|

市場調查報告書

商品編碼

1645099

建築用可攜式發電機:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Construction Portable Generators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

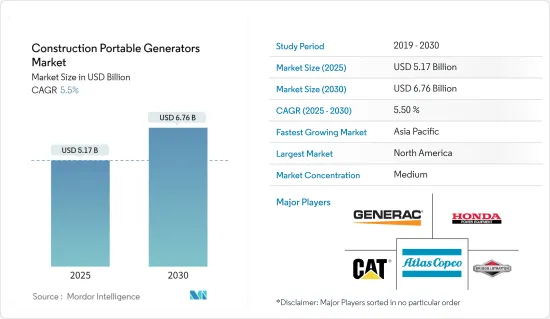

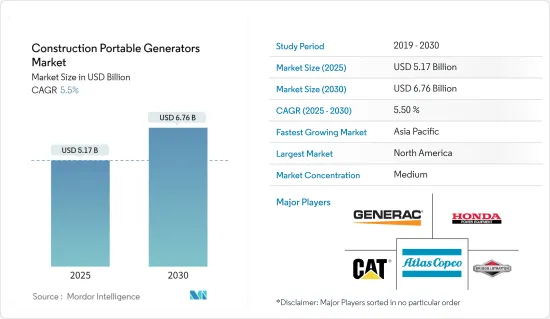

預計 2025 年建築可攜式發電機市場規模為 51.7 億美元,預計到 2030 年將達到 67.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.5%。

從中期來看,不斷成長的電力需求、缺乏可靠的電網基礎設施、對緊急備用電源解決方案的需求以及對建築工地穩定電源的需求等因素正在推動可攜式發電機市場的發展。

另一方面,可攜式發電機面臨來自電池儲存系統的激烈競爭。此外,其他更乾淨的電力源預計也會阻礙可攜式發電機市場的發展。

預計新興經濟體商業和工業領域的新建築以及住宅領域的新建築將在不久的將來為市場參與企業提供重大商機。

預計北美將佔據主要市場佔有率,大部分需求來自美國和印度等國家。

建築可攜式發電機的市場趨勢

10KW以上將成為重要細分市場

- 可攜式發電機對於建築業來說至關重要。承包商經常會遇到施工現場缺乏電力服務或停電的情況,這意味著他們必須使用可攜式照明設備。由於多種因素,預計未來幾年建築業可攜式發電機市場將大幅成長。首先,市場受到全球對基礎設施開發和建設活動日益成長的需求的推動。

- 工地使用10kVA以上的柴油發電機來持續供電。建築工地需要它為起重機和挖掘機等重型機械提供動力,並運行必要的工具。

- 此外,停電變得越來越頻繁,特別是在新興國家,從而推動了對可攜式發電機的需求。電網電力不穩定,需要使用可攜式發電機來防止工作中斷。

- 2023年2月,Caterpillar宣布推出搭載Cat C9.3B柴油引擎的XQ330可攜式柴油發電機。它還具有幾個適合租賃的功能,包括電池充電器、引擎加熱器、可切換電壓輸出、永磁發電機 (PMG) 和拖車安裝選項。

- 此外,近年來美國的建築支出一直穩定成長。 2023年,住宅和住宅建築支出也在增加。環保建築實踐趨勢也促進了市場的成長。建設公司擴大轉向運作生物柴油和天然氣等替代燃料的可攜式發電機,以減少排放氣體和環境影響。

- 由於這些因素,預計未來幾年該領域將佔據相當大的市場佔有率。

北美佔據主要市場佔有率

- 2023年,美國的電力消耗量約為4,000兆瓦時。儘管電網基礎設施複雜,全國電力供應充足,但停電和備用電源需求增加等問題預計將推動該國備用發電市場的需求。停電每年平均給該國造成約 180 億至 330 億美元的損失。因此,備用發電機或UPS被認為是保持業務運作不間斷的最可行選擇。

- 此外,由於激進的貨幣緊縮政策導致房屋抵押貸款利率上升,且高通膨持續影響住宅承受能力,預計住宅建築業將出現最大萎縮。不過,由於政府的獎勵策略,非住宅建築仍保持強勁。 《基礎設施投資與就業促進法案》旨在對老化的基礎設施(道路、高速公路、橋樑、鐵路、寬頻開發等)進行全面投資,預計將在今年刺激建設。隨著住宅領域建設的增加,建築用可攜式發電機的市場利用率預計也將增加。

- 截至 2024 年,美國等國家已計劃在非住宅領域實施多個建設計劃。例如,戈迪豪國際大橋、Brightline West高速鐵路和加州高速鐵路等計劃是即將實施的一些重大計劃,這些項目可能會在建築工地產生對可攜式發電機的需求。

- 截至2023年,美國是世界上最大的資料中心建設國家之一。主要市場包括紐約和芝加哥的金融中心,灣區(舊金山)、西雅圖和波特蘭的科技中心,達拉斯和洛杉磯的人口中心,以及華盛頓特區/維吉尼亞的政府中心。美國的資料中心總數是距離最近的市場(英國)的5倍多,美國也是無可爭議的「網路之鄉」。隨著資料中心建設的不斷增加,市場成長預計將在不久的將來達到頂峰。

- 鑑於上述情況,由於美國、加拿大和墨西哥的住宅和工業建設不斷增加,預計北美將佔據市場主導地位。

可攜式建築發電機行業概況

建築可攜式發電機市場較為分散。市場的主要企業包括 Generac Holdings Inc.、Caterpillar Inc.、Honda Siel Power Products Ltd.、Briggs & Stratton Corporation 和 Atlas Copco AB。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 可攜式電源需求不斷成長

- 增加全球建築業的投資

- 限制因素

- 對電池儲存系統和其他清潔備用電力源的需求不斷增加

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 額定功率

- 小於5KW

- 5~10KW

- 10KW以上

- 燃料類型

- 氣體

- 柴油引擎

- 其他燃料

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Ltd.

