Motor Corporation

- 6.3.8 Hyundai Motor Company

- 6.3.9 Ducati Motor Holding SpA

- 6.3.10 Fiat Chrysler Automobiles NV

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research & Development and Technological Advancements in the Internal Combustion Engine Design

02-2729-4219

+886-2-2729-4219