- Briggs & Stratton Corporation

- Kohler Power Systems

- Wacker Neuson SE

- Atlas Copco AB

- Eaton Corporation PLC

- Yamaha Motor Co. Ltd.

- 市場排名/佔有率(%)分析

- 其他知名公司名單

第7章 市場機會與未來趨勢

- 新興國家不斷成長的商業和工業部門

The Construction Portable Generators Market size is estimated at USD 5.17 billion in 2025, and is expected to reach USD 6.76 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Over the medium term, factors such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for steady power supply at construction sites are driving the portable generator market.

On the other hand, Portable generators face tough competition from battery storage systems. Also, other cleaner sources of standby power are expected to hinder the portable generators market.

Nevertheless, the new constructions in the commercial and industrial sectors of emerging economies and the residential sector of developed economies are expected to create significant opportunities for market participants in the near future.

North America is expected to have a significant market share, with the majority of the demand coming from countries such as the United States and India.

Construction Portable Generators Market Trends

Above 10 KW to be a Significant Market Segment

- Portable power generators are an essential part of the construction industry. In many situations, contractors may find themselves at job sites where the lack of electrical service or power failures requires them to utilize portable lighting units. The portable generator market in the construction industry is expected to witness substantial growth in the coming years due to several factors. Firstly, the growing demand for infrastructure development and construction activities across the globe is driving the market.

- The above 10 kVA diesel generators are used at construction sites for continuous power supply. Construction sites are vital for powering heavy machinery, such as cranes and excavators, and for running essential tools.

- Additionally, the increasing frequency of power outages, especially in developing countries, is boosting the demand for portable generators. Unreliable grid power necessitates the use of portable generators to ensure uninterrupted work progress.

- In February 2023, Caterpillar announced the launch of the XQ330 portable diesel generator powered by the Cat C9.3B diesel engine. It is also equipped with several rental-ready features, including a battery charger, block heater, switchable voltage outputs, permanent magnet generator (PMG), and optional mounting on a trailer.

- Furthermore, construction spending has grown steadily in the United States over the last couple of years. Up to 2023, residential building construction spending and non-residential construction also increased. The rising trend of green construction practices also contributes to market growth. Construction companies are increasingly adopting portable generators that run on alternative fuels, such as biodiesel and natural gas, to reduce emissions and environmental impact.

- Thus, owing to such factors, the segment is expected to have a significant market share in the coming years.

North America to Have a Significant Market Share

- In 2023, the electricity consumption in the United States was about 4000 terawatt-hours. Despite the presence of a complex electricity grid infrastructure and 100% electricity access across the country, problems like power outages and increasing demand for standby power sources are expected to drive the demand for the backup power generation market in the country. Power outages cost an average of about USD 18 billion to USD 33 billion per year in the country. Therefore, backup generators and UPS are considered the most viable options for making business operations run continuously without any interruption.

- Moreover, It is expected that the residential building segment will see the largest contraction because aggressive monetary tightening is feeding into higher mortgage rates, and high inflation weighs on the affordability of homeownership. However, non-residential construction remains more resilient due to government stimulus. The Infrastructure Investment and Jobs Act will provide a stimulus for construction this year, aiming at comprehensive investments in aging infrastructure (including roads, highways, bridges, rail, and broadband development). The growing residential sector constructions will, in turn, culminate in the growth in the utilization of construction portable generators in the market.

- As of 2024, countries like the United States have several upcoming construction projects in the non-residential sector. For instance, projects like Gordie Howe International Bridge, Brightline West High-Speed Rail, and California High-Speed Rail are a few significant upcoming projects, which are likely to create demand for portable generators in the construction sites.

- As of 2023, the United States was one of the largest countries in the world for the construction of data centers. Major markets include the financial hubs of New York and Chicago, the tech hubs of the Bay Area (San Francisco), Seattle, and Portland, the population hubs of Dallas and Los Angeles, and the center of Government in Washington DC/Virginia. With the country's total data center numbers outweighing its nearest market (the United Kingdom) by five times, the United States is also the undisputed "home of the internet. The growing construction of data centers will culminate in the market's growth in the near future.

- Owing to the above points, with the increase in residential and industrial construction in the United States, Canada, and Mexico, North America is expected to dominate the market.

Construction Portable Generators Industry Overview

The Construction Portable Generators Market is fragmented. Some of the major companies operating in the market include Generac Holdings Inc., Caterpillar Inc., Honda Siel Power Products Ltd, Briggs & Stratton Corporation, and Atlas Copco AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for portable power source

- 4.5.1.2 Increasing investments in Construction Sector across the Globe

- 4.5.2 Restraints

- 4.5.2.1 Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 KW

- 5.1.2 5-10 KW

- 5.1.3 Above 10 KW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 Qatar

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Honda Siel Power Products Ltd.

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Kohler Power Systems

- 6.3.6 Wacker Neuson SE

- 6.3.7 Atlas Copco AB

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Yamaha Motor Co. Ltd.

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Commercial and Industrial Sectors of Emerging Economies